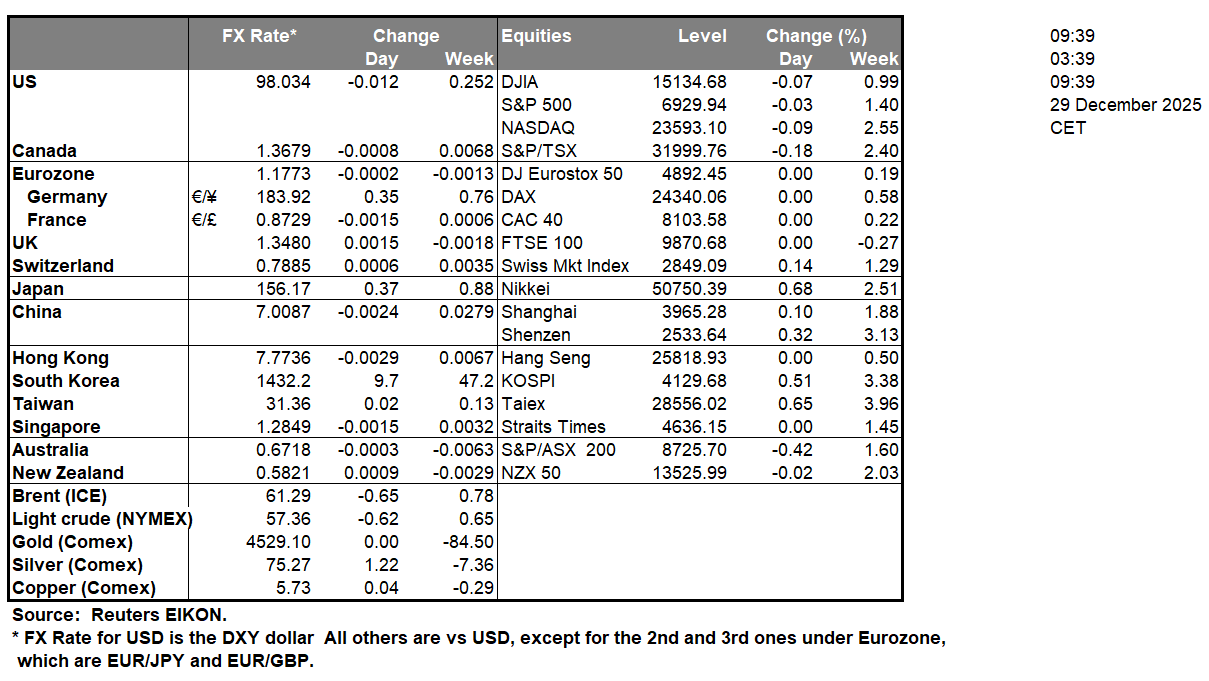

This week will see the markets transitioning from the current year to 2026. Markets are to be closed on January 1, New Year’s Day, and trading volume is expected to be low; hence, we note the possibility of thin trading conditions applying in the markets. For investors, catalysts will be few as the economic calendar is light, with the highlight possibly being the release of the Fed’s December meeting minutes. Precious metals pulled back on Monday, with silver losing ground after hitting a record high and gold easing from near record highs, on profit-booking and easing safe-haven demand. US President Trump said that he and Ukrainian President Zelenskiy were “getting a lot closer, maybe very close” to an agreement to end the war in Ukraine. On the other hand, we are not so optimistic about the meeting between US President Trump with Israeli Prime Minister Netanyahu and a possible escalation of tensions in the Middle East, including Iran, could renew interest in buying gold.

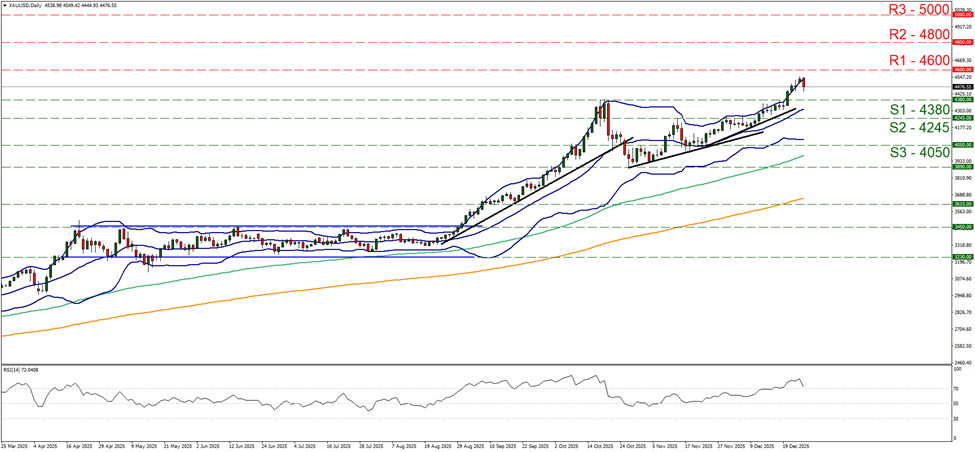

Gold’s price also edged lower in today’s Asian session, after reaching new record highs yet remained well between the 4600 (R1) and the 4380 (S1) levels. The RSI indicator corrected lower, yet is still above the reading of 70, implying a strong bullish market sentiment and the possibility of gold’s price still being at overbought levels. We maintain our bullish outlook for the precious metal’s price as long as the upward trendline guiding it remains intact. Should the bulls maintain control over gold’s price as expected we may see it aiming for the 4600 (R1) resistance line. Should the bears take over we may see gold’s price reversing course, breaking initially the 4380 (S1) line and continue to break the prementioned upward trendline in a first signal of an interruption of the upward movement and continue to break the 4245 (S2) support level.

