The market’s machines are roaring back to life again and next week’s calendar is expected to be full with high impact financial releases from various countries, which could lift volatility in the FX market. On a fundamental level, we note the World Economic Forum, throughout the week. On Monday, we get China’s GDP rate for Q4 and Canada’s CPI rates for December. On Tuesday, we get UK’s employment data for November and Germany’s ZEW indicators for January. On Wednesday we get UK’s CPI rates for December and Canada’s CPI rates for the same month. On Thursday we get Japan’s trade data for December, Australia’s employment data also for December, in Norway and in Turkey, Norgesbank and CBT are to release their interest rate decisions, from the US we note the release of the weekly initial jobless claims figure, the final GDP rate for Q4 and Core PCE rates for November, while from New Zealand we get Q4’s CPI rates. Finally on Friday, we get Japan’s CPI rates for December, the preliminary PMI figures for January and BoJ is to release its interest rate decision, in the UK December’s retail sales growth rate is to be released and we also get Germany’s, France’s, the Euro Zone’s, the UK’s and the US preliminary PMI figure for January, Canada’s retail sales for November and the final US University of Michigan consumer sentiment for January.

USD – PCE and GDP rates to be the next big test for the USD

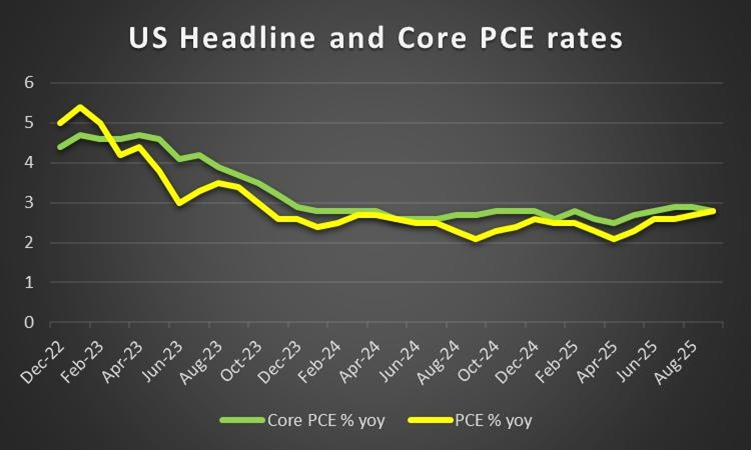

The USD seems about to end the week in the greens against its counterparts. On a macroeconomic level, we note that the CPI rates for December remained relatively unchanged which in our opinion tends to stress the presence of inflationary pressures in the US economy. That was underscored also by the release of the PPI rates which slowed down less than expected for October and actually accelerated in November, implying the existence of inflationary pressures at a producer’s level. Also, the retail sales rate for November accelerated more than expected signaling a robust demand side for the US economy. In the coming week, we highlight the release of the final US GDP rate for Q3 25, a release which along with the PCE rates for November next Thursday could be regarded as the next big test for the USD. Should the rates accelerate we may see the Fed’s hawks getting additional support thus could provide some support for the USD. On a monetary level, we note that the attacks of US President Trump on the Fed intensified as over the past weekend the Fed was subpoenaed. It’s clear that the efforts of the US President aim to set under his control the bank’s monetary policy, as Trump wishes for the Fed to lower its rates dramatically. Fed Chairman Powell replied with a defiant video, yet should the efforts of US President Trump intensify further we may see the USD retreating as the prospect of substantially lower rates could weigh.

Analyst’s opinion (USD)

“Overall in the coming week we highlight the release of final US GDP rate for Q3 25 and the PCE rates for November as possible market movers for the USD. A possible acceleration of the rates could provide some support for the USD as it could enhance the Fed’s intentions to keep rates unchanged for longer. ”

