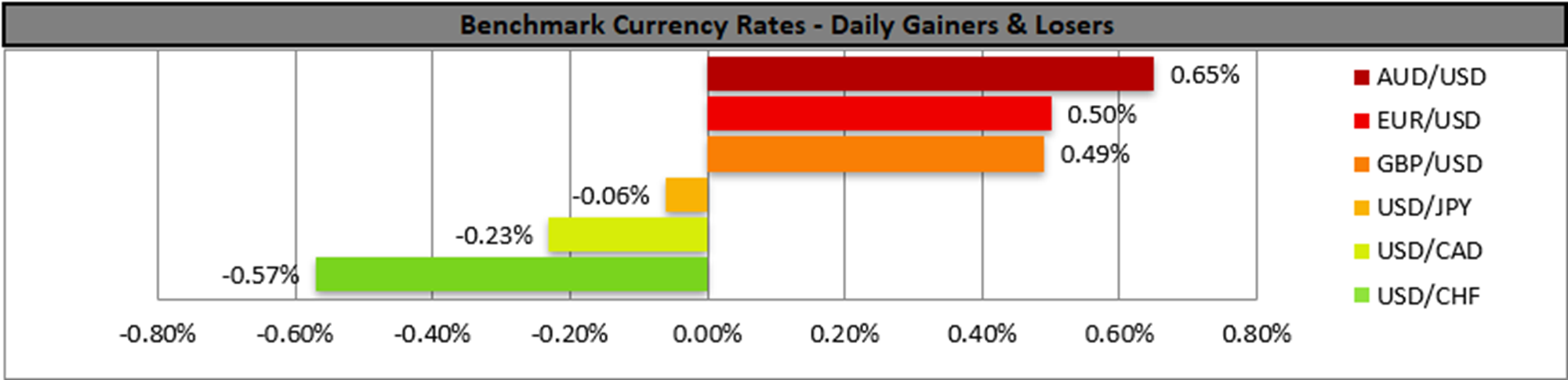

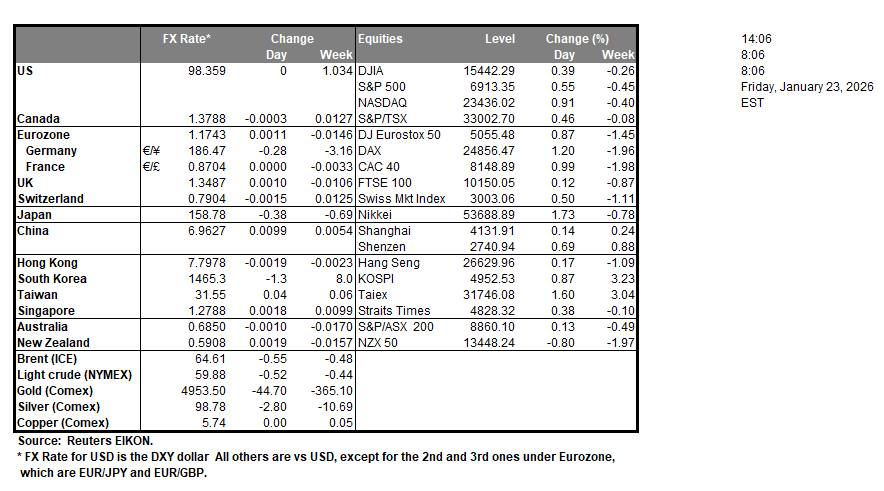

- USD weakened despite favorable data

The selling momentum for the USD in the FX market was maintained yesterday, given the geopolitical shifts and the world’s reserve currency is about to end the week in the reds. November’s PCE rates displayed a resilience of inflationary pressures and the final GDP rate for Q3 25 accelerated, which may harden the Fed’s stance, ahead of next week’s interest rate decision meeting.

