The week is nearing its end and we have a look at what next week’s calendar has in store for the markets. We make a start with an easy Monday with UK’s CBI distributive trades for July and continue on Tuesday with Sweden’s preliminary GDP rate for Q2 and the US consumer confidence indicator for July. On Wednesday we note the release of Australia’s CPI rates for July and Q2, France’s, Germany’s, the Euro Zone as a whole and the US preliminary GDP rates for Q2 as well as Switzerland’s KOF indicator for July, while on a monetary level, we note the interest rate decision of BoC from Canada and we highlight in the US the release of the Fed’s interest rate decision. On a packed Thursday we get Japan’s preliminary industrial output for June, China’s NBS PMI figures for July, Australia’s building approvals and retail sales, both for June, France’s and Germany’s preliminary HICP rates for July, the US consumption rate for June, the US PCE rates for June, the weekly US initial jobless claims figure and finally Canada’s GDP rate for May. On Friday we get China’s Caixin manufacturing PMI figure, UK’s nationwide house prices for July, Euro Zone’s preliminary HICP rates for July, the US ISM manufacturing PMI figure, the final US UoM consumer sentiment reading and we highlight the release of the US employment report for July.

USD – Fed’s interest rate decision in focus

On a monetary level, we highlight the Fed’s interest rate decision next Wednesday. The bank is widely expected to remain on hold and currently Fed Fund Futures imply a probability of 97% for such a scenario to materialise, while also imply that the market expects the bank to deliver a rate cut in the September meeting and another rate cut in the December meeting. Hence there seems to be a dovish inclination of the market for the bank’s intentions. Our attention is to be placed on the bank’s forward guidance. Should the bank imply that it is prepared to keep rates high for longer, thus contradicting the market’s expectations we may see the USD getting substantial support. On the flip side should the bank imply that it may proceed with a rate cut in its next meeting, in September, we may see the release weighing on the USD. Also on monetary level we cannot ignore the constant attacks of US President Trump and his associates against Fed Chairman Powell, and should the market’s worries for the independence of the Fed intensify over the coming week, we may see them weighing on the USD.

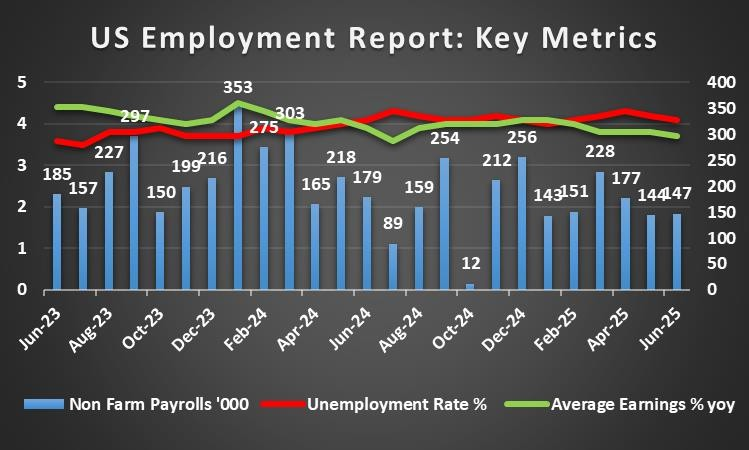

On a macro level, it’s to be a busy week for the greenback, yet we highlight three releases which are to provide insights in regards for growth, the labour market and inflationary pressures in the US economy. The first is to be the release of the GDP advance rate for Q2 and the rate is expected to accelerate after last quarter’s disappointing -0.5%qq. Should the actual rates fail to meet the market’s expectations or even contract once again, we may see the release weighing on the USD while should the rates accelerate beyond market expectations, we may see the release exciting traders providing support for the greenback. On Thursday we highlight the release of the US PCE rates for June. Should the rates accelerate, verifying the intensification of inflationary pressures in the US economy, we may see the USD gaining and vice versa. Last but not least we highlight the release of the US employment report for July on Friday. The NFP figure is expected to drop to 102k if compared to June’s 147k and the unemployment rate to tick up to 4.2%, with both indicators implying an easing of the US employment market which in turn may weigh on the USD. Yet the actual rates and figures seldomly meet the market’s expectations and should the actual data show an unexpected tightening of the US employment market, it could provide substantial support for the USD.

