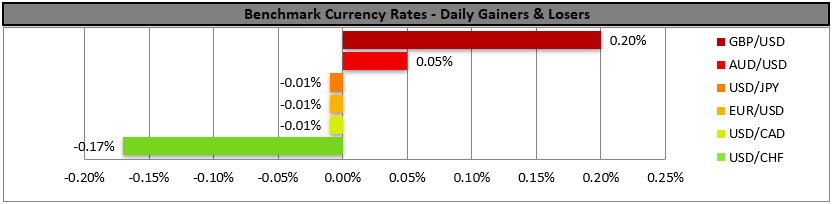

USD edges higher in the FX market

The greenback edged higher in the FX market as the week begins and substantial focus is expected to be placed on the release of the Fed’s meeting minutes on Wednesday.

Other than that we expect the dominance of the USD to ease in the FX market given that the gravity and frequency of US financial releases is reduced, thus allowing for a more balanced trading mix to emerge.

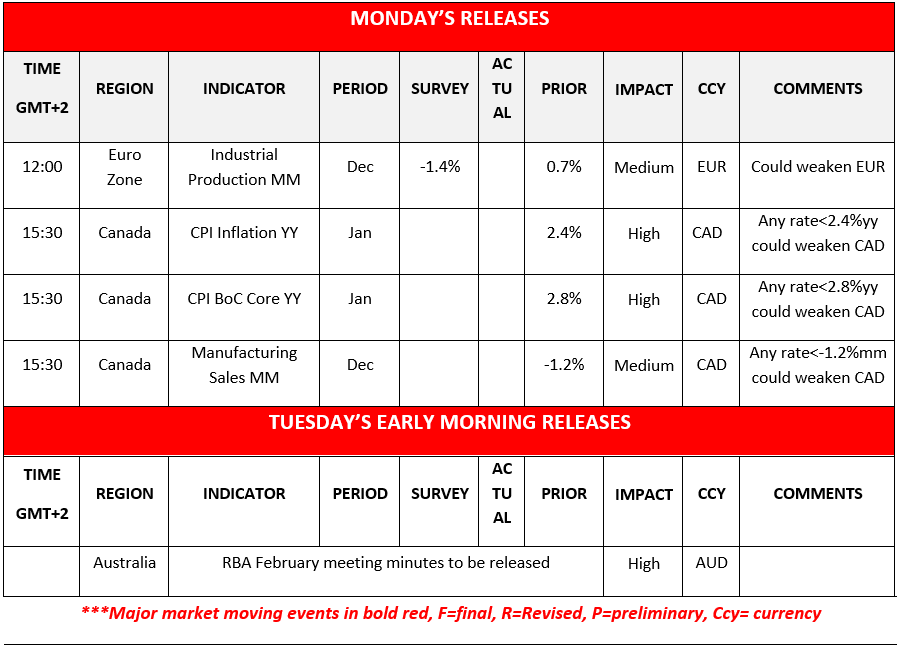

In the meantime, we note today the release of Canada’s CPI rates for January and a possible acceleration of the rates could take the markets by surprise providing a boost for the Loonie.

In tomorrow’s Asian session the release from Australia of RBA’s last meeting minutes and a hawkish tone could support the Aussie. We also note that JPY seems to be slipping after a nice run in the past week, also partially due to the disappointing release of the GDP rate for Q4 25.

US stock markets remain stable

As for equity markets we note that the slightly lower than expected US CPI rates for January, released on Friday tended to enhance market expectations for a faster monetary policy easing by the Fed, yet any gains for US stock markets were capped from worries about AI spending.

We also note that Warner Bros seems to be reconsidering the takeover bid by Paramount which could provide some support for the latter’s share price, yet at the same time could weigh on Netflix’s share price.

As for the crypto market we note that Bitcoin’s price has edged lower over the weekend, yet seems to be rather stable in today’s Asian session, remaining just above $68k, yet we still see the risk-off market sentiment weighing on a fundamental level.

دیگر نکات مهم امروز:

Today we get Euro Zone’s industrial output for December and Canada’s manufacturing sales for December.

در مورد مابقی هفته:

On Tuesday we get UK’s employment data for December and Germany’s ZEW indicators for February, on Wednesday we get Japan’s trade data for January, in New Zealand RBNZ is to release its interest rate decision, we get UK’s CPI rates for January, we get the US industrial output for January and we highlight the release of the FOMC’s last meeting minutes.

On Thursday, we get Japan’s Machinery orders for December, Australia’s employment data for January, the weekly US initial Jobless claims figure, the US Philly Fed business index for February, Canada’s trade data for December and New Zealand’s trade data for January.

On Friday we get Japan’s CPI rates for January, China’s PBoC interest rate decision, UK’s retail sales for January, Sweden’s CPI rates for January, the EuroZone’s, UK’s and US’s preliminary PMI figures for February and the US preliminary GDP rate for Q4.