- Euro Zone’s Preliminary January PMI figures

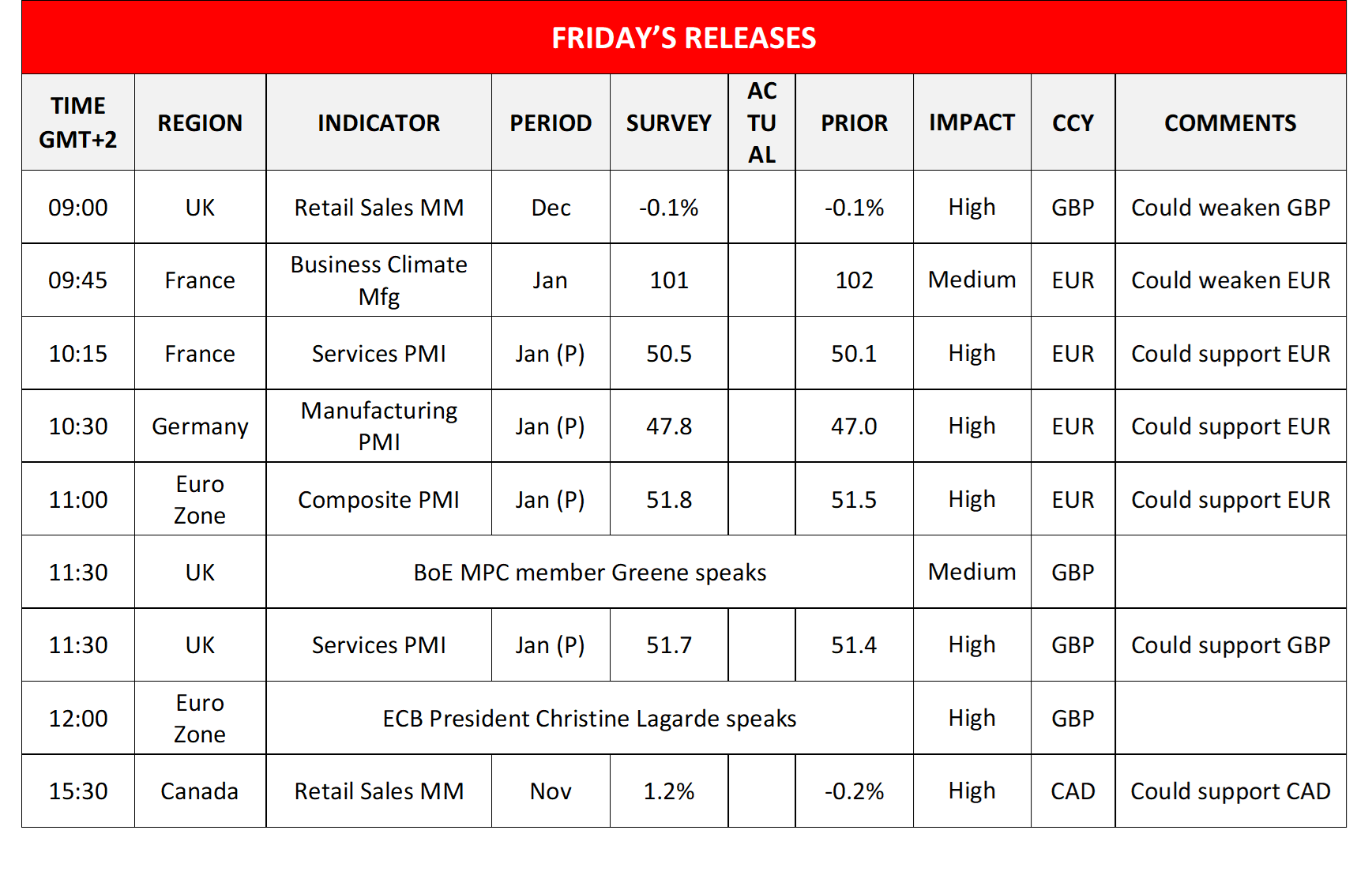

Today we highlight the release of Euro Zone’s preliminary PMI figures for January, We intend to keep a close eye on the release of France’s services sector, Germany’s manufacturing sector and for a rounder view Euro Zone’s composite indicator. Overall, a possible faster expansion of economic activity in the Euro Zone may provide support for the common currency.

- BoJ remains on hold

BoJ remained on hold as was widely expected keeping rates unchanged at 0.75%, yet failed to convince the markets for its intentions to tighten its monetary policy further in the coming months. The release along with a considerable easing of inflationary pressures in the Japanese economy weighed on JPY.

- Intel drops 12% on disappointing forward guidance

Intel’s share price was reported dropping as much as 12% in some point of the aftermarket hours as despite its earnings report including better than expected figures for EPS and revenue the company’s forward guidance especially about data centers tended to disappoint investors, yet that may prove to be a temporary setback.

- Charts to keep an eye out

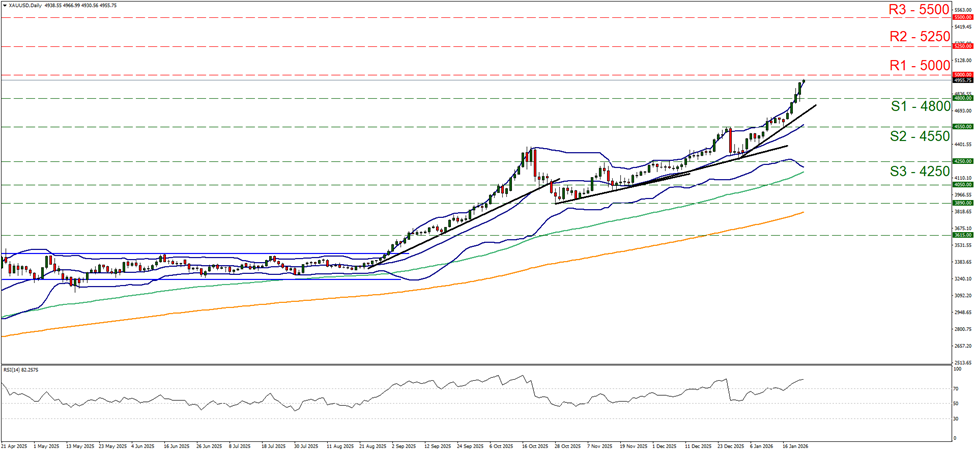

Gold’s price continued to rise yesterday and during today’s Asian session aiming for the $5000 (R1) resistance line. We intend to maintain our bullish outlook for the precious metal’s price as long as the upward trendline guiding it remains intact. Should the bulls maintain control, we may see gold’s price breaking the 5000 (R1) resistance line and we set as the next possible target for the bulls the 5250 (R2) resistance level. At the same time we issue a warning for a possible correction lower as gold is at overbought levels, given that the RSI indicator is substantially above the reading of 70 and the precious metal’s price action is above the upper Bollinger band. Should the bears take over, which we consider as a remote scenario currently, we may see gold’s price action breaking the 4800 (S1) support line, the prementioned upward trendline and continue even lower to break also the 4550 (S2) support barrier.

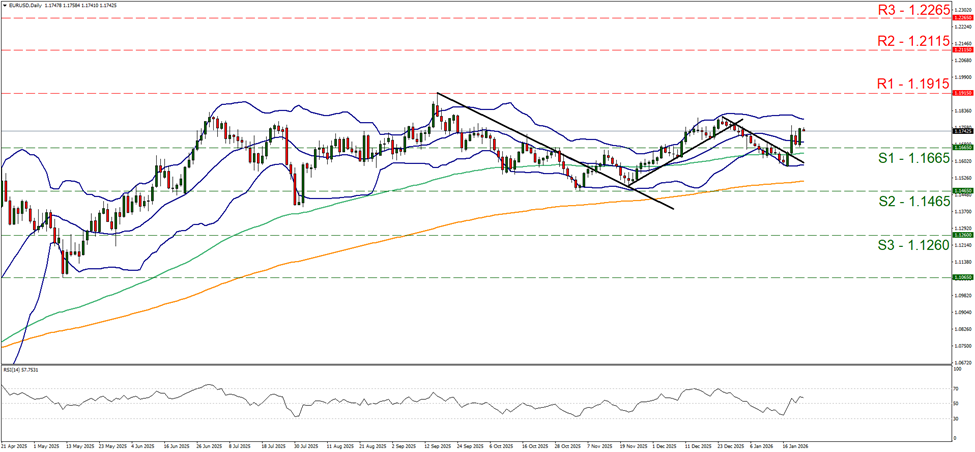

EUR/USD edged higher yesterday after bouncing on the 1.1665 (S1) support line. The pair’s price action seems to be locked in a sideways motion between the 1.1915 (R1) resistance line and the 1.1465 (S2) support level, with the S1 being seemingly the axis around which the price action revolves. We maintain our bias for a sideways motion of the pair yet note that the RSI indicator is slightly above the reading of 50, which may imply a bullish predisposition of the market for EUR/USD. Should the bulls get in the driver’s seat, we may see EUR/USD breaking the 1.1915 (R1) line and start aiming for the 1.2115 (R2) level. In a bearish scenario, we may see EUR/USD breaking the 1.1665 (S1) line and continuing lower, breaking the 1.1465 (S2) level.