On a fundamental level, Trump’s trade wars continue to shake the markets. In a latest development the US President has announced that a trade deal has been reached. The US President posted on Truth Social, that the US import tariffs for Japanese products would be of 15% which is significantly lower than previous 25%, which was expected to come into effect from the 1st of August onwards. On the flip side, Japan is to invest $550 billion in the US. It’s important to state that the deal was announced just eight days before US President Trump’s 1st of August deadline and given the trading volume of the two nations, the deal can be considered as very important. Attention is now placed on the EU-US trade negotiations with analysts, citing the scenario of a US-EU 15% trade deal being near, yet nothing is certain yet and Trump’s deadline is nearing. On the flip side the EU seems to keep its retaliation options open. We expect the market’s worries for the US trade relationships being heightened until next Friday and the more trade deals are announced the more support the USD could get on fundamental level.

Analyst’s opinion (USD)

“Developments in the US are expected to keep the markets on the edge of their seats as we have in the calendar high impact releases and issues. WE expect market interest to heightened from Wednesday onwards as the US GDP rate for Q2, the Fed’s interest rate decision, June’s PCE rates, July’s employment data and US President Trump’s tariff deadline on the 1st of August could keep volatility high not only for USD pairs in the FX market but also have ripple effects in US equities markets and gold’s price.”

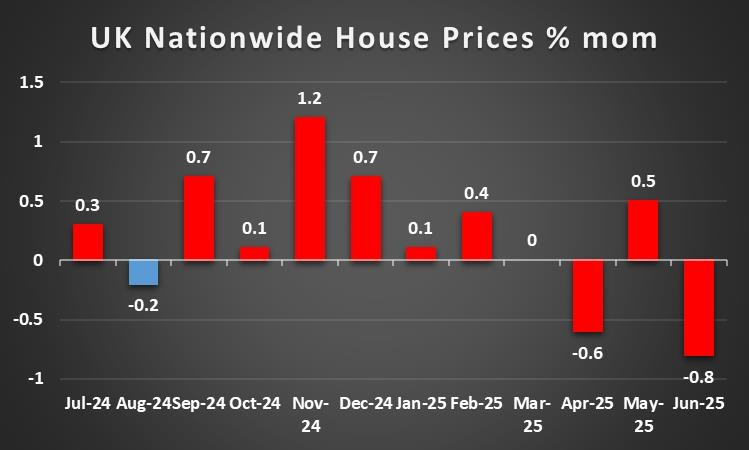

GBP – Fundamentals to lead the pound

On a macroeconomic level, the unexpected drop of the preliminary services sector PMI figure for July implied a slowdown of the expansion of economic activity for the critical UK services sector. On the other hand the acceleration of the retail sales growth rate for June, with the rate escaping the negatives, showing growth again, despite not reaching market expectations, tends to imply an improvement of the demand side of the UK economy. On the other hand the deeper contraction of House prices for the current month, tends to create some slight worries for the UK real estate sector, yet we note in the coming week the release of the Nationwide House Prices also for July next Friday which may shed more light on the path of house prices in the UK. In the coming week, given the low number of high impact of financial releases from the UK, we may see fundamentals leading the pound.

On a monetary level, BoE’s interest rate decision is still a way off, on the 7th of August, yet the market seems to maintain its expectations for a rate cut in the bank’s next meeting, but also for two additional rate cuts until the end of the year. In a latest speech of BoE Governor Bailey opted to concentrate on defending the current banking rules, given UK finance minister’s objection and pleads for an easing. Neverthelss we expect the bank to maintain a dovish inclination and thus should we see the market’s dovish expectations being maintained if not enhanced, we may see the pound being weakened on a monetary level.