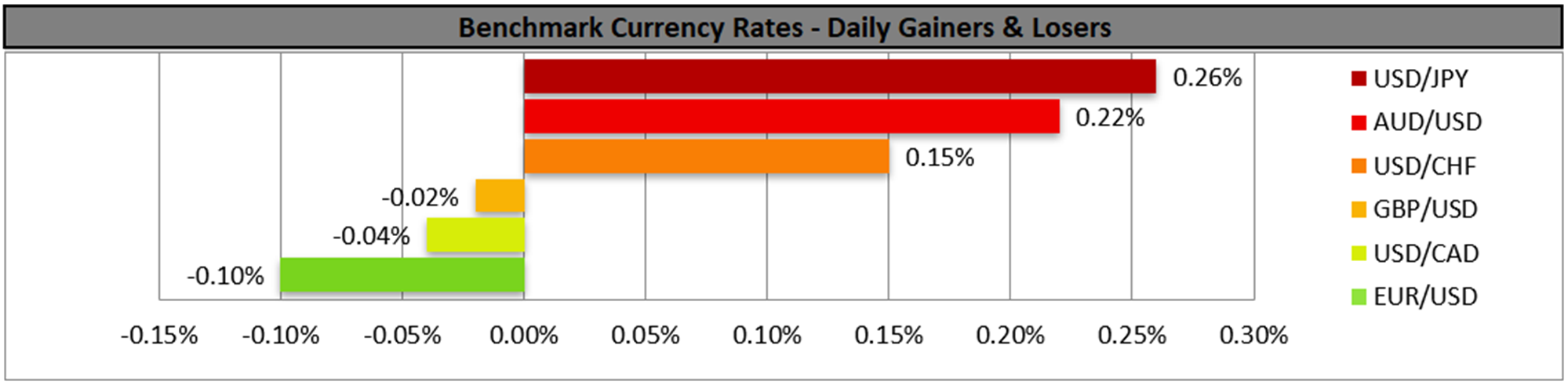

In the FX market JPY seemed to regain some ground against the USD in today’s Asian session, after some weakening last Friday. The main issue currently puzzling JPY traders seem to be BoJ’s intentions to hike rates again. It should be noted that BoJ policymakers discussed the possibility of further monetary policy tightening as shown by the summary of opinions of the December meeting. Also the low levels of JPY have instigated last week, discussions for a possible market intervention. The market expectations were further intensified by statements of Japan’s Finance Minister Satsuki Katayama last week.

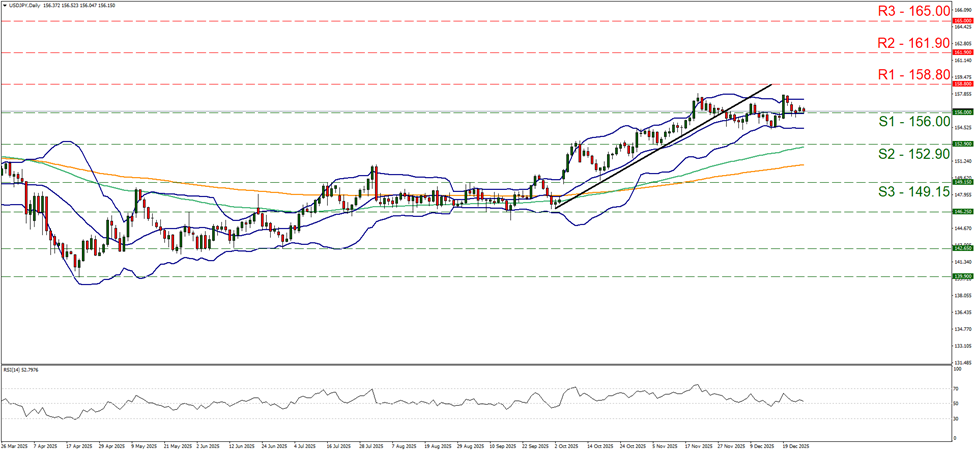

USD/JPY remained just above the 156.00 (S1) support line over the past few days. The pair’s price action seems to have stabilised, as it hit the upper Bollinger band and correcting lower, while the RSI indicator returned near the reading of 50 signaling a rather uncertain market that may allow the sideways motion to be maintained for now. Furthermore we note that the Bollinger bands tend to remain narrow which may imply an easing of volatility for the pair. Should the bulls regain control, we may see the pair breaking the 158.80 (R1) resistance line and thus pave the way for the 161.90 (R2) resistance hurdle. Should the bears take over, we may see the pair breaking the 156.00 (S1) support line and start aiming if not breaching the 152.90 (S2) support barrier.

Otros puntos destacados del día:

No major market updates scheduled to be released today.

En cuanto al resto de la semana:

On Tuesday the 30th of December we get Switzerland’s December KOF indicator and we highlight the release from the US of the FOMC December meeting minutes. On Wednesday, the last day of the year, we note the release of China’s NBS PMI figures for December and the US weekly initial jobless claims figure. On January the 1st we note the release of China’s Caixin manufacturing PMI figure for December. Finally on Friday the 2nd of January, we note the release of UK’s nationwide house prices for December and the Czech Republic’s revised GDP rate for Q3.

XAU/USD Gráfico Diario

- Support: 4380 (S1), 4245 (S2), 4050 (S3)

- Resistance: 4600 (R1), 4800 (R2), 5000 (R3)

USD/JPY Daily Chart

- Support: 156.00 (S1), 152.90 (S2), 149.15 (S3)

- Resistance: 158.80 (R1), 161.90 (R2), 165.00 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.