As expected on Friday’s report, the Yen gained across the board during today’s Asian session, as the Japanese currency was aided by BoJ Governor Ueada’s comments. Mr. Ueda practically allowed for a rate hike in the near term despite the Japanese Government’s wishes for any monetary policy tightening to be slow. The BoJ Governor stated that the bank is to contemplate about the “pros and cons” of rate hike in the December meeting, in another, possibly the strongest signal for a tightening before the year’s end. He also stated that he will be further elaborating about the bank’s rate hiking path, once rates are raised to 0.75%. In the December meeting, the bank plans to take into consideration wage information and other data. JPY OIS currently continue to imply a market expectations for the bank to remain on hold, yet the recent weakening of the JPY against the USD especially, tends to support the possibility of a rate hike by the bank.

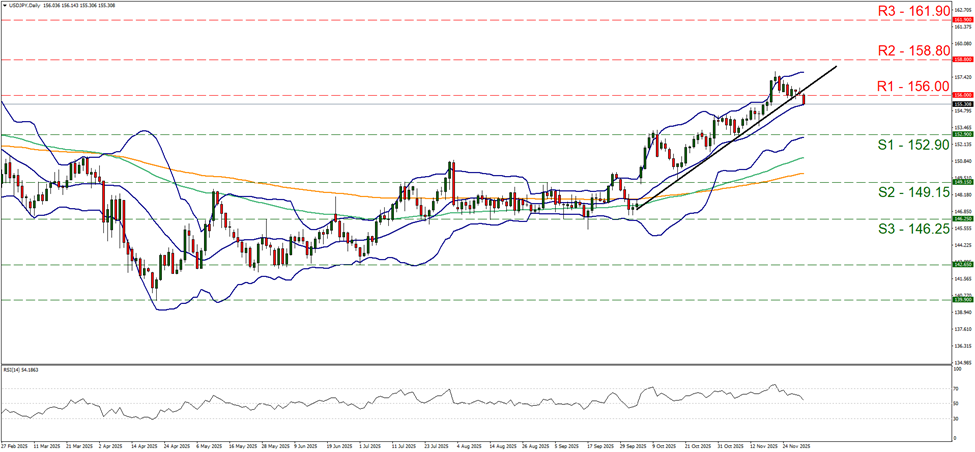

In the FX market we note that USD/JPY dropped breaking the 156.00 (R1) support line now turned to resistance. As the pair’s price action in its downward motion has also broken the upward trendline guiding it since the start of October, we switch our bullish outlook in favour of a sideways motion for the time being. We note that the RSI indicator has dropped nearing but not reaching if breaking the level of 50, which tends to imply that the bullish market sentiment has eased considerably, but a bearish sentiment does not seem to appear yet. Should the bears take over, we may see the pair aiming if not breaching the 152.90 (S1) support line and we set as the next possible target for the bears the 149.15 (S2) support level. Should the bulls regain control over the pair we may see the pair breaking the 156.00 (R1) resistance level, and start aiming for the 158.80 (R2) resistance level.

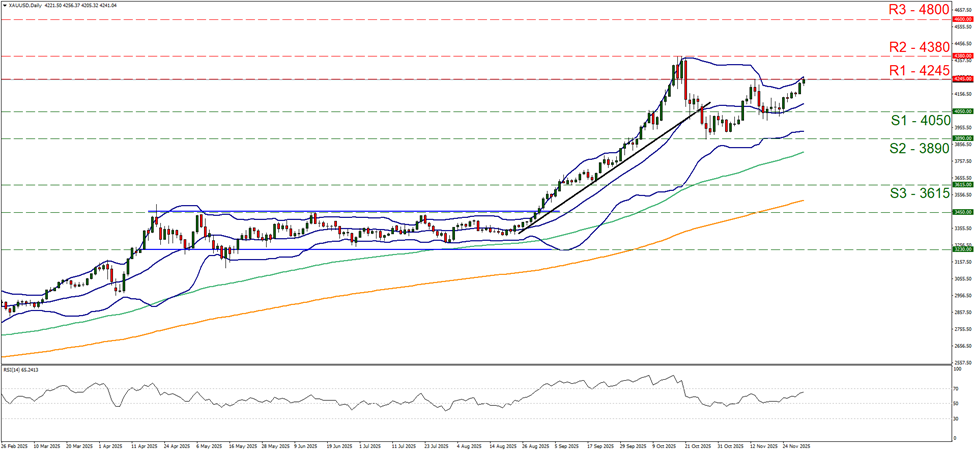

Also on a technical level, we note that gold’s price continued to edge higher and is currently teasing the 4245 (R1) resistance level, a level at which the precious metal’s price has reached and subsequently corrected lower on the 13th of November. Please note that the RSI indicator is rising and nearing the reading of 70, reporting an intensifying bullish market sentiment for gold’s price. Hence we note the bullish tendencies of gold’s price, yet for the adoption of a bullish outlook we would require gold’s price to form a new higher peak. Should the bulls take over ,we may see gold’s price breaking the 4245 (R1) resistance line and start aiming for the 4380 (R2) resistance level, an All Time High (ATM) for gold. For a bearish outlook to emerge gold’s price would have to break the 4050 (S1) line and continue lower to aim the 3890 (S2) support level.

