Trump’s tariffs on Europeans are paused

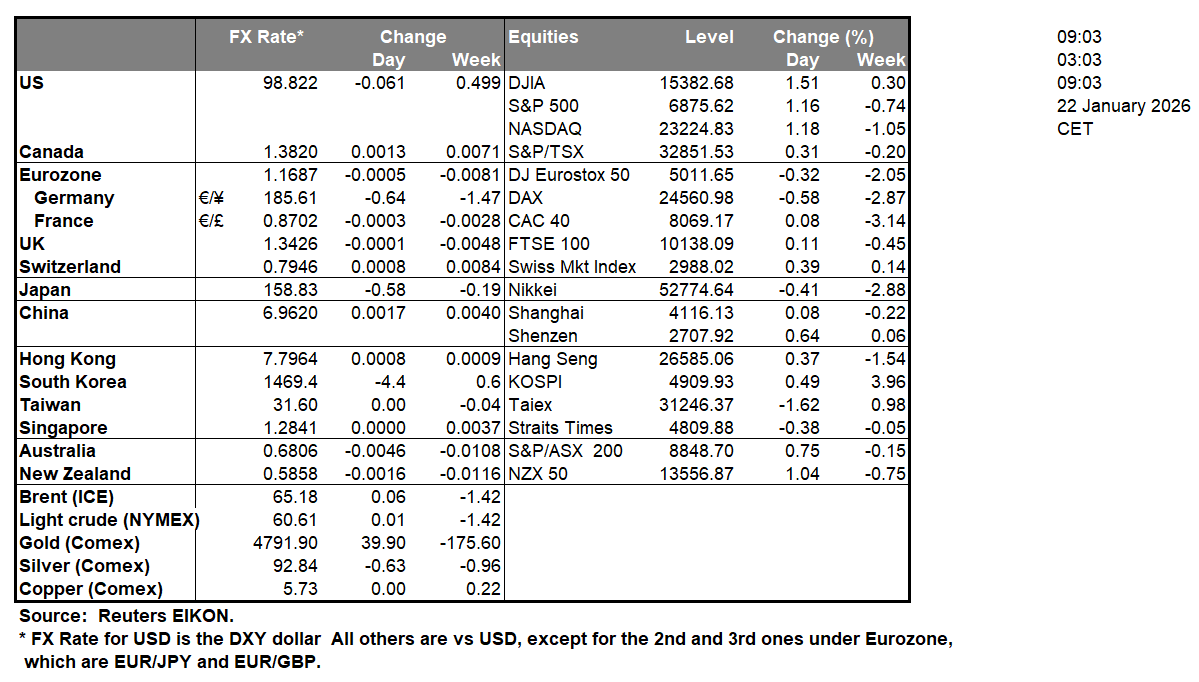

US President Trump postponed the placement of tariffs, as the possibility of a deal over Greenland emerged. Market sentiment improved, supporting riskier assets, allowing US equities to reversing some of Tuesday’s losses and halting Bitcoin’s drop.

Final Q3 US GDP rate and December’s US PCE rates eyed

Today, we highlight the release of the final US GDP rate for Q3 and the PCE rates for December and a possible acceleration could mean faster growth of the US economy and a resilience of inflationary pressures, which could harden the Fed’s intentions to remain on hold for longer, thus providing support for USD and weighing on gold’s price and US equities.

