This week WTI failed to capitalize on the excess optimism of China’s reopening as it extended its sideways motion near the $80 range as recession fears kept capped crude oil’s potential. US inventories recorded buildups for a third straight week, yet not of the same magnitude and next week energy traders await for any clues from the OPEC+ ministerial convention. In this report we aim to shed light on the catalysts driving WTI’s price, assess its future outlook and conclude with a technical analysis.

Optimistic recovery plans clash with recession worries

Despite gloomy forecasts for decreased growth levels across the globe and predictions for recessions, market participants remain unjustifiably optimistic for WTI’s future. More specifically, calls for increased demand from China after the abandonment of its strict zero covid policy have put a floor under crude oil prices since the start of 2023. Fueling the positive sentiment further were the statements from the Chinese authorities, commenting that the number of Covid-related deaths and infections have fell drastically since the start of the year and provided more conviction for faster economic recovery from the second largest consumer of crude. Keeping crude prices capped, were the rumors that surfaced yesterday, pointing out that the United States government has determined that some Chinese companies are helping Russia’s war efforts against Ukraine, by providing “non-lethal” military assistance and economic support. Should that be the case and in light of actual evidence, investigations prove that there is militaristic and economic aid sent to Russia from Chinese corporations we may see tensions arise between the US and China, which could have material impact on their relations.

OPEC+ ministers meet next week

On February 1 as the Federal Reserve will announce its interest rate decision, OPEC+ ministers are set to convene to discuss ongoing developments and energy traders hope that the meeting may provide an update of their current production output levels of the oil cartel. According to Reuters, the panel will “certainly discuss the economic outlook” of the Chinese economy, taking into consideration their reopening efforts. China’s pivotal shift near the end of 2022, to abandon its draconian covid related restrictions and opt for a full-fledged reopening, have boosted optimism for higher oil demand from the second largest oil consuming country. No adjustments to the organization’s policy are expected according to experts, as the convention is not an official OPEC+ meeting, but nevertheless, crude traders will be paying attention for any clues that will aid their outlook assessments.

Crude stocks up in the previous week

On Tuesday the weekly API crude oil inventories figure pointed to buildup of 3.4 million barrels in stocks, higher than the expectation for only 1.6 million, while yesterday EIA’s weekly oil inventories recorded a mere 0.5 million barrels of crude, below expectations nearly 1 million for the same period. The results suggest weakening demand for crude which may have had little impact on WTI prices. Lastly, we would note that last Friday the Baker Hughes oil rig count showed that the number of active oil rigs in the US has dropped by a count of 10 reaching a total of 613, indicating a slowdown in demand.

Analyser la technique

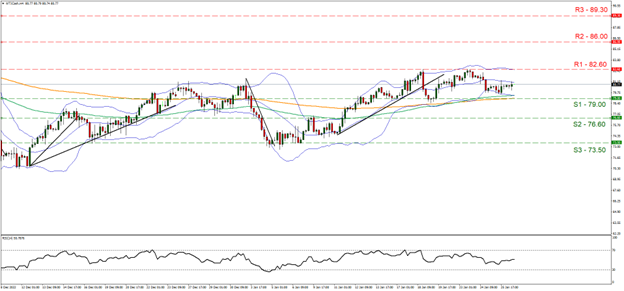

WTI Cash H4

Looking at WTICash 4-hour chart we observe oil prices trading in a tight rangebound motion over the past week, confined between 79.00 (S1) support and 82.60 (R1) resistance levels. We maintain our sideways bias for the commodity and supporting our case is the RSI indicator below our 4-hour chart that currently registers a value of 49, signaling indecision surrounding WTI. We also note that the price action may continue to find support near the 100 et 200-period Moving Averages, which have converged and could be interpreted as another signal for temporary consolidation et extension of sideways price movement. Should the bulls take initiative over crude’s direction, we may see the price action rise and break the 82.60 (R1) and move closer to the 86.00 (R2) resistance barrier. Should on the hand the bears take over, we may see the price action fall below the 79.00 (S1) support level and move decisively lower towards the 76.60 (S2) support base.

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing.