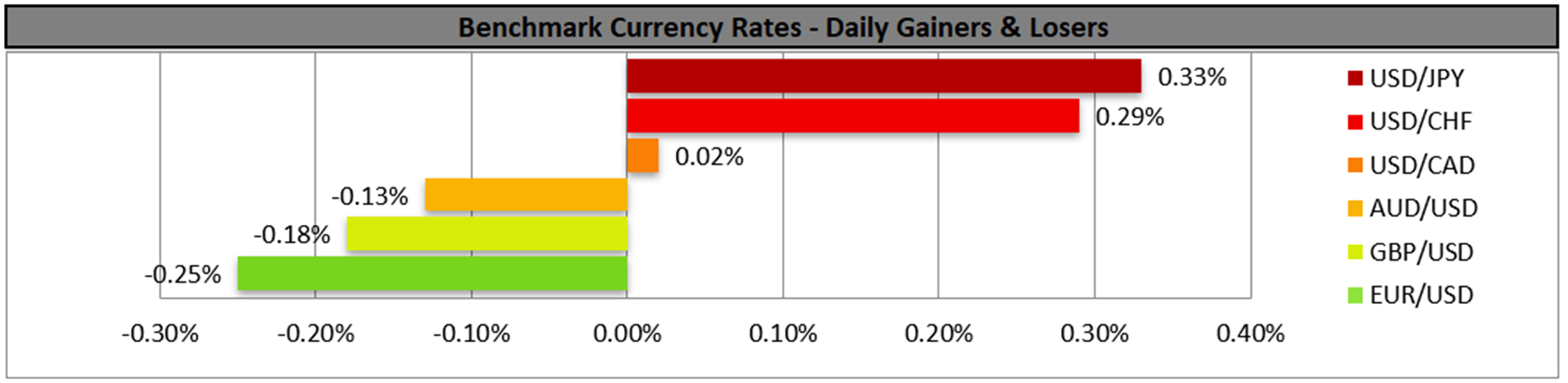

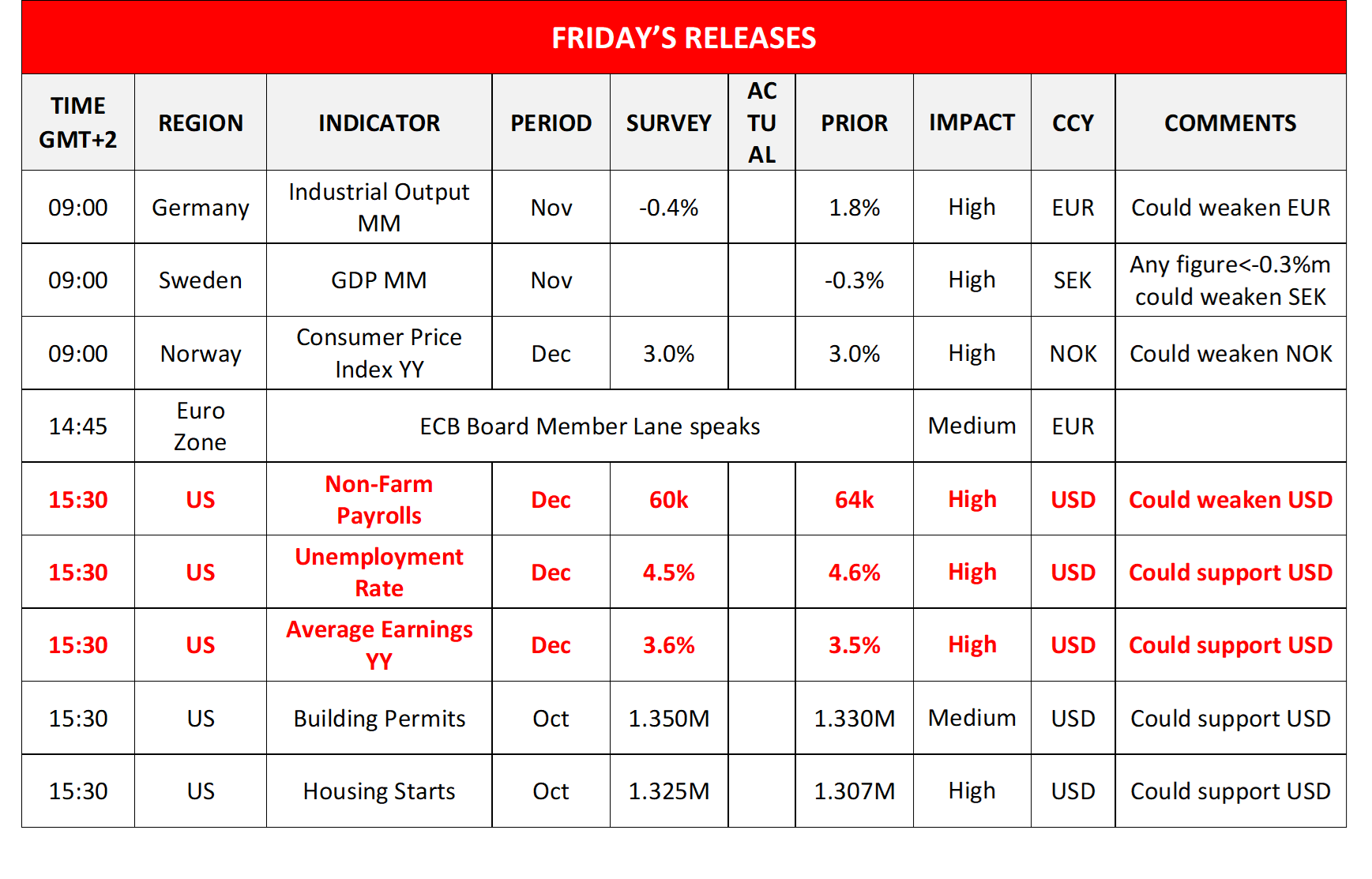

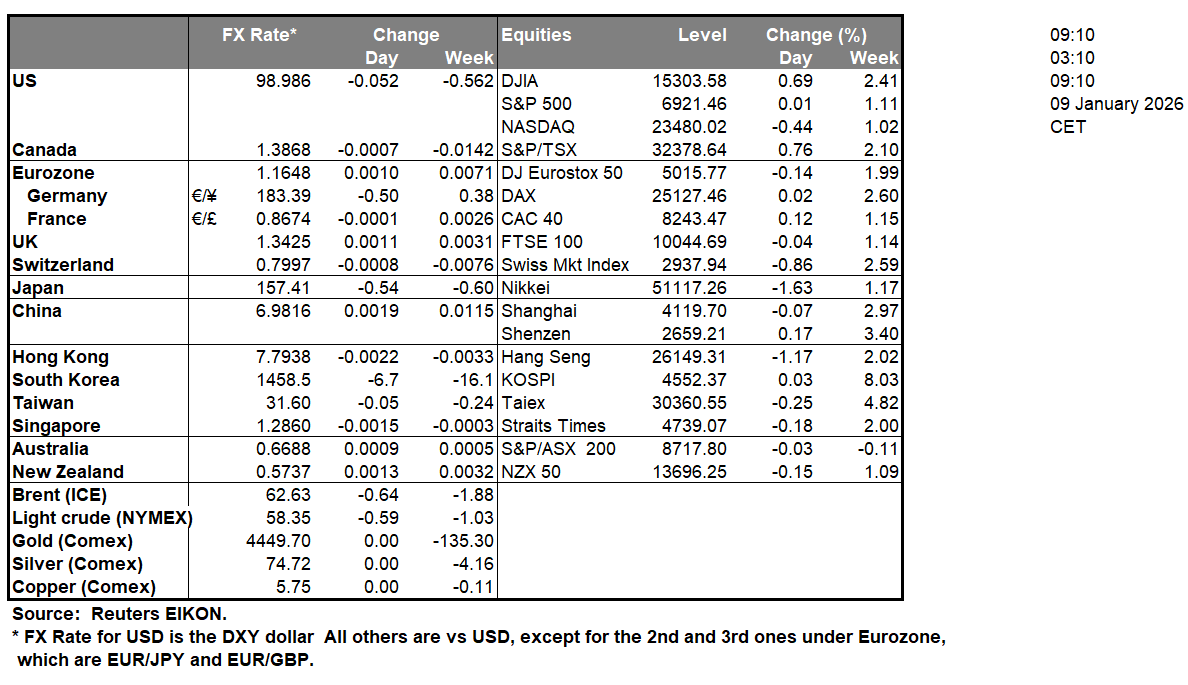

The USD continued to strengthen against its counterparts in the FX market yesterday and during today’s Asian session. Today we highlight the release of the US employment report for December as the main event for the markets. The release is expected to be closely watched as it may provide more insight for the state of the US economy and may alter somewhat the market’s expectations for the Fed’s intentions. The NFP figure is expected to drop slightly reaching 60k if compared to November’s 64k, while the unemployment rate to tick down to 4.5%, thus forecasts tend to provide mixed signals. Should the actual rates and figures differ substantially from the forecasts, we may see the market’s being taken by surprise and thus creating increased volatility in the markets. Should the data show a picture of a tighter than expected US employment market we may see the USD getting some support, while at the same time the release could weigh on gold’s price and US stock markets. On the flip side a possibly looser than expected US employment market could weigh on the USD and lift gold’s price and US equities markets. Also on a fundamental level, we note the possibility of the US Supreme Court releasing its ruling on whether US President Trump can invoke the International Emergency Economic Powers Act (IEEPA) and impose tariffs without the approval of Congress. Should the act be considered as constitutional we may see the USD getting some support.

