WTI managed to string three consecutive sessions in the greens this week, rebounding from last week’s lows and the commodity is currently trading near the $79 per barrel. Supporting the ascend to higher ground has been growing concerns over supply shortages alongside rekindled optimism for a recovery in demand. Furthermore, the shutdown of Turkey’s Ceyhan port this week in the aftermath of a devastating earthquake incident on early Monday morning, provided further support for crude prices, alongside Saudi Arabia’s announcement that it would lift crude prices for Asian markets, in attempts to capitalize on demand from China y India. In this report we aim to shed light on the catalysts driving WTI’s price, assess its future outlook and conclude with a technical analysis.

Goldman Sachs foresees $100 crude in 2023

Earlier this week, the head of commodities research of Goldman Sachs, Jeff Currie, reiterated the bank’s projections for crude oil prices for the year ahead. Currie foresees WTI prices rising to $100 per barrel, making the commodity one of the best performing assets in 2023, since without sufficient supply capacity y investment, crude would run into a long period of shortages which would then lead to higher prices. Albeit his call being considered as bold, Currie noted that crude, y commodities by an extend, are in a multiyear super-cycle and the current consolidation near the $75 per barrel range would serve as the floor where WTI is expected to rally from. His expectations point out that by May, oil markets should flip to a supply deficit as underinvestment, lack of exploration and low stockpiling efforts from the Western nation, combined with China’s insatiable hunger for oil following its full-fledged reopening, would create a “bullish concoction” for WTI prices. Sharing a similar outlook with Goldman Sachs is Morgan Stanley who also foresees dwindling spare capacity production around the second half of the year which would propel prices north of $100 per barrel.

JPMorgan counters bullish outlook, sees crude struggling to breach $100 level

Sitting on the opposite camp from Goldman Sachs, is JPMorgan Chase’s head of commodities research Natasha Kaneva, who expects oil prices struggling to reach the $100 per barrel mark should there be an absence of a geopolitical event. The rationale behind the projection is based on the expectations that many developed and developing economies would decelerate substantially throughout 2023. Therefore, deteriorating economic growth y activity would inadvertently diminish demand for oil, capping the commodity’s ascent to higher levels. Countering Goldman Sachs’ views for an impending supply shortage due to underinvestment and low levels of spare capacity, Kaneva stated “the reality for the oil market is that there is simply more supply than demand this year.” Siding with JPMorgan’s “bearish” outlook is Citigroup’s head of commodities research, Ed Morse, who warns that global oil demand will see only “meager” growth this year and forecasts that crude would trend around $80 a barrel in 2023.

Análisis técnico

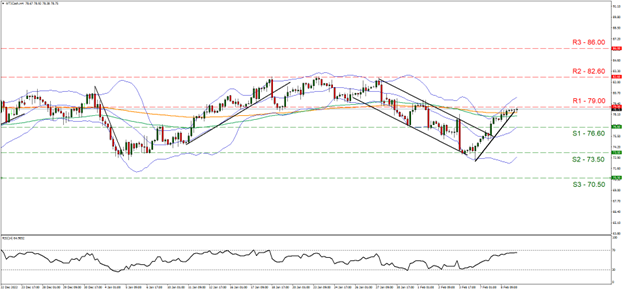

WTI Cash H4

Looking at WTICash 4-hour chart we observe oil prices finding support around the 73.50 (S2) level earlier this week, breaking above the upper limit of the descending channel and rising towards the 79.00 (R1) resistance level. We hold a bullish bias towards for the commodity given the aforementioned break and supporting our case is the RSI indicator below our 4-hour chart which registers a value of 67, indicating the bullish sentiment surrounding WTI. Should the bulls maintain control, we may see the price action break above the 79.00 (R1) resistance level and head closer to the 82.60 (R2) resistance barrier. Should on the other hand, the bears take over, we may see the break below the ascending trendline, the break of the 76.60 (S1) support level and price action moving closer to the 73.50 (S2) support base.

Si tiene preguntas generales o comentarios relacionados con este artículo, envíe un correo electrónico directamente a nuestro equipo de investigación a research_team@ironfx.com

Descargo de responsabilidad:

Esta información no se considera un consejo de inversión ni una recomendación de inversión, sino una comunicación de marketing