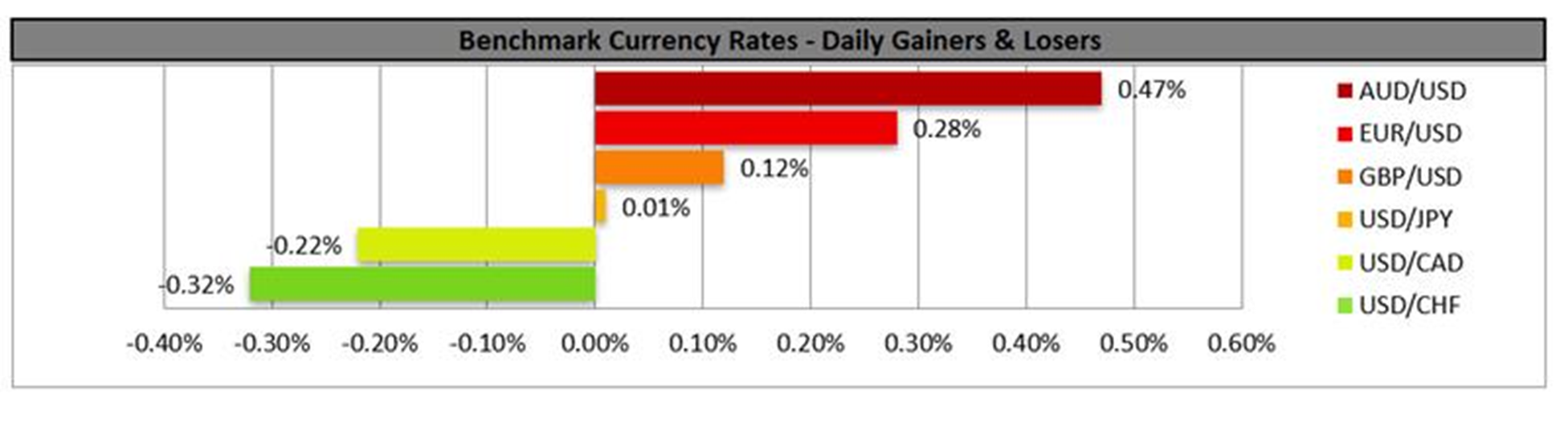

President Donald Trump stated yesterday that he would be announcing the next Fed Chair early next year. As a reminder, the next Fed Chair will be taking over from Fed Chair Powell in May 2026. Moreover, during his comments, the President teased reporters that the next Fed Chair may be in the room, “I guess a potential Fed chair is here too. Am I allowed to say that? Potential. He’s a respected person, that I can tell you. Thank you, Kevin”. ‘Kevin’ refers to Kevin Hasset the Director of the National Economic Council in the US who was been touted as the current frontrunner for the Fed Chair position. In turn, the dovish implications stemming from a Trump nominee and considering Hassett’s alignment with Trump on monetary policy, any official announcement could weigh on the dollar.In terms of financial releases, dollar traders may be interested in today’s ADP national employment figure for November which is anticipated to showcase a loosening labour market in the US. In turn should the figure come in as expected or lower it may weigh on the dollar and vice versa.In the European Equities markets, we continue with our focus on Airbus with Bloomberg reporting that “Airbus SE cut its 2025 aircraft delivery target after discovering production glitches on its bestselling A320 jet that require additional checks,” which in turn could further weigh on the company’s stock price.Sticking to Europe, traders may be interested in ECB President Lagarde’s speech today which could influence the EUR.

On a technical level, EUR/USD appears to be moving in an upwards fashion after re-emerging above our 1.1560 (S1) support level. We now opt for a bullish outlook for the pair and supporting our case are all three indicators below our chart which tend to imply a bullish market sentiment. For our bullish outlook to be maintained, we would now require a clear break above our 1.1685 (R1) resistance level, with the next possible target for the bulls being our 1.1815 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. Lastly, or a bearish outlook we would require a clear break below our 1.1560 (S1) support line with the next possible target for the bears being our 1.1405 (S2) support level.

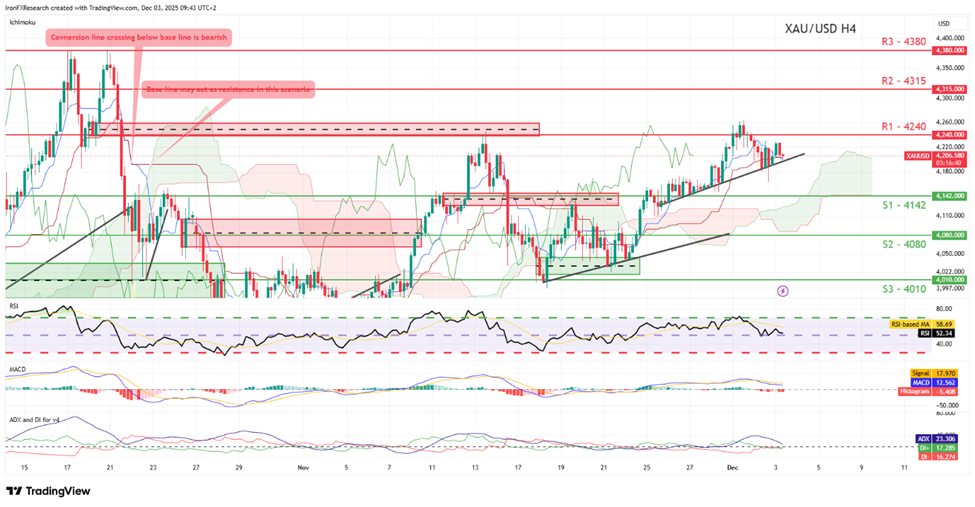

XAU/USD appears to be moving in an upwards fashion after clearing our resistance now turned to support at the 4142 (S1) level. We opt for a bullish outlook for the precious metal’s price and supporting our case is the upwards moving trendline located on our chart. For our bullish outlook to be maintained we would require a clear break above our 4240 (R1) resistance line with the next possible target for the bulls being our 4315 (R2) resistance level. On the other hand, for a sideways bias we would require gold’s price to remain confined between our 4142 (S1) support level and our 4240 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4142 (S1) support level with the next possible target for the bears being our 4080 (S2) support line.

