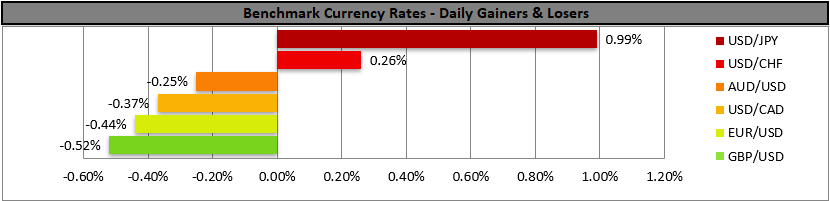

Fed January minutes show a divide among policymakers

The Fed’s January meeting minutes were released yesterday and the different approaches towards the Fed’s monetary policy by various policymakers.

Some seemed to insist on the necessity of further easing, while others seemed open to a possible tightening. It’s characteristic that the possibility of a rate hike was mentioned maybe for the first time in two years.

Overall despite the mixed signals a hawkish tilt seemed to prevail supporting the USD. We set as the next possible test for the markets the release of the US PCE rates for December and preliminary GDP rates for Q4 25, tomorrow.

Oil prices rally on US-Iranian conflict worries

Oil prices rallied yesterday as the failure of the US-Iranian negotiations to show a more concrete progress rekindled market worries for a possible US-Iran conflict which in turn could weigh o the supply side of the commodity’s market.

The negotiations were for Tehran’s nuclear program and despite the two sides agreeing to reconvene in a couple of weeks, the escalation of military activity by both in the region, tended to create worries.

The issue is currently tantalizing the international oil market, and a possible intensification of the market’s worries could boost oil prices further.

US equities rise despite rate hike worries

US equities ended their day in the greens despite the release of the Fed’s meeting minutes opening the door for the possibility of a monetary policy tightening.

AI investment worries tended to ease in the markets yesterday, which may have allowed for the prementioned gains in US stock markets.

Possible further easing of market worries could allow US equities to advance further.

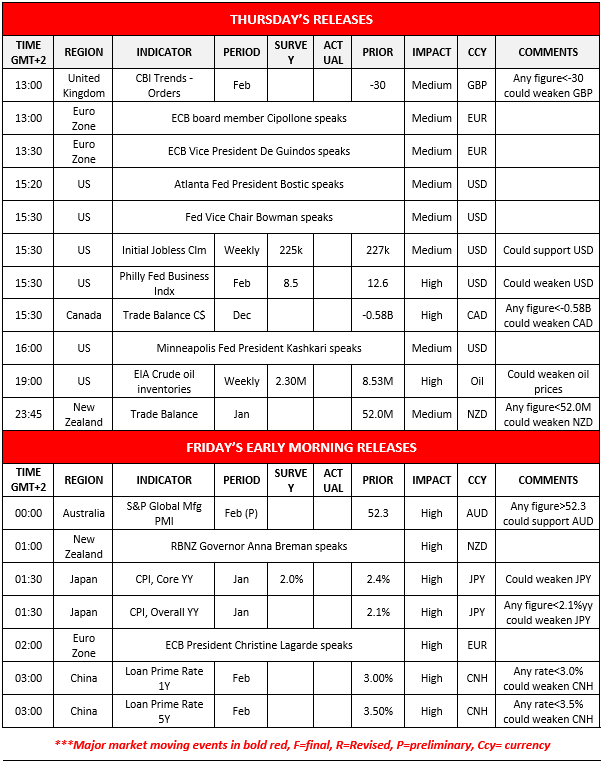

Other highlights for today

Today we get UK’s CBI industrial orders for February and from the US the weekly initial jobless claims figure, February’s Philly Fed Business index and the weekly EIA crude oil inventories figure.

On a monetary level, we note that ECB’s De Guindos and the Fed’s Bostic, Bowman and Kashkari are speaking. In tomorrow’s Asian session, we note the release of Australia’s preliminary PMI figures for February, Japan’s January CPI rates and from China PBoC’s interest rate decision, while in New Zealand, RBNZ’s Governor Anna Brennan and in the US ECB President Christine Lagarde are scheduled to speak.

Charts to keep an eye out

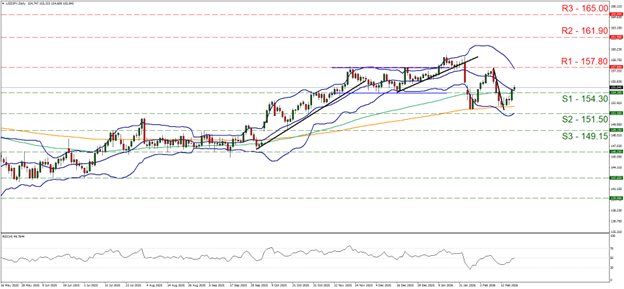

USD/JPY was on the rise yesterday breaking the 154.30 (S1) resistance line, now turned to support. We note that the RSI indicator has risen and has reached the reading of 50, implying an erasing of the bearish sentiment for the market for the pair and we highlight the pair’s bullish tendencies of the pair.

Should the bulls remain in charge of the pair’s direction, we may see USD/JPY aiming if not breaching the 157.80 (R1) resistance line. Should the bears take over, we may see the pair breaking the 154.30 (S1) support line and continue to also break the 151.50 (S2) support level, while even lower we note the 149.15 (S3) barrier.

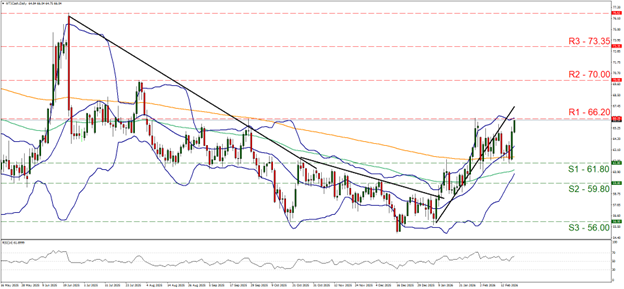

WTI’s price rallied yesterday and during today’s Asian session, covering the distance between the 61.80 (S1) support line and the 66.20 (R1) resistance level.

We also note that the RSI indicator has risen implying an enhancement of the market’s bullish sentiment for the commodity’s price, yet WTI’s price action is still within the boundaries setting its sideways motion for the past three weeks.

At the same time we note that the commodity’s price action is nearing the upper Bollinger band which may slow down the bulls. For a bullish outlook we require WTI’s price to clearly break the 66.20 (R1) resistance line and start aiming for the 70.00 (R2) resistance level.

For a bearish outlook to emerge, WTI’s price action has to drop break the 61.80 (S1) support line and start aiming for the 59.80 (S2) support level.

USD/JPY Daily Chart

- Support: 154.30 (S1), 151.50 (S2), 149.15 (S3)

- Resistance: 157.80 (R1), 161.90 (R2), 165.00 (R3)

WTI Daily Chart

- Support: 61.80 (S1), 59.80 (S2), 56.00 (S3)

- Resistance: 66.20 (R1), 70.00 (R2), 73.35 (R3)

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.