On a fundamental level, we note that the UK Government, seems to maintain an orientation of a tighter UK fiscal policy, yet at the same time tries to give a boost to the UK economy through an easing of rules. It’s characteristic that UK finance minister Rachel Reeves stated that fiscal rules will be followed, while at the same time refused to rule out a wealth tax. At the same time we note that inflationary pressures in the UK economy may be adding to UK’s debt burden. Overall we see the case for the UK Government’s tight fiscal policy to weigh on the GBP.

Analyst’s opinion (GBP)

“High impact financial releases from the UK are scarce, which in turn may allow fundamentals to lead the pound. On a monetary level, BoE’s dovish intentions tend to weigh on the pound as do the UK Government’s intentions for a tight fiscal policy.”

JPY – BoJ expected to remain on hold

On a fundamental level, we note the defeat of the ruling coalition in Japan’s upper house elections last Sunday as it lost the majority in the upper legislative House. The election results seem to have been anticipated by the markets as we had also flagged such a scenario in last week’s report. Political stability in Japan is now at risk as Japanese PM Ishiba vowed to stay in power, yet doubts about his leadership emerge. It’s characteristic that reports highlighted the possibility of PM Ishiba resigning end of August, a scenario that was refuted by the Japanese PM. Also the Government’s ability to rule is set into question as it does not enjoy the majority nor in the upper house neither in the lower house, but also given the opposition within his own party, the Liberal Party. For the time being the possibility of the Japanese PM resigning remains open as he stated that he will be considering it after getting more clarity in regards to the outcome of the US-Japanese trade talks. The political instability in Japan could weigh on JPY.

On a monetary level, we note the release of BoJ’s interest rate decision next Thursday as a key event. Currently the bank is widely expected to remain on hold, hence market attention is expected to be placed on the bank’s forward guidance. The market seems to expect BoJ to hike rates one more time until the end of the year hence tends to be leaning on the hawkish side. We also see hawkish tendencies within the BoJ, yet the bank is facing increasing pressure, mostly on a political level, to maintain rates unchanged or even lower them and adopt a more supportive role for the Japanese economy. We also note the easing of inflationary pressures in the Japanese economy, which may have started to contradict BoJ’s narrative. Should we see the bank maintaining a more hawkish tone in its forward guidance could provide additional support for the JPY while a more dovish tone could weigh on the Yen.

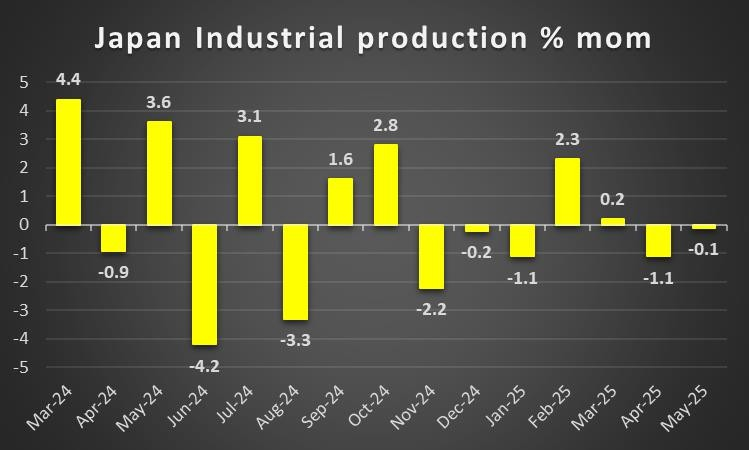

On a macroeconomic level, we note the drop of the preliminary manufacturing PMI figure for July, which implies a contraction of economic activity for the Japanese manufacturing sector. Hence we note in the coming week the release of the preliminary industrial output for June next Thursday for more clues for economic activity in Japan’s manufacturing sector.