Autres faits marquants de la journée :

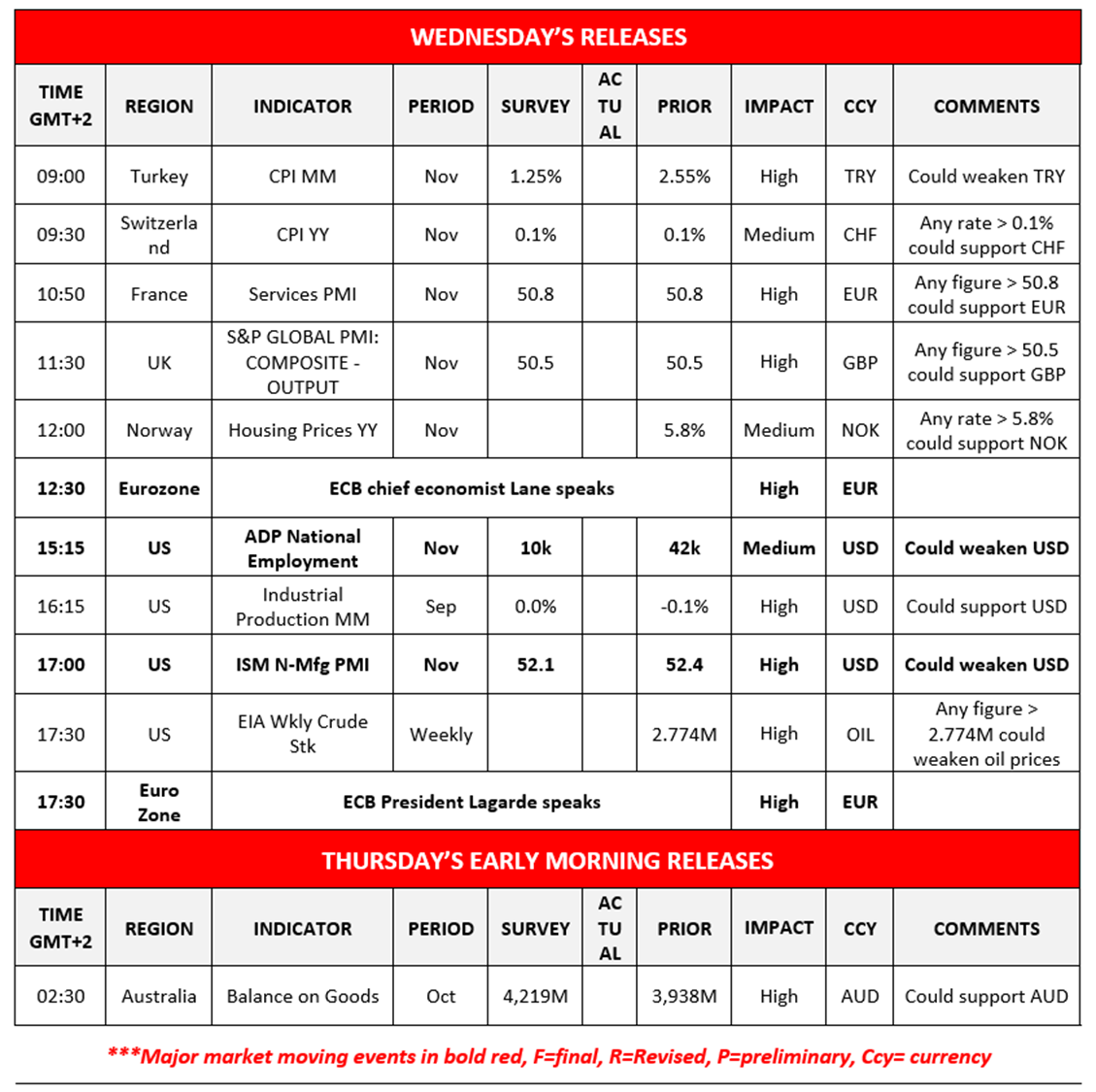

Today we get Turkey’s and Switzerland’s CPI rates for November, followed by France’s services PMI figure, the UK’s composite PMU figure and Norway’s housing prices rate all for November as well. During the American session we note the US ADP national employment figure for November, US industrial production rate for September, the US ISM non-manufacturing PMI figure for November and the US EIA weekly crude oil inventories figure. On a monetary level we would like to note the speeches by ECB Chief Economist Lane and ECB President Lagarde today. For tomorrow’s Asian session we would like to note Australia’s trade balance figure.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1405 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

XAU/USD H4 Chart

- Support: 4142 (S1), 4080 (S2), 4010 (S3)

- Resistance: 4240 (R1), 4315 (R2), 4380 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.