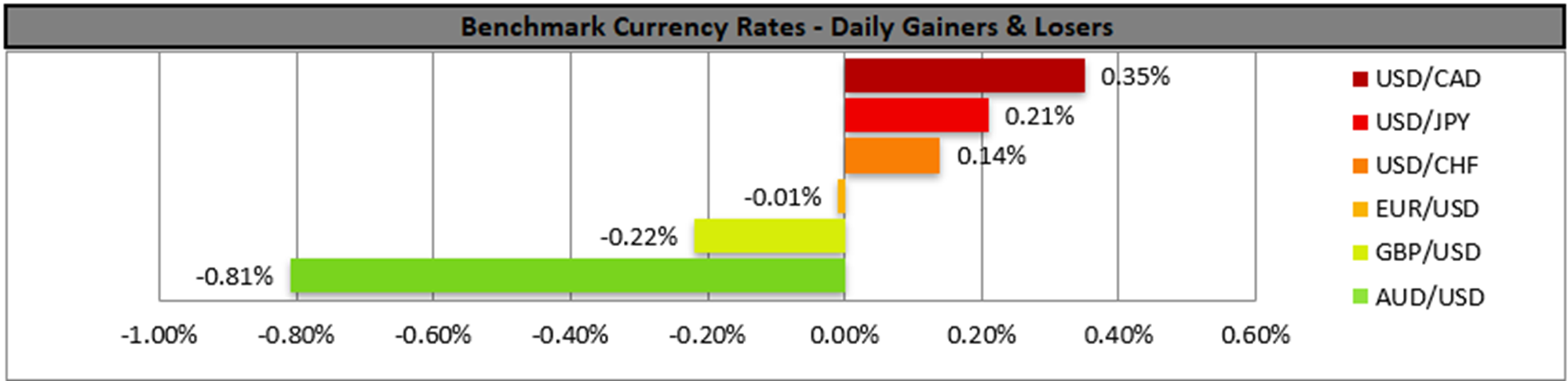

The USD despite some slight support in today’s Asian session, remains near three-year lows against its counterparts. On a fundamental level, there is intense interest for US President Trump’s tariff wars and his 9th of July deadline, which is nearing. The US President seems confident that trade deals will be achieved yet market uncertainty remains high. Any further signs of escalation in the international trade relationships could weigh on the USD and vice versa.

