The week is nearing its end and we have a look at what next week has in store for the markets. On Monday we get Germany’s Ifo figures for August, on Tuesday we note the US durable goods orders rate for July and the US consumer confidence figure for August, on Wednesday we get Australia’s CPI rates for July, on Thursday we note Switzerland’s GDP rates for Q2, the Zone’s final consumer confidence figure for August, the US GDP rate for Q2 and the weekly initial jobless claims figure. Lastly, on a very busy Friday we note Japan’s CPI rates for August and unemployment rate for July followed by Sweden’s final GDP rate for Q2, France’s final GDP rate for Q2 and preliminary HICP rate for August, followed by Switzerland’s Kof indicator figure for August, the Czech Republic’s final GDP rate for Q2, Germany’s preliminary HICP rate for August, the US PCE rates for July, Canada’s GDP rate for Q2 and the US UoM final consumer sentiment figure for August

USD – US PCE rates in view

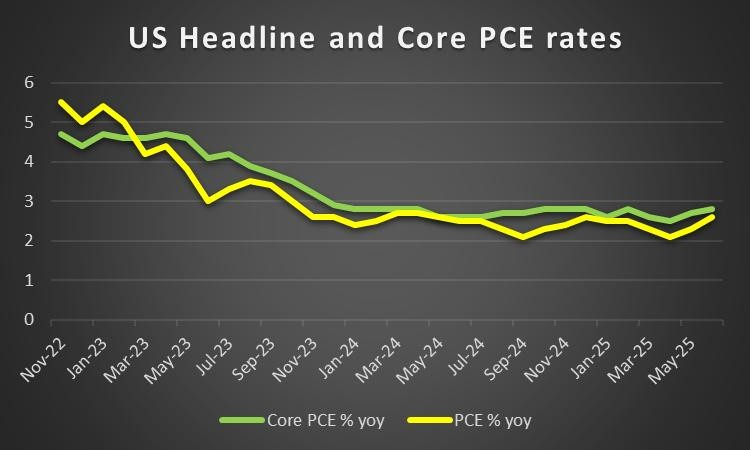

On a monetary level, the Jackon Hole Symposium is ongoing and later on today Fed Chair Powell’s speech is set to garner significant attention as the particular event is notoriously known for providing insight into the Fed’s monetary policy inclinations for the remainder of the year. Moreover, given the continued attacks by the US President on Fed Chair Powell and their strained relationships, any comments made by the Fed Chair could spark retaliatory commentary from the President potentially leading to heightened volatility. Furthermore, the Fed’s last meeting minutes were released on Wednesday and showcased heightened concern amongst the majority of policymakers who judged that the upwards risks to inflation outweighed the risks to the employment market, which could be perceived as hawkish in nature. Nonetheless, should Fed Chair Powell’s comments be perceived as hawkish in nature it could aid the dollar and vice versa. On a macroeconomic level, we take a look into the release of the US GDP rate for Q2 next week and the US PCE rates which are both key financial releases and of interest for dollar traders. On the one hand we have the state of the economy where should it showcase an expansion i.e economic growth it may aid the dollar and yet on Friday we have the PCE rates which is the Fed’s favourite tool for measuring inflationary pressures. Should the PCE rates showcase an acceleration of inflationary pressures in the US economy it may outweigh other financial releases, as pressure on the Fed to remain on hold may mount which may then aid the dollar. However, easing inflationary pressures in the US economy may have the opposite effect.

Analyst’s opinion (USD)

“Fed Chair Powell’s speech today will be one to watch, yet our sights will also be on President Trump’s reaction. In our view, the President is clearly displeased with the Fed’s monetary policy decisions and thus any comments which could be perceived as hawkish from the Fed may result in a new barrage of insults towards the Fed Chair. Moreover, we are curious as to what the PCE rates will show and we would not be surprised to see them showcasing persistent inflationary pressures in the US economy”

GBP – UK Inflation print comes in hotter than expected

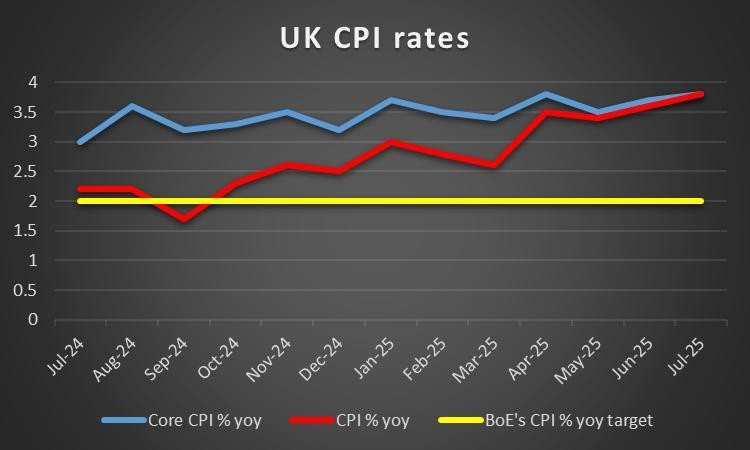

On a macroeconomic level, we note the release of the nation’s CPI rates for July which came in hotter than expected. Specifically, both the Core and Headline rates for July came in at 3.8% implying not only persistent inflationary pressures in the UK economy but an acceleration. The inflation print may in turn increase pressure on the BoE to refrain from cutting interest rates in the near future as the battle against inflation may have not yet finished and could thus have provided some support for the sterling. For next week however it’s set to be a pretty easy-going week for pound traders with no major financial releases expected. On a political level, UK Prime Minister Starmer was alongside other world leaders who met with President Trump earlier on this week to discuss a possible peace deal between Ukraine and Russia, although no market impact may be seen, the UK’s status as a member of the “coalition of the willing” which is essentially implies the UK would be willing to send peacekeeping forces to Ukraine may lead to other political implications and thus polls may warrant close attention.

Analyst’s opinion (GBP)

“It’s a dicey situation for the UK with their hotter than expected inflation print. In our view we would not be surprised to see a slightly hawkish rhetoric emerging from policymakers”

JPY – Japan’s Tokyo CPI rates in focus

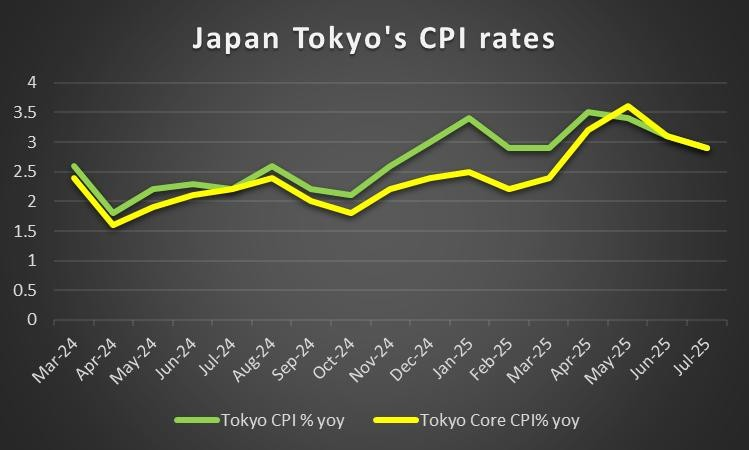

For JPY traders on a macroeconomic level, we highlight the release of the nation’s nationwide CPI rates for July. The CPI rates on a core level came in hotter than expected at 3.1% versus the expected rate of 3.0%. In turn the implication of a persistence of inflationary pressures in the Japenese economy could potentially increase pressure on the bank to resume their rate hiking path. However, when looking at the bigger picture last month’s rate was at 3.3% and thus despite it being higher than expected, inflationary pressures appear to be easing. Therefore, we turn our attention to the release of Japan’s Tokyo CPI rates for August next week, which may provide some indication into the most recent status of the inflation narrative in Japan. Hence, should they showcase an acceleration of inflationary pressures it may aid the JPY and vice versa.

Analyst’s opinion (JPY)

“Despite the Core Nationwide CPI coming in higher than expected, when compared to the prior rate it still has eased and thus we would like to see next week’s Tokyo CPI data before taking a stance on the possible path the BOJ may take in their next meeting”

EUR – EU inflation data in the spotlight

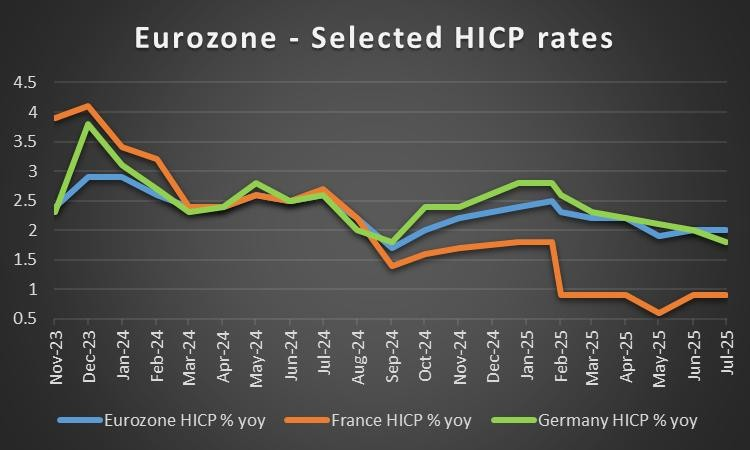

On a fundamental level, EUR traders are expected to be keeping a close eye on releases from across the Zone next week. Starting with Germany’s Ifo figures for August which are due out on Monday. In particular the current conditions and inflation expectations may influence the EUR as should current economic conditions worsen it may imply less consumer spending and could thus weigh on the EUR. Moreover, key interest will be in the release of the preliminary HICP rates for France, Germany and the Eurozone as a whole. Should the financial releases showcase an acceleration of inflationary pressures, it may increase pressure on the ECB to refrain from cutting interest rates in the near future and could thus provide support for the common currency. On the other hand, should the inflation metrics showcase easing inflationary pressures it may then have the opposite effect and could thus weigh on the EUR.

