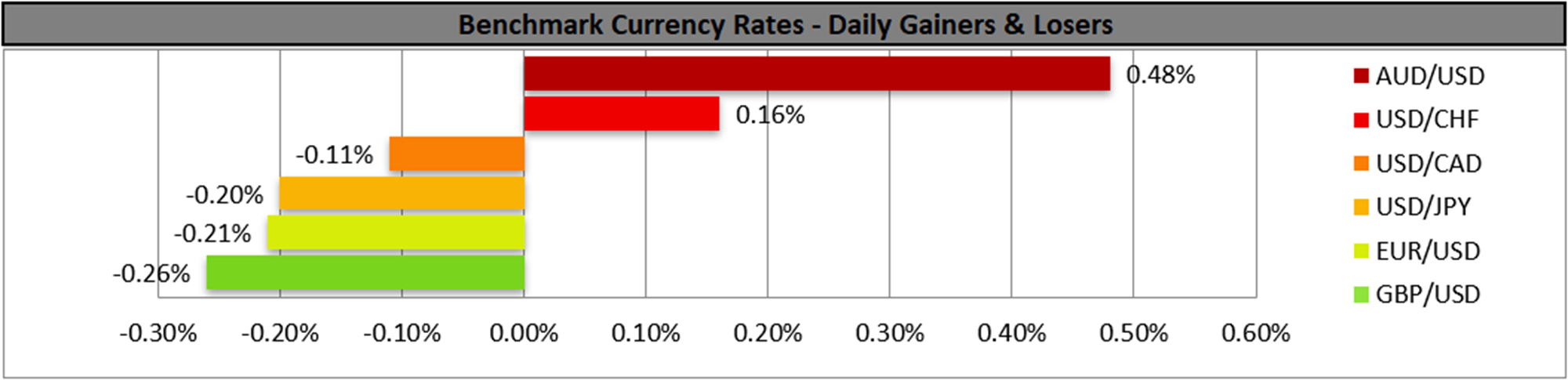

JPY gained against the USD, the EUR and GBP in today’s Asian and early European sessions, as the possibility of a joint US-Japanese market intervention was floated by Japan’s Finance Minister Satsuki Katayama. She stated that Japan is not to rule out any options while also stated that the joint US-Japanese statement issued last September “was extremely significant and included language on intervention“. It should be noted that USD/JPY in the past few days reached highs not seen since early July last year, indicative of JPY’s weakness. We regard the possibility of a market intervention as high, yet at the same time, we highlight that the fundamentals surrounding the Japanese currency continue to create headwinds for the Yen. We note Japan’s PM Takaichi’s intentions to dissolve the lower House of the Diet and call for a snap election, which tends to weigh on JPY given the Japanese Government’s stance against the hiking intentions of BoJ and the possible political uncertainty emerging in the land of the rising sun. Developments on the issue are expected on Monday morning as Ms. Takaichi is expected to proceed with relevant announcements.

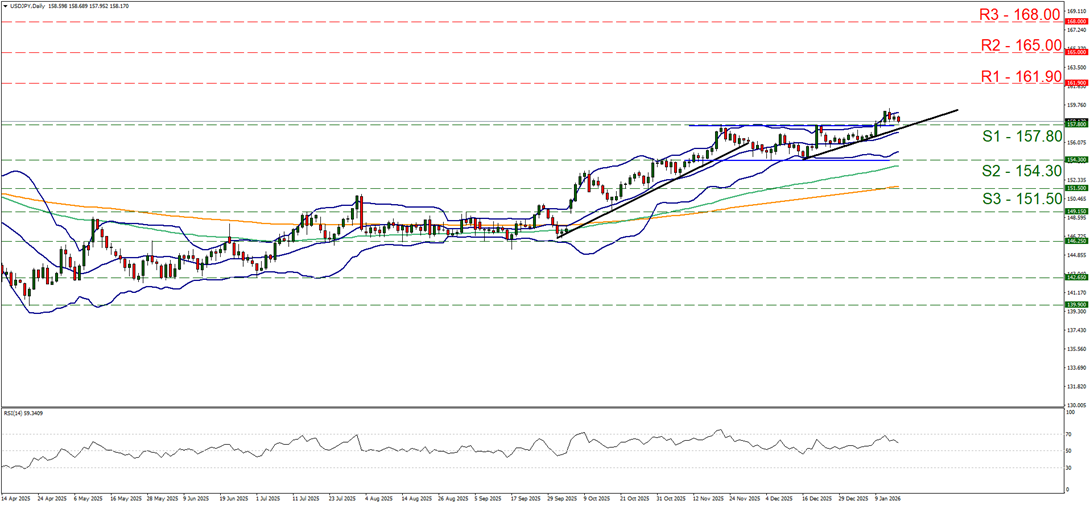

USD/JPY corrected lower in today’s Asian session, in today’s Asian session nearing the 157.80 (S1) support line. We maintain a bullish outlook for the pair given that the upward trendline guiding the pair remains intact, yet we note the easing bullish market sentiment for the pair as the RSI indicator has retreated from the highs of the reading of 70. Should the bulls maintain control as expected, we may see the pair start aiming for the distant 161.90 (R1) resistance level. On the flip side, should the bears take over, we may see USD/JPY breaking initially157.80 (S1) support line continue to break also the prementioned upward trendline in a first signal of an interruption of the upward movement and then continue to break also the 154.30 (S2) base.

CAD slips on lower oil prices

Also, we note the slight weakening of the CAD after the sharp drop in oil prices yesterday, a scenario that we had warned about in yesterday’s report. The Loonie is sensitive to the level of oil prices as Canada is a major oil-producing economy. Also, macroeconomic data showed that manufacturing sales, wholesale trade and building permits were all in the red. On a fundamental level, Canadian PM Carney is on tour in China trying to improve Sino-Canadian trade relationships, which could provide some support for the Loonie if materialized, while we also note the release of Canada’s number of House starts for December, today, while the next big test for the Loonie is to be the release of Canada’s CPI rates for December on Monday.

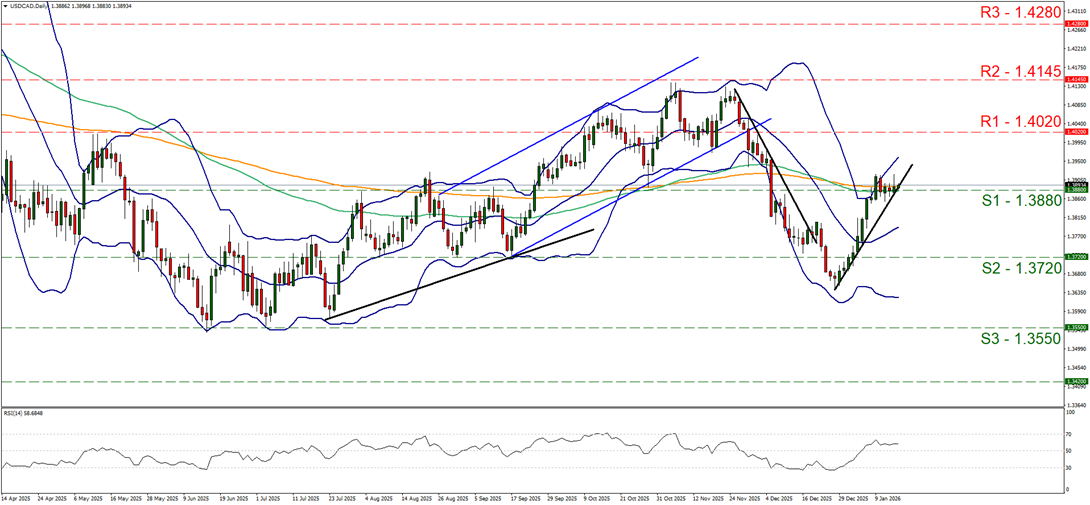

USD/CAD seems to remain close to the 1.3880 (S1) support line. We tend to maintain a bullish predisposition of the pair as the upward trendline is still valid, yet the pair’s sideways motion of the past three days is putting the upward trendline to the test, hence we issue along the bullish outlook also a warning for a possible stabilisation of the pair. Also the RSI indicator remains above the reading of 50, implying a rather weak bullish market sentiment for the pair. Should the bulls remain in charge, we may see the pair aiming for the 1.4020 (R1) resistance line. Should the bears take over, we may see the pair breaking the prementioned upward trendline, the 1.3880 (S1) support line and start aiming for the 1.3720 (S2) support level.

