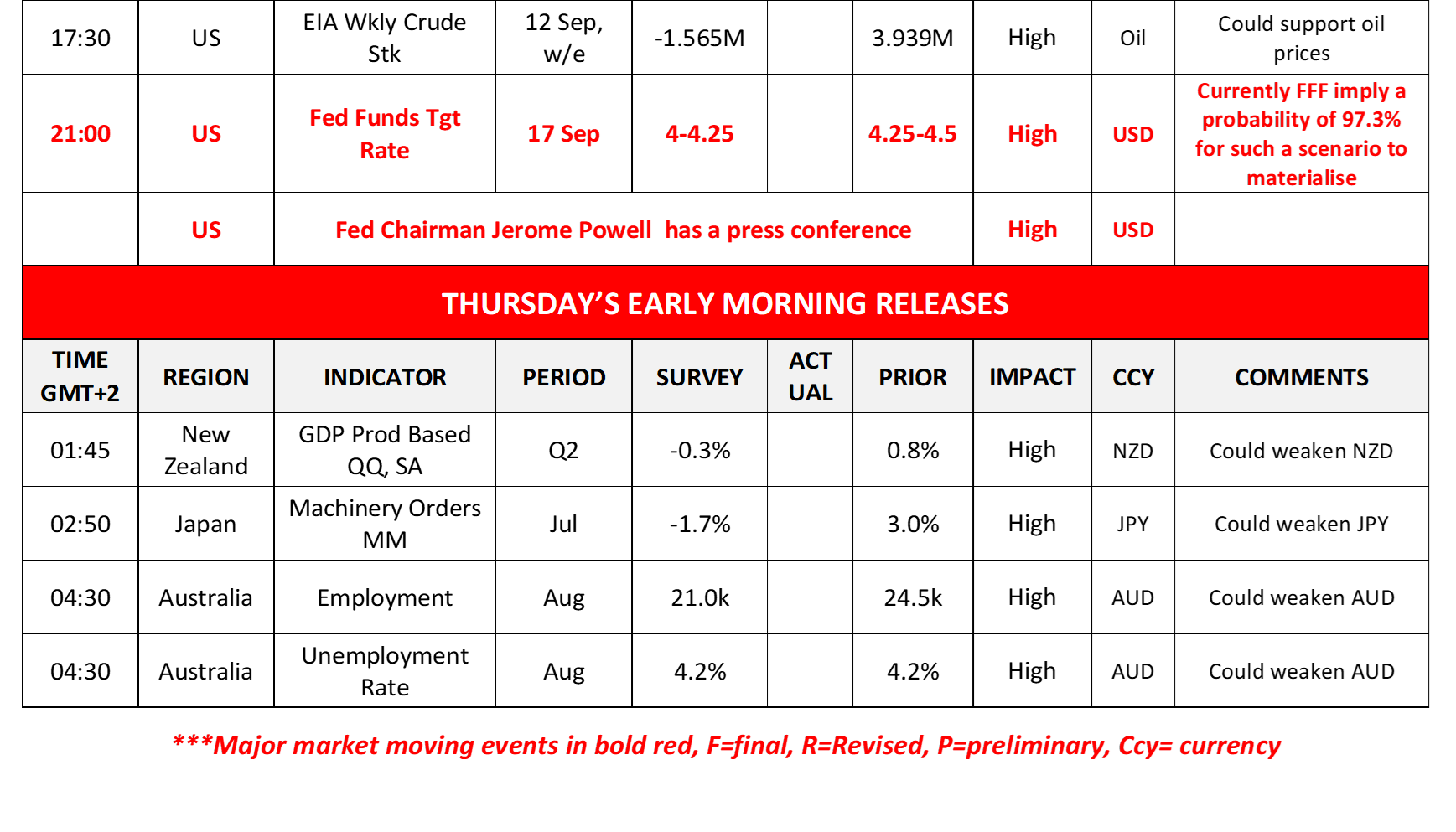

The Fed’s interest rate decision is set to occur today and is set to garner significant market attention. The bank is widely expected to cut rates by 25 basis points and currently Fed Fund Futures (FFF) imply a probability of 97.3% for such a scenario to materialise with the rest implying that a 50 basis points rate cut is also possible. FFF also imply that the bank is expected to deliver another rate cut in its October meeting and a third one in the December meeting. Should the bank today, cut rates as expected, which is also our base scenario, we expect the market’s expectations to shift towards the bank’s forward guidance, which is to be included in the accompanying statement, the bank’s projections, especially the new dot plot as well as Fed Chairman Powell’s press conference later on. Should the bank in its forward guidance signal that it intends to follow the market’s expectations we may see the USD weakening moderately, while should the bank exceed its expectations we may see the greenback tumbling. On the flip side if the forward guidance shows that the bank is more restrained and hesitant to deliver another two rate cuts in October and December, we may see the USD getting asymmetric support as the market’s dovish expectations may ease and the market may be forced to reposition itself.

