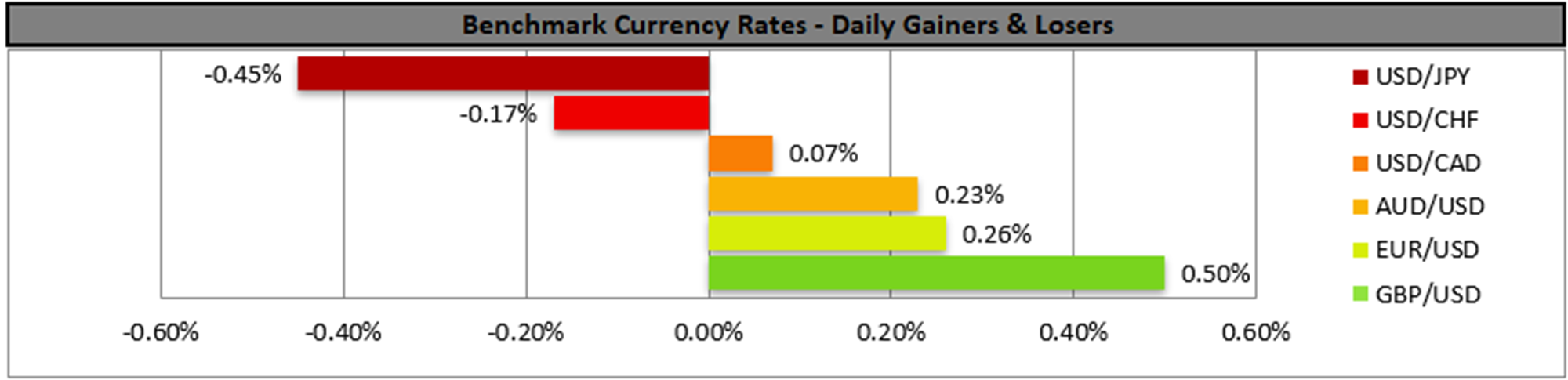

The USD edged lower against its counterparts yesterday as market worries for the US employment market intensified. The release of the JOLTS job openings figure for July showed that in the US employment market, there was a lower-than-expected number of job openings at the end of July, which in turn tended to underscore the easing of the US employment market. The release intensified the market interest for the release of the US employment report for August, due out in tomorrow’s early American session, yet today we note the release of the US ADP National employment figure for August. Despite not sharing some analysts’ view of the ADP figure as a precursor for Friday’s NFP figure, we still see the case for a possible wider-than-expected drop in the indicator’s reading to weaken the USD. Furthermore, the market’s expectations for the Fed to cut rates in its next meeting tended to solidify. It’s characteristic that Fed Board Governor Waller yesterday stated that he thinks the Fed should be cutting at its next meeting. Fed Fund Futures currently imply a probability of 98% for such a scenario to materialise while also suggesting that another rate cut in October is probable. Any enhancement of market expectations for the Fed to ease its monetary policy further could weigh on the USD and vice versa. US stock markets sent mixed signals yesterday, while gold’s price had a correction lower in today’s Asian session, probably some profit-taking given its all-time high levels.

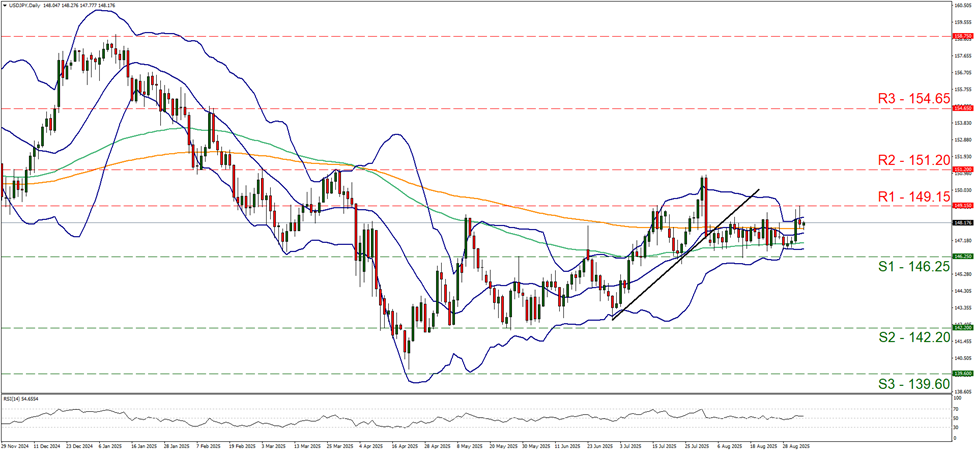

In the FX market, USD/JPY edged lower yesterday after briefly visiting the 149.15 (R1) resistance line. The RSI indicator continued to run just above the reading of 50, implying rather a relative market indecisiveness than any bullish tendencies. Should the bulls take over, we may see the pair breaking the 149.15 (R1) resistance line and start aiming for the 151.20 (R2) resistance level. For a bearish outlook to emerge we would require USD/JPY to break the 146.25 (S1) support line and start aiming for the 142.20 (S2) support base.

