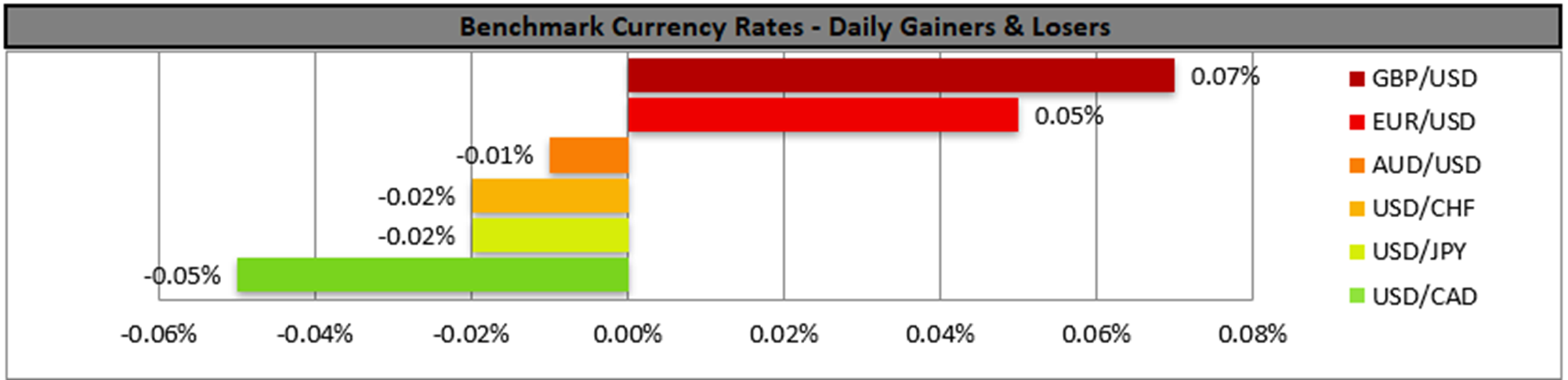

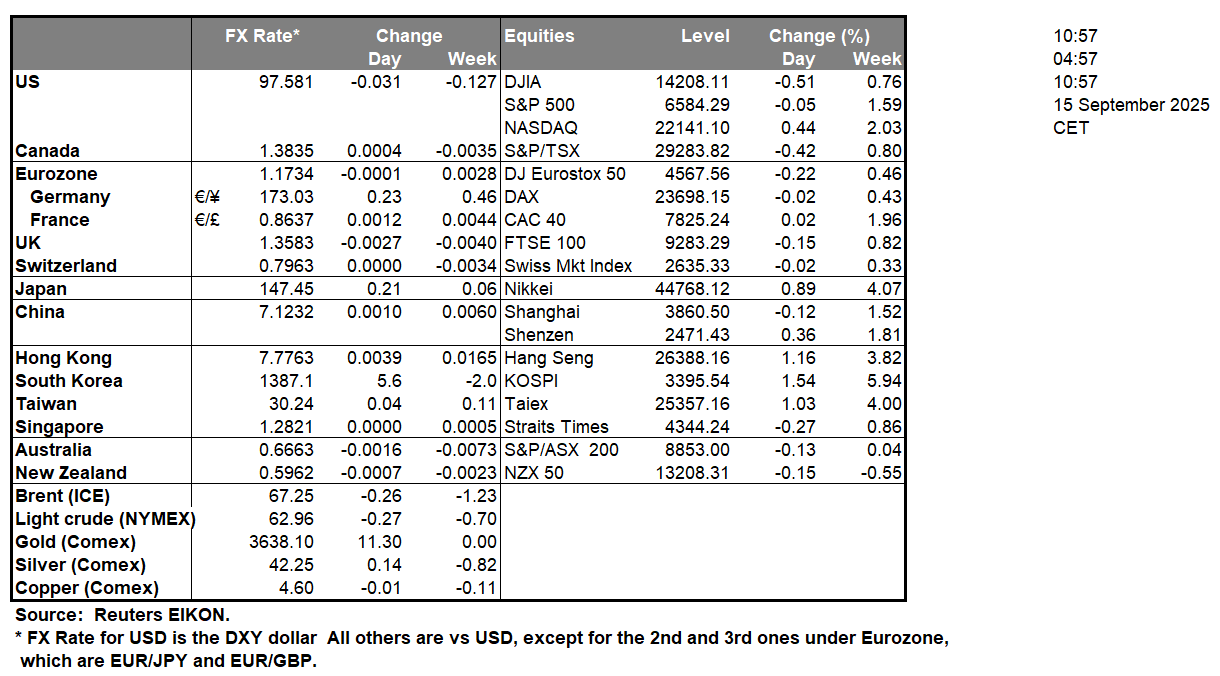

Overall, volatility in the markets seems to be low in today’s Asian session. Given also that today’s calendar is rather empty of high-impact financial releases, we expect fundamentals to lead the markets. Main event for the week is expected to be the release of the Fed’s interest rate decision on Wednesday, while a number of other central banks are also to release their interest rate decisions during the week. In the FX market, the EUR wobbled a bit after France’s debt was downgraded by Fitch but overall seems to remain relatively steady. In US equities markets the situation seems to remain relatively stable yet we note some worrying news for Nvidia, as Chinese authorities seem to find that the company violated anti-monopoly law. In the commodities market, we note the slight rise in oil prices, given the attack of Ukraine on Russian refineries. Finally, gold’s price also seems to remain relatively stable, with the market’s dovish expectations for the Fed implying some bullish tendencies for the precious metal. Please note that currently FFF imply a probability of 95% the bank to deliver a 25 basis points rate cut on Wednesday.