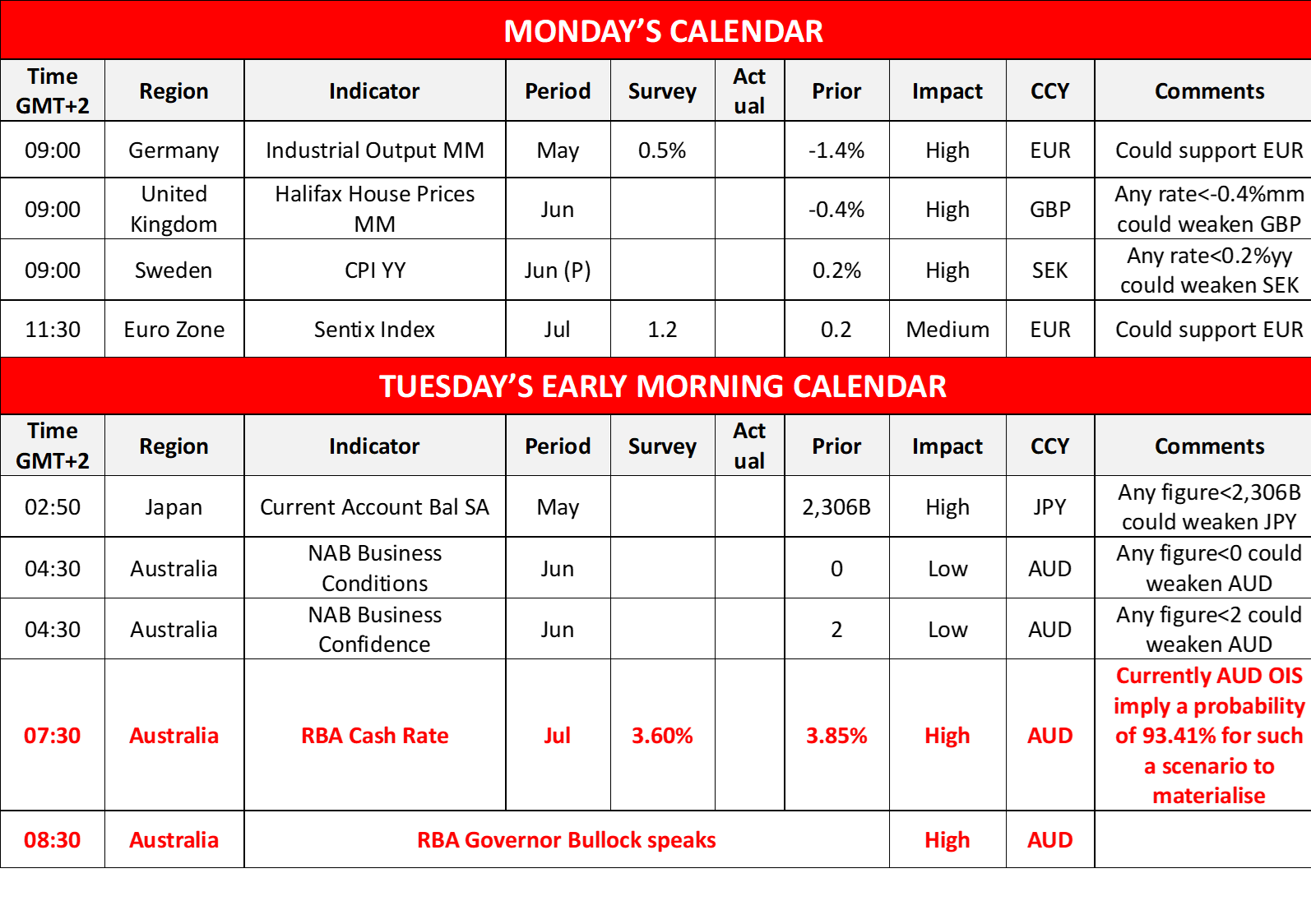

On a monetary level, we note the market’s expectations for Australia’s RBA to deliver three more rate cuts by the end of the year. Hence, RBA’s interest rate decision in tomorrow’s Asian session, is to garner significant attention from Aussie traders. The market is expecting the bank to cut rates in tomorrow’s Asian session, with AUD OIS currently implying an 93.41% probability for such a scenario to materialize. In turn should the bank’s accompanying statement be perceived as dovish in nature, ie implying that they may continue cutting rates down the road as is currently expected it could weigh on the Aussie. Should the bank imply that they may deviate from such a path, it may be perceived as hawkish in nature which could provide asymmetric support for AUD as the market may be caught by surprise and be forced to re-adjust its expectations.

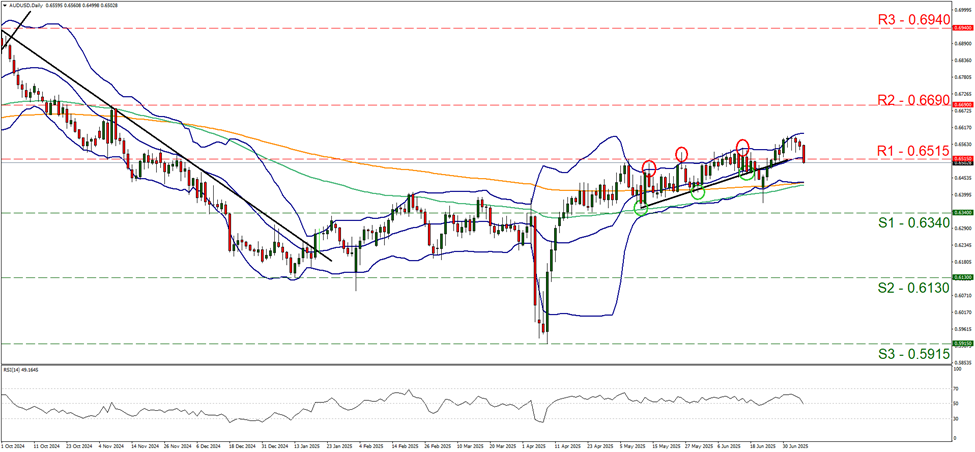

AUD/USD dropped in today’s Asian session, breaking the 0.6515 (R1) support line, now turned to resistance. The RSI indicator though, despite dropping, remains close to the reading of 50, implying that the market is rather indecisive for the pair’s direction. For a bearish outlook, we would require the pair to break the 0.6340 (S1) support line opening the gates for the 0.6130 (S2) support level. For a bullish outlook, which we currently view as remote, we would require the pair to break the 0.6515 (R1) resistance line and continue to also break the 0.6690 (R2) resistance level.