Charts to keep an eye out

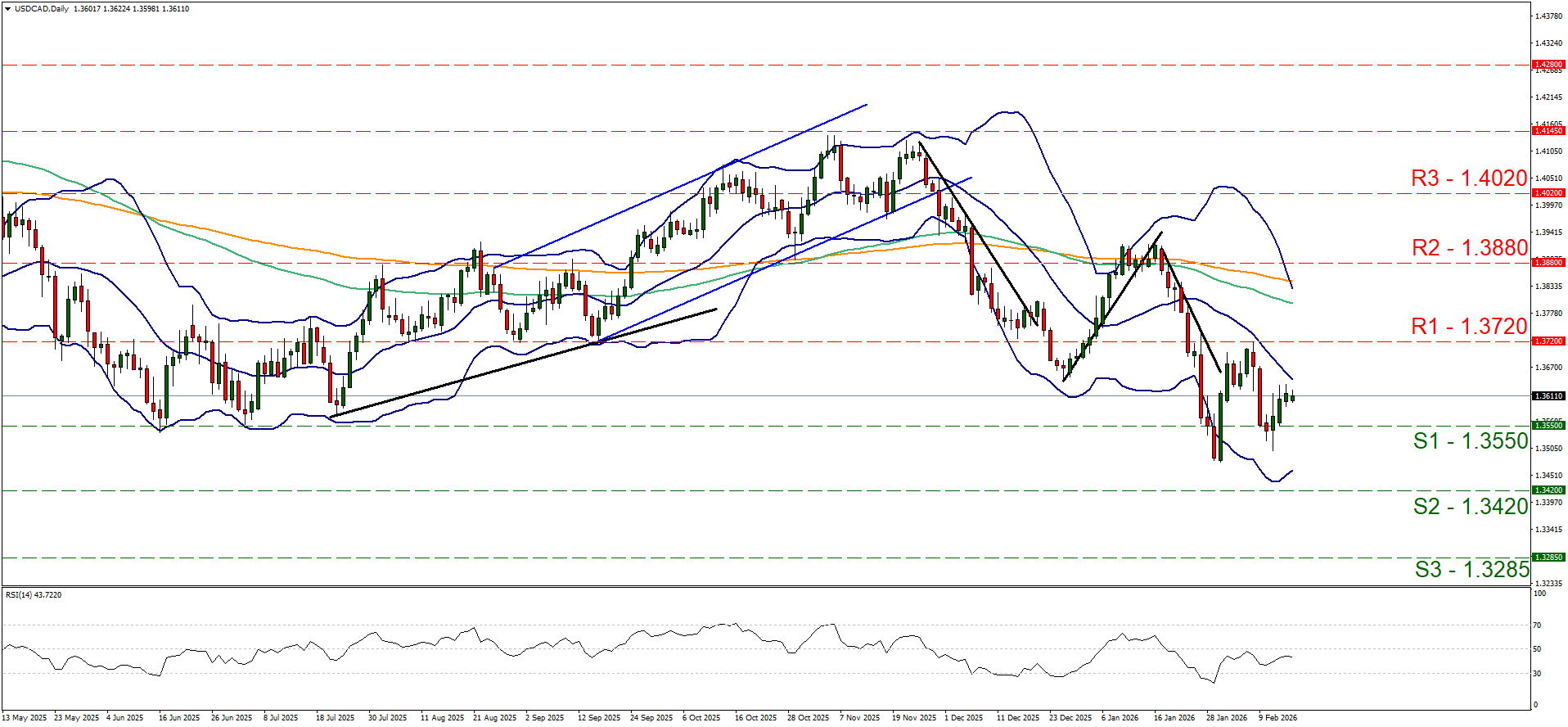

USD/CAD remained relatively stable on Friday and during today’s Asian session, between the 1.3720 (R1) resistance line and the 1.3550 (S1) support level.

The RSI indicator has risen approaching the reading of 50, implying further easing of the market’s bearish sentiment, hence we tend to maintain a bias for the pair’s sideways motion to be maintained for now. Should the bulls take over, we may see the pair breaking the 1.3720 (R1) resistance line and start aiming for the 1.3880 (R2) resistance base.

Should the bears be in charge, we may see the pair breaking the 1.3550 (S1) support line and start aiming for the 1.3420 (S2) support barrier.

