US Equities markets rose since our last report as all three major equities indexes S&P 500, Dow Jones and Nasdaq moved to higher grounds, albeit with slight variations. In today’s report we are to examine fundamentals which may have affected US equities, have a look at a couple of companies which we found especially interesting and conclude the report with a technical analysis of S&P 500’s daily chart.

US-Sino trade deal lifts stocks

The most intense upward movement of US stockmarkets since our last report occured on Monday. The main catalyst behind it was the announcement of the US-Sino trade deal. Negotiations between the US and China over the weekend, which we had noted in last week’s report, proved to be productive, according to statements from both sides, including comments by US secretary Bessent and China’s Vice Premier He Lifeng. The deal includes a substantial lowering of tariffs which the two countries have imposed on each other’s goods and is to be in effect for 90 days. The deal tends to resemble something like a trade war ceasefire, which is to give diplomacy a chance to find a solution on the problem. Any further indications of a thawing of US-Sino trade tensions could enhance the bullish effect on US stock markets, as it would be easing market worries intensifying the risk on orientation of the market.

April’s US CPI rates had little effect on US stockmarkets

The release of April’s US CPI rates yesterday, left stock market traders widely unimpressed yet caused substantial headlines. The core rate remained unchanged at 2.8%yy as was expected yet the headline rate unexpectedly slowed marginaly as it reached 2.3%yy. Despite headlines in the media mentioning a downward surprise by the release citing also a marginal slow down on a month on month level, we tend to see a rather muted release, with rates implying a possible persistence of inflationary pressures in the US economy. It’s characteristic that before the release the market expected the Fed to deliver another two rate cuts until the end of the year, yet Fed Fund Futures currently imply that the market readjusted its position towards the hawkish side and is now expecting only one more rate cut before ethe year ends. Should we see Fed policymakers intensifying their doubts for the necessity of extensive rate cuts, we may see their stance weighing on US stock markets as the market’s anticipation for an easing of the Fed’s tight monetary policy may be even further lowered.

News for Nvidia and Volkswagen

NVIDIA’s share price is rallying in the premarket hours, with the rise being fuelled by a deal with Saudi Arabian company Humain. NVIDIA is reportedly to provide 18000 of its most advanced chips to the Saudi company. Also the company seems to be currently enjoying a preferred status from US President Trump, as Trump praised NVIDIA CEO Huang in contrast to Apple CEO Cook. For the time being we tend to see the case for the bullish outlook of the NVIDIA’s share price to be maintained.

On the flip side, German automaker Volkswagen seems to be caught between conflicting fundamentals. On the one hand the company’s CFO stated to the FT that the historic restructuring of the company may not be enough, citing a “huge risk [that] complacency kicks in again”, which does not pose well for the company. On the other hand the news that China has released has issued first rare earth magnet export permits with Volkswagen suppliers being on the list, is cite as a substantial positive for the company’s share price, as it opens the way for the production of electric vehicles. At this point we note that the company’s confidence for the ID7 EV seems unstoppable. Despite the correction lower today of VW’s share price, we tend to maintain our bullish outlook for the German automaker.

テクニカル分析

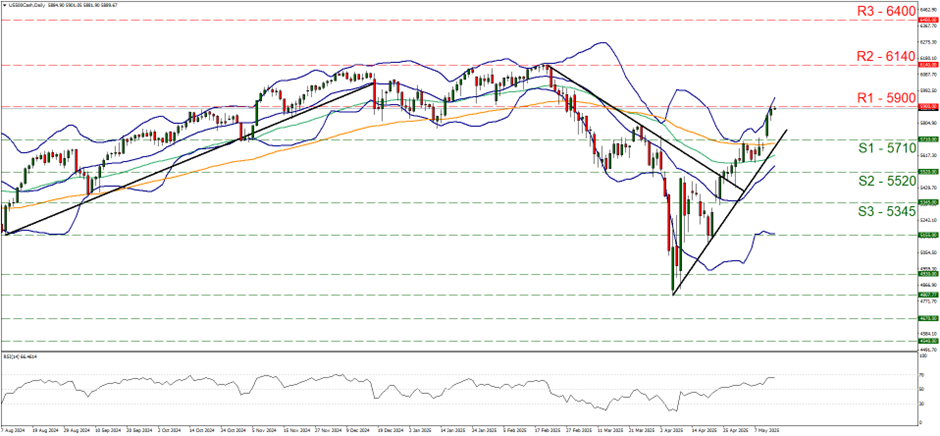

US500 Daily Chart

- Support: 5710 (S1), 5520 (S2), 5345 (S3)

- Resistance: 5900 (R1), 6140 (R2), 6400 (R3)

S&P 500 rallied over the past week in a continues upward motion and is currently testing the 5900 (R1) resistance line. We tend to maintain our bullish outlook for the index as long as its price action remains above the upward trendline guiding the index since the 4th of April. The RSI indicator has been nearing the reading of 70, also implying a strong bullish sentiment for the index, yet S&P 500 may be nearing overbought levels, yet for such a comment to come into effect the RSI indicator has to breach above the reading of 70. Should the bulls maintain control over the index aas expected, we may see it breaking the 5900 (R1) resistance line and start aiming for the all time high level marked by the 6140 (R2) resistance barrier. Should the bears find a chance and take over, we may see the index reversing course, initially breaking the prementioned upward trendline in a first signal that the upward motion has been interrupted and continue to break the 5710 (S1) support line with the next possible target for the bears being set at the 5520 (S2) support level.

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。