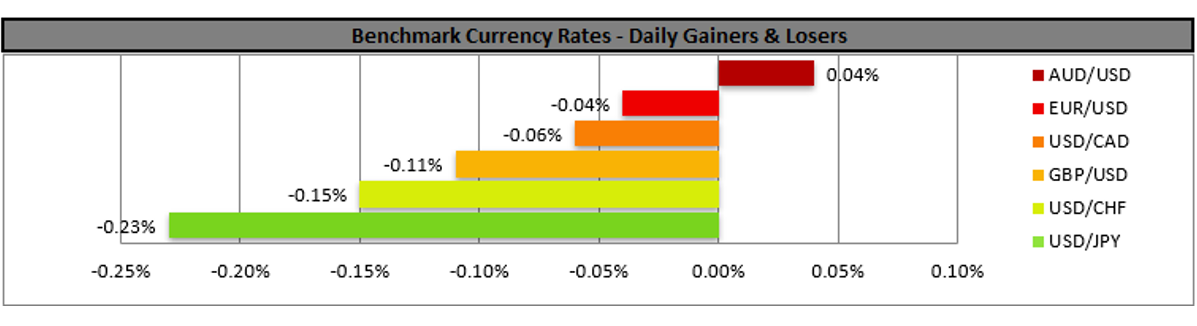

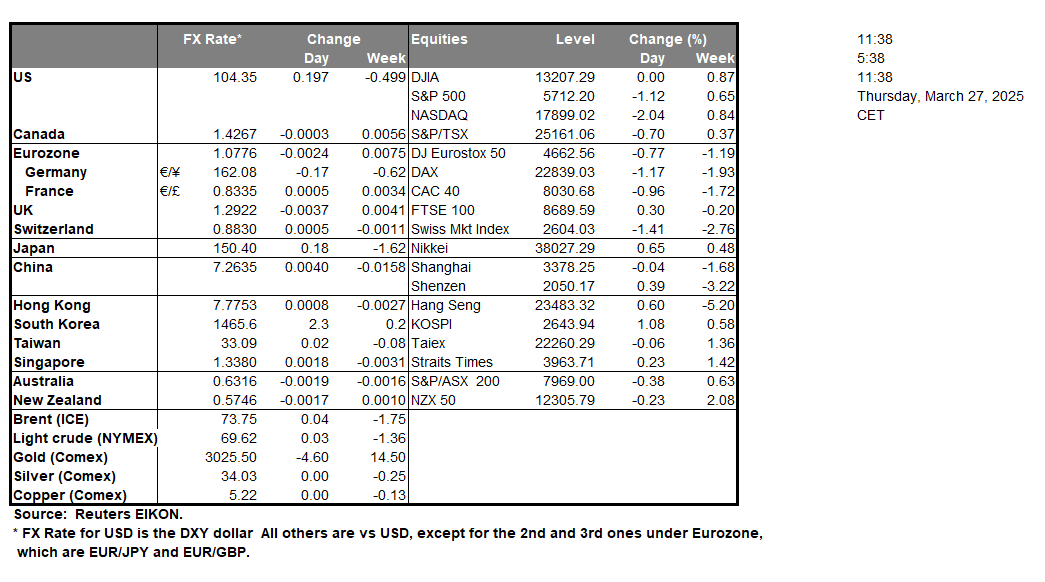

Market uncertainty was on the rise over the past 24 hours as US President Trump unveiled new 25% auto tariffs on vehicles imported in the US. The tariffs are to be applied on passenger cars and light trucks and are to come into effect from the 3rd of April onwards. Countries most affected are to be Germany, Japan, Korea and Mexico and the new tariffs are to be on top of duties allready introduced for steel and aluminum products. The new tariffs may provoke retaliatory action from the affected countries and enhanced market uncertainty as share prices of major automakers being adversely affected. Overall, we may see the issue weighing on riskier assets and providing inflows of safe-haven instruments. On a monetary level, we note the comments of St. Louis Fed President Musalem yesterday, highlighting the possible inflationary effect of US President Trump’s tariffs, which in turn could increase the doubts of Fed policymakers regarding further rate cuts. On a macroeconomic level, we note the narrower-than-expected slowdown of the US durable goods orders growth rate for February yesterday and turn our attention to the release of the final US GDP rates for Q4. Should the rate accelerate, we may see the USD getting some support as it would imply that the UK economy in the last quarter of 24, grew at a faster pace, while a possible slowdown, could reignite market worries for the US economic outlook weighing on the USD.