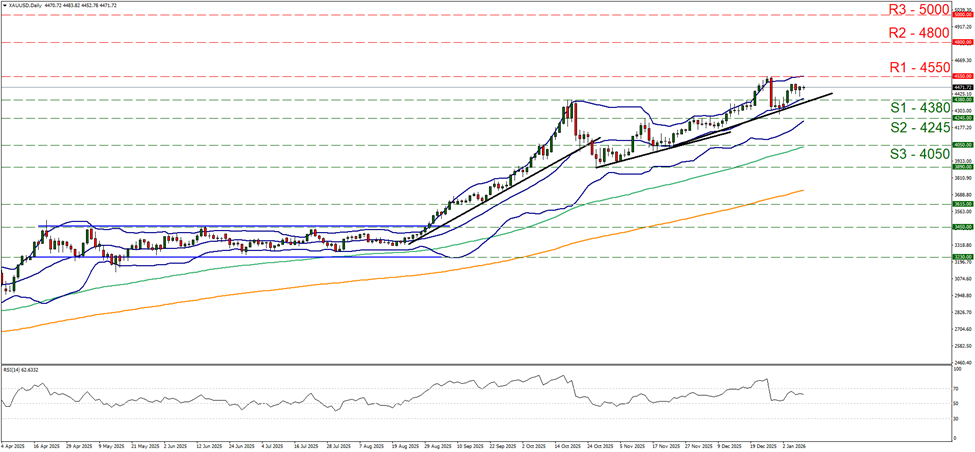

Gold’s price remained rather stable yesterday and during today’s Asian session, well between the 4380 (S1) support line and the 4550 (R1) resistance level. The RSI indicator continues to be between the reading of 50 and 70, implying a bullish predisposition of the market for the precious metal’s price. We note the upward trendline yet for the time being we maintain our bias for a sideways motion of the precious metal’s price and for the adoption of a bullish outlook we would require gold’s price to break the 4550 (R1) resistance line, and we set as the next possible target for gold’s bulls the 4800 (R2) level. For a bearish outlook we would require gold’s price to break the 4380 (S1) support line and start aiming if not reaching the 4245 (S2) barrier.

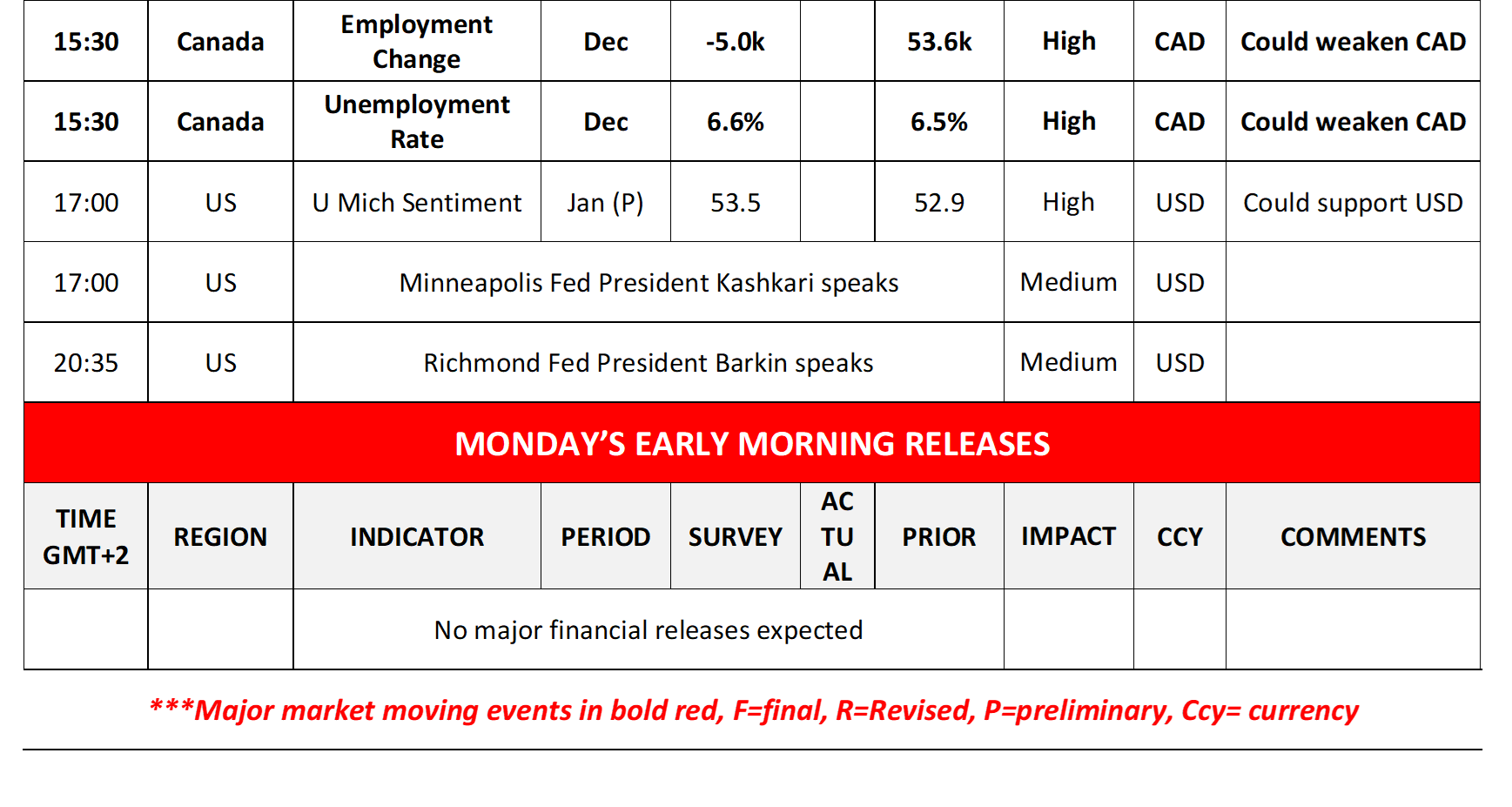

Also today we highlight the release of Canada’s December employment data along with the US ones. The employment change figure is expected to drop into the negatives reaching -5k if compared to November’s 53.6k. Forecasts tend to expect the unemployment rate to tick up to 6.6% if compared to November’s 6.5% in another signal of a loosening Canadian employment market. On the flip side should the actual data show a tightening Canadian employment market we may see the Loonie gettting some support as BoC’s slightly hawkish tendencies may intensify.

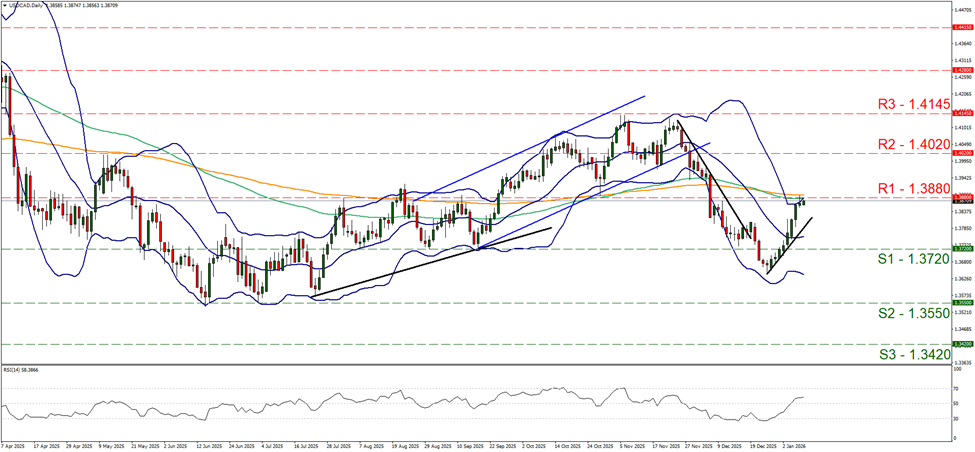

On a technical level, USD/CAD continued to rise yesterday and briefly tested the 1.3880 (R1) resistance line. We tend to maintain a bullish outlook for the pair and note that the RSI indicator below our daily chart is above the reading of 50 implying a bullish predisposition of the market for the pair. Yet we also note that the pair’s price action has reached the upper Bollinger band, which may slow down the bulls or even cause a correction lower. Should the bulls maintain control over the pair, we may see USD/CAD breaking the 1.3880 (R1) resistance line and start actively aiming for the 1.4020 (R2) resistance level. Should the bears take over we may see USD/CAD dropping breaking the upward trendline guiding it, continue to also break the 1.3720 (S1) support line and start aiming for the 1.3550 (S2) support level.

Autres faits marquants de la journée :

Today we also get Germany’s industrial output for November, Sweden’s GDP rate for the same month, Norway’s CPI rates for December, the US building approvals and housing starts for October as well as the preliminary UoM Consumer Sentiment for January. On a monetary level, we note the planned speeches of ECB’s Lane and the Fed’s Kashkari and Barkin.

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

XAU/USD Daily Chart

- Support: 4380 (S1), 4245 (S2), 4050 (S3)

- Resistance: 4550 (R1), 4800 (R2), 5000 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.