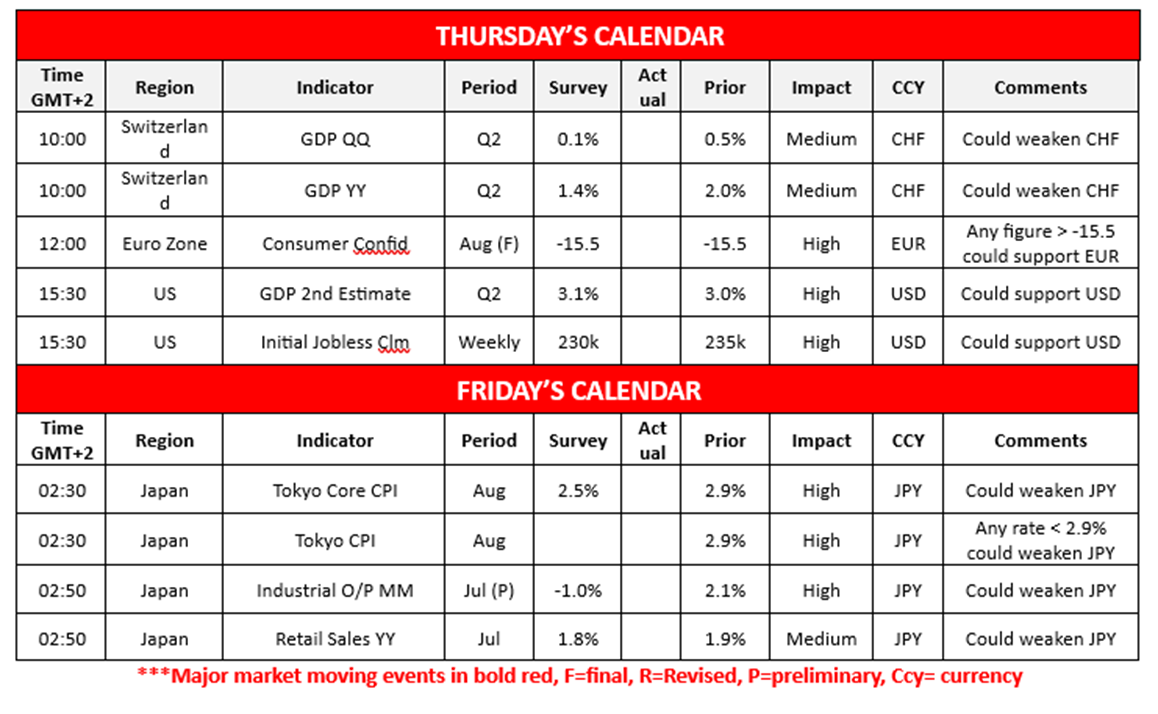

The US GDP rates for Q2 are set to be released during today’s American session. The current expectations by economists for the release is for the GDP rate to come in at 3.1% thus implying economic growth and an improvement from the prior rate of 3.0%. In turn such a scenario could provide support for the dollar as the economic situation in the US appears to be improving. However, a failure to meet the expectations by economists could weigh on the dollar and could increase pressure on the Fed to further consider a possible rate cut in their next meeting.In tomorrow’s Asian session Japan’s Tokyo CPI rates for August are set to be released and could garner significant attention from Yen traders. In particular on a core level, the inflation print is expected to come in at 2.5% which would be lower than the prior rate of 2.9% and could thus imply easing inflationary pressures in the Japanese economy. Hence, should inflation appear to be easing it may reduce pressure on the BOJ to resume on their rate hiking cycle, which may then weigh on the JPY. However, should the inflation print take the markets by surprise by coming in higher than expected, it could increase calls for the BOJ to hike in their next meeting and could thus provide support for the JPY.Nvidia’s earnings for the quarter were released last evening. The company beat expectations from analysts with their earnings per share coming in at $1.05 versus $1.01 whilst also beating revenue estimates. In turn the better-than-expected earnings report may have in theory provided support for the company’s stock price initially. Yet, as we had discussed yesterday the company’s forward guidance garnered more attention and of particular interest in our opinion was that “Nvidia said it has not assumed any shipments of its H20 chips to China in its outlook”, per Reuters. The continued issues over the sale of Nvidia’s H20 in China could lead to concerns over the company’s future revenue.