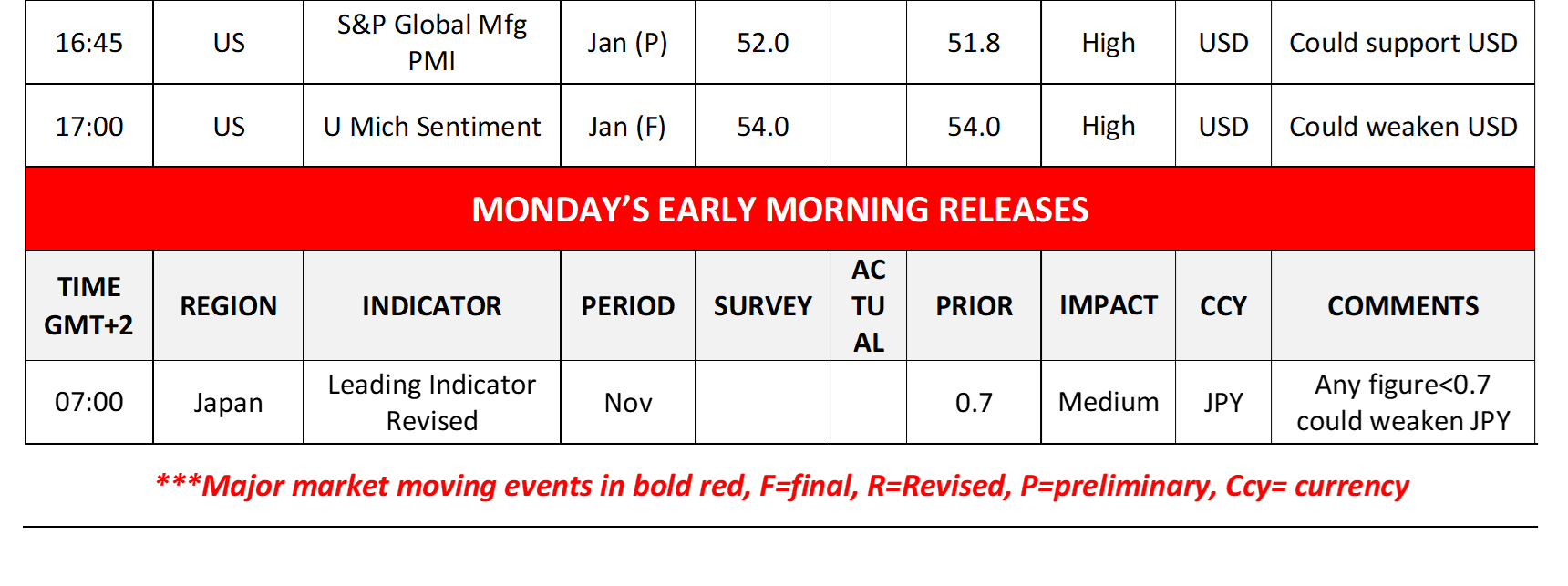

Other highlights for the day:

Today we get UK’s retail sales for December, France’s Business climate for January, January’s preliminary PMI figures for the UK and the US, Canada’s retail sales for November and the US final UoM consumer sentiment for January. On a monetary level, we note that ECB President Lagarde and BoE’s MPC member Greene speak. In Monday’s Asian session, we get Japan’s leading index for November.

XAU/USD Daily Chart

- Support: 4800 (S1), 4550 (S2), 4250 (S3)

- Resistance: 5000 (R1), 5250 (R2), 5500 (R3)

EUR/USD Daily Chart

- Support: 1.1665 (S1), 1.1465 (S2), 1.1260 (S3)

- Resistance: 1.1915 (R1), 1.2115 (R2), 1.2265 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.