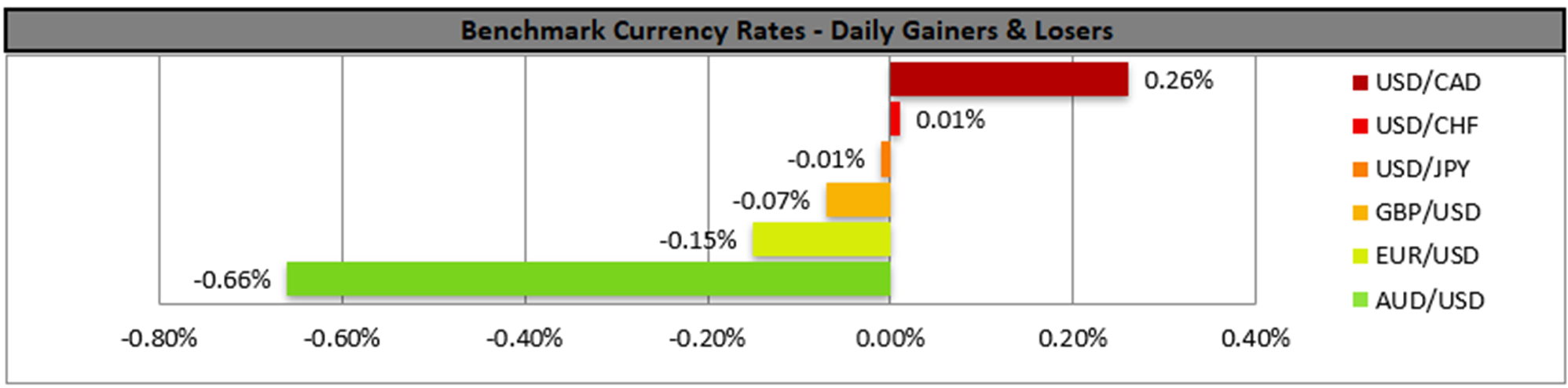

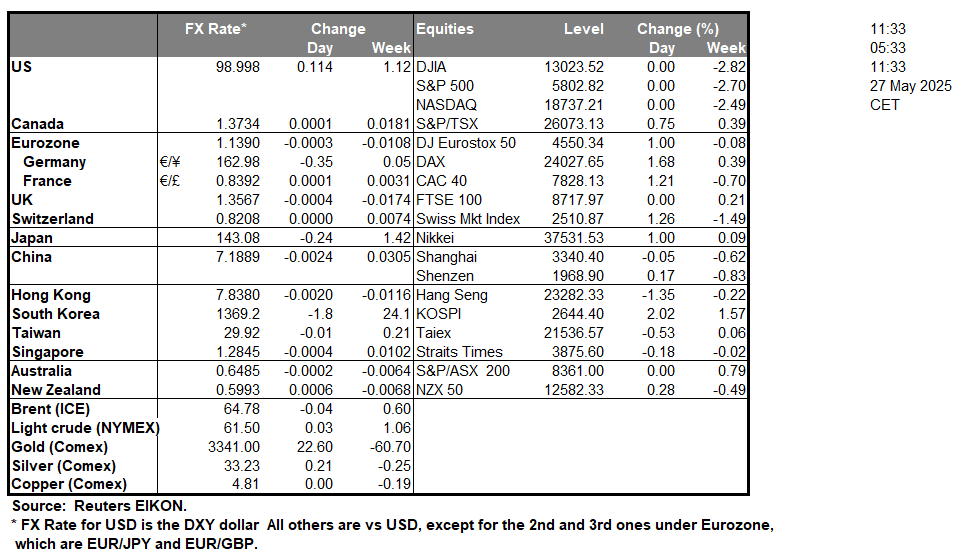

BOJ Governor Ueda stated earlier on today that “To the extent that incoming data allows us to gain more confidence in the baseline scenario, as economic activity and prices improve, we will adjust the degree of monetary easing as needed by raising rates” according to a report by Reuters. It appears that the Governor is concerned about the possible risks posed to the Japanese economy as a result of inflationary pressures and thus his most recent comments, showcase a willingness to resume the bank’s rate hiking path in the future, which in turn may aid the JPY. Moreover, the comments by the Governor may have been spurred following the release of the BOJ’s Core CPI rate on a year-on-year level which was released earlier on today and came in higher than expected at 2.4% versus 2.3%, showcasing an acceleration of inflationary pressures in the economy.Moving on to Australia, the nation’s CPI rate for April is set to be released in tomorrow’s Asian session and could influence the Aussie’s direction against its counterparts. Therefore, should the CPI rates showcase an acceleration of inflationary pressures it may increase pressure on the RBA to remain on hold during their next meeting. On the other hand, should the CPI rates showcase easing inflationary pressures, it may increase pressure on the bank to cut rates in their next meeting, which could weigh on the AUD.In Europe, France’s preliminary HICP rate for May came in lower than expected at 0.6% versus 0.9%, implying easing inflationary pressures in one of the largest economies in the Zone. Thus, the financial release could increase pressure on ECB policymakers to continue on their rate-cutting path, which could weigh on the common currency.

