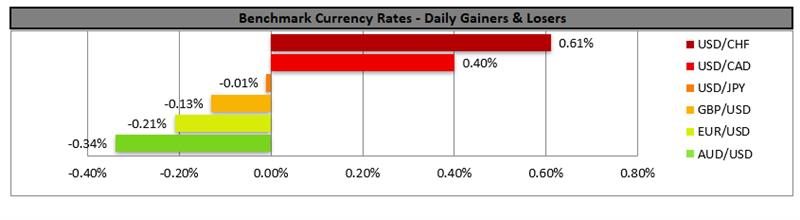

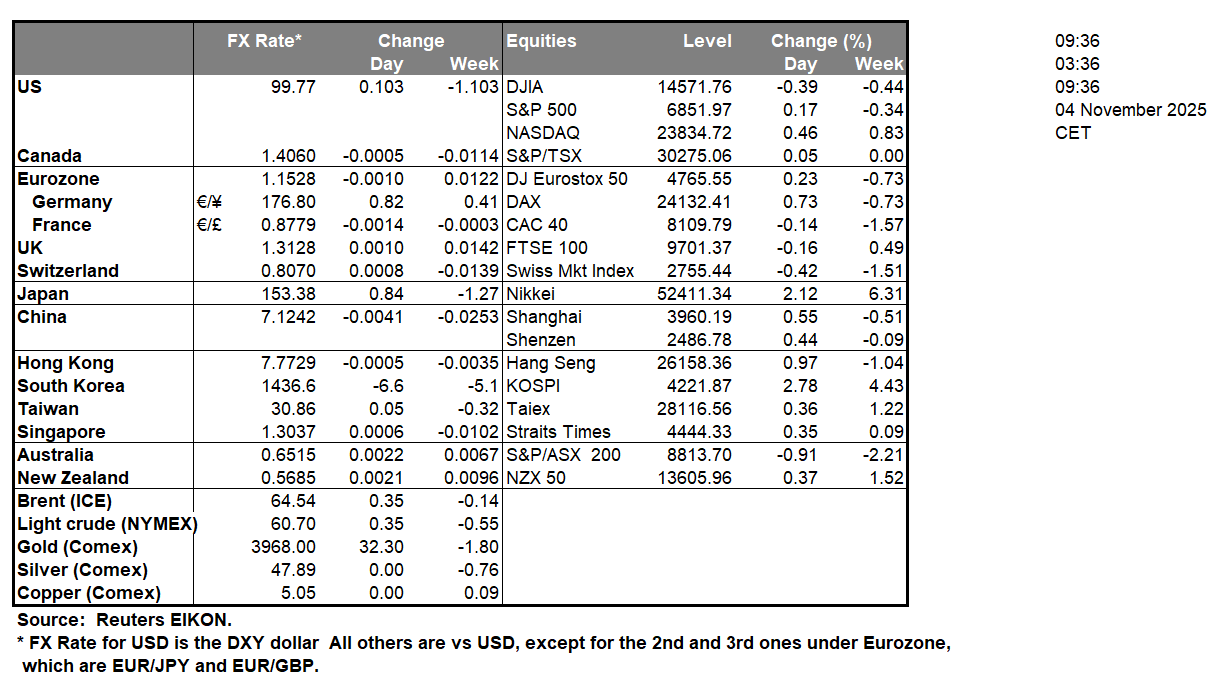

The RBA’s interest rate decision occurred earlier on today, with the bank remaining on hold as was widely expected by market participants. However, RBA Governor Bullock during the press conference following the bank’s decision stated that “The board is going meeting by meeting and using data to see whether the outlook still looks reasonable, and if it isn’t, they’ll change their mind” implying that the surprise surge in inflation could lead to the bank remaining on hold for a prolonged period of time. Hence, the possibility of a rate cut by the end of the year from the bank may have diminished and thus may have aided the Aussie.In the UK, Chancellor of the Exchequer Reeves is allegedly preparing to break Labour’s manifesto pledge during a surprise pre-budget speech which is being touted as occurring today. In our view we would not be surprised to see Labour breaking their manifesto pledges as we have repeatedly stated that Labour’s pledges when compared to the state of the UK economy are frankly very difficult to achieve. Moreover, as a result of this unusual pre-budget speech we would not be surprised to see heightened volatility in the sterling and the FTSE100 during today’s trading session.In tomorrow’s Asian session the BOJ’s September meeting minutes are set to be released. Although the release itself may not garner significant attention, it may provide some insight into the way policymakers were perceiving the state of the economy and may thus lead to some reactions in the JPY.In the US today, traders are waiting to see if the US JOLTS job openings figure is released, which may influence the USD.

XAU/USD appears to be moving in an upwards fashion. Yet with the Ichimoku cloud possibly acting as a resistance appear we would opt for a predominantly sideways bias. For our sideways bias to be maintained we would require the precious metal’s price to remain confined between our 3980 (S1) support level and our 4045 (R1) resistance line. On the other hand, for a bullish outlook we would require a break above our 4045 (R1) resistance line with the next possible target for the bulls being our 4145 (R2) resistance level. Lastly, for a bearish outlook we would require a break below our 3980 (S1) support line with the next possible target for the bears being our 3895 (S2) support level.

