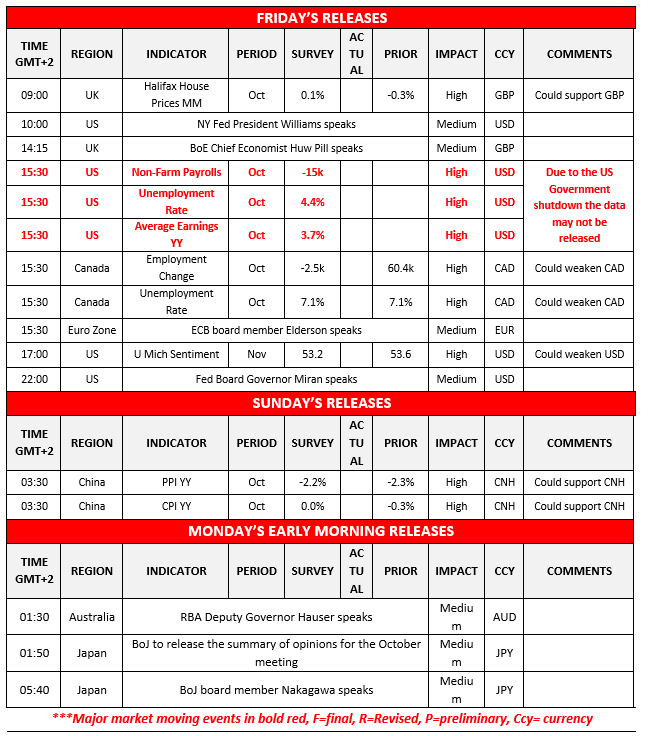

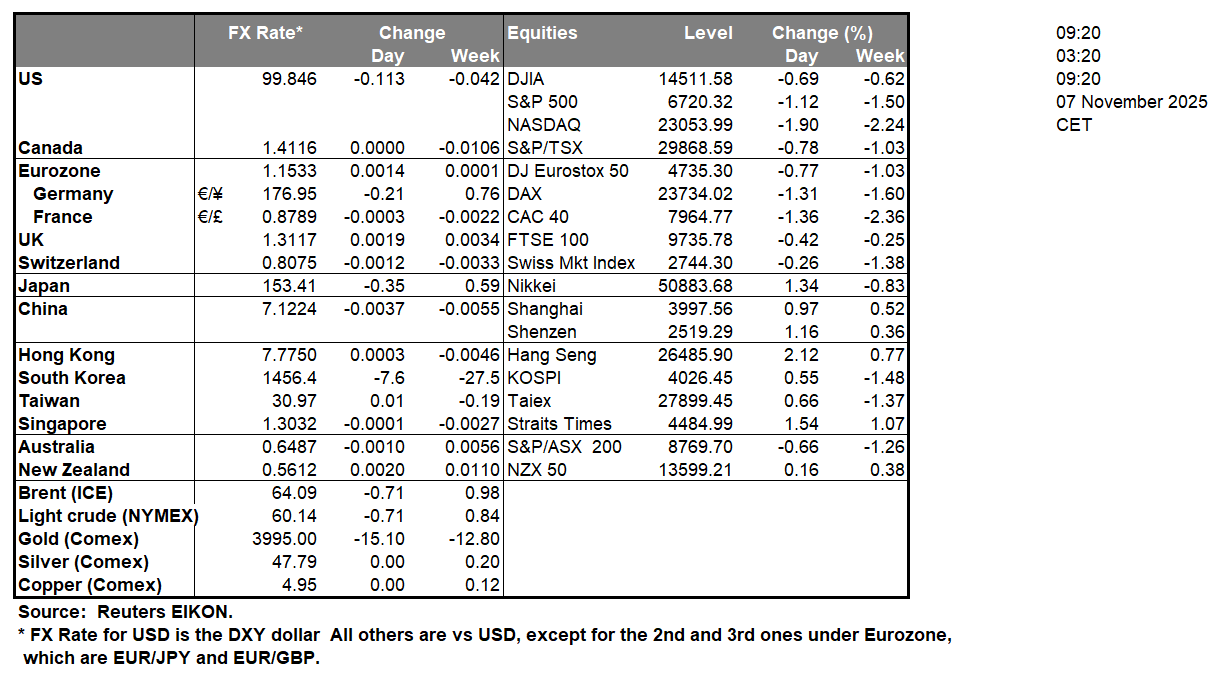

The USD seems to be staging a rebound after yesterday’s losses, yet remains quite fragile. Under normal circumstances, the market’s interest would focus on the release of the US employment report for October today; however, the US Government shutdown is expected to delay its release. We note that the US Government shutdown has started to affect the US economy in a more substantial manner, as it is the longest shutdown in history of the US and still there seems to be no resolution on the horizon. It’s characteristic that the US is shutting down 10% of all flights in key airports.