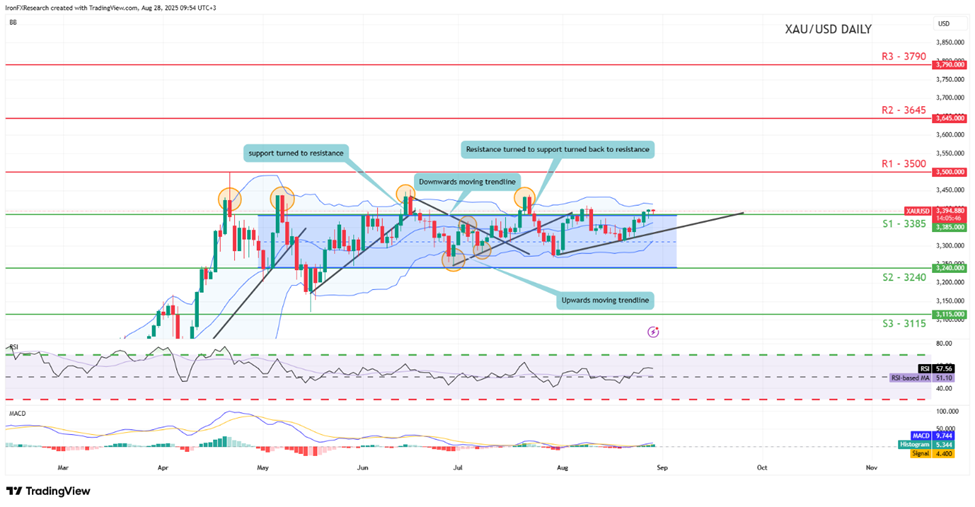

XAU/USD appears to be moving in an upwards fashion after clearing our resistance now turned to support at the 3385 (S1) support level. We opt for a bullish outlook for gold’s price and supporting our case is the upwards moving trendline in addition to the RSI and MACD indicator below our chart. For our bullish outlook to continue we would require a break above the 3500 (R1) resistance level, with the next possible target for the bulls being the hypothetical 3645 (R2) resistance line. On the other hand, for a sideways bias we would require the commodity’s price to remain confined between the 3385 (S1) support level and the 3500 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 3385 (S1) support level with the next possible target for the bears being the 3240 (S2) support line.

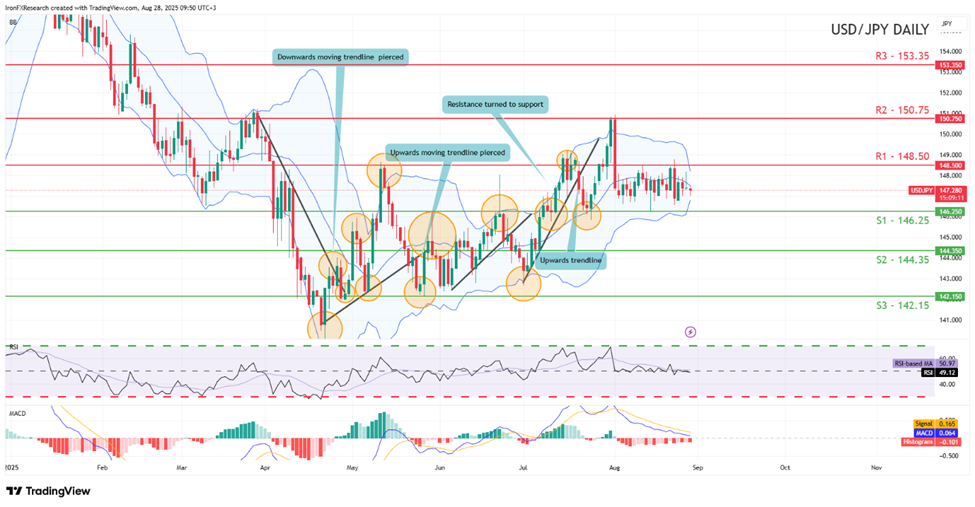

USD/JPY appears to be moving in a sideways bias. We opt for a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require the pair to remain confined between our 146.25 (S1) support level and our 148.50 (R1) resistance line. On the other hand, for a bullish outlook, we would require a clear break above our 148.50 (R1) resistance line with the next possible target for the bulls being the 150.75 (R2) resistance level. Lastly, for a bearish outlook to occur we would require a clear break below our 146.25 (S1) support line with the next possible target for the bears being the 144.35 (S2) support level.

Other highlights for the day:

Today we get Switzerland’s GDP rates for Q2, the Eurozone’s final consumer confidence figure for August, the US’s 2nd GDP Estimate for Q2 and the weekly initial jobless claims figure. In tomorrow’s Asian session we note Japan’s Tokyo CPI rates for August, Japan’s preliminary Industrial output rate for July and Japan’s retail sales rate for July.

XAU/USD Daily Chart

- Support: 3385 (S1), 3240 (S2), 3115 (S3)

- Resistance: 3500 (R1), 3645 (R2), 3790 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 144.35 (S2), 142.15 (S3)

- Resistance: 148.50 (R1), 150.75 (R2), 153.35 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.