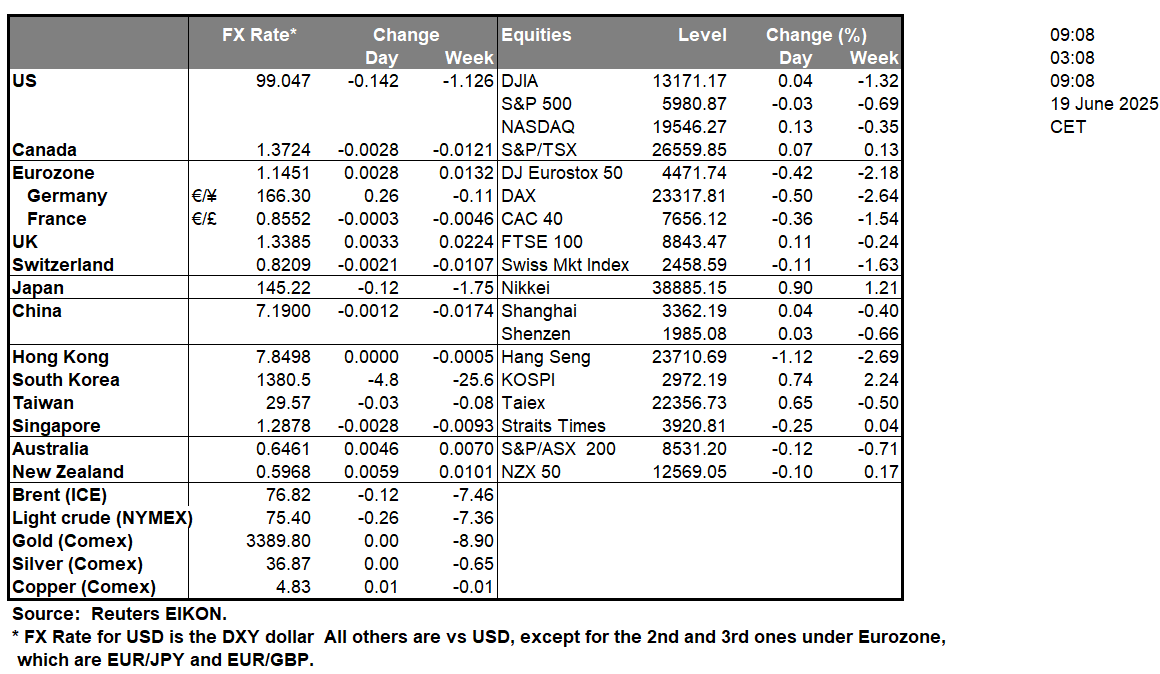

The Fed remained on hold as was widely expected yesterday. The bank mentioned the solid pace of economic activity expansion, the tightness of the US employment market and that inflation remains somewhat elevated in its accompanying statement. All the comments tend to point towards a delay in any further easing of the bank’s monetary policy yet in the bank’s projections the new dot plot implies Fed policymakers’ expectations for two more rate cuts until the end of the year which seems to be in line with the market’s expectations. Should we see though Fed policymakers proceeding with more hawkish comments in the coming days contradicting the market’s expectations we may see the USD getting some support.

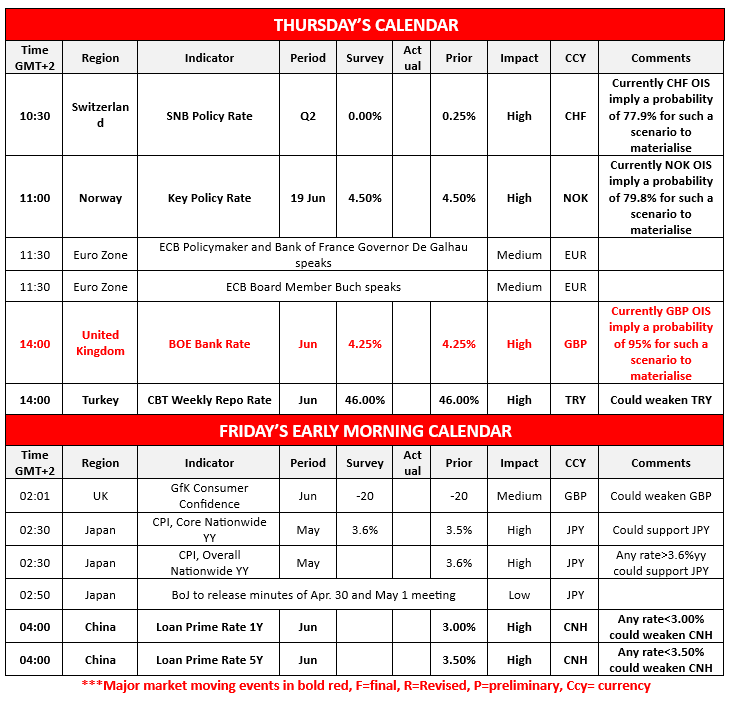

On a monetary level, BoE’s interest rate decision is expected to dominate the interest of pound traders today. The bank is currently widely expected to remain on hold at 4.25% and GBP OIS imply a probability of 95% for such a scenario to materialise. It should be noted though that GBP OIS also currently imply that the market expects the bank to proceed with two more rate cuts until the end of the year, one in September and one in December, which in turn showcases a dovish inclination of the market’s expectations for the bank’s future intentions. Should the bank remain on hold as expected and imply that there are more rate cuts down the line, we may see the GBP slipping as the market’s expectations could be enhanced. On the flip side, should the bank fail to provide any dovish signals or sound more hawkish than the market expects, we may see the pound getting asymmetric support.

