Since our last report, US equities have lost considerable ground, a movement characterised as something beyond a simple correction lower, a movement that may be laying the groundwork for a change of trend. On a fundamental level, we are to discuss the Fed’s intentions, financial releases that could shake US stock markets, while we are also to discuss the much-awaited release of NVIDIA’s earnings report. For a more complete picture, we are also to provide a technical analysis of the broad S&P 500’s daily chart.

The Fed’s intentions and the release of the bank’s October meeting minutes

On a more fundamental level, one cannot disassociate the recent drop of US stock markets from the change in the market’s expectations over the Fed’s intentions. It should be noted that past market expectations for the Fed to continue cutting rates in the December meeting on Friday were reduced to such a degree that the chance of a rate cut was like tossing a coin. Fed Funds Futures (FFF) implied that the chances between a rate cut and the bank remaining on hold were 50-50. The situation intensified further with the start of the week as the market increasingly priced in the scenario of the bank keeping rates unchanged, a scenario that FFF currently implies a probability of 57.9% materialising. Comments of Fed policymakers are largely conflicting, yet the big picture seems to be showing a shift of Fed policymakers towards keeping rates unchanged, which tends to weigh on US equities. Today, we highlight the release of the Fed’s October meeting minutes, as the release is to show the opinions expressed by Fed policymakers in the last meeting, thus providing a deeper insight into the bank’s intentions. We intend to focus mostly on centrists and try to identify shifts to either direction. Should the document be characterised by a dovish tone, implying a continuance of the easing of the Fed’s monetary policy, we may see US stock markets gaining as it would imply easing financial conditions in the US economy and wider prospects for revenue and profitability. On the flip side, should the document highlight the concerns of some Fed policymakers about further easing of the bank’s monetary policy, we may see US equities losing ground as the market’s expectations for the Fed to remain on hold may intensify.

The release of October’s employment report

Besides the release of the Fed’s October meeting minutes, we also highlight the release of October’s employment data, which could shake US equities. The now lifted US Government shutdown has left the market, on a macroeconomic level, largely in the dark. Market worries tend to revolve around the US employment market as it is expected to have weakened, while at the same time along with inflation remains a key determinant of the Fed’s monetary policy. Should we see the data showing a considerably weakening US employment market with the unemployment rate rising and the NFP dropping, possibly even into the negatives, we may see the market reversing its current expectations for the Fed to remain on hold and start pricing in a rate cut, once again, in the December meeting. Such a scenario could create support for US stock markets, while on the flip side, should the data show that the US employment market has not weakened considerably, or has even tightened, we may see the market’s expectations for the Fed to remain on hold being enhanced, and thus the release could weigh on US equities.

The release of NVIDIA’s earnings report

The release of NVIDIA’s earnings report in today’s aftermarket hours could have wider effects on US equities. Before commenting on the release as such we have to note that the company seems to be riding the wave of the market’s AI frenzy and its characteristic that today Microsoft, NVIDIA and Anthropic have announced a strategic partnership. The partnership is expected to heighten the market’s expectations for the three companies at an AI level and could provide additional support for the companies’ share prices. On the other hand, other market participants doubt the rally of AI companies, and its characteristic that SoftBank (as mentioned in last week’s report) has offloaded its entire stake in NVIDIA. Also, Peter Thiel’s hedge fund was reported to have sold its entire stake in Nvidia last quarter, cashing out from the NVIDIA market hype. Lastly, Michael Burry’s Scion Asset Management is betting against NVIDIA. Today the market expectations are for NVIDIA’s EPS figure to rise from 1.04 to 1.25 (20% rise), while revenue is expected to rise from 46.7B to 54.8B (17% rise). Should the company’s report outperform the market’s expectations, NVIDIA’s share price is expected to get some support, while should there be mixed signals or the actual figure undershoot the market’s expectations, the share price is expected to retreat. We also highlight the release of the company’s forward guidance. Should the company signal a growing revenue and profitability, NVIDIA’s share price may get additional support and vice versa. Yet the release, as noted at the beginning, could have wider effects on US equities. Should the data show that the company’s results are better than expected, and it has a solid prospect, we may see the market’s doubts for the AI frenzy and a possible bubble easing, allowing for a more optimistic, risk-on approach to emerge which could provide a more generic support for US stock markets. While should the figures and the company’s forward guidance disappoint the markets we may see the markets becoming more doubtful for the AIS rally and causing a wider drop of US stock markets.

Analisis Teknikal

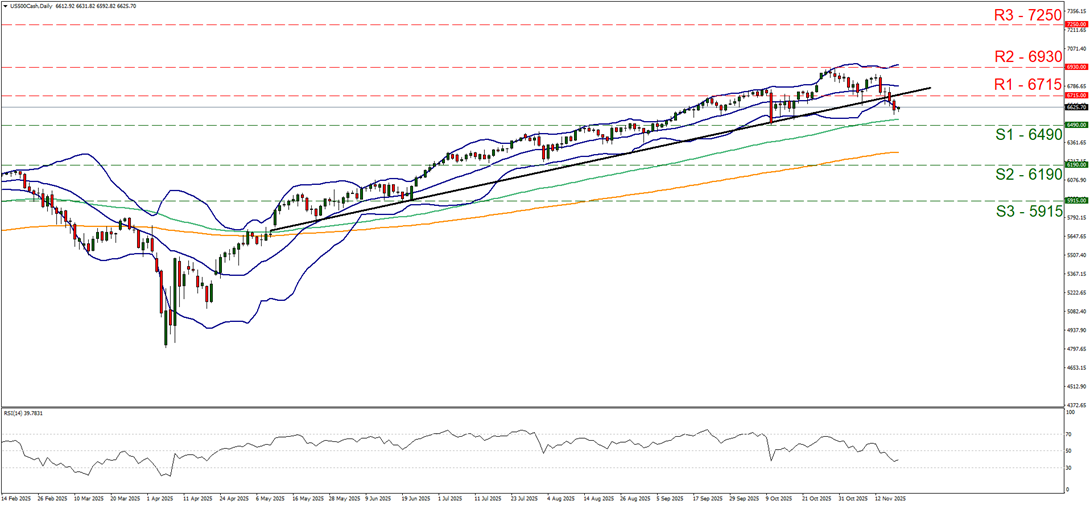

US500 Daily Chart

- Support: 6490 (S1), 6190 (S2), 5915 (S3)

- Resistance: 6715 (R1), 6930 (R2), 7250 (R3)

In the past week, the main characteristic of US stock markets was a continuous drop. Characteristically S&P 500 dropped, breaking the 6715 (S1) support line, now turned to resistance. In its downward motion, the index also broke upward trendline guiding it since the 12th of May, signalling an interruption of its upward motion. The index’s price action seems to be finding some support on the lower Bollinger Band, while the RSI indicator has dropped below the reading of 50, at some point almost nearing 30, signalling an intensification of the bearish market sentiment among market participants. Hence we switch our bullish outlook in favour for a sideways motion bias for the time being, yet at the same time we issue a warning for possible further bearish tendencies of the index’s price action. For a bearish outlook to be adopted we would require the index to drop below the 6490 (S1) support line and start aiming for the 6190 (S2) support base, a level that halted the bearish tendencies of the index on the 10th of October. For a bullish outlook to emerge, which may prove difficult yet not impossible at the current stage, we would require the index to break the 6715 (R1) resistance line and continue to break also the 6930 (R2) resistance level, a level marking the index’s All Time High.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.