Autres faits marquants de la journée :

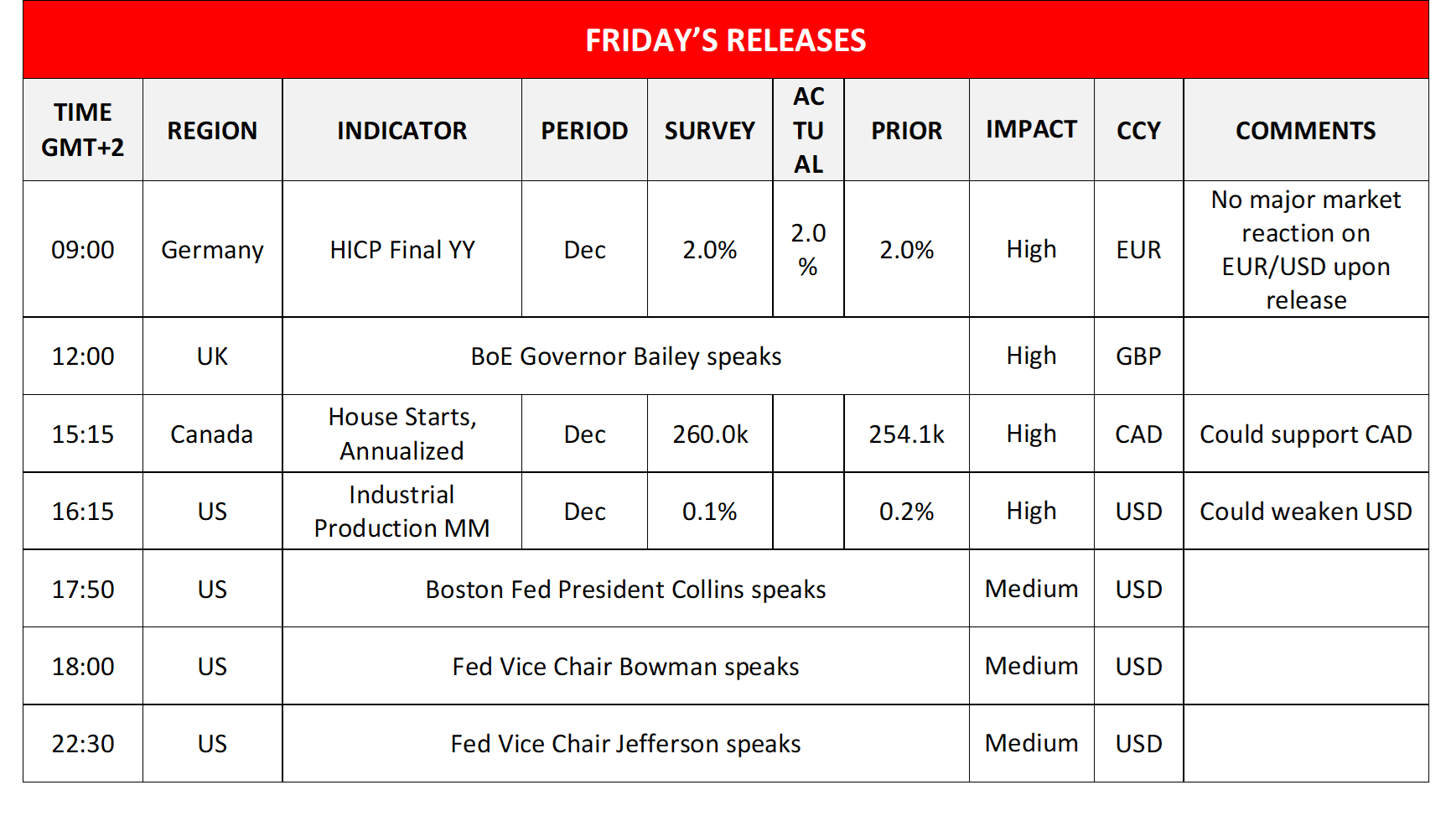

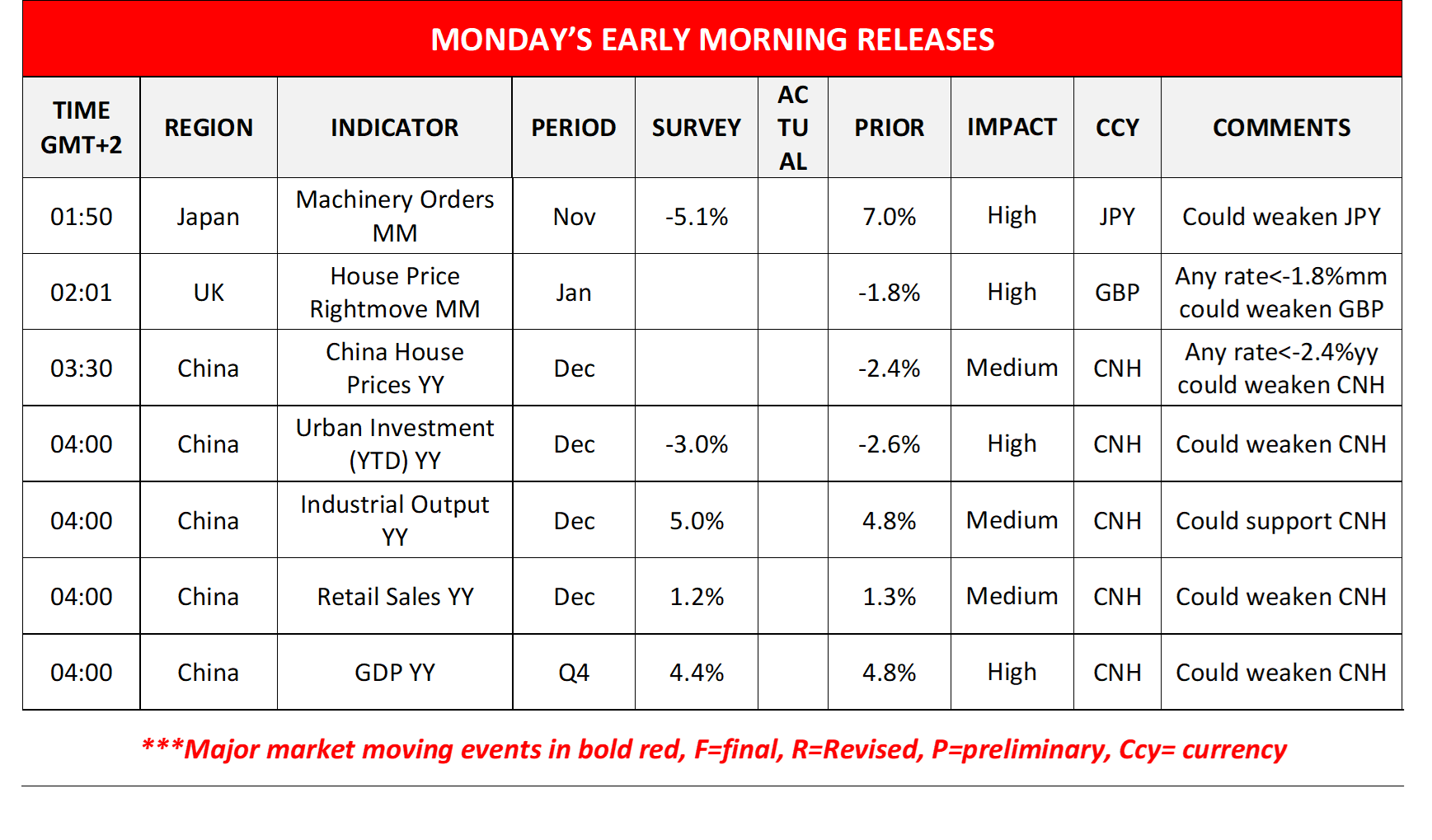

Today we get the Germanys’ final HICP rate for December and the US industrial output for the same month, while BoE Governor Bailey, Boston Fed President Collins, Fed Vice Chair Bowman and Fed Vice Chair Jefferson speak. In Monday’s Asian session, we note the release of Japan’s November Machinery orders, UK’s Rightmove house prices for January, and we note from China the release of December’s China House Prices, Urban Investment, Industrial Output and Retail Sales, while we highlight also China’s GDP rate for Q4 25.

USD/JPY Daily Chart

- Support: 157.80 (S1), 154.30 (S2), 151.50 (S3)

- Resistance: 161.90 (R1), 165.00 (R2), 168.00 (R3)

USD/CAD Daily Chart

- Support: 1.3880 (S1), 1.3720 (S2), 1.3550 (S3)

- Resistance: 1.4020 (R1), 1.4145 (R2), 1.4280 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.