Gold continues its downward motion while during today’s European session reached characteristically a two-month low. On a basic level, it seems that the negative correlation of the USD with Gold’s price still is the main factor behind the precious metal’s price direction. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

White House reaches a deal for US debt ceiling

On the fundamental side, we note that the main issue tantalizing the markets is the possibility of the US defaulting and whether the White House could reach an agreement with Congress about raising the US debt ceiling, thus averting a US default. US Treasury Secretary Yellen last Friday warned that the X-date is nearing, updating the possible default date to June 5th. Yet over the weekend US President Biden and Republican lawmakers intensified their efforts and reached a deal for the rise of the US debt ceiling. Hence the pressure is now transferred to Congress where the deal is to be voted into law. Yet the agreement seems to have created some backlash from more conservative US lawmakers, as well as former US President Trump and Florida Governor De Santis, both running for the Republican nomination of the 2024 US Presidential election. Should the US Congress be able to pass the deal into law, in time, we expect market nerves to calm while should the Congress fail to do so, considerable upheaval should be expected in the markets which in turn could create safe haven inflows for the precious metal.

The Fed’s intentions

Last Friday the US Core PCE growth rate for April was released and tended to pass a bit under the radar. The release showed that inflationary pressures within the US economy remain persistent as the growth rates accelerated both on a year-on-year and month-on-month level. The release may force Fed policymakers to maintain an intense hawkish rhetoric, implying that more rate hikes are to come or at least that interest rates may have to remain at high levels for a prolonged period. Such a scenario would contradict the market’s current expectations which include another 25 basis-points rate hike in the Fed’s next meeting and rate cuts before the end of the current year. Should Fed policymakers decide to sharpen the hawkish rhetoric we may see the USD gaining some ground and given the USD’s negative correlation with gold’s price, such a scenario may amplify the selling pressure on Gold.

US employment report the next big test

Yet the next big test for gold’s price is expected to be the release of the US employment report for May, due out this Friday. Expectations currently are for the NFP figure to drop from 253k to 195k and the unemployment rate to tick up to 3.5%. Should the actual rates and figures meet their respective forecasts and despite the unemployment rate implying a relative tightness of the US employment market as it remains at relatively low levels, the expected drop of the NFP signals the cracking of the tightness of the US employment market, something that may weaken the USD, while at the same time may cause Fed policymakers to hesitate. Should the release overall release, weaken the greenback we may see it providing some support for gold’s price. On the other hand, we have to note that the uncertainty for the actual rates and figures is high and it would not be the first time that the actual data have disproven the prognosis. Hence we may see wide volatility also affecting gold’s price and we would advise caution whilst trading near the time of the release.

Technical Analysis – Gold

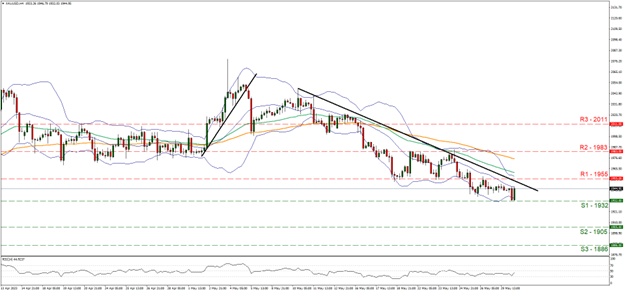

XAUUSD H4 Chart

- Support: 1932 (S1), 1905 (S2), 1886 (S3)

- Resistance: 1955 (R1), 1983 (R2), 2011 (R3)

As we are writing this report, Gold’s price maintained a sideways motion in the past few days and bounced impressively on the 1932 (S1) support line during today’s European session. Yet we tend to maintain a bearish outlook for gold’s price as long as its price action remains below the downward trendline incepted since the 10th of May. On the flip side, we note that the RSI indicator has bounced on the reading of 30, implying that the influence of the bears may be weakening. At this point we would like to note the aforementioned relative stabilisation of Gold’s price which under certain circumstances may threaten the prementioned downward trendline and should it be broken that would force us to switch our bearish outlook in favour of a sideways motion bias initially. Should the bears maintain control over the precious metal’s price, we may see it breaking the 1932 (S1) support line and aim for the 1905 (S2) support level. On the other hand, should a buying interest be expressed by the market, we may see gold’s price rising, breaking the prementioned downward trendline, signaling the interruption of the downward movement, breaking clearly also the 1955 (R1) resistance line, with the next possible target for the bulls being the 1983 (R2) resistance barrier.

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing.