US stock markets move lower, as market fears of the US defaulting on its debt have heightened. In this report we aim to present the recent fundamental and economic news releases that impacted the US stock markets, look ahead at the upcoming events that could affect their performance and conclude with a technical analysis.

Airbnb’s overoptimism may be its Achilles heel

Airbnb (#Airbnb), the world’s most popular accommodation hosting service was surprisingly in the reds during aftermarket trading, following its 2023 Q1 earnings report, with the stock currently trading in pre-market at the $110 mark, beaten down by more than 14%. Since the beginning of this year, Airbnb’s share prices have greatly experienced an increase, rising from $86 to its yearly high of $142 per share in February, indicative of increased consumer spending as the large amount of disposable income appeared to increase demand for oversees travels and holidays by pent up consumers. The company on Tuesday released its quarterly earnings report, which was indicative of a better than predicted revenue figure, yet its earnings per share came in slightly lower than anticipated. Overall, the results should have supported the stock’s price, as Airbnb reported that during Q1 the company experienced record high night stays and experiences. Despite the company’s optimistic outlook lying ahead, it would appear that traders do not share Airbnb’s optimism since the economic data paints a different picture, as market analysts anticipate a recession, which could weaken demand for Airbnb’s services thus eating away at their profits.

US CPI data set to make waves in the equities markets

Last week the S&P 500, the Dow Jones 30 recorded declines, however the tech orientated NASDAQ 100 managed to remain afloat, being lifted by Apple’s (#AAPL) earnings release , as market sentiment rapidly deteriorated. Following talks of the US potentially defaulting on its debt, equities markets appear to have taken a hit, as the very real possibility of a default has reduced consumer confidence in US stocks. Furthermore, should the US CPI data, which at the time of this report, has not been released, facilitate fears of persistent inflationary pressures in the US economy, we may see heightened recession worries, as the Fed’s inflation mandate may dictate further rate hikes. Thus, the prospect for further tightening by the Fed could lead to the greenback strengthening, as higher interest rates could make the currency more expensive for international investors looking to buy US stocks who may be deterred by the increased costs of acquisition. Overall, despite last Friday’s Employment data being indicative of a resilient labor market in the US, the uncertainty that has emerged, may be further supported by stronger than anticipated CPI data thus weakening the sentiment surrounding the equity markets.

Analyser la technique

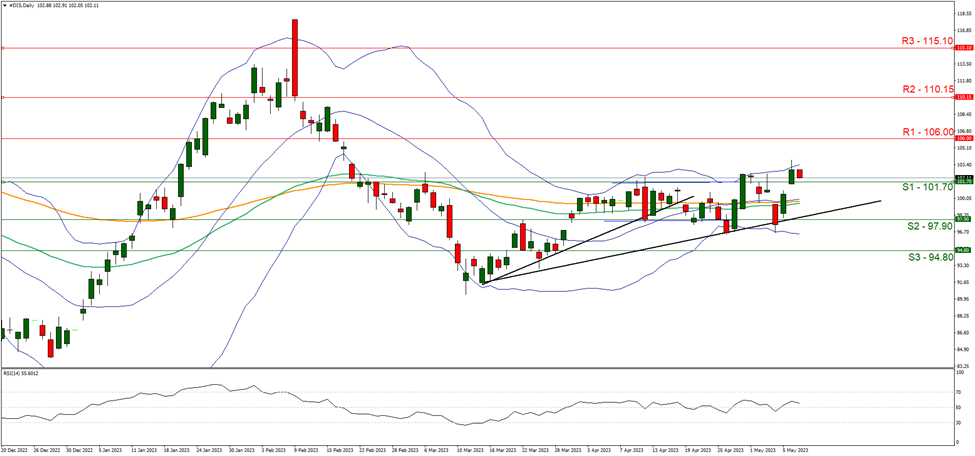

#DIS DAILY Chart

Support: 101.70 (S1), 97.90 (S2), 94.80 (S3)

Resistance: 106.00 (R1), 110.15 (R2), 115.10 (R3)

Looking at #DIS Daily chart we observe investors anticipating a positive earnings report from Disney, as the stock has broken above resistance turned support at 101.70 (S1) on the 8 of May. We hold a bullish outlook bias for Disney as the stock continues to validate our upwards moving trendline and supporting our case is the RSI indicator which broke above the reading of 50. For our bullish outlook to continue, we would like to see a break above the 106.00 (R1) resistance line with the next potential target for the bulls being the 110.15 (R2) resistance line. For a bearish outlook, we would like to see a clear break below the 101.70 (S1) support level, with the move towards support at 97.90 (S2).

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.