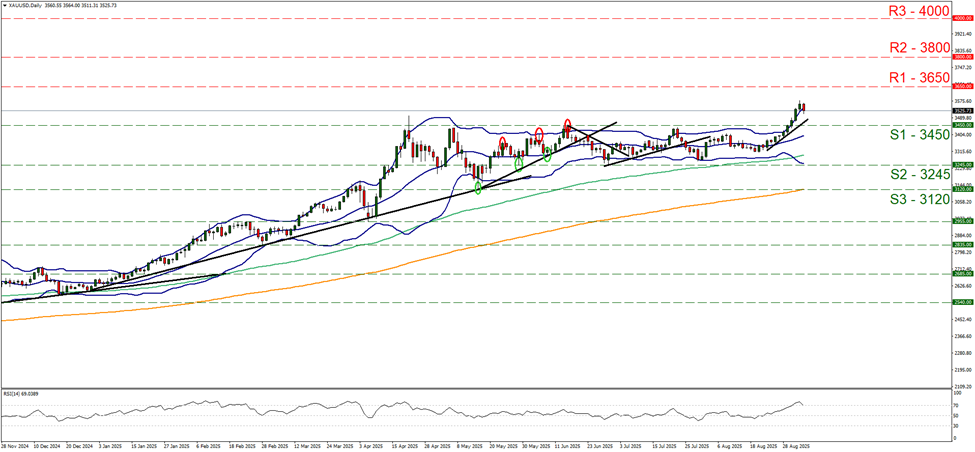

Gold’s price continued to edge higher yesterday, yet corrected lower in today’s Asian session, remaining well between the 3450 (S1) support line and the 3650 (R1) resistance level. We also note that the RSI indicator corrected lower, yet remains above the reading of 70 implying that the price action of gold could correct even lower. Also the price action of gold remains close to the upper Bollinger band, also implying the possibility of a continuance of the correction lower. In any case, we maintain our bullish outlook for the precious metal’s price, given that the upward trendline formed at the initial stages of the ascent of gold’s price about ten days ago, remains intact from the correction lower of gold’s price. Should the bulls maintain control over bullion we may see its price reaching new All Time Highs by aiming if not breaching the 3650 (R1) resistance line. For a bearish outlook to be adopted we would require gold’s price to initially break the prementioned upward trendline signaling an interruption of the upward movement and continue to break the 3450 (S1) support line and start actively aiming for the 3245 (S2) support level.

Otros puntos destacados del día:

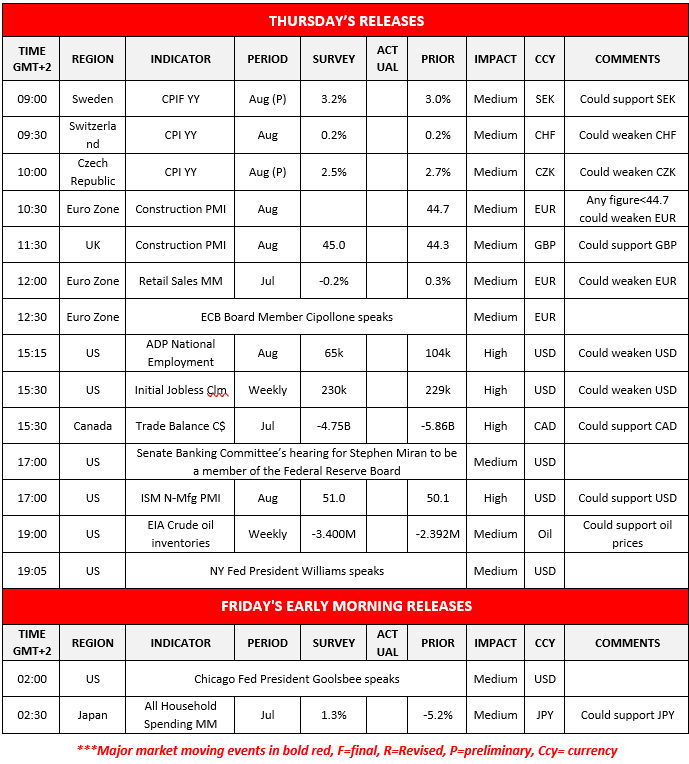

In a packed day we note the release of Sweden’s, Switzerland’s and the Czech Republic’s CPI rates for August, Euro Zone’s and the UK’s construction PMI figures also for August, Euro Zone’s retail sales for July and from the US we get the weekly initial jobless claims figure, Canada’s trade balance for July and the US ISM non-manufacturing PMI figure for August. Oil traders may be more interested in the release of the EIA weekly crude oil inventories figure. On a monetary policy level, we note that ECB Board Member Cipollone and NY Fed President Williams are scheduled to speak, while the US Senate Banking Committee’s hearing for Stephen Miran to be a member of the Federal Reserve Board is to take place. In tomorrow’s Asian session, we get Japan’s all household spending rate for July, while Chicago Fed President Goolsbee is scheduled to speak.

USD/JPY Daily Chart

- Support: 146.25 (S1), 142.20 (S2), 139.60 (S3)

- Resistance: 149.15 (R1), 151.20 (R2), 154.65 (R3)

XAU/USD Gráfico Diario

- Support: 3450 (S1), 3245 (S2), 3120 (S3)

- Resistance: 3650 (R1), 3800 (R2), 4000 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.