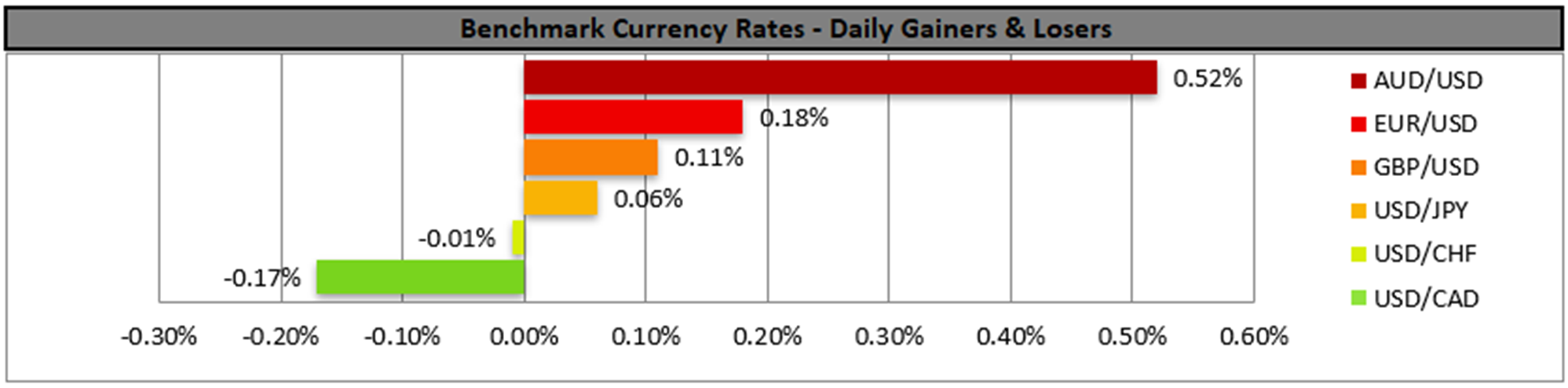

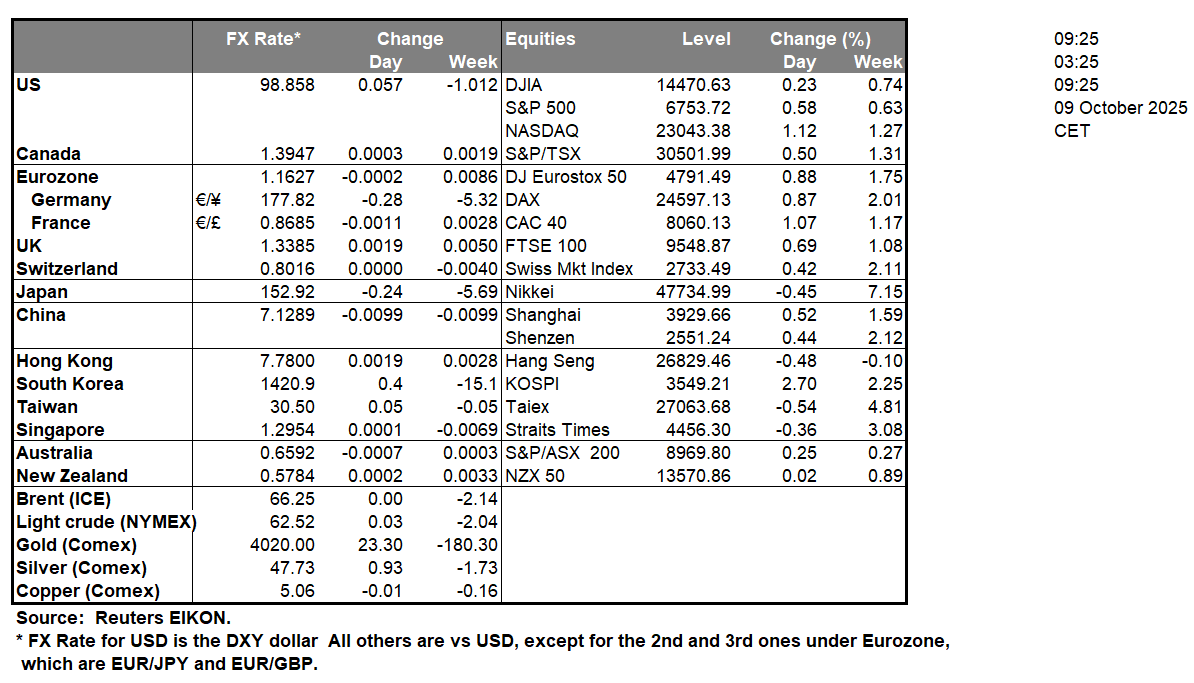

The greenback bulls continued to push the USD Index higher yesterday and during today’s Asian session, in a sign of a strengthening Dollar against its counterparts. The main event yesterday was the release of the Fed’s September meeting minutes, which highlighted the divide among Fed Policymakers as was mentioned in yesterday’s report. There was a consensus that risks for the US employment market had been enhanced, an element that justified the 25-basis points rate cut. On the flip side, Fed policymakers are still worried about the high inflation and tended to debate the negative effect of high borrowing costs on the US economy. On the one hand, we consider the document as confirming the bank’s dovish pivot, yet at the same time we note a relative cautiousness on behalf of Fed policymakers for extensive further easing of the bank’s monetary policy. After the release, the markets maintained their expectations for the bank to deliver another two rate cuts until the end of the year and we tend to concur as our base scenario as well, yet the bank’s moves will need close monitoring in shifts of tone and intentions. Today we note that a number of Fed and other central bank policymakers are scheduled to speak yet we highlight the comments of Fed Chairman Powell at