BoJ’s interest rate decision

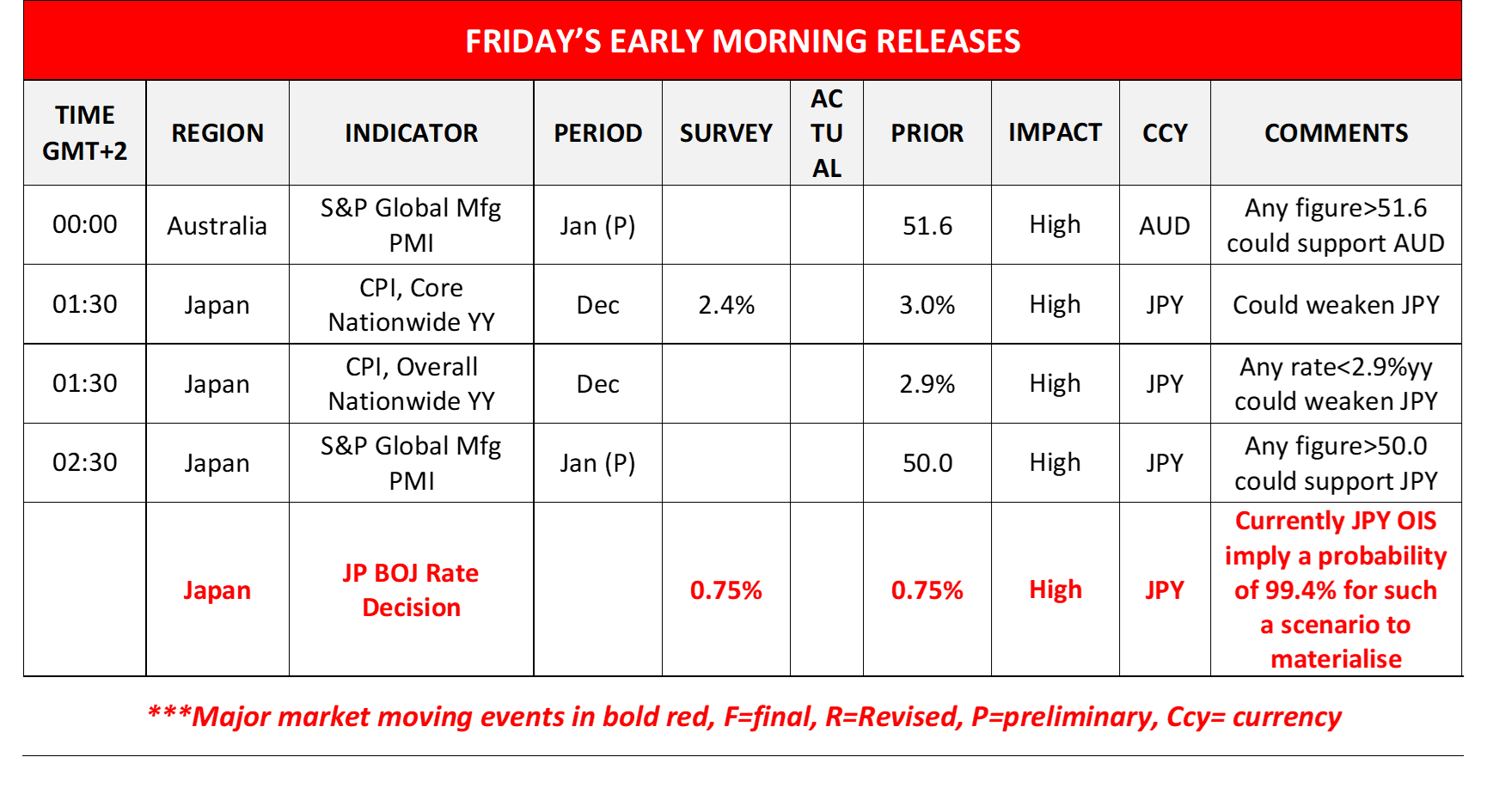

BoJ is to deliver its interest rate decision in tomorrow’s Asian session and is widely expected to remain on hold. If actually so, which is our base scenario as well, market attention is expected to turn towards the bank’s forward guidance and a possibly more than expected hawkish tone could support the JPY.

AUD rallies on stronger than expected employment data

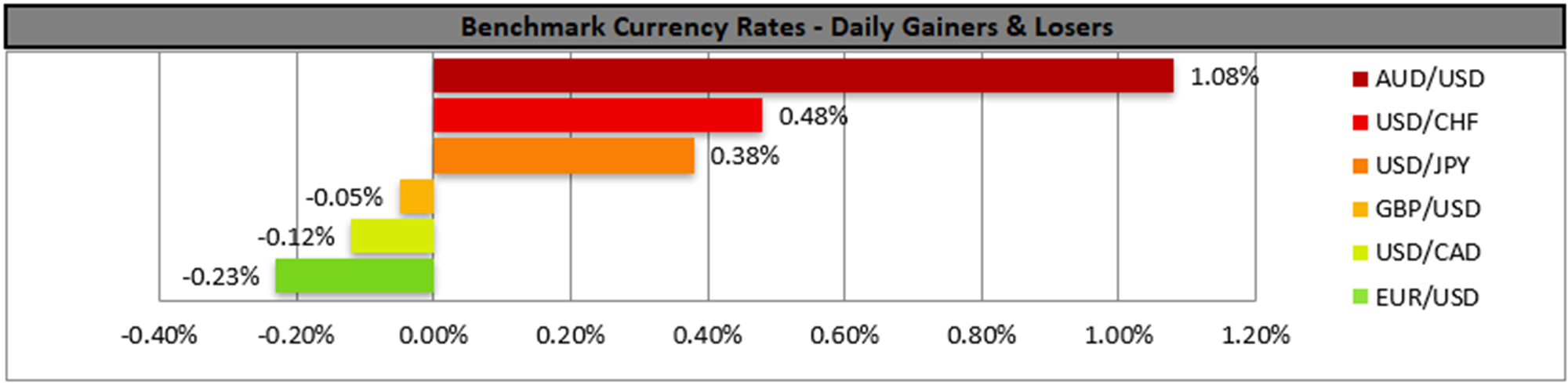

The Aussie rallied in today’s Asian session, as Australia’s employment data for December showed a tighter-than-expected Australian employment market. The release could enhance market expectations for RBA to remain on hold throughout the year.