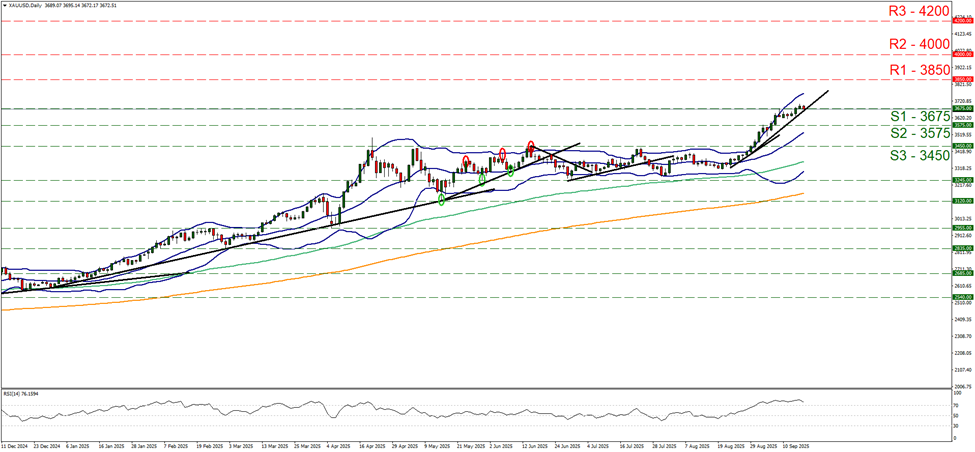

Gold’s price edged lower and is currently testing the 3675 (S1) support line. We maintain a bullish outlook for the precious metal’s price given that the upward trendline guiding it remains intact and the RSI indicator remains above the reading of 70, showcasing a strong bullish market sentiment for the precious metal, yet at the same time implies that a correction lower is also possible. On the flip side the distance between the upper Bollinger band and gold’s price action suggests that there is still room for the precious metal’s price to rise further. Should the bulls maintain control as expected, we may see it aiming for the 3800 (R1) resistance line. Should the bears take over, we may see gold’s price clearly breaking the 3675 (S1) support line and continuing to break the prementioned upward trendline in a first signal that the upward motion has been interrupted and continue even lower to breach the 3575 (S2) support base.