the Community Bank Conference will be closely watched for fresh clues on monetary easing. We expect the Fed Chairman to maintain a moderately dovish tone confirming that more easing of monetary policy lies ahead and if actually so we may see the USD slipping. On the flip side, should the Fed Chairman opt to reiterate or underscore his doubts for the necessity of extensive easing of the bank’s monetary policy we may see the USD gaining some ground.

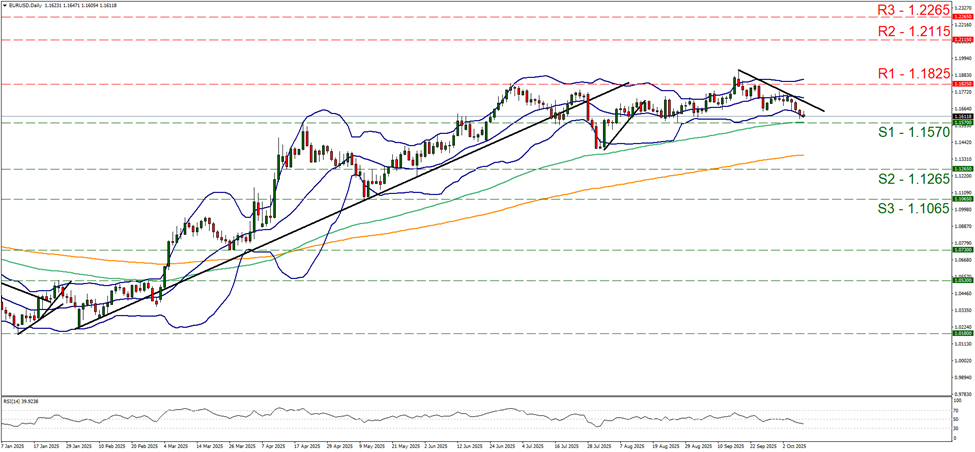

EUR/USD edged lower aiming for the 1.1570 (S1) support line. The pair has been forming a series of lower peaks and lower troughs since the 17th of September, implying a bearish direction. Also the RSI indicator has dropped below the reading of 50, implying a strengthening bearish sentiment among market participants for the pair. Also the pair’s price action has reached the lower Bollinger band which may slow down the bears. Should a bearish outlook prevail we may see the pair breaking the 1.1570 (S1) support line and start aiming for the 1.1265 (S2) level. For a bullish outlook to emerge we would require the pair to reverse direction breaking the downward trendline guiding it, in a first signal of an interruption of the pair’s bearish tendencies and continue higher breaking the 1.1825 (R1) resistance line and starting to aim for the 1.2115 (R2) level.

