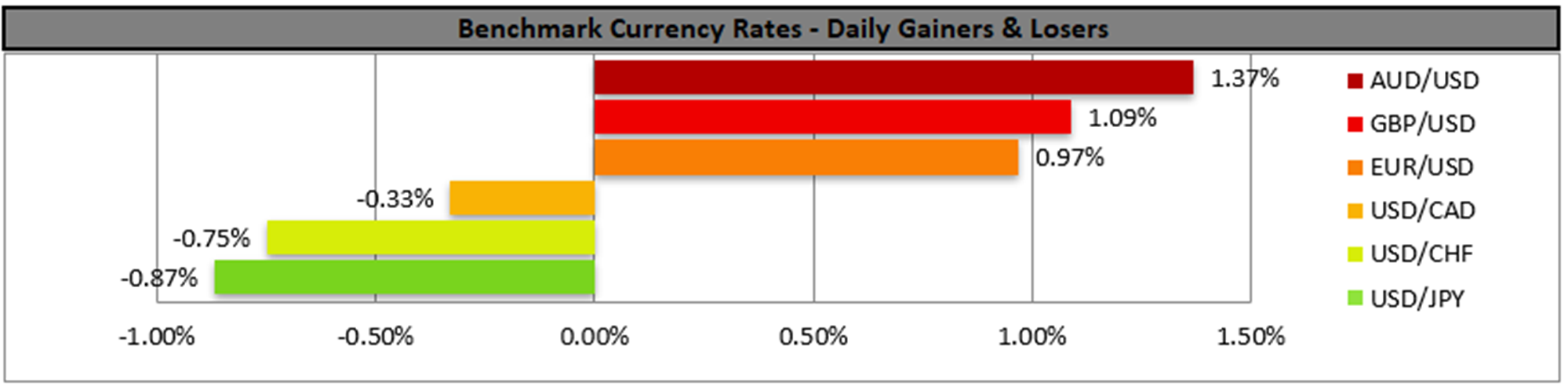

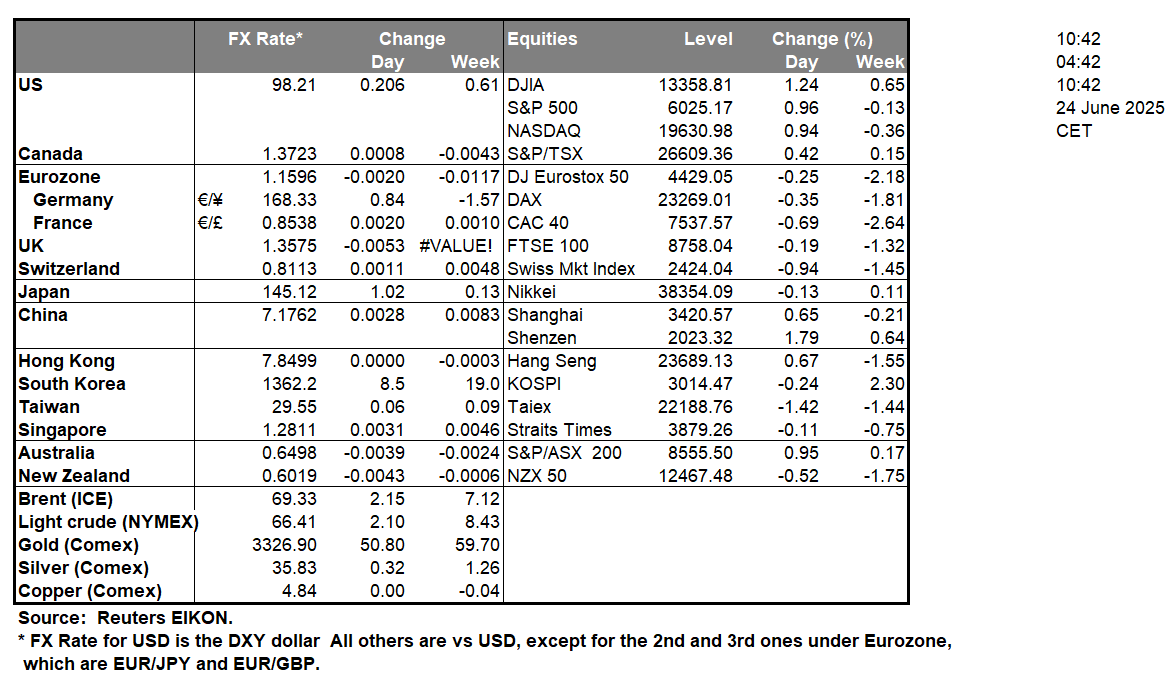

US President Trump stated yesterday that a ceasefire between Israel and Iran was agreed setting a timetable that was a bit confusing. The post on Truth Social was made only hours after Iran proceeded with another attack with waves of missiles, which according to Israeli authorities killed four persons. As per Reuters, the Iranian side confirmed that Tehran had agreed to a ceasefire, but the country’s foreign minister said there would be no cessation of hostilities unless Israel stopped its attacks which tends to blur the picture somewhat. As for the markets, the announcement caused the USD to retreat as well as gold’s price as both instruments suffered outflows, while the most impressive move may have been the tumbling of oil prices as market worries for the supply side of the international oil market tended to ease. Should we see further signals for a de-escalation, we may see the markets’ reaction being enhanced and riskier assets such as equities and commodity currencies benefiting while safe havens such as gold could mark losses. On a monetary level, we note the testimony of Fed Chairman Powell before the US Congress. Investors are expected to keep a close eye on the testimony in search of clues regarding the bank’s intentions. Should the Fed Chairman actually imply that the bank may prefer to keep rates unchanged for longer as the US