Analyst’s opinion (JPY)

“In the coming week, we highlight BoJ’s interest rate decision as the key event for the coming week. The bank is expected to remain on hold and a possibly hawkish tone in its forward guidance could provide some support for the Yen. On a fundamental level, we may see the JPY being moved by political developments within Japan and the trade negotiations of Japan with the US. ”

EUR – US tariff war and financial data to tantalize the EUR

On a monetary level we note ECB’s decision to remain on hold was no surprise for the markets as its expectations for such a scenario to materialise were well anchored. In its accompanying statement the bank mentioned that the economy is resilient and that inflation is currently at the 2% medium target, while also highlighted that “the environment remains exceptionally uncertain, especially because of trade disputes”. The bank also mentioned that it remains ready to adjust its monetary policy remaining data dependent, especially on its “assessment of the inflation outlook and the risks surrounding it”. We see the case for the bank to maintain a wait and see position and despite the bank highlight the inflation outlook, we also see the international trade risks as a possible issue that could tip the bank’s stance to either direction depending on the developments. Should we see the trade war of the EU and the US intensify, we may see the ECB maintaining a more dovish stance and vice versa.

On a fundamental level, we note the negotiations of the US with the EU to reach a possible trade deal. Reports highlight the possibility of a scenario at which US tariffs of 15% are to be applied on EU products entering the US, while we would not rule out also the agreement to stipulate EU investments of some hundreds of billions in the US. On the other hand we note that the EU is ready to retaliate in case a deal is not reached with the nuclear option being open. The EU may go as far as to invoke EU’s Anti-Coercion Instrument which could limit the access of US businesses in the EU markets, for example may not allow them to tender for public procurement contracts. Another option would be to intensify, in the services sector, barriers of entry for EU markets, which would be signaling an overspill of the issue from trading of manufacturing goods to the services. Overall, should we see the trade relationships of the EU and the US improve we may see the EU getting some support, while an escalation of tensions could weigh on the common currency.

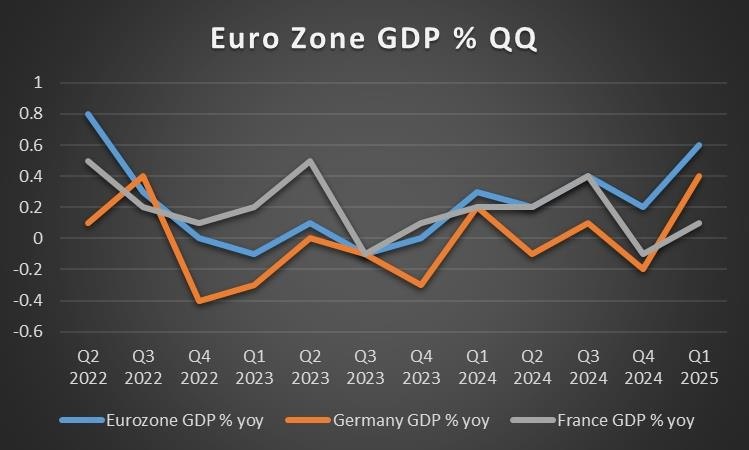

On a macroeconomic level, we note the improvement of Euro Zone’s preliminary PMI figures for July implying an improvement of economic activity across sectors for the Zone in the current month. Yet our focus in the coming week is placed on the preliminary HICP rates for July as well as the preliminary GDP rates for Q2. Both growth and inflation tend to be critical for Euro Zone’s outlook, as a possible slowdown of the HICP rates could enhance market expectations for a possible easing of the ECB’s monetary policy, while a possible slowdown of the GDP rates could gather clouds over Euro Zone’s macroeconomic outlook. Hence a slowdown of the HICP rates or/and the GDP rates could weigh on the EUR and vice versa.

Analyst’s opinion (EUR)

“In the coming week we expect that the releases of the preliminary GDP rates for Q2 and HICP rates for July could affect EUR’s direction. Yet EUR trader’s attention may be fixed on the developments of the US- EU trade talks and a possible improvement of the trade relationships could provide some support for the EUR.”