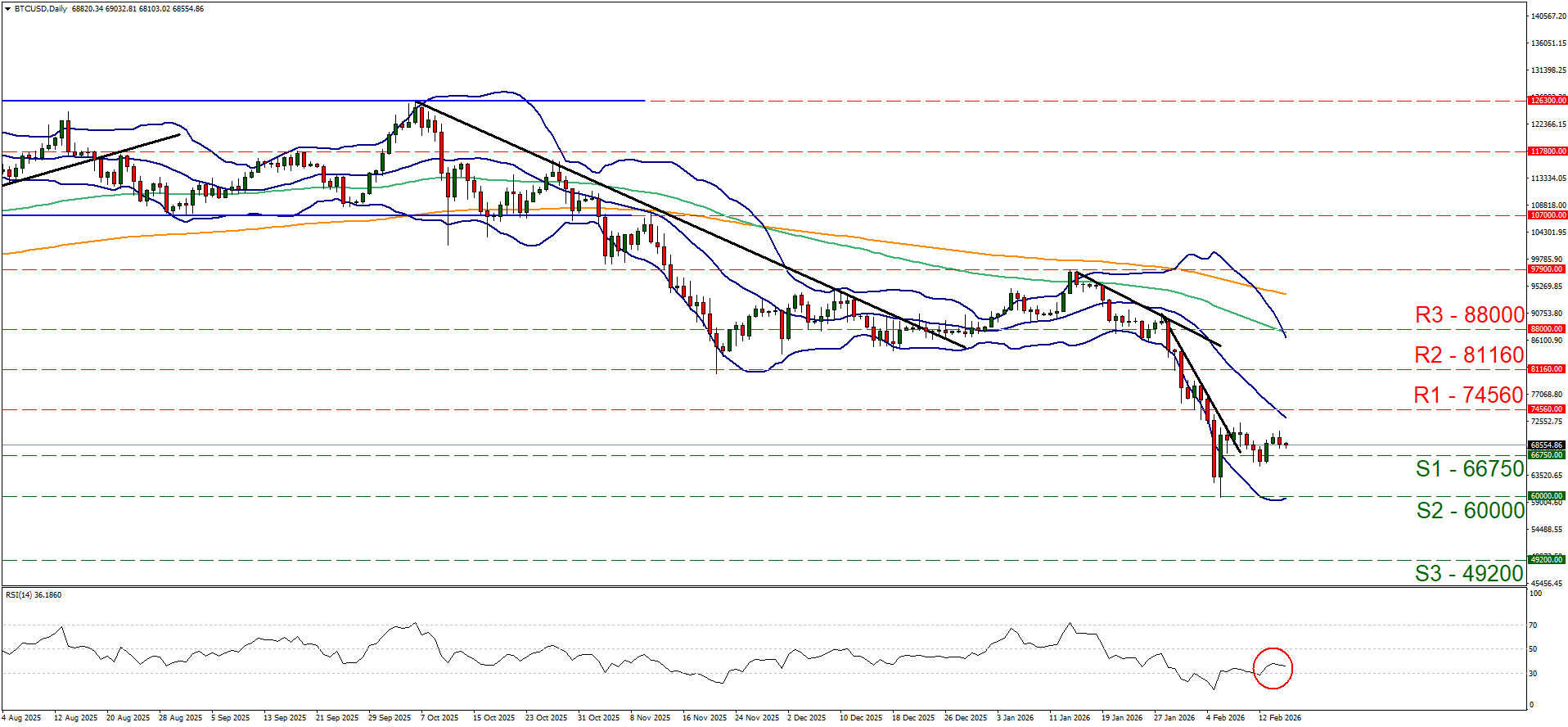

BTC/USD remained relatively stable just above the 66750 (S1) support line over Friday and the weekend. We maintain currently a bias for the crypto’s sideways motion to continue, yet we highlight the possibility of a bearish movement as the RSI indicator remains near the reading of 30, implying a continuance of the market’s bearish sentiment.

For a bearish outlook to emerge we would require the crypto’s price action to break the 66750 (S1) support line and continue to also break the 60000 (S2) support barrier.

For a bullish outlook to be adopted, the crypto-king’s price action has to break the 74560 (R1) resistance line clearly and start aiming for the 81160 (R2) resistance hurdle.

USD/CAD Daily Chart

- Support: 1.3550 (S1), 1.3420 (S2), 1.3285 (S3)

- Resistance: 1.3720 (R1), 1.3880 (R2), 1.4020 (R3)

BTC/USD Daily Chart

- Support: 66750 (S1), 60000 (S2), 49200 (S3)

- Resistance: 74560 (R1), 81160 (R2), 88000 (R3)

سلب مسئولیت:

این اطلاعات به عنوان مشاوره سرمایه گذاری یا توصیه سرمایه گذاری در نظر گرفته نمی شود ، بلکه در عوض یک ارتباط بازاریابی است. IronFX هیچ گونه مسئولیتی در قبال داده ها یا اطلاعاتی که توسط اشخاص ثالث در این ارتباطات ارجاع و یا پیوند داده شده اند ندارد.