For EUR traders we note today’s financial releases of Germany’s industrial orders for May and Euro Zone’s Sentix index for July. On a deeper fundamental level, we note the no confidence vote for EU Commission President Von der Leyen in the EU Parliament. We expect the EU Commission President to survive the vote yet concessions may have to be made to the left and right.

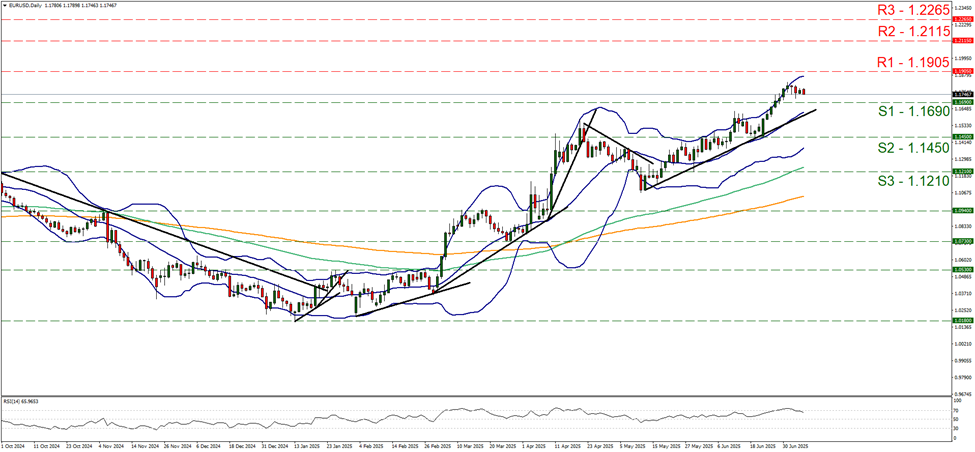

EUR/USD edged lower in today’s Asian session, yet the price action is reflecting a relative stabilisation between the 1.1690 (S1) support line and the 1.1905 (R1) resistance level. We maintain our bullish outlook for the pair as long as the upward trendline guiding the pair since the 13th of May remains intact. The RSI indicator despite correcting lower remains near the reading of 70, implying an easing but still strong bullish sentiment on behalf of market participants for the pair. Should the bulls maintain control, we may see it aiming if not breaking the 1.1905 (R1) line, and start aiming for the 1.2115 (R2) level. Should the bears take over, EUR/USD could drop, breaking the 1.1690 (S1) line and start aiming for the 1.1450 (S2) level.

دیگر نکات مهم امروز:

Today we get UK’s Halifax house prices for June and Sweden’s preliminary CPI rates for June. In tomorrow’s Asian session, we note the release of Japan’s current account balance for May.

در مورد مابقی هفته:

On Tuesday we note Canada’s Ivey PMI figure for June. On Wednesday, we note China’s PPI and CPI rates for June and the RBNZ’s interest rate decision. On Thursday we note Japan’s corporate goods price rate for June, Sweden’s GDP rate for May, Norway’s Core CPI rate for June, the Czech Republic’s final CPI rate for June and the US weekly initial jobless claims figure. On Friday we note Germany’s final HICP rate for June, the UK’s GDP rates for May and manufacturing output rate for May, France’s final HICP rate for June and lastly Canada’s employment data also for the month of June.

نمودار چهار ساعته دلار استرالیا به دلار آمریکا

- Support: 0.6340 (S1), 0.6130 (S2), 0.5915 (S3)

- Resistance: 0.6515 (R1), 0.6690 (R2), 0.6940 (R3)

نمودار چهار ساعته یورو به دلار آمریکا

- Support: 1.1690 (S1), 1.1450 (S2), 1.1210 (S3)

- Resistance: 1.1905 (R1), 1.2115 (R2), 1.2265 (R3)

اگر در مورد این مقاله سوال یا نظر ی کلی دارید، لطفاً ایمیل خود را مستقیماً به تیم تحقیقاتی ما بفرستیدresearch_team@ironfx.com

سلب مسئولیت:

این اطلاعات به عنوان مشاوره سرمایه گذاری یا توصیه سرمایه گذاری در نظر گرفته نمی شود ، بلکه در عوض یک ارتباط بازاریابی است. IronFX هیچ گونه مسئولیتی در قبال داده ها یا اطلاعاتی که توسط اشخاص ثالث در این ارتباطات ارجاع و یا پیوند داده شده اند ندارد.