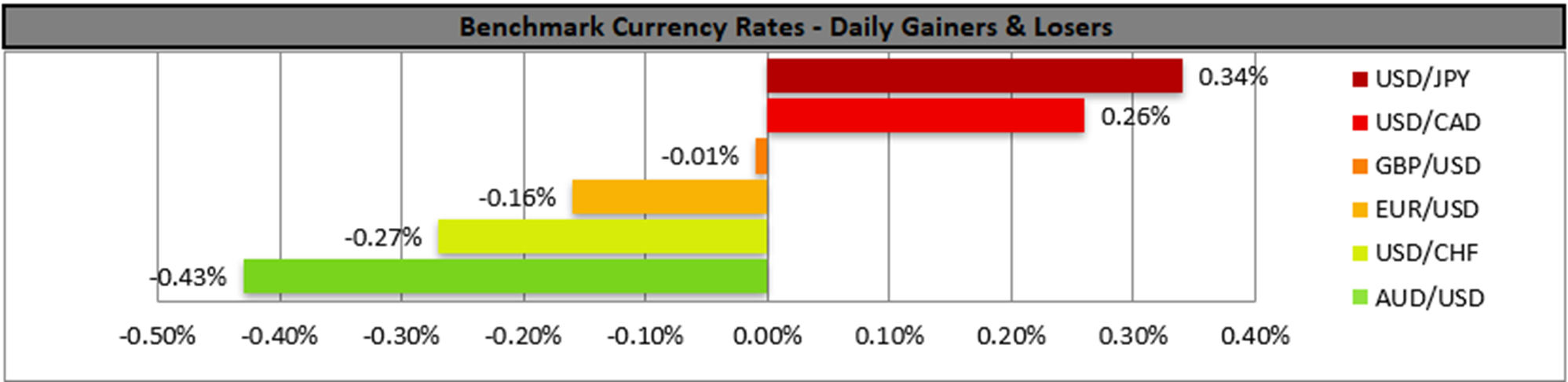

The USD tended to edge higher against its counterparts yesterday. On a monetary level, the Fed remained on hold yesterday, as was widely expected thus causing little reaction for the USD. The bank’s worries about the rising uncertainty and its possible adverse effects on the economy were highlighted. It’s characteristic that in its forward guidance included in the accompanying statement, the bank mentioned that “The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen”. We consider the particular comment as an indirect opposition on the current economic policies of US President Trump, especially about the tariffs which have been imposed on US imports. Also between the lines, one may be recognising the bank’s worries for a possible stagflation in the US economy. Overall the bank tends to maintain a wait-and-see position in regards to its monetary policy and the tone adopted seemed to lean more towards the hawkish side and should we see Fed policymakers in the coming days underscoring the possible inflationary pressures which could be created by the US tariffs, we may see them having a bullish effect on the USD.

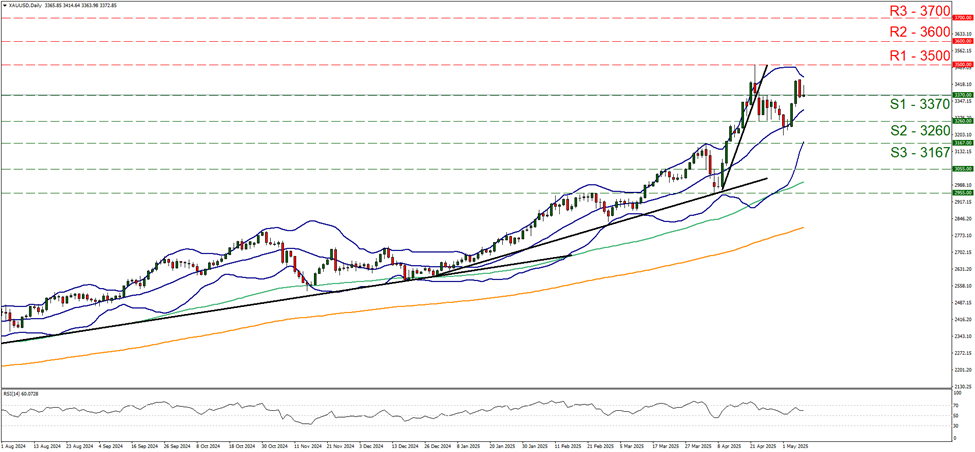

Gold’s price corrected lower yesterday testing the 3370 (S1) support line and in today’s Asian session tended to remain rather stable around that level. The RSI indicator, remained above the reading of 50, implying the continuation of the bullish predisposition of the market. Should the bulls regain control over the precious metal’s price action, we may see it reversing yesterday’s losses and continue higher, breaking the 3500 (R1) record high level, with the next possible target for the bulls being set at the 3600 (R2) resistance level. Yet yesterday’s drop was intense and should the bearish movement intensify, the S1 may finally be broken. Hence should the bears take over, we may see the precious metal’s price breaking the 3370 (S1) support line and continue lower to aim if not break the 3260 (S2) support level.