GBP – Employment data and CPI rates to move the sterling

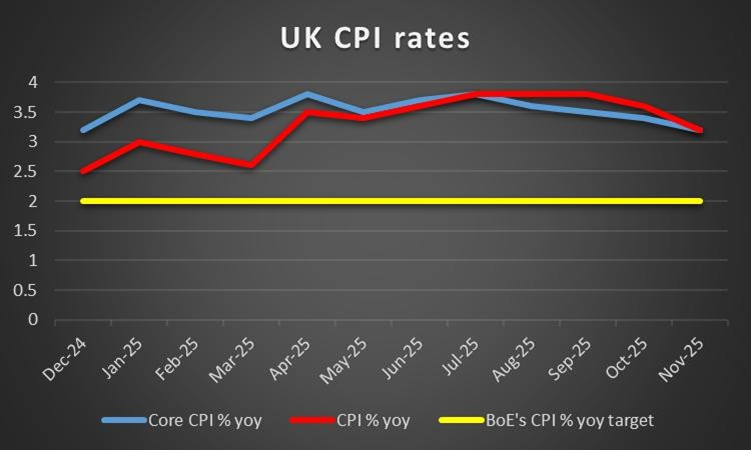

The pound remained relatively unchanged against the USD and the EUR yet seems to be gaining a bit against the JPY. We note that the beyond-expectations acceleration of the GDP rate for November, brightened the outlook of the UK on a macroeconomic level. In the coming week, we note the release of the UK employment data for November on Tuesday and we highlight the release of UK CPI rates for December on Wednesday. Should the data show a tightening UK employment market and the CPI rates accelerate implying an intensification of inflationary pressures in the UK economy, we may see the sterling getting some support as it would add more pressure on the BoE to keep rates unchanged for longer. On a monetary level, we note that Bank of England Monetary Policy Committee member Alan Taylor stated that rates are likely to continue to fall as inflation is likely to settle around the central bank’s 2 per cent target soon. The comment could be considered as dovish and more comments of the same tone from BoE policymakers, could weigh on the pound. For the time being we note that GBP OIS imply that the market expects the bank to cut rates twice in the coming year. Also we note the market worries for the BoE lowering UK banks’ capital requirements too much. The issue could increase risks for UK banks as these capital requirements acted as buffers for potential losses.

Analyst’s opinion (GBP)

“In the coming week, we highlight the release of UK’s employment data and CPI rates as possible market movers for the GBP. Should the rates show a tighter UK employment market and a persistence of inflation we may see the pound getting some support.”

JPY – BOJ interest rate decision in the epicenter

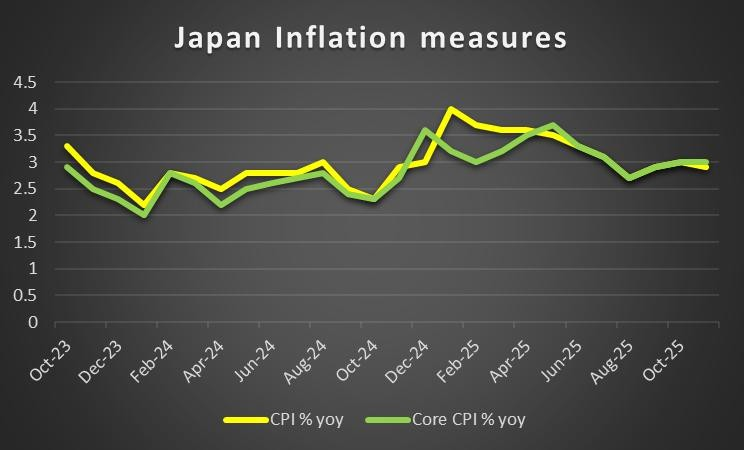

JPY seems to be on the losing side for the current week in the FX market as it loses ground against the USD, GBP and the EUR, implying a wider weakness. We note on a fundamental level the intentions of Japanese PM Takaichi to call a snap election, possibly on the 8th of February, by dissolving the Lower House of the Diet. Japan’s PM may be hoping that snap elections could widen the majority of her party and thus solidify the grasp on power. The issue is highly controversial and tends to weigh on the JPY. Announcements are expected to be made on Monday and could shake the JPY. Also we highlight the risk of a possible market intervention and the recent comments of Japan’s Finance minister Satsuki Katayama for a possible joint US- Japanese market intervention to the JPY’s rescue, were indicative of such a scenario materialising. On a monetary level we highlight the release of BoJ’s interest rate decision on Friday’s Asian session. Currently the market expects the bank to remain on hold, which is also our base scenario for now. Characteristically JPY OIS almost fully prices in such a scenario to materialise. Hence we expect market attention to be placed on the release of BoJ’s accompanying statement and BoJ Governor Ueda’s following press conference. Should the BoJ opt to maintain a hawkish tone, reiterating of implying its intentions to hike rates again in the current year, we may see JPY getting some support. On a macroeconomic level in the coming week we note the release of Japan’s CPI rates for December next Friday and a possible acceleration of the rates could provide some support for the JPY, yet the release of BoJ’s interest rate decision later the same day could overshadow the release of Japanese inflation metrics.