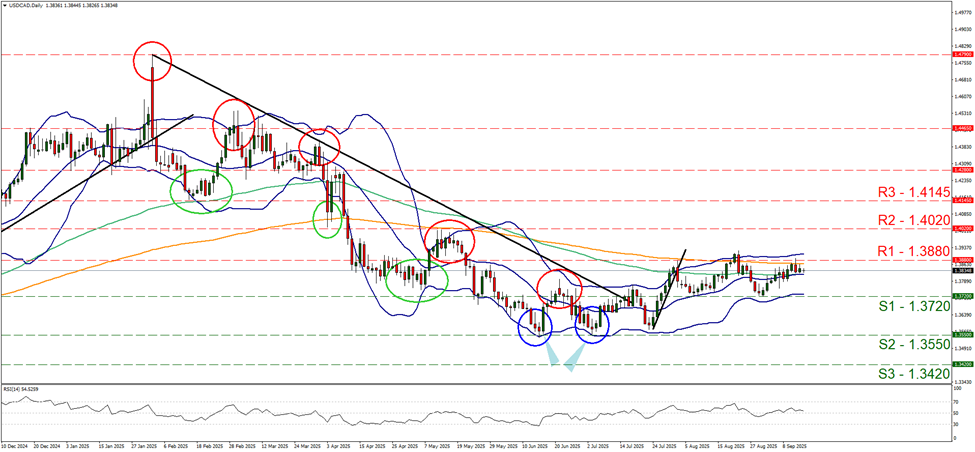

USD/CAD tended to remain relatively stable just below the 1.3880 (R1) resistance line. We maintain a bias for the sideways motion to continue currently given also that the RSI indicator continues to run along the reading of 50 implying a rather indecisive market. Fo a bullish outlook to emerge, we would require the pair’s price action to break the 1.3880 (R1) resistance line and start aiming for the 1.4020 (R2) resistance level. For a bearish outlook to be adopted, we would require the pair to break the 1.3720 (S1) support line and start aiming for the 1.3550 (S2) support base.

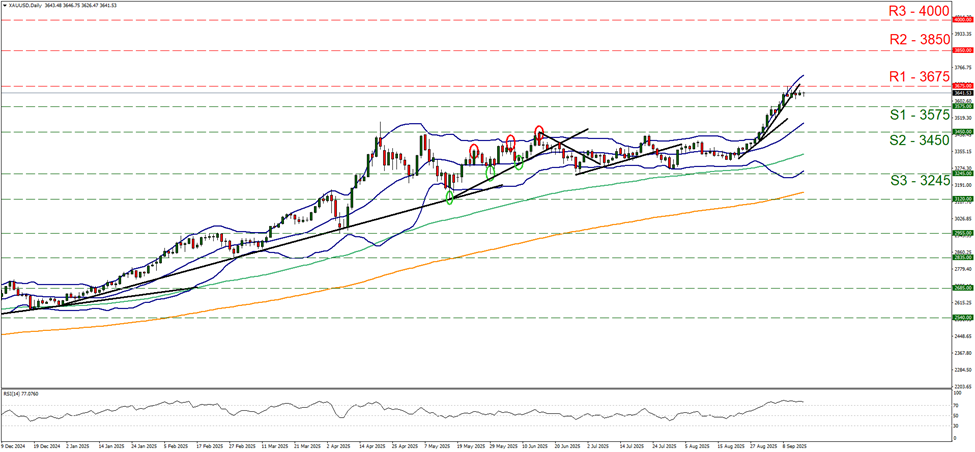

Gold’s price sems to be finding considerable difficulty in breaking the 3675 (R1) resistance line. The precious metal’s price action has breached the upward trendline guiding it since the 22nd of August hence we temporarily switch our bullish outlook in favour of a sideways motion. The RSI indicator remains above the reading of 70, implying the presence of a strong bullish sentiment for the precious metal, yet at the same time it may also imply that gold is at overbought levels and may be ripe for a correction lower. Should the bulls regain control over gold’s price, we may see it breaking the 3675 (R1) resistance line which currently marks a record high level for gold’s price and continue higher aiming possibly for the 3850 (R2) resistance level. Should the bears take over, we may see gold’s price dropping, breaking the 3575 (S1) support line and start aiming for the 3450 (S2) support level.