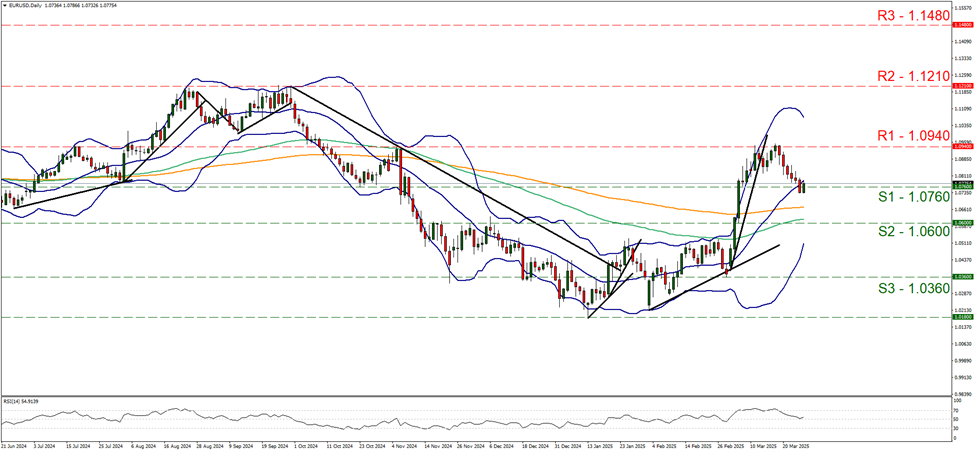

EUR/USD edged lower yesterday and at some point broke the 1.0760 (S1) support line, yet in today’s Asian session the pair recovered largely yesterday’s losses. We note the pair’s downward motion over the past week, yet we still require the pair to break the 1.0760 (S1) support line clearly and nearing the 1.0600 (S2) support level, before adopting a bearish outlook for EUR/USD. We also note that the RSI indicator seems to stick on the reading of 50 which may be suggesting a rather indecisive market. Hence a stabilisation of the pair’s price action may be possible. For a bullish outlook, the bar is high and for it to emerge the price action of the pair would have to break the 1.0940 (R1) resistance line, thus paving the way for the 1.1210 (R2) resistance level.