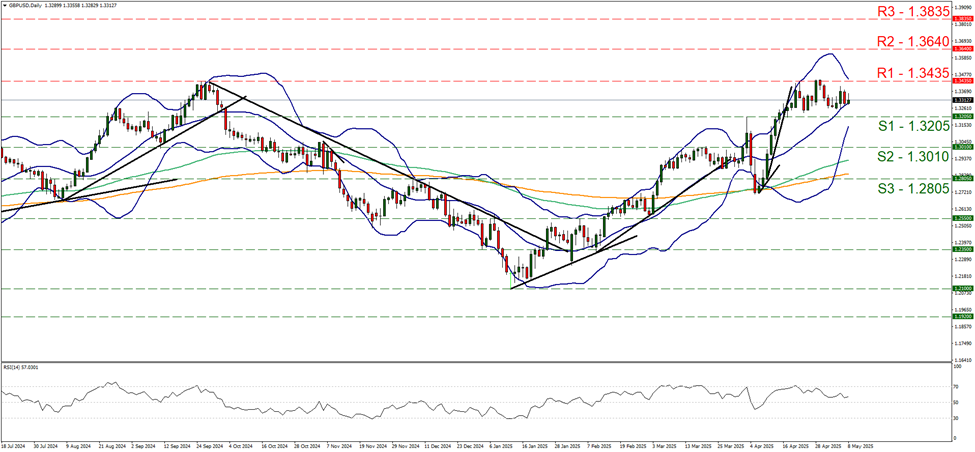

Across the Atlantic, BoE is to release its interest rate decision later today and is expected to cut rates by 25 basis points. Should the bank also showcase its readiness for more rate cuts to come, we may see the pound slipping as the market’s already dovish expectations as mentioned in yesterday’s report could be enhanced. On a political level for pound traders, we highlight the possibility for further developments on the tariff front. US President Trump has stated that a major trade deal is to be announced with a number of analysts speculating that it’s the UK and if so we may see the pound getting some support.

On a technical level, the Cable corrected lower yesterday, yet remained well within the boundaries set by the 1.3205 (S1) support line and the 1.3435 (R1) resistance level and remained relatively level in today’s Asian session. We maintain our bias for the continuance of GBP/USD’s sideways motion and we note that the RSI indicator remains above the reading of 50, despite a correction lower which tends to imply further easing of the bullish sentiment among market participants. For the adoption of a bullish outlook, we would require the pair’s price action to break clearly the 1.3435 (R1) resistance line clearly and start aiming for the 1.3640 (R2) resistance level. For a bearish outlook we would require the pair to break the 1.3205 (S1) support line and start aiming for the 1.3010 (S2) support level.

その他の注目材料

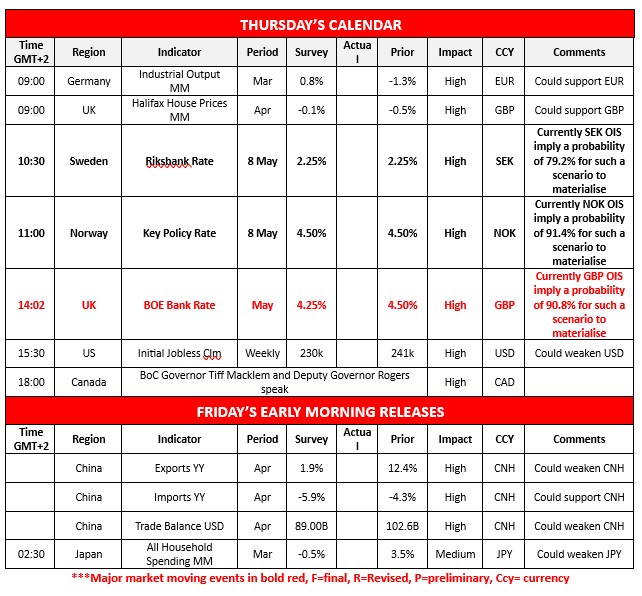

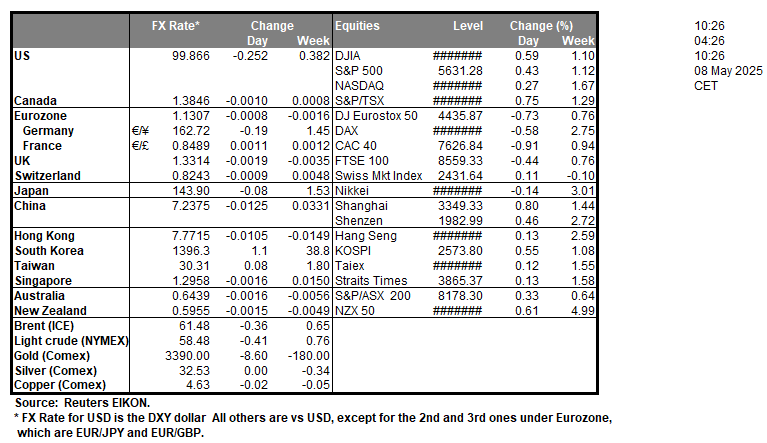

Today we get Germany’s industrial output for March, UK’s Halifax House prices for April and on a monetary level, besides BoE’s interest rate decision, we also get the interest rate decisions of Sweden’s Riksbank and Norway’s Norgesbank and later, from the US, we note the release of the weekly initial jobless claims, while BoC’s Governor Tiff Macklem and Deputy Governor Rogers are scheduled to speak. In tomorrow’s Asian session, we highlight the release of China’s trade data for April and note the release of Japan’s All household spending for March.

XAU/USD Daily Chart

- Support: 3370 (S1), 3260 (S2), 3167 (S3)

- Resistance: 3500 (R1), 3600 (R2), 3700 (R3)

GBP/USD Daily Chart

- Support: 1.3205 (S1), 1.3010 (S2), 1.2805 (S3)

- Resistance: 1.3435 (R1), 1.3640 (R2), 1.3835 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。