Intel’s earnings report in focus

Intel’s share price jumped around 9% yesterday and today we highlight the release of its earnings report. Possible better-than-expected EPS and revenue figures, accompanied by a possibly optimistic forward guidance, could provide additional support.

Charts to keep an eye out

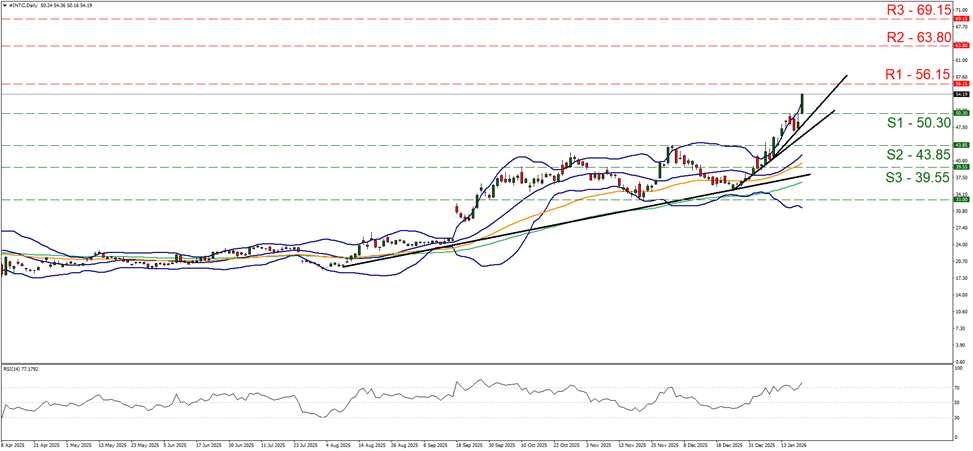

Intel’s share price rose approximately 9% yesterday breaking clearly the 50.30 (S1) resistance line, now turned to support. We maintain our bullish outlook as long as the upward trendline guiding the share’s price remains intact. Please note that Intel’s price action has reached overbought territory and seems ripe for a correction lower. Should the bulls maintain control, we may see intel’s share price breaking the 56.15 (R1) resistance line and start aiming for the 63.80 (R2) resistance level. Should the bears take over, which we consider as remote currently, we may see the share’s price action cutting through the 50.30 (S1) support line, the prementioned upward trendline, the 43.85 (S2) support barrier and pave the way for the 39.55 (S3) level.

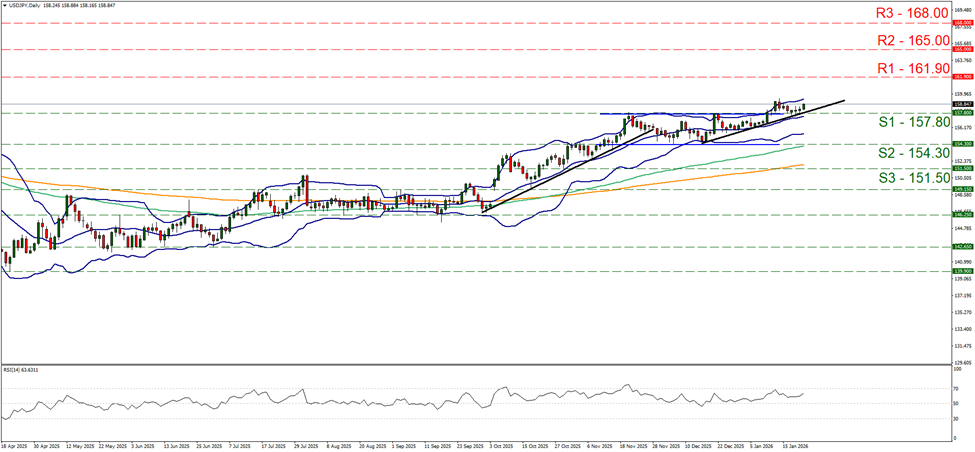

USD/JPY edged higher during today’s Asian session, yet for the time being seems to remain just above the 157.80 (S1) support line, unconvincing of its bullish tendencies. Nevertheless we maintain our bullish outlook as the pair’s movement continues to respect the upward trendline guiding it and the RSI indicator implies a bullish market predisposition. Should the bulls remain in control, we may see the pair aiming for the 161.90 (R1) resistance line. Should the bears take over, we may see USD/JPY breaking the prementioned upward trendline, breaking also the 157.80 (S1) support line clearly and continue lower actively aiming for the 0.6375 (S2) support level.

