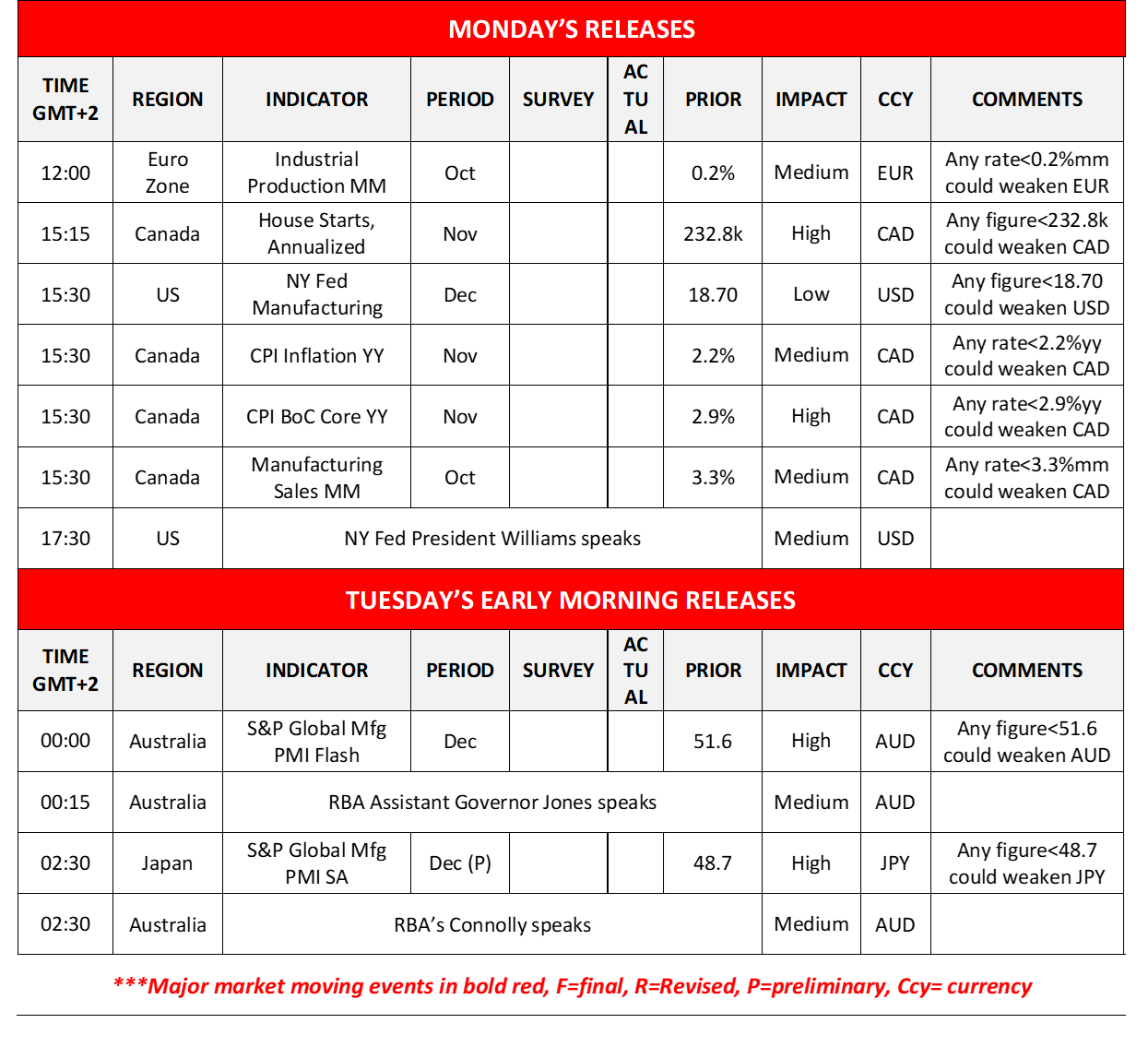

As the week begins the market is expected to focus on the release of the US employment and inflation data later this week as well as various interest rate decisions from various banks. Today, we highlight the release of Canada’s November CPI rates. The importance of the release is further enhanced as in the latest BoC interest rate decision the bank highlighted the importance of inflation in its future monetary policy moves. Should the rates accelerate possibly beyond market expectations we may see the Loonie getting some support as pressure on BoC to keep rates steady or even proceed with a hike may increase. On the flip side a possible slowdown of the rates could weigh on the CAD.

