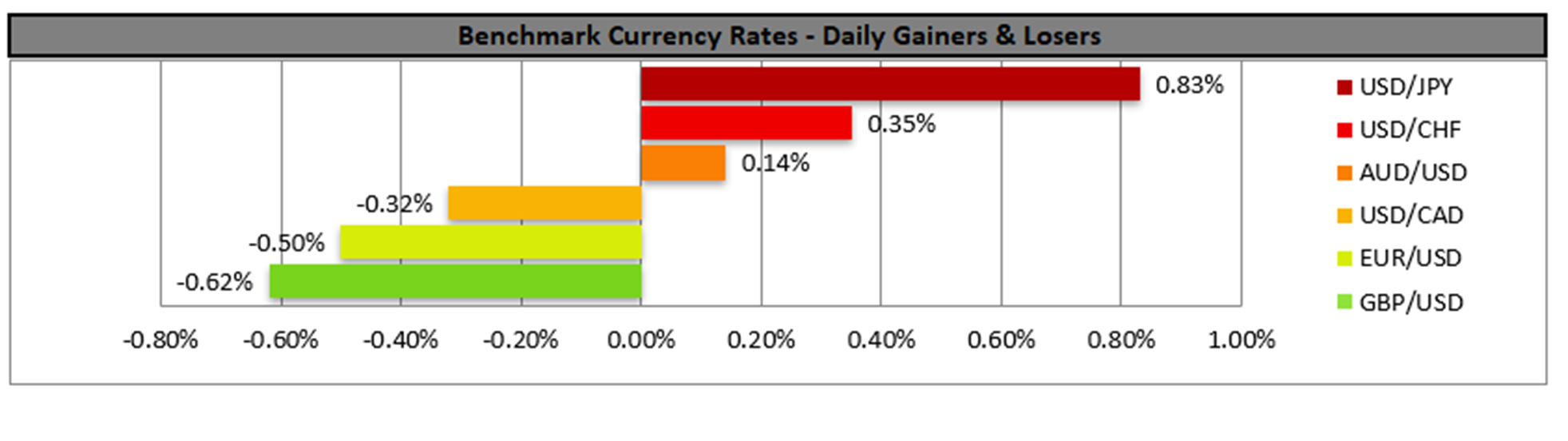

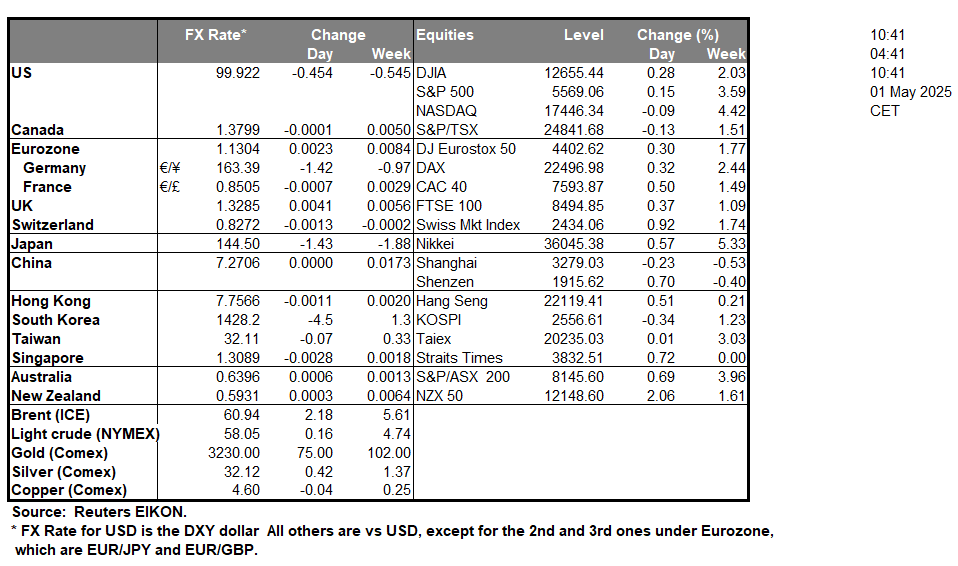

The BOJ’s interest rate decision occurred earlier on today. The bank remained on hold at 0.5% as was widely expected, with the bank also slashing growth forecasts as a result of “extremely high uncertainties” over trade, per the FT. The increased concerns by the BOJ in regards to the ongoing tariffs and their impact on the economy may have been perceived as a willingness by the bank to refrain from continuing on their rate hiking cycle in the near term, which in turn may have weighed on the JPY.In the US the advance GDP rate for Q1 was released yesterday. The rate came in at -0.3% which is significantly lower than the prior quarter’s 2.4% and the expected rate of 0.2%. Essentially the preliminary GDP rate for Q1 showcases a contraction in the US economy, which in turn may increase pressure on the Fed ahead of their meeting next week to adopt a more dovish tone. In turn this may have weighed on the dollar.Sticking with the US, the ISM Manufacturing PMI figure for April is set to be released during today’s American session with the figure expected to come in at 48.0 which would be lower than the prior figure of 49.0. Thus such a scenario may imply a widening contraction in the manufacturing sector of the US economy which may spark some concern over the resiliency of the US economy and thus could potentially weigh on the dollar. On the other hand, should the actual figure exceed the markets expectations it may have the opposite effect and thus potentially aid the greenback.On a political level, it has been reported by various media outlets that the US and Ukraine have signed a minerals deal which may increase the prospect of the US pushing for a peace deal between Ukraine and Russia on a more aggressive level in order to bring an end to the war. In turn this could potentially weigh on gold’s price.