On a technical level, EUR/USD appears to be moving in a downwards fashion after clearing our 1.1560 (R1) support now turned to resistance level. We opt for a bearish outlook for the pair and supporting our case are all three indicators below our chart which tend to point towards a bearish market sentiment. For our bearish outlook to continue we would require a clear break below our 1.1405 (S1) support level with the next possible target for the bears being our 1.1225 (S2) support line. On the other hand, for a bullish outlook we would require a clear break above our 1.1560 (R1) resistance line with the next possible target for the bulls being our 1.1650 (R2) resistance level. Lastly, for a sideways bias we would require the pair to remain confined between our 1.1405 (S1) support level and our 1.1560 (R1) resistance line.

Autres faits marquants de la journée :

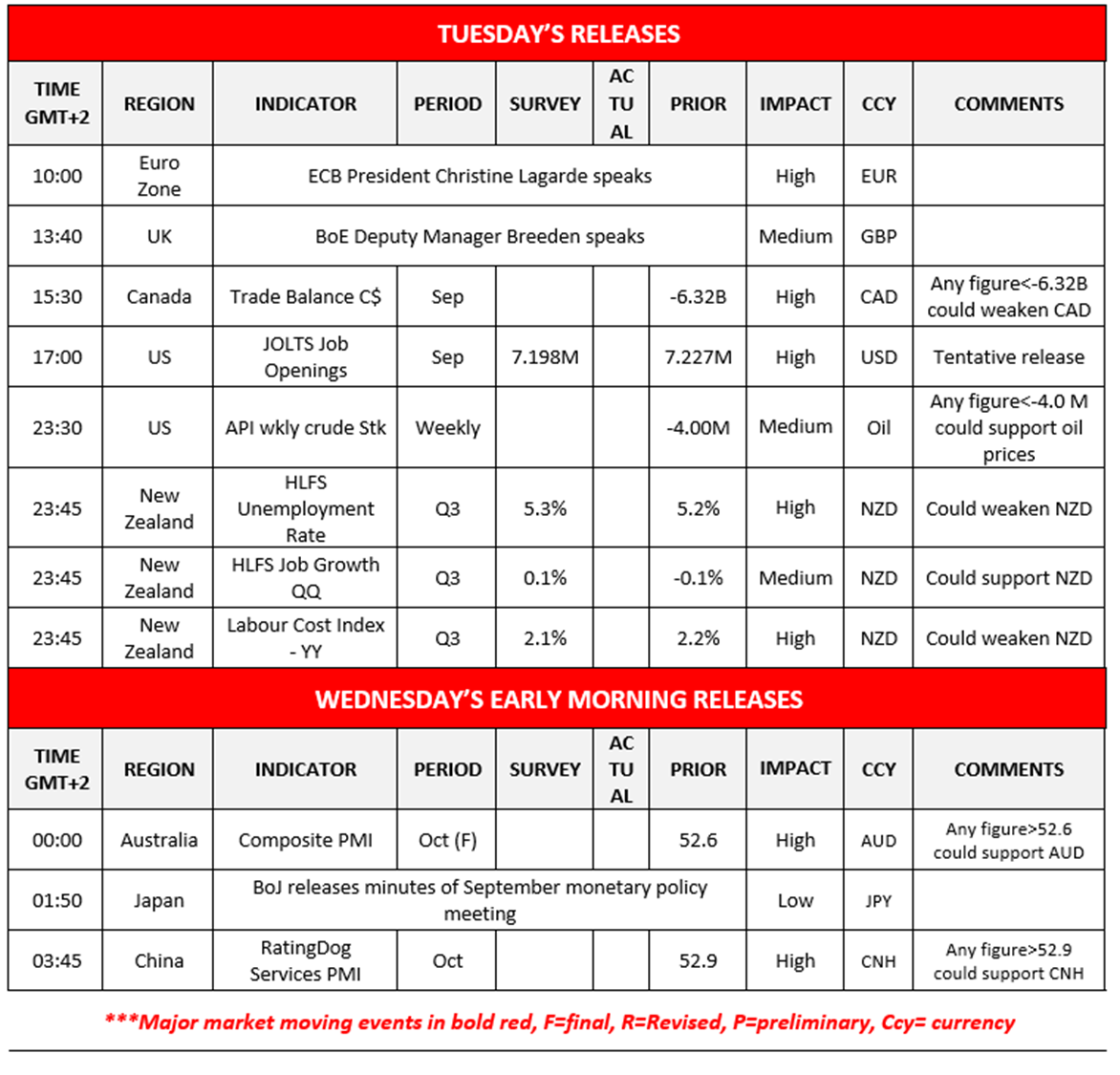

Today we get Canada’s trade data for September, the US Jolts openings figure for the same month albeit that could be postponed, the weekly US API crude oil inventories figure and New Zealand’s employment data for Q3. On a monetary level, we note that ECB President Lagarde is to be on a visit in Bulgaria and may proceed with statements on various occasions while later on BoE Deputy Manager Breeden speaks. Tomorrow Wednesday, we get Australia’s Composite PMI figure as well as China RatingDog Services PMI both being for October.

XAU/USD H4 Chart

- Support: 3980 (S1), 3895 (S2), 3790 (S3)

- Resistance: 4045 (R1), 4145 (R2), 4240 (R3)

EUR/USD Daily Chart

- Support: 1.1405 (S1), 1.1225 (S2), 1.1190 (S3)

- Resistance: 1.1560 (R1), 1.1650 (R2), 1.1815 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.