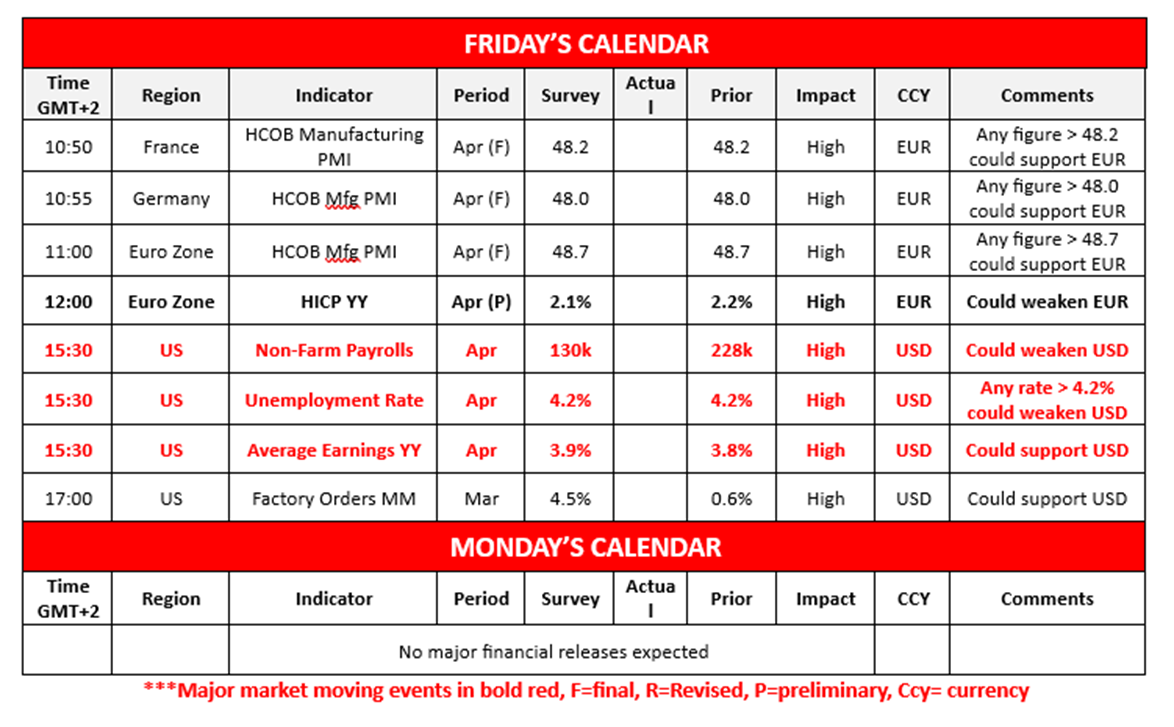

The US Employment data for April is set to be released later on today. The current expectations are for the Non-Farm payrolls figure to come in at 130k which would be lower than last month’s figure of 228k, implying a loosening labour market. However, it should be noted that the unemployment rate is expected by economists to remain steady at 4.2% whereas the Average hourly earnings rate on a yoy basis is expected to increase from 3.8% to 3.9% which could mitigate the negative implications on the dollar should the NFP figure come in as expected or lower. On the other hand, should the employment data showcase a resilient labour market it could potentially aid the dollar.The Eurozone’s preliminary HICP rate for April is set to be released during today’s European session. The preliminary HICP rate is expected to come in at 2.1% which would be lower than last month’s rate of 2.2% thus implying loosening inflationary pressures in the European economy. In turn this may increase pressure on the ECB to continue on their rate cutting path which in turn could potentially weigh on the EUR. However, should the HICP rate come in higher than expected and thus imply persistent or even an acceleration of inflationary pressures, it may possibly aid the EUR.According to a report by Bloomberg, the Chinese Ministry has stated that “The US has recently sent messages to China through relevant parties, hoping to start talks with China”, implying that the two nations may be on the verge of beginning trade talks. Thus, the possibility of trade talks occurring between China and the US may ease market worries about the global economy and thus may weigh on gold’s price.According to the FT , Europe is preparing to offer Trump a €50 billion trade deal, in order to address the “problem” between the EU’s and the US’s trade relationship. Such a possibility could further reduce concerns about the global economic resiliency.

EUR/USD appears to be moving in a sideways fashion after failing to clear our 1.1470 (R1) resistance line. We opt for a sideways bias for the pair and supporting our case is the RSI indicator which has moved below 60, implying that the bullish momentum may be fading away. For our sideways bias to continue we would require the pair to remain confined between the 1.1185 (S1) support line and the 1.1470 (R1) resistance level. On the flip side for a bearish outlook we would require a clear break 1.1185 (S1) support level with the next possible target for the bears being the 1.0950 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 1.1470 (R1) resistance level with the next possible target for the bulls being the 1.1685 (R2) resistance line.

XAU/USD appears to be moving in a sideways fashion between our 3235 (S1) support level and the 3350 (R1) resistance line. We opt for a neutral outlook for gold’s price and supporting our case is the precious metal’s failure to clear our 3235 (S1) support level in addition to the RSI indicator below our chart which currently registers a figure close to 50 implying a neutral market sentiment. For our sideways bias to continue we would require the precious metal’s price to remain confined between the 3235 (S1) support level and 3350 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below the 3235 (S1) support line with the next possible target for the bulls being the 3115 (S2) support level. Lastly, for a bullish outlook we would require a clear break above the 3350 (R1) resistance level with the next possible target for the bulls being the 3500 (R2) resistance line.

その他の注目材料

Today we France’s , Germany’s and the Eurozone’s final manufacturing PMI figures for April, followed by the Eurozone’s preliminary HICP rate for April. During the American session we highlight the US Employment data and then ending off the week is the US Factory orders rate

EUR/USD Daily Chart

- Support: 1.1185 (S1), 1.0950 (S2), 1.0740 (S3)

- Resistance: 1.1470 (R1), 1.1685 (R2), 1.1890 (R3)

XAU/USD Daily Chart

- Support: 3235 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3350 (R1), 3500 (R2), 3650 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。