Analyst’s opinion (JPY)

“On a fundamental level, we note Japan PM Takaichi’s intentions to call for a snap elections which tends to weigh on the JPY, On a monetary level, we highlight the release of BoJ’s interest rate decision next Friday and a possibly hawkish tone could provide some support for JPY. Also we note that JPY is at very low levels against the USD, which may prompt a possible market intervention by Japan’s for the rescue of its currency.”

EUR – January preliminary PMI figures in focus

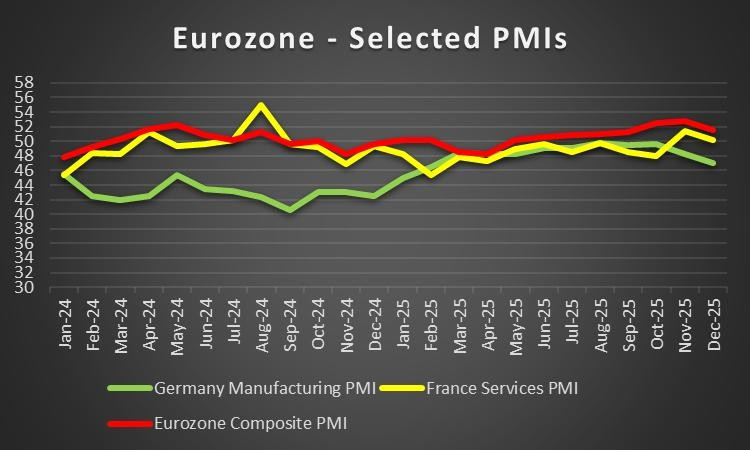

The common currency seems to remain rather stable for the week against the USD, GBP and JPY. On a monetary basis, we note the support the EUR gets by the market’s expectations for the bank to remain on hold throughout the year, as per EUR OIS, in contrast to the Fed and BoE which are expected to cut rates to some degree or the other in 2026. As a sidenote, please bear in mind that ECB Vice President De Guindos warned about the possible negative consequences on growth by geopolitical issues. On a macroeconomic level, we note the verification of the slow down of Euro Zone’s HICP rate for December to the ECB’s target of 2%yy. In the coming week we get a number of interesting macroeconomic data like Germanys’ ZEW indicators for January but our eye is fixed on the release of January’s preliminary PMI figure for France, Germany and the Euro Zone as a whole. Market worries seem to revolve around Germany’s manufacturing sector, thus the reading for the particular sector may be closely watched. Currently growth of the economy may be the main issue for the Europeans and should the release show improved economic activity, we may see the EUR getting some support.

Analyst’s opinion (EUR)

“In the coming week, we highlight the release of Euro Zone’s preliminary PMI figures for January and should the release show improvement of economic activity we may see the common currency getting some support.”

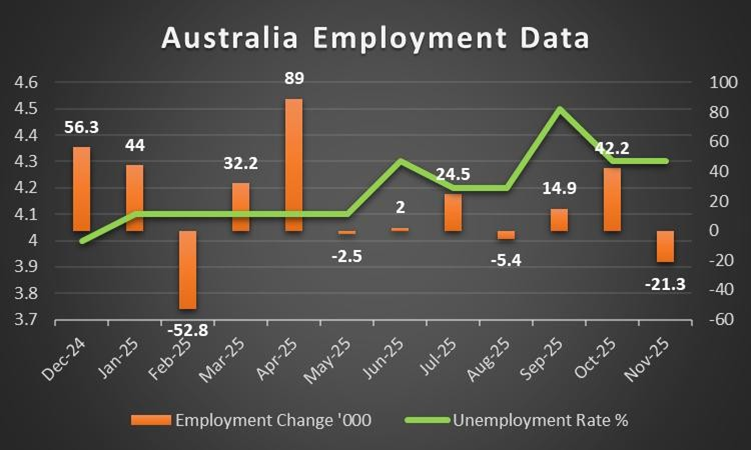

AUD – Aussie traders to concentrate on December’s Employment data

Also the Aussie tended to remain relatively unchanged for the week against the USD. On a fundamental level, note that the risk off sentiment in the markets tends to keep the Aussie under pressure and we tend to highlight the market sentiment as maybe the main issue for Aussie traders on a fundamental level. Yet Aussie traders are always keeping China also in their peripheral vision given the close Sino Australian economic ties. China’s December trade data revealed that the imports growth rate accelerated beyond market expectations, which tends to bode well with Aussie traders. Also the acceleration of China’s industrial output for the same month is a positive signal for Australian exports and subsequently for the Aussie as such. In the coming week, we note the release of China’s GDP rate for Q4 and a possible acceleration could aid AUD and the vice versa. On a macroeconomic level, it has been a quiet week for Aussie traders, yet in the coming week, we highlight the release of Australia’s December employment data. Should the data show a tightening of the Australian employment market we may see the Aussie getting some support as the market’s expectations for RBA to continue tightening its monetary policy may intensify. Please bear in mind that currently AUD OIS imply that the market expects the bank to proceed with a rate hike in the May meeting and then remain on hold for the rest of the year, with such expectations providing moderate support for the AUD of a monetary level.