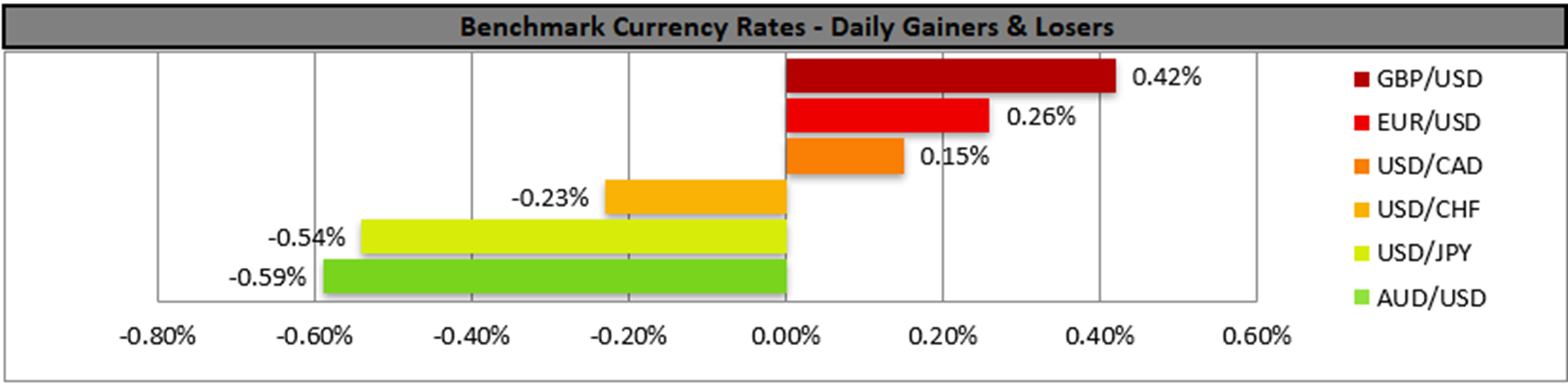

North of the US border we highlight the release of Canada’s employment data for October. The employment change figure is expected to dive into the negatives, reaching -2.5k, while the unemployment rate is expected to remain unchanged at 7.1%, a quite high level for Canadian standards. Should the data show a tightening Canadian employment market we may see the Loonie enjoying asymmetric support, while should the actual rates and figures meet or show an even wider slack in the Canadian employment market, we may see the Loonie losing ground as pressure on BoC to ease its monetary policy may be enhanced. For the time being Canada’s central bank is in no mood to cut rates further and it’s characteristic that BoC Governor Tiff Macklem is not even considering such a scenario. Yet the bank’s firm stance seems not to be able to help the CAD, which continues to lose ground against the USD for six days in a row. Market uncertainty especially about trade, with the US and at an international level, seem to be keeping the CAD down, while a possible drop of oil prices could further enhance the Loonie’s bearish tendencies. On the flip side a rebound could be nearing should trade relationships normalise and the Fed continue cutting rates as the central bank interest rate differentials outlook between the Fed and BoC, may start favoring the CAD.