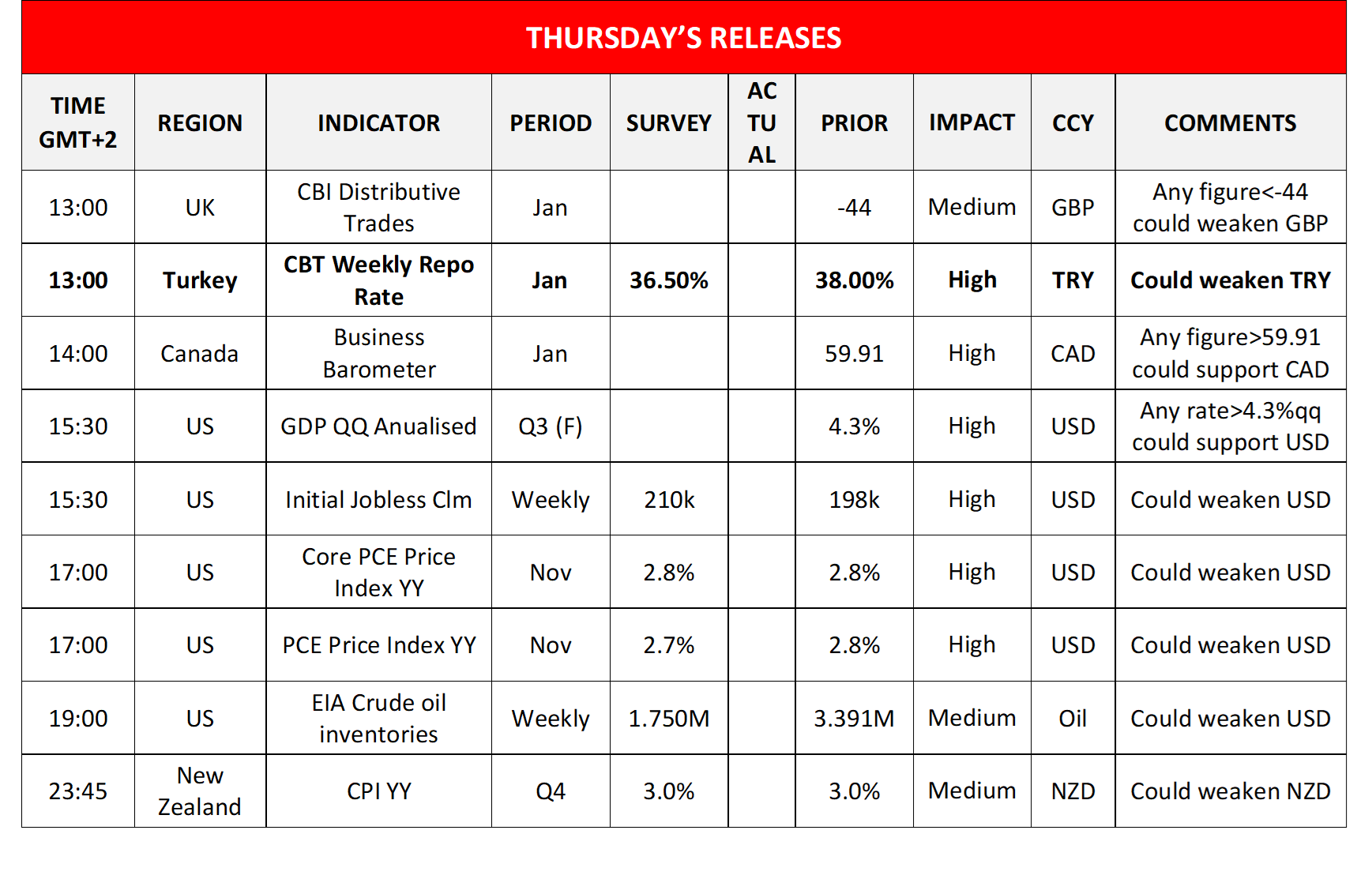

Other highlights for the day:

Today get Turkey’s CBT interest rate decision, Canada’s January business barometer, the US weekly initial jobless claims figure and the weekly EIA crude oil inventories, while later on we get New Zealand’s CPI rates for Q4. In tomorrow’s Asian session, we get Japan’s and Australia’s preliminary PMI figures for January while from Japan we also get the December CPI rates.

Intel Daily Chart

- Support: 50.30 (S1), 43.85 (S2), 39.55 (S3)

- Resistance: 56.15 (R1), 63.80 (R2), 69.15 (R3)

USD/JPY Daily Chart

- Support: 157.80 (S1), 154.30 (S2), 151.50 (S3)

- Resistance: 161.90 (R1), 165.00 (R2), 168.00 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.