Analyst’s opinion (AUD)

“The main market mover for Aussie traders in the coming week may prove to be the release of Australia’s employment market and data pointing towards a possibly tighter than expected Australian employment market may provide some support for AUD. Also the cautious market sentiment seems to keep the Aussie under pressure as AUD is considered a risky asset in the FX market.”

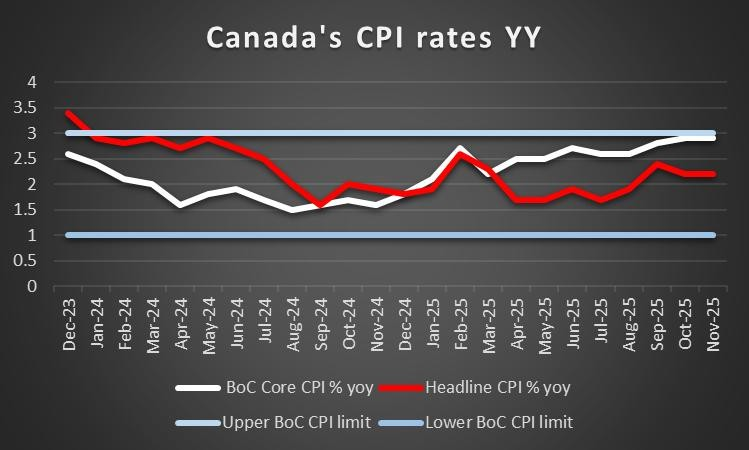

CAD –Canada’s December inflation data could shake the Loonie

The Loonie is about to end the week relatively steady against the USD. On a monetary level, BoC is currently expected to remain on hold until the end of the year, which tends to be supportive for the Loonie on a monetary level. On a fundamental level, we note the perception of a positive correlation between the CAD and oil prices, given Canada’s status as a major oil producer. The reversal of Venezuela’s oil production cuts tends to place pressure on the CAD as Venezuelan oil could prove to be antagonistic for Canadian oil. On the other hand, the rise of oil prices seems to have been halted through a drastic drop yesterday, possibly weighing somewhat on the CAD. Also, on a fundamental level, we note that Canadian PM Carney is on tour in China trying to improve Sino-Canadian trade relationships, which could provide some support for the Loonie if materialized. On a macroeconomic level, the contraction of the building permits, wholesale trade and manufacturing sales growth rates tends to weigh on the CAD somewhat. In the coming week, we highlight the release of Canada’s December CPI rates on Monday and a possible acceleration of the rates could enhance the market’s expectations for the BoC to remain on hold, thus providing support for the Loonie. We also note the release of the PPI rates for the same month on Wednesday and a possible acceleration could also act bullishly for the Loonie.

Analyst’s opinion (CAD)

“In the coming week we highlight the release of Canada’s CPI rates as possibly the main event of the week. A possible acceleration of the rates could enhance the market’s expectations for the BoC to remain on hold, thus providing support for the Loonie.”

General Comment

In the FX market all being equal, we expect the USD relent some of the initiative to other currencies, and density and gravity of US financial releases tends to ease somewhat. Allowing other currencies to get under the spotlight in the coming week may form a more balanced mix for traders. Indexes related to US stockmarkets tend to remain stable over the week but at record high levels. US President Trump’s intentions to cap interest rates at 10% on credit cards, tended to weigh on US stock markets somewhat. Also we note the start of the earnings season, and large US banks reported healthy rates and figures, often surpassing market expectations in the past few days. In the coming week, notable earnings releases could be on Tuesday, Netflix and 3M, on Wednesday J&J and on Thursday Visa, Louis Vuitton, P&G and Intel. Should the earnings releases show improved and possibly better than expected figures, could provide a more risk on market sentiment with wider repercussions. As for precious metal’s we note that gold has reached new record high levels as did silver’s price, with the latter rising with substantially more intensity with the bullish outlook currently remaining intact for both.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.