Looking at USD/JPY the pair appears to be moving in a downwards fashion. We opt for a bearish outlook for the pair which has broken below our upwards moving trendline which was incepted on the 21st of April. Moreover, further aiding our bearish outlook is the RSI indicator below our chart which currently registers a figure near 40, implying a bearish market sentiment, in addition to the MACD indicator. For our bearish outlook to continue we would require a clear break below the 142.25 (S1) support level, with the next possible target for the bears being the 139.85 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between the 142.25 (S1) support level and the 145.25 (R1) resistance line. Lastly, for a bullish outlook we would require a break above the 145.25 (R1) resistance line, with the next possible target for the bulls being the 147.70 (R2) resistance level.

XAU/USD appears to be to moving in a sideways fashion, with the commodity’s price appearing to be facing resistance near our 3365 (R1) resistance level. We opt for a sideways bias for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the precious metal’s price to remain confined between the 3240 (S1) support line and the 3365 (R1) resistance level. On the other hand, for a bullish outlook, we would require a clear break above the 3365 (R1) resistance level, with the next possible target for the bulls being the 3500 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below the 3240 (S1) support level, with the next possible target for the bears being the 3115 (S2) support line.

その他の注目材料

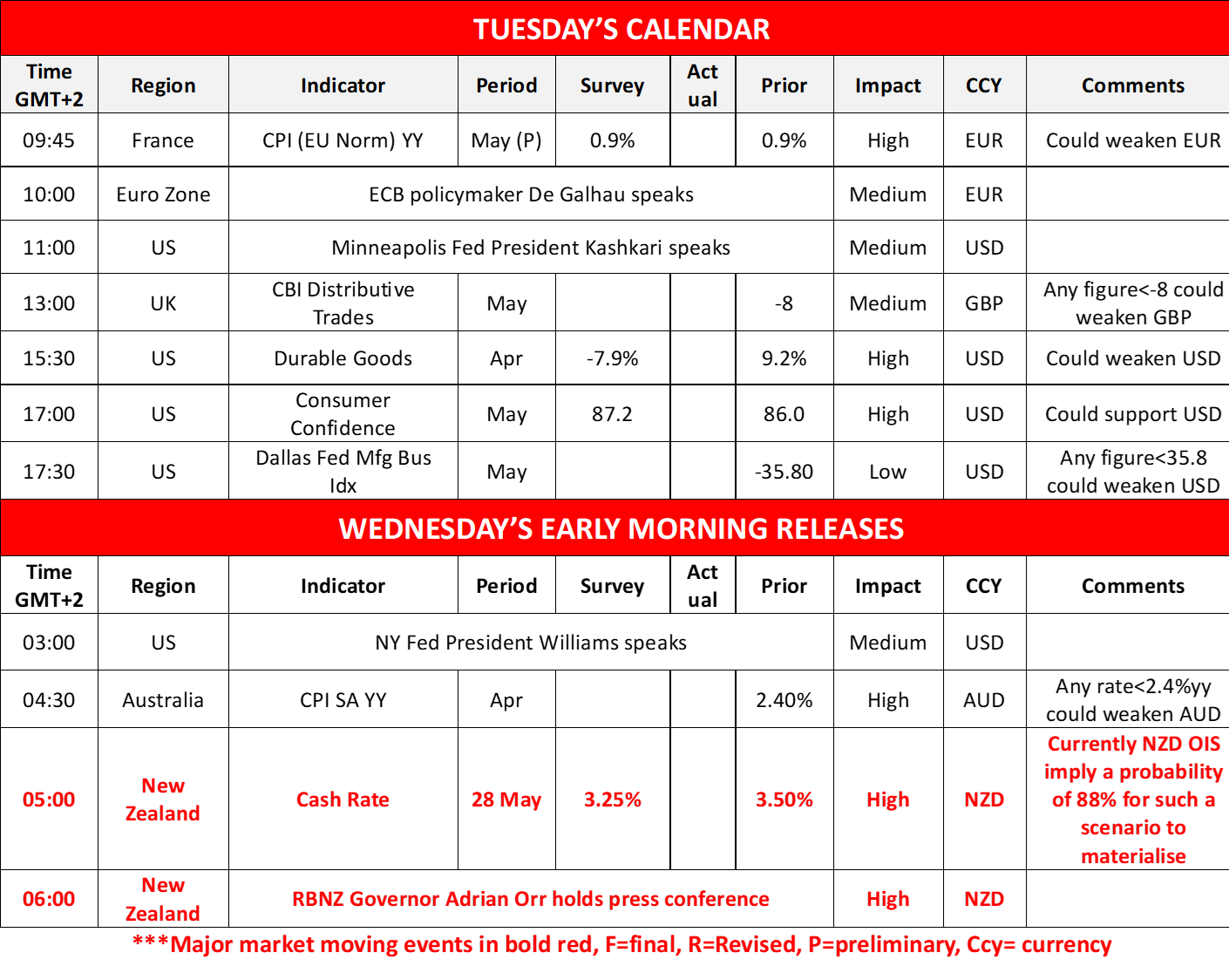

Today we note the release of France preliminary HICP rate for May, the UK’s distributive trades for the same month, and from the US the durable goods orders for April as well as the consumer confidence and Dallas Fed Business index both for May. On the monetary front we note that ECB policymaker De Galhau and Minneapolis Fed President Kashkari are scheduled to speak. In tomorrow’s Asian session, we get besides New Zealand’s RBNZ interest rate decision also Australia’s CPI rates for April, while NY Fed President Williams speaks.

USD/JPY Daily Chart

- Support: 142.25 (S1), 139.85 (S2), 137.25 (S3)

- Resistance: 145.25 (R1), 1470.40 (R2), 150.45 (R3)

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3645 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。