EUR/USD appears to be moving in a sideways fashion after failing to clear our 1.1470 (R1) resistance line. We opt for a sideways bias for the pair and supporting our case is the RSI indicator which has moved below 60, implying that the bullish momentum may be fading away. For our sideways bias to continue we would require the pair to remain confined between the 1.1185 (S1) support line and the 1.1470 (R1) resistance level. On the flip side for a bearish outlook we would require a clear break 1.1185 (S1) support level with the next possible target for the bears being the 1.0950 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 1.1470 (R1) resistance level with the next possible target for the bulls being the 1.1685 (R2) resistance line.

USD/JPY appears to be moving in an upwards fashion with the pair currently testing our 144.55 (R1) resistance line. We opt for a bullish outlook for the pair and supporting our case is the MACD indicator below our chart and the RSI indicator whose figure near 50 may imply a neutral market sentiment, yet when looking at the bigger picture may also imply bullish market tendencies. Nonetheless, for our bullish outlook to continue we would require a clear break above the 144.55 (R1) resistance level with the next possible target for the bulls being the 147.50 (R2) resistance line. On the flip side for a sideways bias we would require the pair to remain confined between the 141.75 (S1) support level and the 144.55 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 141.75 (S1) support level with the next possible target for the bears being the

その他の注目材料

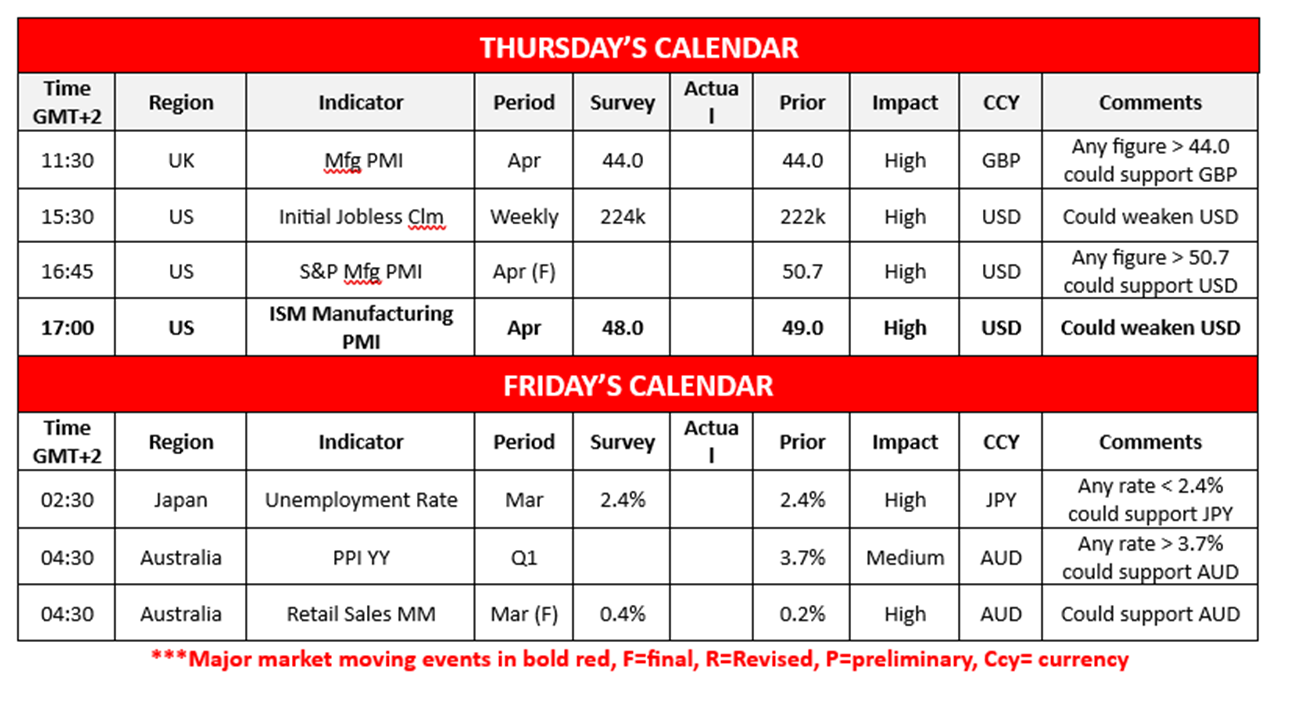

Today we get the UK’s manufacturing PMI figure for April, the US weekly jobless claims figure, followed by the S&P final manufacturing PMI figure for April and the ISM manufacturing PMI figure also for April. In tomorrow’s Asian session, we note Japan’s unemployment rate for March, Australia’s PPI rate for Q1 and Australia’s final retail sales rate for March

EUR/USD Daily Chart

- Support: 1.1185 (S1), 1.0950 (S2), 1.0740 (S3)

- Resistance: 1.1470 (R1), 1.1685 (R2), 1.1890 (R3)

USD/JPY Daily Chart

- Support: 141.75 (S1), 139.60 (S2), 137.25 (S3)

- Resistance: 144.55 (R1), 147.40 (R2), 149.80 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。