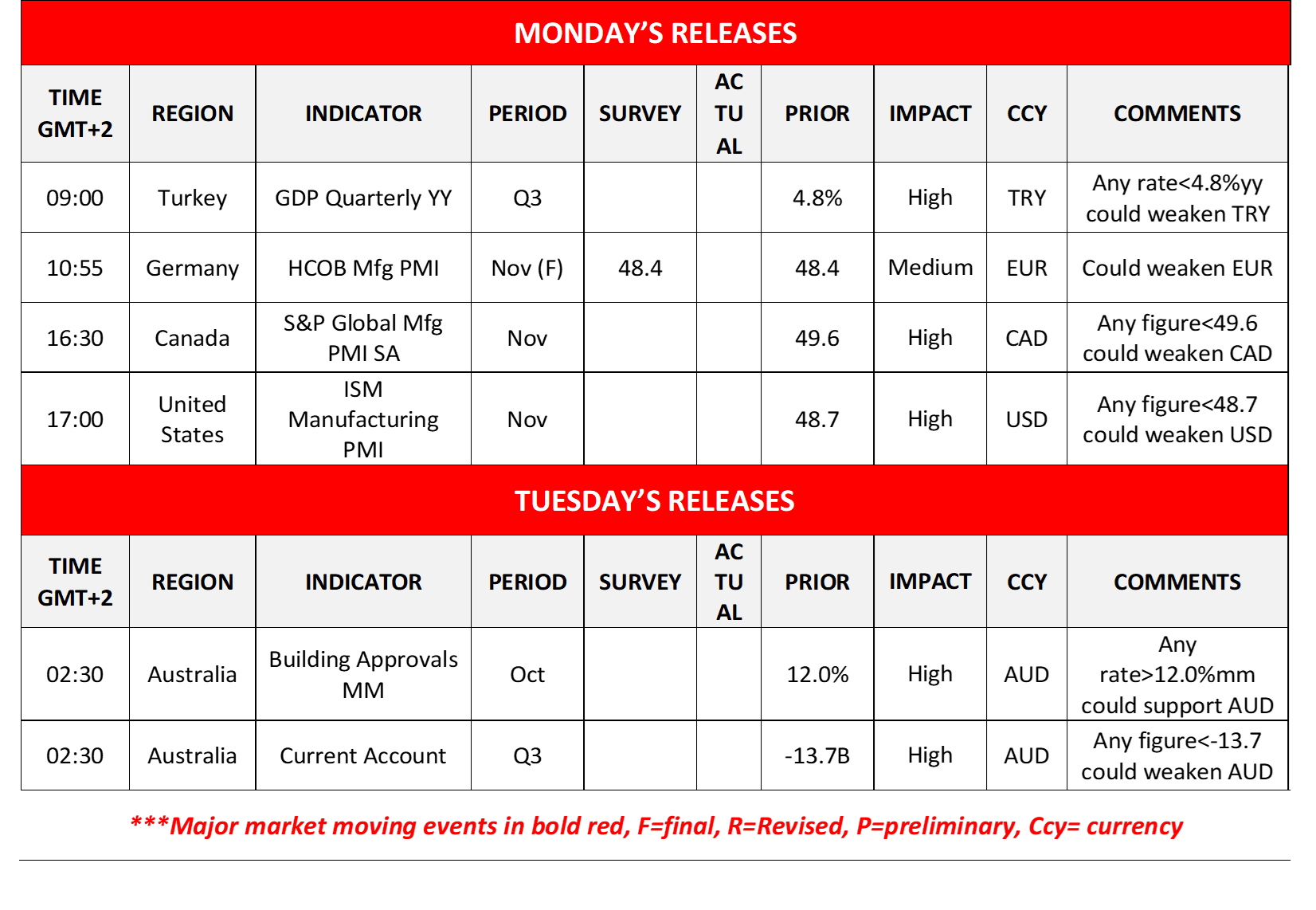

Other highlights for the day:

Today we get Turkey’s GDP rate for Q3, Germany’s final manufacturing PMI figure, Canada’s PMI and from the US the ISM manufacturing PMI figure, all for November. In tomorrow’s Asian session, we get Australia’s building approvals for October and current account balance for Q3.

As for the rest of the week:

On Tuesday, we get the UK’s nationwide house prices rate for November and the Eurozone’s preliminary HICP rate for November. On Wednesday, we get Australia’s GDP rate for Q3, Turkey’s and Switzerland’s CPI rates, the US ADP Employment change figure all for November, the US industrial production rate for September and the ISM non-manufacturing PMI figure for November. On Thursday, we get Australia’s trade balance figure for October, Sweden’s and the Czech Republic’s preliminary CPI rates for November, the US weekly initial jobless claims figure and Canada’s trade balance. On Friday we note Japan’s household spending rate, Germany’s industrial orders rate for October, the UK’s Halifax house prices rate for November, the Eurozone’s revised GDP rate for Q3, Canada’s employment data for November, the US PCE rates, Factory orders and consumption rate all for September and ending the week is the US UoM preliminary consumer sentiment figure for December.

USD/JPY Daily Chart

- Support: 152.90 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 156.00 (R1), 158.80 (R2), 161.90 (R3)

XAU/USD Daily Chart

- Support: 4050 (S1), 3890 (S2), 3615 (S3)

- Resistance: 4245 (R1), 4380 (R2), 4800 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.