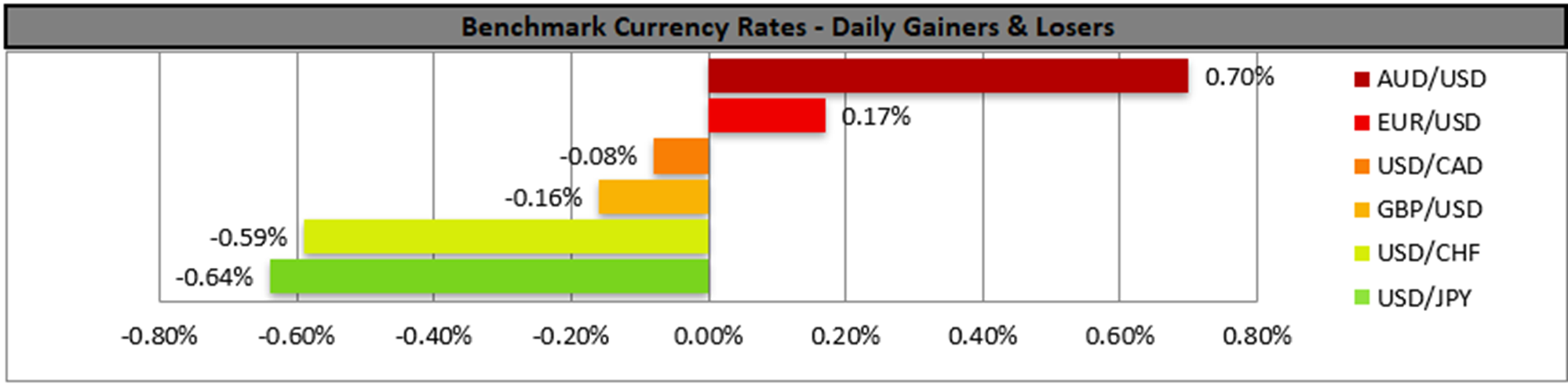

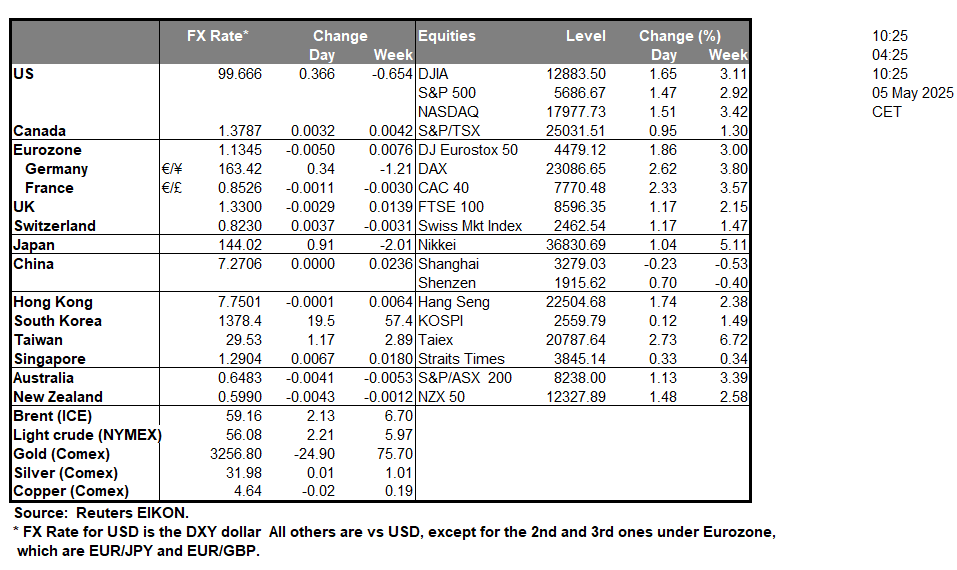

The USD edged lower in today’s Asian session against its counterparts, as market worries tended to ease further ahead of the Fed’s interest rate decision on Wednesday. Today we expect market attention to be on the release of the US ISM non-manufacturing PMI figure for April and a possible wider-than-expected drop of the indicator’s reading could weigh on USD. In the FX market, the Aussie was on the rise against the USD as the Australian elections resulted in a clearcut win of the Labour Party, which is expected to provide some stability on a political level in the land of the down under, given the wide majority it now has. Aussie traders are also expected to keep an eye out for Australia’s building approvals growth rate for March.