AUD – CPI rates to shake the Aussie

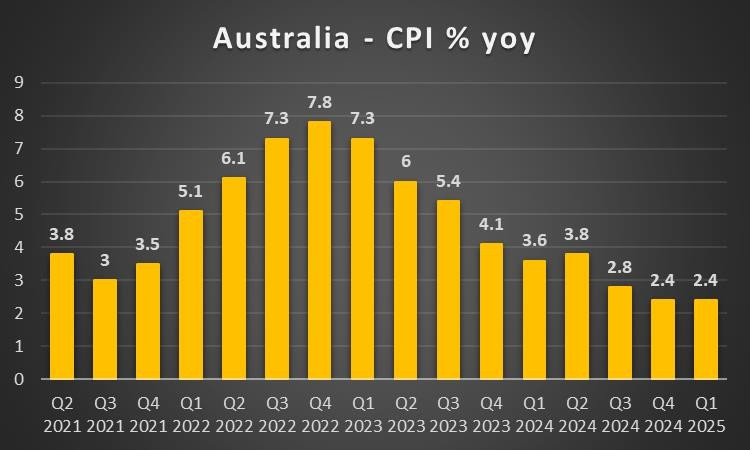

In the past week on a macro level, we note the rise of the preliminary PMI indicators’ readings for July. The release highlighted a faster expansion of economic activity across sectors in the current month, improving the macroeconomic outlook of the Australia. In the coming week, we highlight the release of Australia’s CPI rates for June and Q2. A possible slowdown of the CPI rates could weigh on the Aussie as it would be signalling an easing of inflationary pressures in the Australian economy. We should note that currently the CPI rates for June are at 2.1%yy, which is pretty close to RBA’s lower end of its inflation target zone of 2%-3%. Hence a possible slowdown of the CPI rates could add more pressure on Australia’s central bank to ease further its monetary policy.

On a monetary level, we note the market’s expectations for RBA to cut rates mid August and as per AUD OIS continue and cut rates another time in the November meeting, which in turn characterises the market’s dovish expectations for RBA. Yet RBA Governor Michelle Bullock made a speech in the past few days at which she down played the importance of the rise of the unemployment rate for June to 4.3%. The speech laid out the doubts of RBA for the necessity of a faster easing, despite the direction being downwards, which in turn implied a more hawkish stance of the bank contradicting the market’s expectations. Hence should market expectations for the bank to continue cutting rates ease, we may see the Aussie slipping.

On a fundamental level, Aussie traders are expected to keep a close eye on Trump’s trade wars, especially given Trump’s 1st of August deadline and the market’s perception of the Aussie as a riskier asset in the FX market given its commodity currency nature. Hence any improvement, easing of market worries for international trading relationships could provide support for AUD and the contrary also applies. Also we note the close Sino-Australian trading relationships and the Aussie’s sensitivity to developments in China. We note PBoC’s decision to remain on hold, which was largely expected and turn our attention to the release of China’s manufacturing PMI figures for July, due out on Thursday and Friday. Should the indicators’ readings rise above 50, implying an expansion of economic activity in the critical manufacturing sector of China, thus implying possibly more exports of raw material from Australia to China, we may see the Aussie gaining some ground.

Analyst’s opinion (AUD)

“In the coming week, given that Australia’s June employment data have allready be released, we expect Aussie traders to turn their attention to the release of the June’s CPI rates. A slowdown of the rates could weigh on AUD while an acceleration could provide substantial support for the Aussie. On a fundamental level we note the US tariff intentions as a key issue and a possible easing of market worries could support AUD.”