Analyst’s opinion (EUR)

“The EUR will be an interesting currency to watch next week with financial releases expected on numerous days which could influence the currency’s direction. Obviously, our main focus is on the inflation data.”

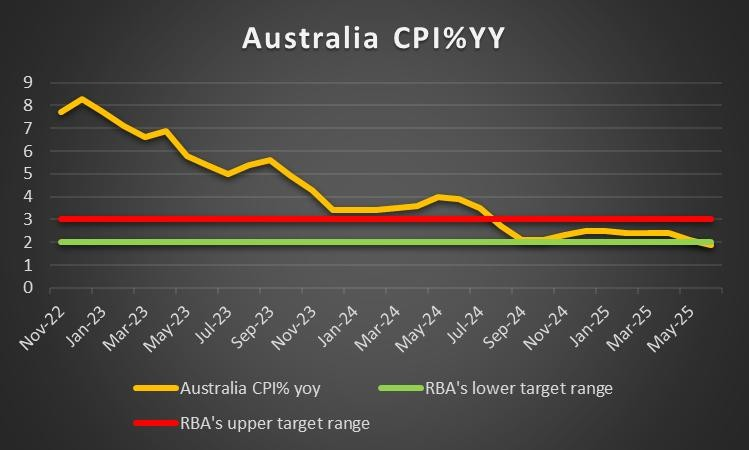

AUD – Australia’s CPI rates due out Wednesday

Australia’s CPI rates for July are set to be released on Wednesday and may thus garner interest from Aussie traders. The release may be crucial for AUD traders as it is the only key event for the day which we have highlighted and thus absent of any unexpected events, it may the main factor influencing the Aussie for the day. Overall, should the inflation print showcase an acceleration of inflationary pressures it may aid the AUD and vice versa. However, we should also note that this week Australia’s preliminary manufacturing PMI figure for August showcased an improvement from 51.3 to 52.9 and thus may have provided a slight boost to the AUD since Thursday or have mitigated the strong pull from the dollar.

Analyst’s opinion (AUD)

“In the coming week the CPI rates given that they are the sole major event we have picked for the entire day could lead to heightened volatility for the AUD during the trading day and could thus garner attention from other market participants as well.”

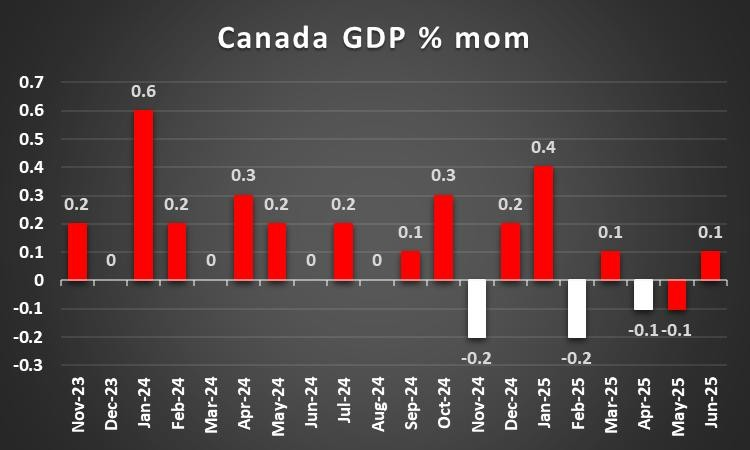

CAD – GDP rates in sight

Canada’s GDP rate for Q2 is set to be released next Friday. Canada finds itself is a precurious situation with it’s southern neighbour having slapped tariffs on their exports and thus any signs of a slowing economy may raise alarm bells, thus placing emphasis an importance on the particular financial releases. Therefore, should the GDP rate for Q2 showcased continued economic growth, it may be seen as a positive for the nation and could thus aid the Loonie. Whereas should the Canadian economy appear to be loosing steam, it may have the opposite effect and could possibly weigh on the Canadian dollar.

Analyst’s opinion (CAD)

“Given how recently the tariffs where imposed, a clear sign in the GDP rate may be unlikely in our view. Yet, with the tariff narrative having begun a couple months ago, we may see some early signs as to how it may be impacting the Canadian economy.”

General Comment

In the coming week, we expect the USD to maintain it’s influence over the markets. We have the inflation print and GDP rate from the US, therefore all eyes may remain on the United States of America. However, Europe is also a contender to take the spotlight with interesting and key financial releases also expected next week. On a political level, the possible meeting with Ukrainian President Zelenksy and Russian President Putin appears to be in the words and thus may be worth monitoring for it’s possible impact on the commodity’s front

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.