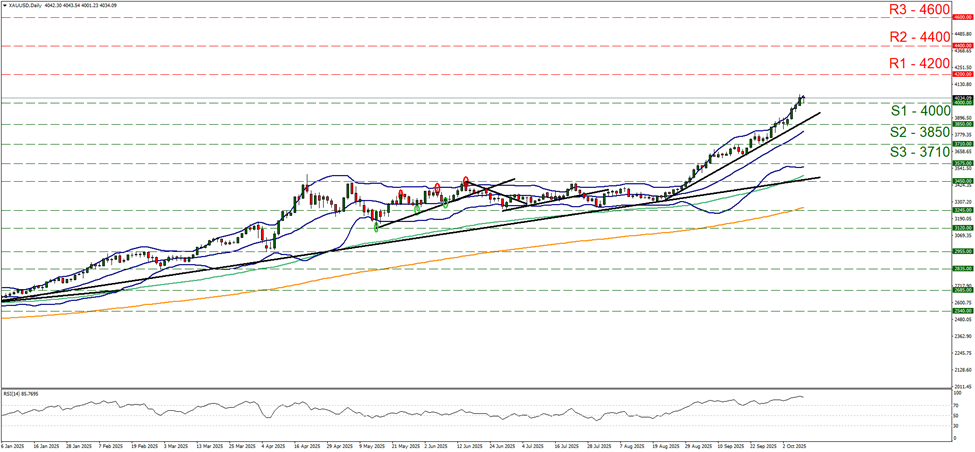

Gold bulls continued to push the precious metal’s price to new record high levels, after breaking the 4000 (S1) level. We maintain our bullish outlook for the precious metal’s price as long as the upward trendline guiding the precious metal’s price remains intact. Yet at the same time given that the RSI indicator is way above the reading of 70, signaling that gold’s price is at over bought levels and the price action is flirting with the upper Bollinger band sending similar signals, we accompany our bullish outlook with a warning for a possible correction lower. Should the bulls maintain control as expected, we set as the next possible target for gold’s price the 4200 (R1) level. For a bearish outlook to be adopted we would require the precious metal’s price to break the 4000 (S1) support line, continue to break also the prementioned upward trendline, in a first signal of an interruption of the upward motion and continue to also break the 3850 (S2) level.

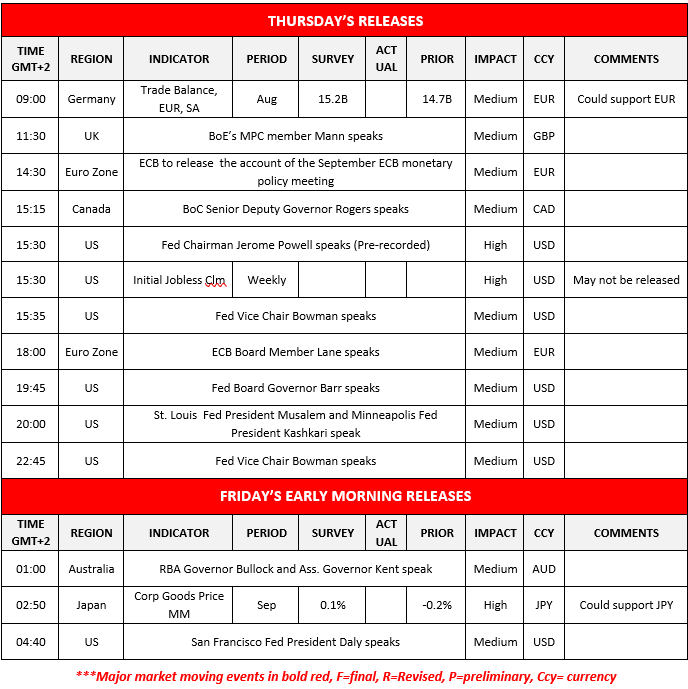

Other highlights for the day:

Today we get Germany’s trade data for August and we note the planned release of the US weekly initial jobless claims figure probably will be delayed. On a monetary level, we note that BoE’s Mann, BoC’s Rogers, Fed’s Bowman, Barr, Musalem, Kashkari and ECB’s Lane, are scheduled to speak, while the ECB is to release the account of the September meeting. In tomorrow’s Asian session, we get Japan’s corporate Goods Prices for September, while RBA’s Bullock and Kent as well as San Francisco Fed President Daly are scheduled to speak.

EUR/USD Daily Chart

- Support: 1.1570 (S1), 1.1265 (S2), 1.1065 (S3)

- Resistance: 1.1825 (R1), 1.2115 (R2), 1.2265 (R3)

XAU/USD Daily Chart

- Support: 4000 (S1), 3850 (S2), 3710 (S3)

- Resistance: 4200 (R1), 4400 (R2), 4600 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.