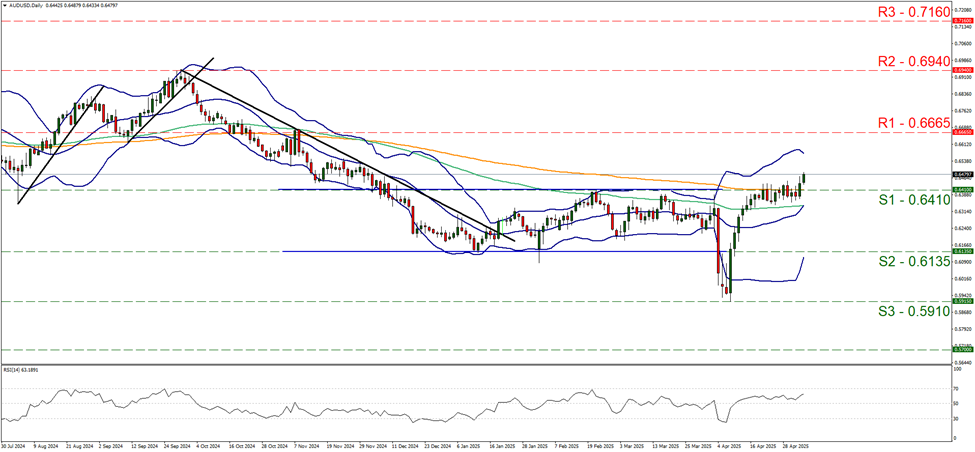

On a technical level, we note that AUD/USD was on the rise on Friday and during today’s Asian session, breaking the 0.6410 (S1) resistance line, now turned to support. Given that the pair’s price action has broken clearly the S1 and the RSI indicator is above the reading of 50 and rising implying an intensification of the bullish sentiment for the pair among market participants, we tend to adopt a bullish outlook for the pair. Should the bulls maintain control over the pair’s direction we may see AUD/USD aiming for the 0.6665 (R1) resistance line, with the next possible target for the bulls being the 0.6940 (R2) resistance level. Should the bears take over, we may see the pair reversing course, breaking the 0.6410 (S1) support line and start aiming for the 0.6135 (S2) support level.

Also, oil prices dropped considerably, as market worries for a possible supply increase intensified. The market seems to expect OPEC+ to increase its production levels further and at an increased speed while at the same time, there is still some uncertainty in regards to the demand outlook. Any signals for increased supply could cause oil prices to weaken further.

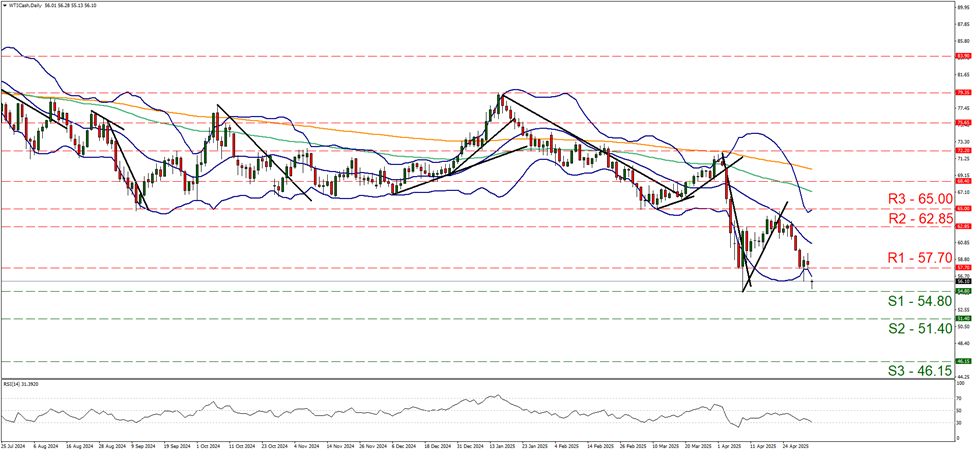

WTI’s price edged lower on Friday and during today’s Asian session, tumbled breaking the 57.70 (R1) support line now turned to resistance. As the downward motion has been renewed, and the RSI indicator has reached the reading of 30, implying a strong bearish market sentiment on behalf of market participants for the commodity’s price, we adopt a bearish outlook for WTI’s price. Should the bears continue to lead the price action of WTI, we may see it breaking the 54.80 (S1) support line and start aiming for the 51.40 (S2) support level. Yet the price action has broken the lower Bollinger band, implying the possibility of being at an oversold state, something that the RSI indicator may also be implying. Yet for the adoption of a bullish outlook, we would require WTI’s price to rise, break the 57.70 (R1) resistance line clearly and aim if not break the 62.85 (R2) resistance level.