Otros puntos destacados del día:

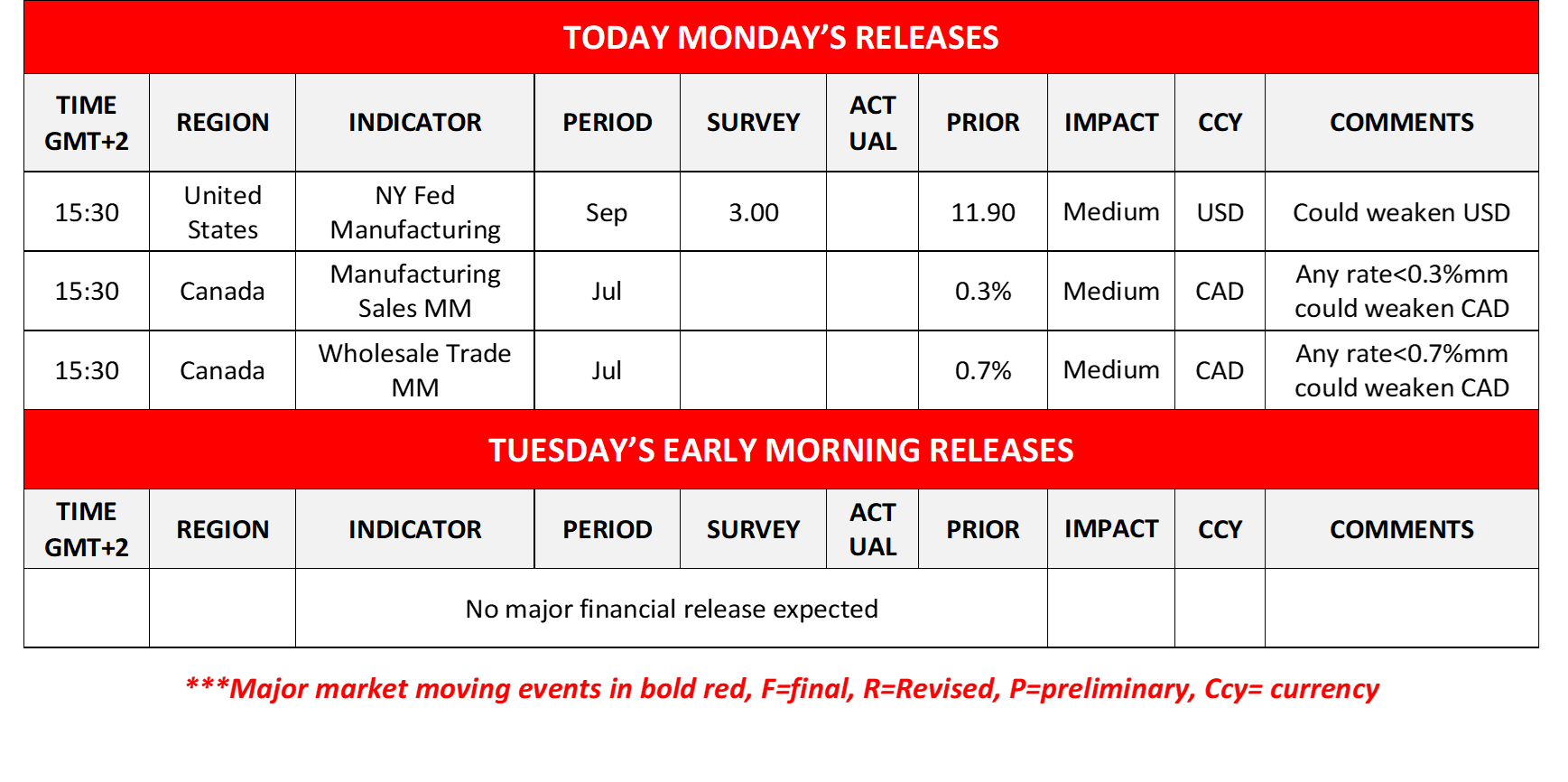

Today, we get the US NY Fed manufacturing index for September and from Canada we get the manufacturing sales and wholesale trade growth rates for July.

En cuanto al resto de la semana:

Monetary policy is expected to dominate the headlines this week, as we get the interest rate decisions of the Fed from the US and BoC on Wednesday, Norway’s Norgesbank’s and UK’s BoE’s interest rate decision on Thursday and on Friday we get from Japan BoJ’s interest rate decision. As for financial releases, on Tuesday, we get UK’s employment data for July, Euro Zone’s industrial output also for July, Germany’s ZEW indicators for September, as well as the US retail sales, Canada’s inflation metrics and the US industrial output all for August. On Wednesday, we get New Zealand’s current account balance for Q2, Japan’s trade data for August and UK’s CPI rates also for August. On Thursday, we note the release of New Zealand’s GDP rate for Q2, Japan’s machinery orders for July, Canada’s business barometer for September and from the US the weekly initial jobless claims and the Philly Fed Business index for September. On Friday, we get New Zealand’s trade data, Japan’s CPI rates and the UK’s retail sales all being for August as well as Canada’s retail sales for July.

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

XAU/USD Gráfico Diario

- Support: 3575 (S1), 3450 (S2), 3245 (S3)

- Resistance: 3675 (R1), 3850 (R2), 4000 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.