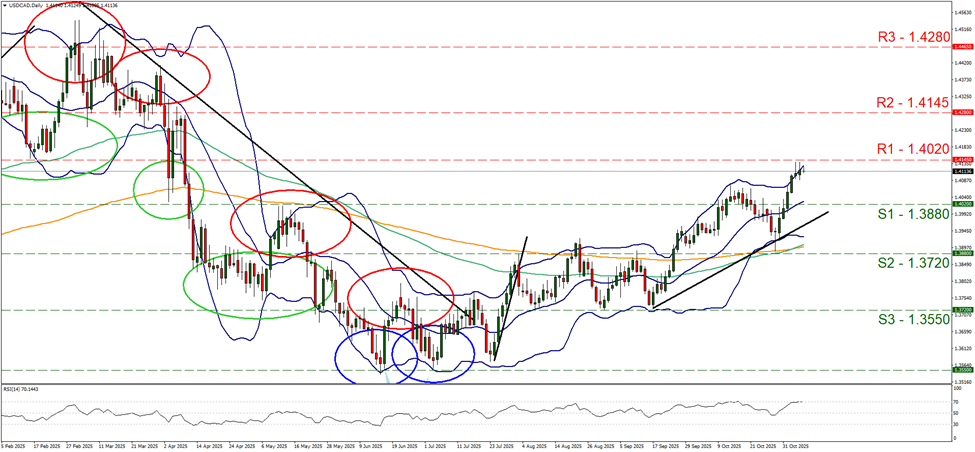

USD/CAD continued to rise yesterday, teasing the 1.4020 (R1) resistance line. We maintain a bullish outlook for the pair, as long as the upward trendline guiding the pair remains intact. Supporting our bullish outlook is the RSI indicator which is running along the reading of 70, suggesting a strong bullish sentiment for the pair among market participants, yet also implying that the pair is near overbought levels and possibly ripe for a correction lower. Similar signals we get from the fact that the price action is flirting with the Bollinger bands. Should the bulls maintain control over the pair, we may see USD/CAD breaking the 1.4020 (R1) resistance level, with the next possible target for the bulls being the 1.4145 (R2) resistance base. Should the bears take over, we may see USD/CAD dropping, breaking the 1.3880 (S1) support line, continue to break also the prementioned upward trendline, in a first signal that the upward motion has been interrupted and continue to aim if not break the 1.3720 (S2) support level.

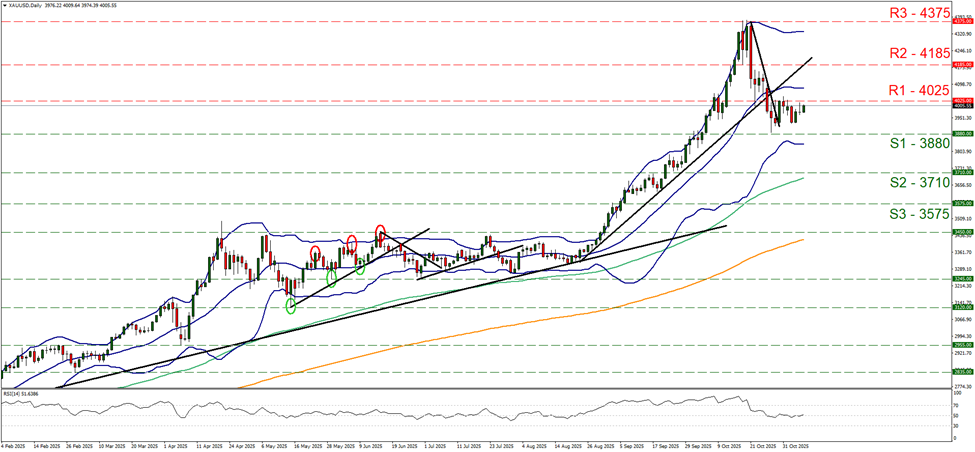

XAU/USD edged higher in today’s Asian session, aiming for the 1.4025 (R1) resistance line. We maintain a bias for a sideways motion for the precious metals price given also that the RSI indicator is at the reading of 50, implying a rather indecisive market for gold. For a bullish outlook to emerge we would require gold’s price to break the 4025 (R1) resistance line and start aiming for the 4185 (R2) resistance level. For a bearish outlook we would require a clear break below our 3880 (S1) support level with the next possible target for the bears being our 3795 (S2) support line.

Autres faits marquants de la journée :

Today we get the UK Halifax house prices rate for October, Canada’s Employment data for October and the UoM consumer sentiment for November. Also NY Fed President Williams, BoE Chief Economist Pill, ECB member Elderson and Fed Governor Miran are speaking. On Sunday we get China’s inflation metrics for October and on Monday’s Asian session, we note the release of the BOJ’s October summary of opinions, while RBA Deputy Governor Hauser and BoJ member Nakagawa speak.

USD/CAD Daily Chart

- Support: 1.3880 (S1), 1.3720 (S2), 1.3550 (S3)

- Resistance: 1.4020 (R1), 1.4145 (R2), 1.4280 (R3)

XAU/USD Daily Chart

- Support: 3880 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4025 (R1), 4185 (R2), 4375 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.