The US ADP non-farm payrolls figure for October are set to be released during today’s American session and given the ongoing Government shutdown, the release could garner greater attention than usual. In particular, the Government shutdown has resulted in the Bereau of Labour statistics delaying their release of reports which also include the US Employment data which should in theory be released in Friday. Hence, given the possibility of the BLS Employment data release not occurring, the anticipated improvement in the ADP employment figure could possibly provide support for the dollar and vice versa.The markets appear to be spooked about the high valuations for AI companies, after top Wall Street executives warned that the market may be due a correction to lower ground. In particular, Goldman Sachs CEO David Solomon stated per CBNC that “It’s likely there’ll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months”, which may have intensified market worries about a possible drawdown. Moreover Michael Burry the American investor who called the housing market bubble, has disclosed a bearish bet on Nvidia and Palantir which could intensify the negative news sentiment surrounding the US Equities markets. In our view, we tend to support the theory that the multiples at which “AI involved” companies are being valued may be due a correction to lower ground, yet the main issue would be the US Government shutdown at this point rather than an overvaluation of companies.The ISM Non-Manufacturing PMI figure is set to be released during today’s American session and could open the door into the state of non-manufacturing sector of the US economy. The release could aid the greenback.

WTICash appears to be moving in a sideways fashion. We opt for a sideways bias for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the commodity’s price to remain between our 58.90 (S1) support level and our 61.75 (R1) resistance line. On the other hand, for a bearish outlook we would require a break below our 58.90 (S1) support level with the next possible target for the bears being our 55.25 (S2) support line. Lastly, for a bullish outlook we would require a break above our 61.75 (R1) resistance line with the next possible target for the bulls being our 66.15 (R2) resistance level.

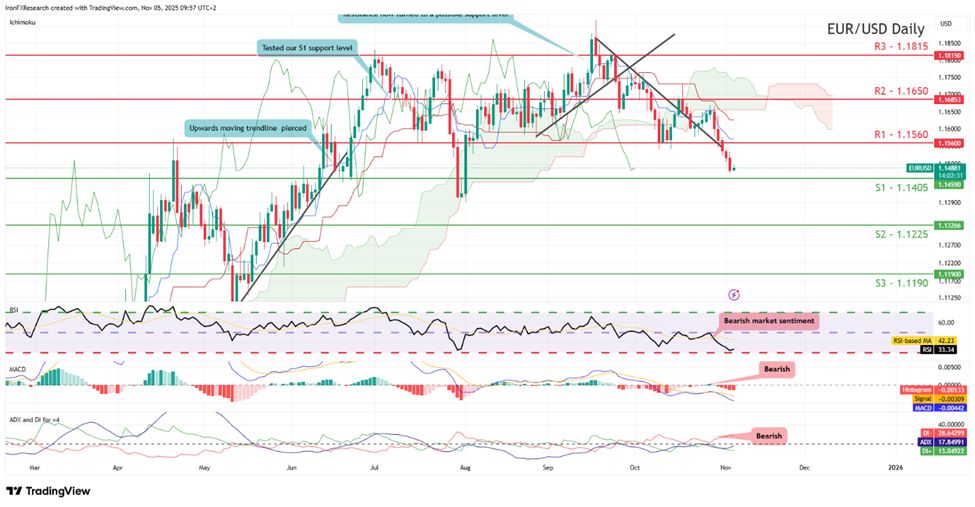

On a technical level, EUR/USD appears to be moving in a downwards fashion after clearing our 1.1560 (R1) support now turned to resistance level. We opt for a bearish outlook for the pair and supporting our case are all three indicators below our chart which tend to point towards a bearish market sentiment. For our bearish outlook to continue we would require a clear break below our 1.1405 (S1) support level with the next possible target for the bears being our 1.1225 (S2) support line. On the other hand, for a bullish outlook we would require a clear break above our 1.1560 (R1) resistance line with the next possible target for the bulls being our 1.1650 (R2) resistance level. Lastly, for a sideways bias we would require the pair to remain confined between our 1.1405 (S1) support level and our 1.1560 (R1) resistance line.