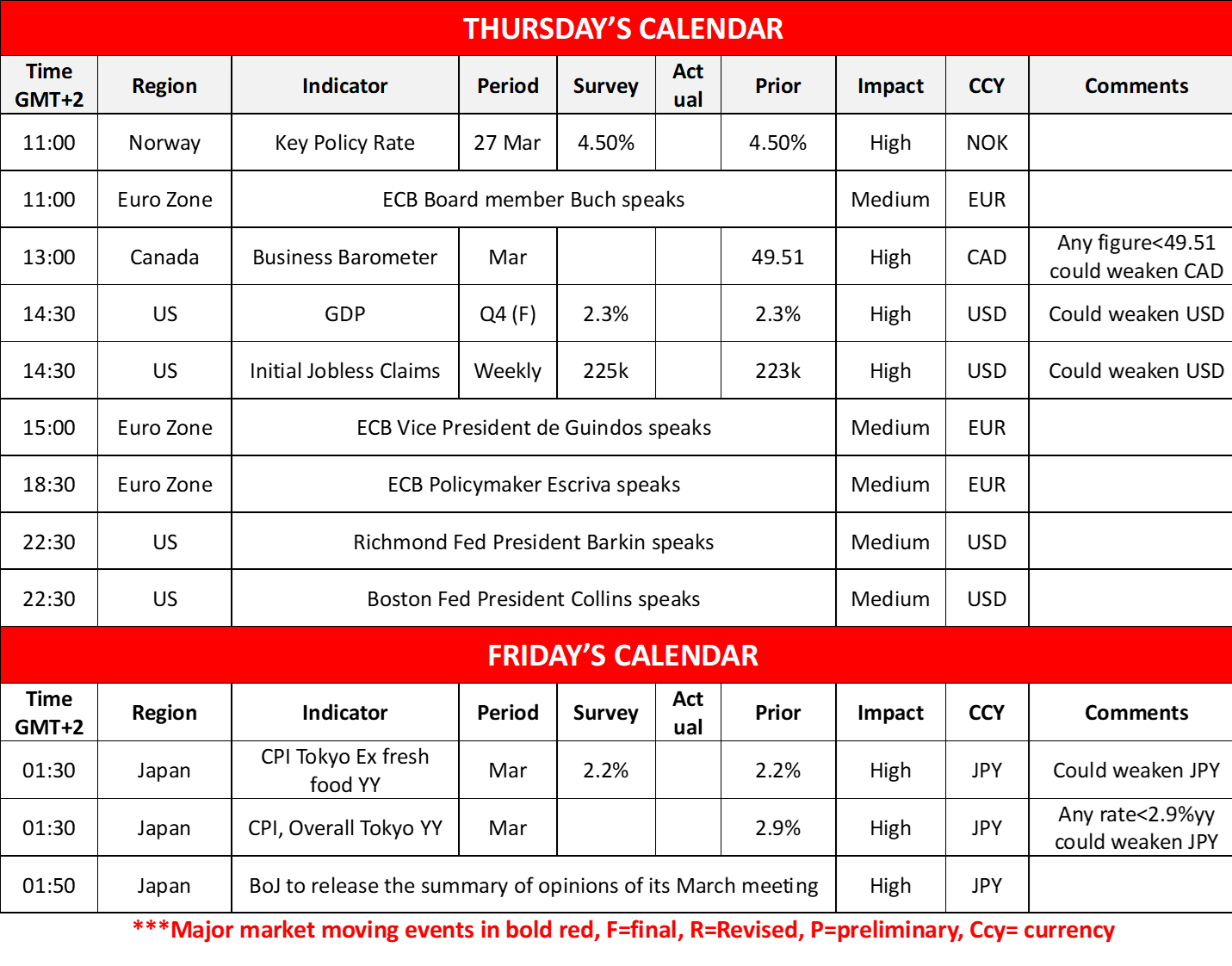

JPY traders on the other hand may scrutinize the summary of opinions of BoJ’s last meeting which are to be released in tomorrow’s Asian session, in search of clues regarding the bank’s intentions. Should the document reinforce market expectations for a possible rate hike by the BoJ we may see the Yen getting some support and vice versa. On a macro-economic level, we also note the release of Tokyo’s CPI rates for March and a possible acceleration implying a persistence of inflationary pressures in the Japanese mega-city could also support JPY.

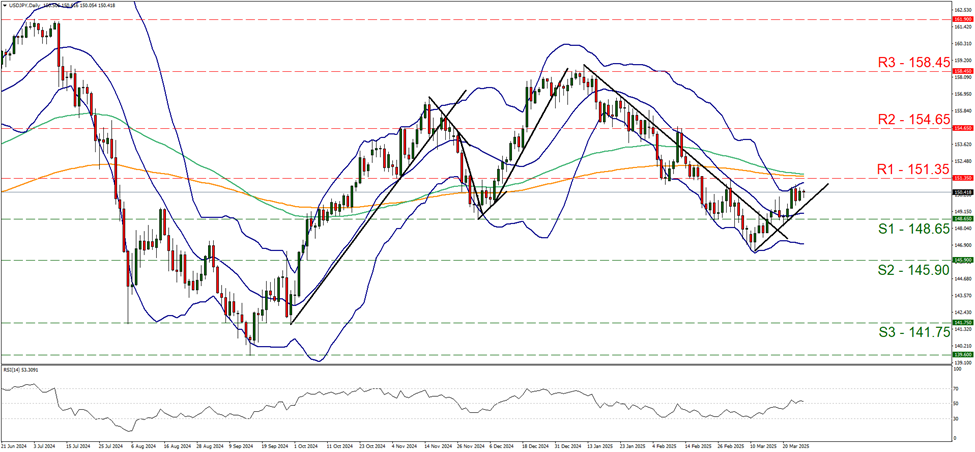

On a technical level, we note the stabilisation of USD/JPY yesterday and during today’s Asian session. The upward trendline guiding the pair since the 11 of March remains intact, thus implying the continuance of the bullish outlook. Yet the RSI indicator has stabilised just above the reading of 50, implying that the bullish predisposition of the market for the pair is still at low levels. Thus for a continuation of the bullish outlook, we would require the pair to break the 151.35 (R1) line clearly and start aiming for the 154.65 (R2) resistance level. For a bearish outlook, we would require the pair’s price action to break the prementioned upward trendline, signaling the interruption of the upward motion continue to break the 148.65 (S1) support line and start aiming for the 145.90 (S2) base.

その他の注目材料

Today we note that Norway’s Norgesbank is to release its interest rate decision, while on a monetary level, we also note that ECB’s Buch, de Guindos and Escriva as well as the Fed’s Barkin and Collins are scheduled to speak. As for financial releases today, we get Canada’s Business Barometer for March, the final US GDP rate for Q4 and the weekly US initial jobless claims figure.

EUR/USD デイリーチャート

- Support: 1.0760 (S1), 1.0600 (S2), 1.0360 (S3)

- Resistance: 1.0940 (R1), 1.1210 (R2), 1.1480 (R3)

USD/JPY Daily Chart

- Support: 148.65 (S1), 145.90 (S2), 141.75 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。