その他の注目材料

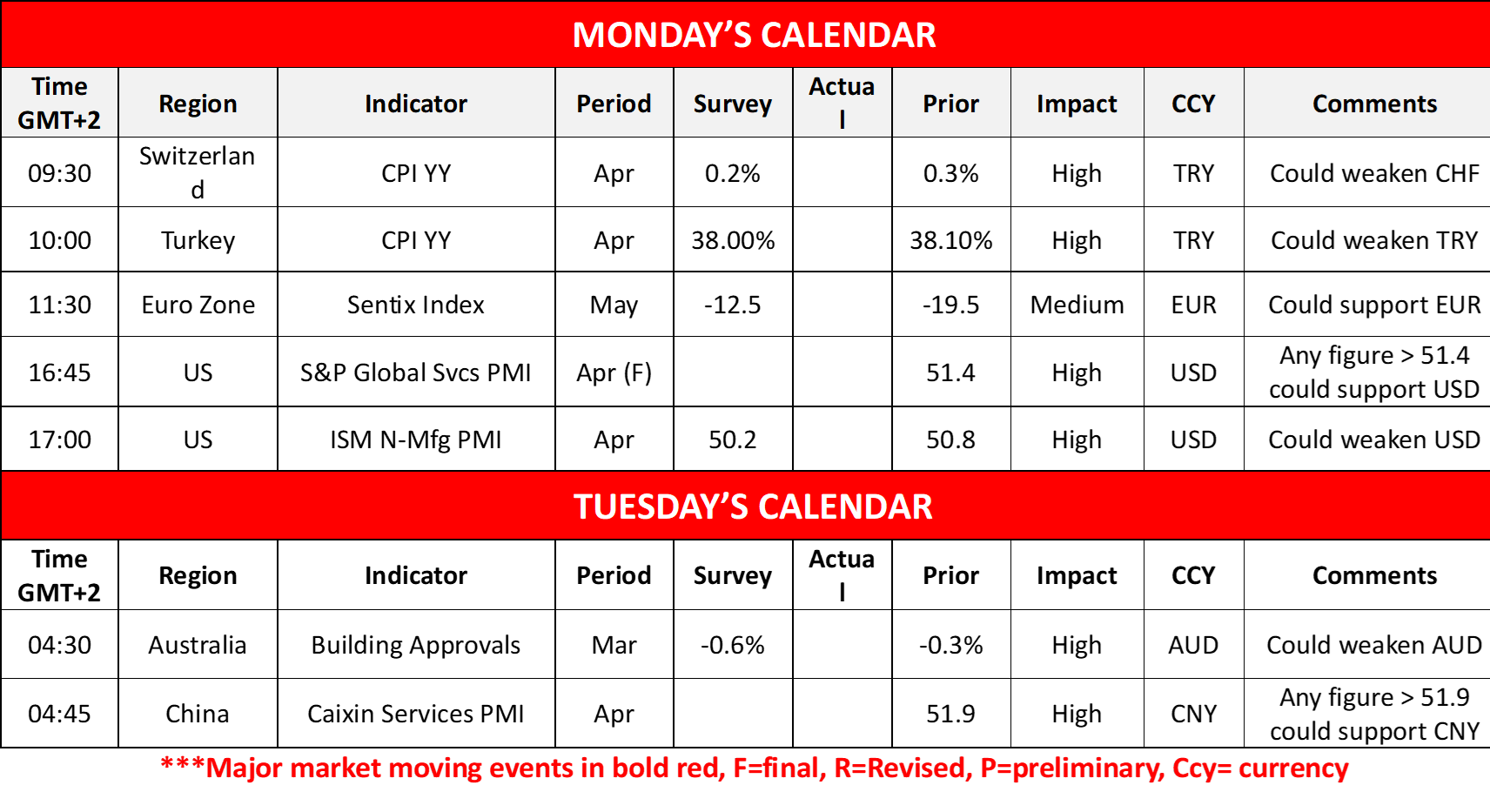

Today we get Turkey’s CPI rate for April, the Eurozone’s Sentix figure for May, the US S&P services PMI figure for April and the US ISM non-manufacturing PMI figure for April. In tomorrow’s Asian session, we get Australia’s building approvals rate for March and China’s Caixin Services PMI figure for April.

今週の指数発表:

On Tuesday we get Switzerland’s unemployment rate, the Czech Republic’s preliminary CPI rate all for April, followed by Canada’s trade balance figure for March and Canada’s Ivey PMI figure for April. On Wednesday we get Australia’s AIG manufacturing PMI figure for April, New Zealand’s unemployment rate for Q1, Sweden’s preliminary CPI rate for April, the Eurozone’s retail sales for March, the Czech Republic’s CNB interest rate decision and the highlight of the week which is to be the Fed’s interest rate decision. On Thursday we get Germany’s industrial output rate for March, the UK’s Halifax house prices rate for April, Sweden’s Riksbank, Norway’s Norgesbank and the UK’s BoE interest rate decisions. On Friday, we get Norway’s CPI rate for April and Canada’s Employment data for April.

AUD/USD デイリーチャート

- Support: 0.6410 (S1), 0.6135 (S2), 0.5910 (S3)

- Resistance: 0.6665 (R1), 0.6940 (R2), 0.7160 (R3)

WTI Daily Chart

- Support: 54.80 (S1), 51.40 (S2), 46.15 (S3)

- Resistance: 57.70 (R1), 62.85 (R2), 65.00 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。