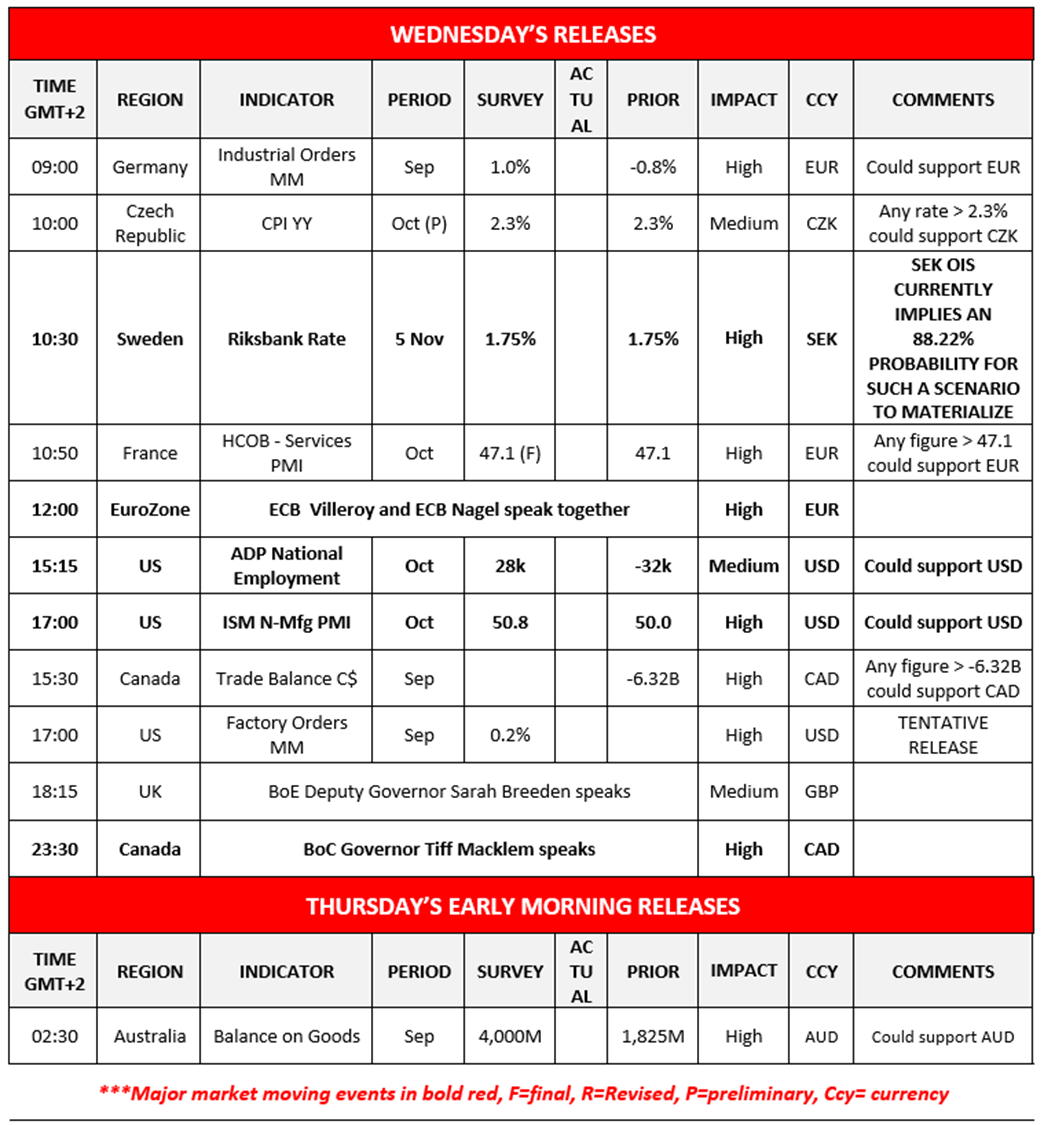

Other highlights for the day:

Today we get Germany’s industrial orders rate for September, the Czech Republic’s preliminary CPI rates for October, the Riksbank’s interest rate decision, France’s final services PMI figure for October, the joint speech by ECB Nagel and Villeroy, the US ADP employment figure and ISM non-manufacturing PMI figure both for October, Canada’s trade balance figure for September, the US Factory orders rate for September, the speech by BoE Deputy Governor Breeden and the speech by BoC Governor Macklem. In tomorrow’s Asian session we would like to note Australia’s trade balance figure for September.

WTICash Daily Chart

- Support: 58.90 (S1), 55.25 (S2), 52.00 (S3)

- Resistance: 61.75 (R1), 66.15 (R2), 69.70 (R3)

EUR/USD Daily Chart

- Support: 1.1405 (S1), 1.1225 (S2), 1.1190 (S3)

- Resistance: 1.1560 (R1), 1.1650 (R2), 1.1815 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.