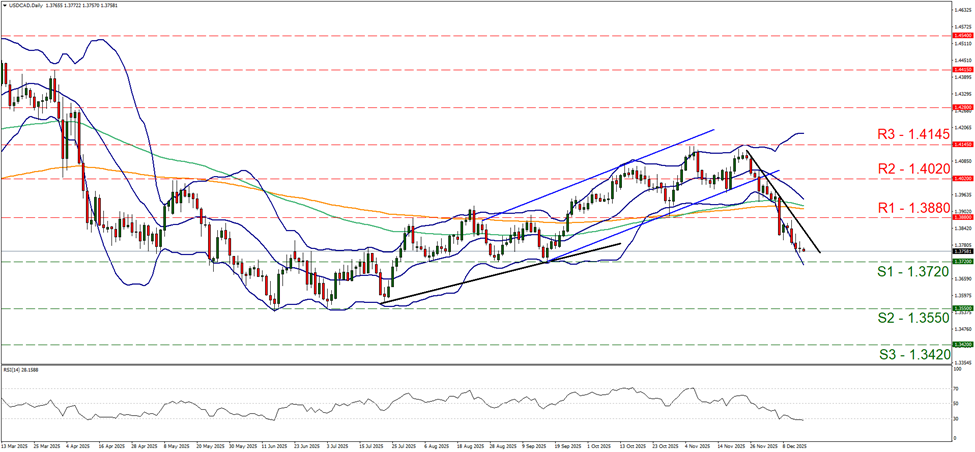

USD/CAD continues to aim the 1.3720 (S1) support line. We maintain our bearish outlook for the pair as long as the downward trendline incepted since the 25th of November. We also note that the RSI indicator has dropped below the reading of 30, implying a strong bearish market sentiment for the pair, yet at the same time it may imply that the pair has reached oversold levels and is ripe for a correction higher. Should the bears maintain control over the pair’s direction, we may see USD/CAD breaking the 1.3720 (S1) support line and continue aiming for the 1.3550 (S2) support level. Should the bulls take over, we may see the pair breaking the 1.3880 (R1) resistance line and start aiming for the 1.4020 (R2) resistance level.

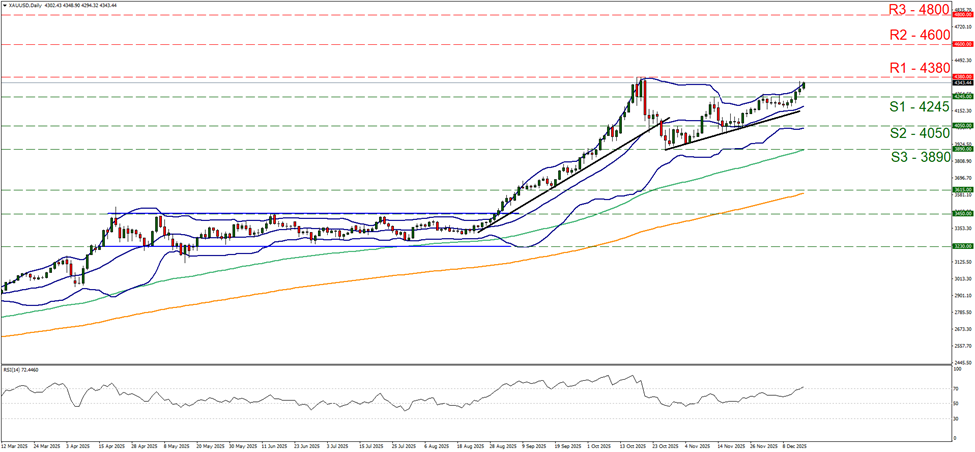

On the flip side gold’s price continued to rise in today’s Asian session, aiming for the 4380 (R1) resistance line, which marks an All Time High (ATH) for the precious metal’s price. We maintain a bullish outlook for gold’s price given that the upward trendline guiding it remains intact since the 28th of October. We also note that the RSI indicator has risen above the reading of 70, implying a strong bullish sentiment among market participants yet at the same time that gold’s price action has reached overbought levels and may be inclined for a correction lower. Similar signals are coming from the price action flirting with the upper Bollinger Band. Should the shiny metal’s bullish outlook be maintained, we may see it’s price action breaking the 4380 (R1) resistance line and set as the next possible target for the bulls the 4600 (R2) resistance barrier. On the flip side for a bearish outlook to be adopted, we require gold’s price to break the 4245 (S1) support line, continue to break the prementioned upward trendline in a first signal of an interruption of the upward movement and continue even lower to reach if not break the 4050 (S2) support base.

Other highlights for the day:

Today, we get Euro Zone’s industrial output for October, Canada’s November House Starts figure, the US NY Fed manufacturing index for December and Canada’s manufacturing sales for October, while NY Fed President Williams speaks. In tomorrow’s Asian session, RBA’s Jones and Connolly are speaking.

As for the rest of the week:

On Tuesday we get France’s , Germany’s, the Euro Zone’s, the UK’s and the US preliminary PMI figures for December as well as UK’s employment data for October, Germany’s ZEW indicators for December and from the US we highlight the release of the US employment report for November, with its NFP figure and also note the release of the retail sales for October. On Wednesday, we get Japan’s trade data for November, UK’s CPI rates for November, Germany’s Ifo indicators for December and New Zealand’s GDP rate for Q3. On Thursday we get the interest rate decisions of Sweden’s Riksbank, Norway’s Norgesbank, UK’s Bank of England, the Euro Zone’s ECB and the Czech Republic’s CNB. Also on Thursday we note from the USD, the release of the CPI rates for November, the weekly initial jobless claims figure and the Philly Fed Business index for December. On Friday we get Japan’s CPI rates for November, BoJ’s interest rate decision, Germany’s Gfk consumer confidence for January, UK’s November retail sales, the US CPI rates for October, Canada’s retail sales for October and the Euro Zone’s preliminary consumer confidence for December.

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

XAU/USD Daily Chart

- Support: 4245 (S1), 4050 (S2), 3890 (S3)

- Resistance: 4380 (R1), 4600 (R2), 4800 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.