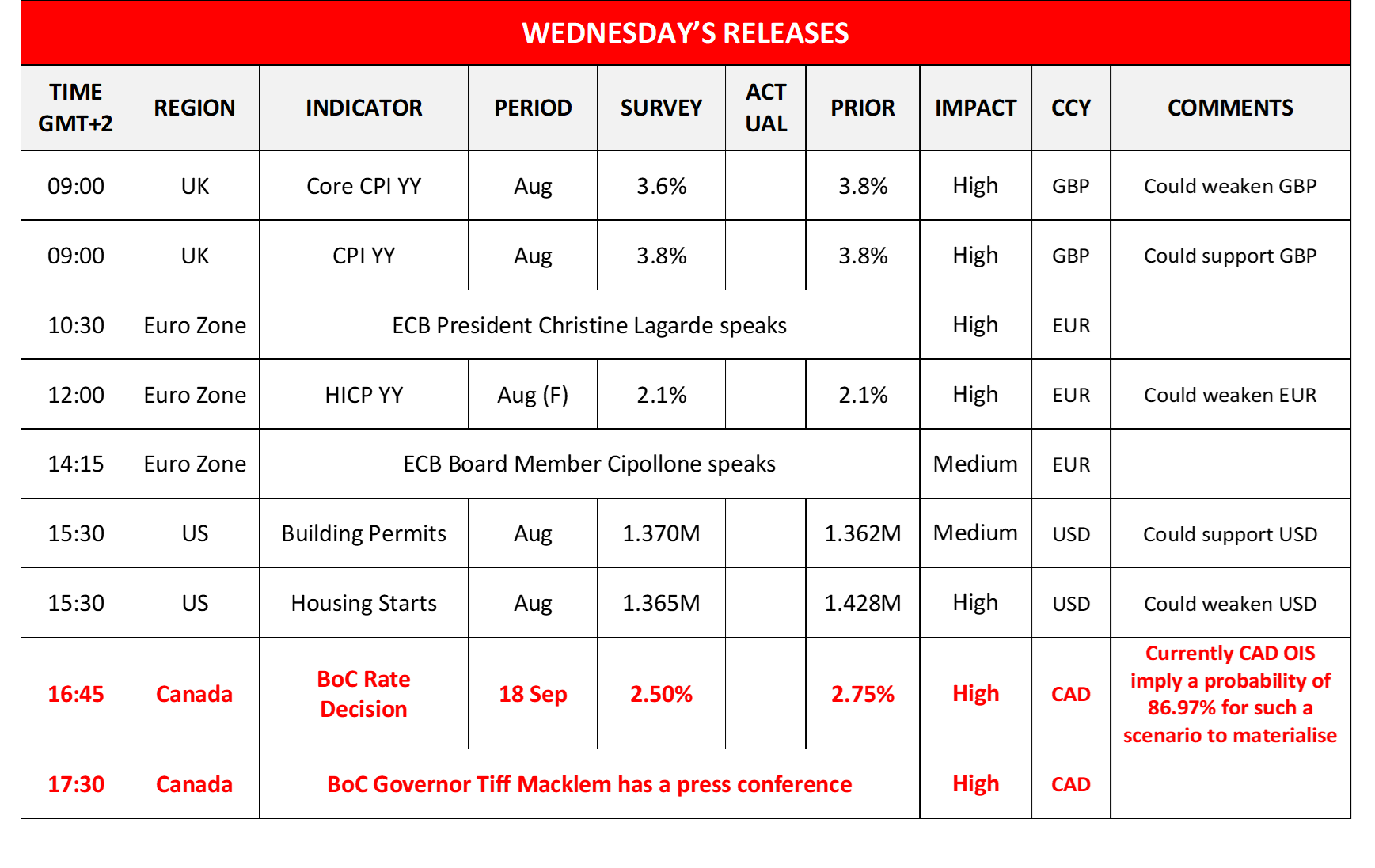

Canada’s CPI rates showed a relative resilience despite undershooting the market’s expectations yesterday. Today we also get BoC’s interest rate decision. The bank is expected to cut rates by 25 basis points and currently CAD OIS imply a probability of 92.3% for such a scenario to materialise. Please note that CAD OIS also currently imply that the market expects the bank to deliver another rate cut in its October meeting, hence a relative dovishness could be detected in the market’s expectations. Should the bank cut rates as expected and signal that it ends its easing cycle here or sound pessimistic for any further easing, we may see the Loonie gaining some ground as the market may push its rate cutting expectations further down the line. Should the bank signal that it’s open to cut rates further, we may see the Loonie losing ground.

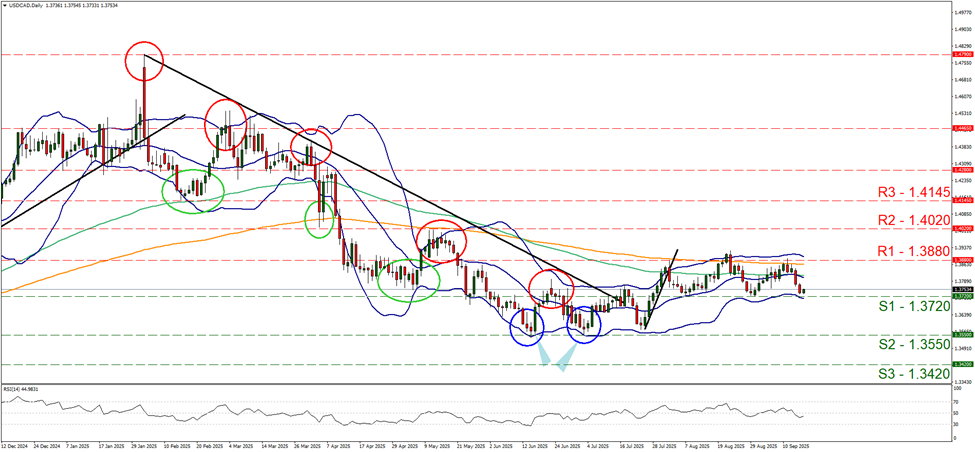

USD/CAD edged lower yesterday, yet corrected higher just before reaching the 1.3720 (S1) support line. We maintain our bias for the sideways motion to continue as long as the pair’s price action remains within the corridor formed by the 1.3720 (S1) support line and the 1.3880 (R1) resistance level. For a bullish outlook to emerge, we would require the pair’s price action to break the 1.3880 (R1) resistance line and start aiming for the 1.4020 (R2) resistance level. For a bearish outlook to be adopted, we would require the pair to break the 1.3720 (S1) support line and start aiming for the 1.3550 (S2) support base.

Otros puntos destacados del día:

The release of the UK CPI Rates for August today tended to display a relative resilience of inflationary pressures in the UK economy despite missing the market’s expectations. Today we get Euro Zone’s final HICP rates for August and from the US we get the building permits and housing starts numbers for the same and the EIA weekly crude oil inventories figure. In tomorrow’s Asian session, we get New Zealand’s GDP rate for Q2, Japan’s machinery orders for July and Australia’s employment data for August.

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

XAU/USD Gráfico Diario

- Support: 3675 (S1), 3575 (S2), 3450 (S3)

- Resistance: 3850 (R1), 4000 (R2), 4200 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.