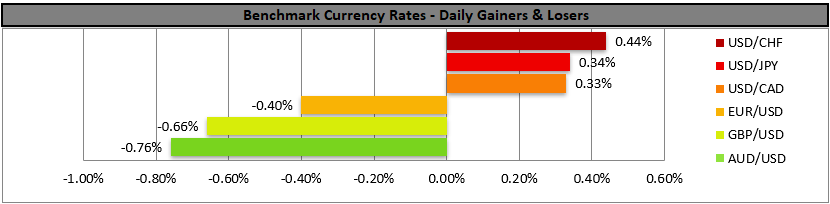

USD gains in the FX market

The dollar climbed to a two-week high in today’s Asian session, despite the ADP national employment figure dropping for January.

On a monetary level, Fed Board Governor Cook stated her worries for inflationary pressures rather than a weakness of inflationary pressures which was hawkish, supporting the greenback ahead of the release of the US employment report for January tomorrow.

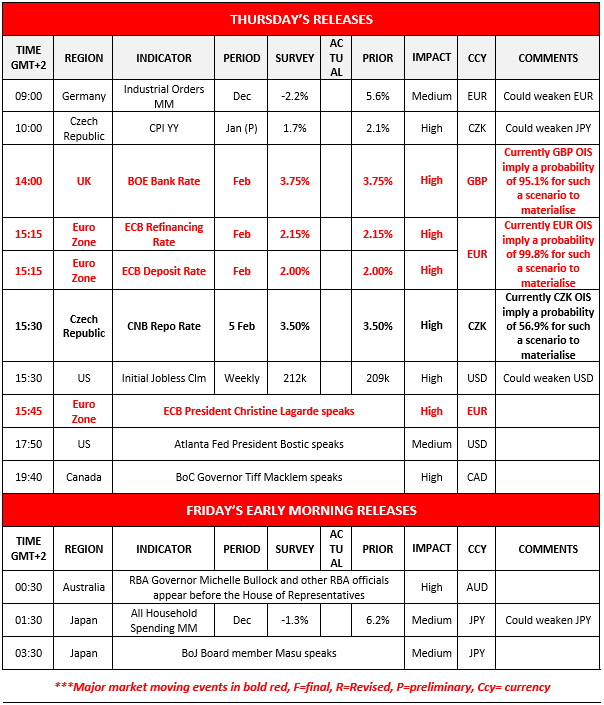

ECB’s and BoE’s interest rate decisions

Today we highlight the release of ECB’s et BoE’s interest rate decisions. Both banks are expected to remain on hold, hence market attention is expected to be shifted towards their respective forward guidance.

We suspect that both banks may sound a bit more dovish than what the markets expect and if so, we may see both the EUR et GBP retreating.

Alphabet surpasses market expectations

Market attention remains on US stock markets as the earnings season is up and running.

Alphabet released its report yesterday, surpassing market expectations for the EPS et revenue figures and also announcing that capital spending in 2026 could double, cloud business booms, with both points possibly supporting its share price.

Amazon’s earnings report next

Amazon invested around $125 billion mostly in its AI et data center infrastructure, while at the same time laid-off around 30k employees in the past four months.

Today we highlight the release of its earnings report and besides the company’s EPS ($1.96 expected) and revenue ($211-212 billion expected) figures, market may also focus on the company’s forward guidance especially about its cloud business.

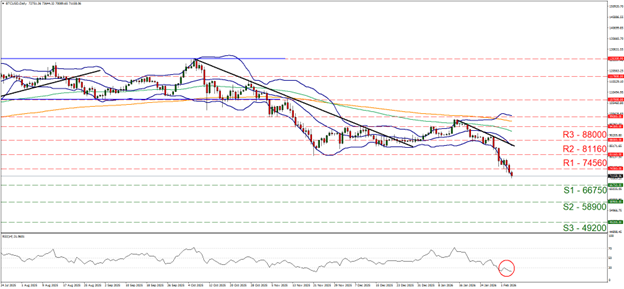

Bitcoin’s falling below 72k

Meanwhile in the crypto market Bitcoin’s price dropped below 72k despite some earlier stabilisation and has now erased all the gains made since US President Trump’s election (Nov24).

The renewal of the bearish tendencies for the crypto king was blamed on a reallocation of investments which we tend to agree with, yet the wider risk-off sentiment may have played a big part in Bitcoin’s weakening, given its riskier nature.

Charts to keep an eye out

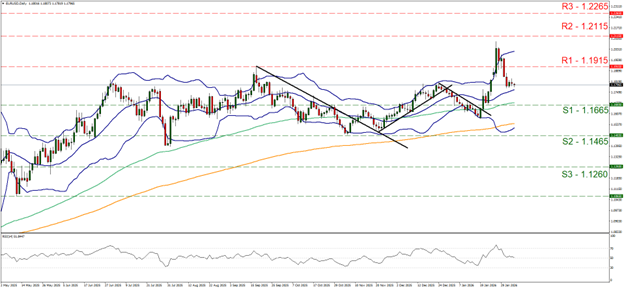

EUR/USD seems to have stabilised between the 1.1915 (R1) resistance line and the 1.1665 (S1) support level. We tend to maintain a bias for a sideways motion of the pair given also that the RSI indicator is running along the reading of 50, implying a rather indecisive market, yet ECB’s interest rate decision may alter the pair’s direction.

Should the bulls take over we may see EUR/USD breaking the 1.1915 (R1) resistance line and start aiming for the 1.2115 (R2) resistance level. Should the bears take over, we may see the pair breaking the 1.1665 (S1) support line, thus paving the way for the 1.1465 (S2) support barrier.

BTC/USD dropped yesterday breaking the 74560 (R1) support line now turned to resistance. We maintain a bearish outlook for the crypto’s price yet note the possibility of a correction higher as it is in oversold territory.

Should the bearish outlook be maintained we see the 66750 (S1) support level as the next possible stop for the bears, while for a bullish outlook to be reinstated the bar is high, as we would require the crypto’s outlook to reverse the losses of the past two weeks by breaking above the 88000 (R3) resistance base.

Autres faits marquants de la journée :

Today and in tomorrow’s Asian session, we intend to focus primarily on monetary policy as a possible market mover, and besides BOE’s, ECB’s and CNB interest rate decisions, Atlanta Fed President Bostic, BoC Governor Tiff Macklem, RBA Governor Michelle Bullock et BoJ Board member Masu speak.

EUR/USD Quotidienne

- Support: 1.1665 (S1), 1.1465 (S2), 1.1260 (S3)

- Resistance: 1.1915 (R1), 1.2115 (R2), 1.2265 (R3)

BTC/USD Daily Chart

- Support: 66750 (S1), 58900 (S2), 49200 (S3)

- Resistance: 74560 (R1), 81160 (R2), 88000 (R3)

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.