CAD – BoC’s interest rate decision in focus

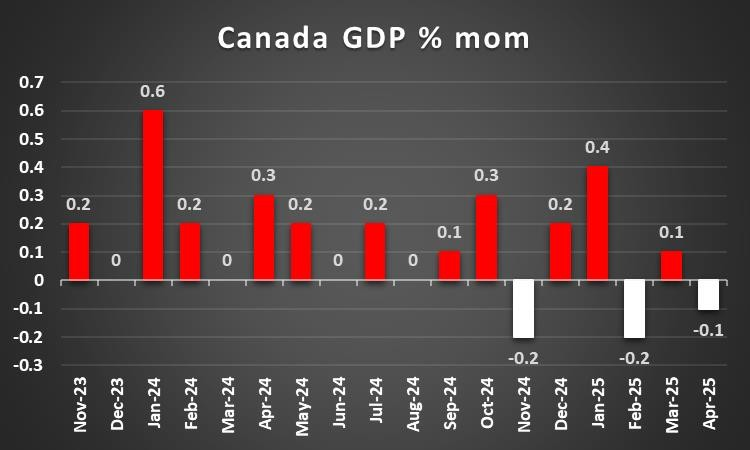

In the coming week we highlight on a monetary level the release from Canada of BoC’s interest rate decision. The bank is expected to remain on hold, keeping rates unchanged at 2.75% and currently CAD OIS imply a probability of 95% for such a scenario to materialise. It should be noted that inflation is near but below the bank’s median inflation target of 2%, while the unemployment rate is quite high reaching 6.9%. Please note that the market’s expectations seem to be for the bank to remain on hold until the end for the year. Hence should the bank in its forward guidance imply that its prepared to keep rates high for longer, we may see the Loonie getting some support, while a possibly dovish tone could take the markets by surprise, thus weighing considerably on the CAD.

On a fundamental level, we note the Canadian government’s persistence for a good trading deal with the US. It’s characteristic that Canada’s PM Mark Carney stated that “Our objective is not to reach a deal whatever it costs,”. It should be noted that the US is Canada’s largest trading partner yet other thoughts emerge. Bloomberg reported that senior officials in Canada are favouring an improvement of Canada’s trade relationships with China, possibly to offset any potential losses from the US- Canadian trading, given the US tariffs. For the time being a possible escalation of the tensions in the US -Canadian trade relationships could weigh in the Loonie and vice versa. Also we note that oil prices remained relatively stable over the past week, practically not affecting the Loonie’s direction, yet a possible substantial weakening of oil prices could weigh on the CAD, given Canada’s status as a major oil producing country.

On a macroeconomic level, we note two financial releases of interest, in the past week. The first would be the PPI rates for June, which accelerated, implying that inflationary pressures on a producers’ level are intensifying. On the flip side the retail sales growth rate for May slowed down as expected, falling into the negatives, which in turn tended to highlight an easing of the demand side of the Canadian economy. In the coming week we highlight the relase of the GDP rate for May. Should we see the rate accelerating and returning into the positives implying growth for the Canadian economy, it could provide support for the Loonie and on the contrary a possible deeper contraction of the rate could weigh on the CAD.

Analyst’s opinion (CAD)

“In the coming week we note the release of BoC’s interest rate decision as the main event for CAD traders. Should the bank imply that its prepared to keep rates unchanged for longer, we may see the Loonie getting some support, while a possibly dovish tone could take the market by surprise thus weighing considerably on the Loonie. The US-Canadian trade relationships tend to dominate on a fundamental level, a escalation of tensions in the US-Canadian trade relationships could weigh on the CAD.”

General Comment

We expect in the coming week, that the USD is to take the initiative in the FX market, given that the frequency and gravity of US financial releases and monetary policy events is to be substantially increased especially from Wednesday onwards. Nevertheless there are still releases from elsewhere that could allow currencies such as JPY, CAD and the EUR, to have an independent course. US equities markets continue to be on the rise with indexes such as Nasdaq and S&P 500 reaching new record high levels. A relative optimism seems to be maintained with AI still playing a particular role in investors’ thinking. Also the earnings season is still on and in the coming week. It’s characteristic that Alphabet’s second quarter earnings data underscored the company’s strong financial health yet again but further broadcasted that the tech giant safeguards its position as a leader in tech innovation and growth pushing 9its share price higher. In the coming week, we note on Tuesday the release of the earnings reports of Visa, P&G, Merck&Co, Booking and Spotify and highlight on Wednesday the earnings reports of Microsoft, and Meta platforms, while on Thursday we get Apple’s, Amazon’s and Mastercard’s reports and on Friday we get the earnings reports of Exxon Mobil and Chevron. We expect market attention to shift towards the tech sector given the high profile companies mentioned which could act as a locomotive for indexes such as Nasdaq. As for Gold we note the correction lower in the past two days which could set the upward outlook into doubt.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.