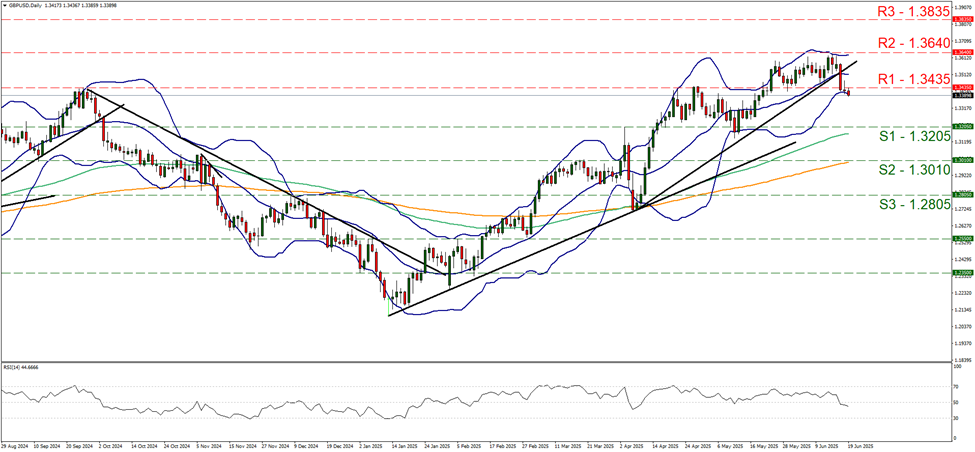

GBP/USD edged lower yesterday practically breaking the 1.3435 (R1) support line, now turned to resistance. With Tuesday’s breaking of the upward trendline guiding the pair since the 8th of April, we note an interruption of the upward movement. The pair’s price action has reached and is currently testing the lower Bollinger Band, yet the Bollinger bands remain narrow. The RSI indicator has breached below the reading of 50, yet remain close by. Overall bearish tendencies seem to be pushing lower, yet for the time being are still weak. For a bearish outlook we would require the pair to start actively aiming if not breaching the 1.3205 (S1) support line with the next possible target being the 1.3010 (S2) support level. For a bullish outlook we would require the pair to break the 1.3435 (R1) resistance line and continue to break also the 1.3640 (R2) resistance level, while even higher we note the 1.3835 (R3) resistance barrier.

その他の注目材料

Monetary policy is expected to dominate the markets today as besides BoE’s interest rate decision we also get the interest rate decisions of Switzerland’s SNB, Norway’s Norgesbank and Turkey’s CBT, while we also note the planned speeches of ECB’s De Galhau and Buch. Tomorrow in the Asian session we note the release of UK’s consumer confidence, from China PBoC’s interest rate decision and the release from Japan of BoJ’s minutes of the Apr. 30 and May 1 meeting, while we highlight the release of Japan’s CPI rates for May and a possible acceleration of the rates, beyond market expectations could add more pressure on BoJ to proceed with an earlier rate hike than expected.

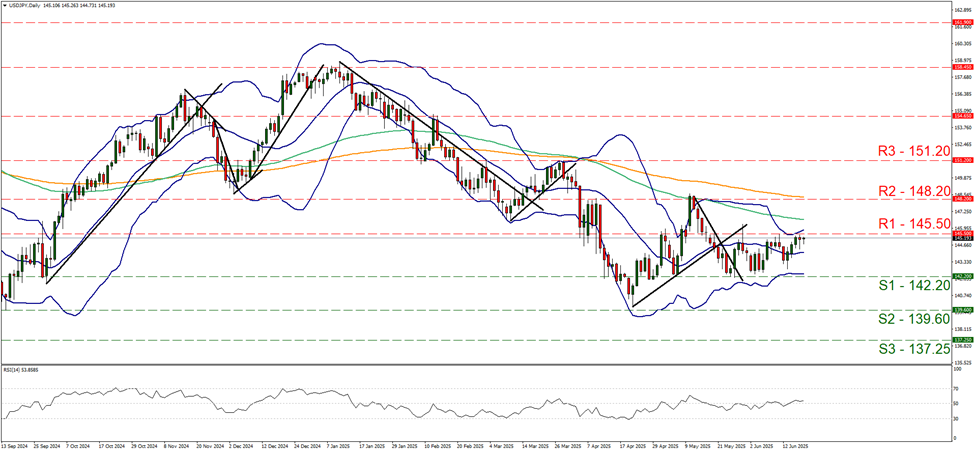

usd/JPY maintains a sideways motion remaining close to the 145.50 (R1) resistance line. We maintain our bias for the sideways motion to continue between the 145.50 (R1) resistance level and the 142.20 (S1) support level. The RSI indicator despite remaining close to the reading of 50, implying a relative indecisive market remains slightly higher, while the refusal of the pair to correct lower after reaching the R1, could imply some slight bullish tendencies. Should the bulls take over we may see USD/JPY to break the 145.50 (R1) resistance line and start aiming for the 148.20 (R2) level. Should the bears take over USD/JPY may break the 142.20 (S1) support line and start aiming for the 139.60 (S2) support level.

GBP/USD Daily Chart

- Support: 1.3205 (S1), 1.3010 (S2), 1.2805 (S3)

- Resistance: 1.3435 (R1), 1.3640 (R2), 1.3835 (R3)

USD/JPY Daily Chart

- Support: 142.20 (S1), 139.60 (S2), 137.25 (S3)

- Resistance: 145.50 (R1), 148.20 (R2), 151.20 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。