employment market remains tight, inflationary pressures somewhat elevated and economic activity continues to expand at a solid pace, we may see the USD getting some support. Yet given the comments made yesterday by Fed policymakers signaling that an easing of monetary policy is on the way, we may see Powell, shifting towards a more dovish tone which in turn may extend the weakening of the USD and support gold’s price and US stock markets.

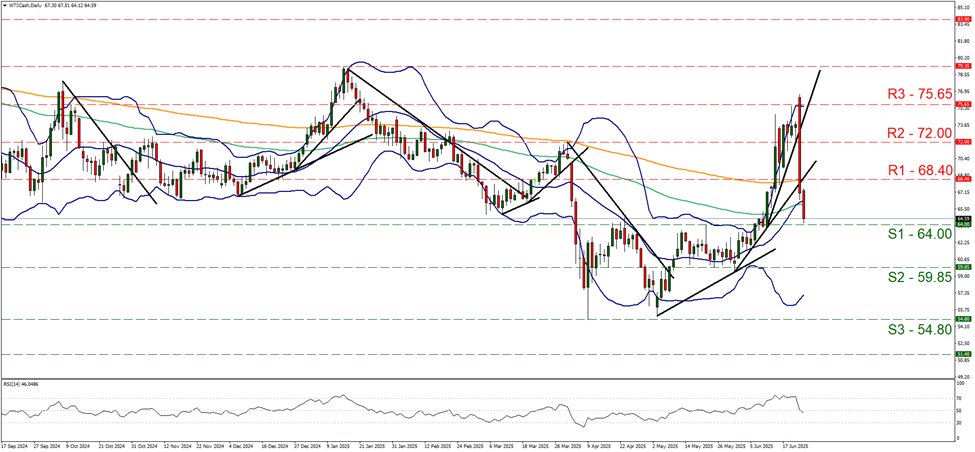

On a technical level WTI’s price tumbled, breaking the 72.00 (R2) and the 68.40 (R1) support line, both now turned to resistance, and the commodity’s price neared the 64.00 (S1) support line. We switch our bullish outlook of yesterday’s report, as the commodity’s price broke in its downward motion, the upward trendline guiding it, while the RSI indicator dropped from the highs of the reading of 70 to 50, marking the deflation of the market’s bullish sentiment for WTI’s price. Overall we see the case for further downward movement yet a correction higher could be in the cards for WTI. Should the bears maintain control as expected, we may see the commodity’s price breaking the 64.00 (S1) support line and start aiming for the 59.85 (S2) support level. On the flip side, a bullish outlook currently seems remote and for its adoption, we would require the commodity’s price to rise break the R1, R2 and aim if not breach the 75.65 (R3) resistance barrier.

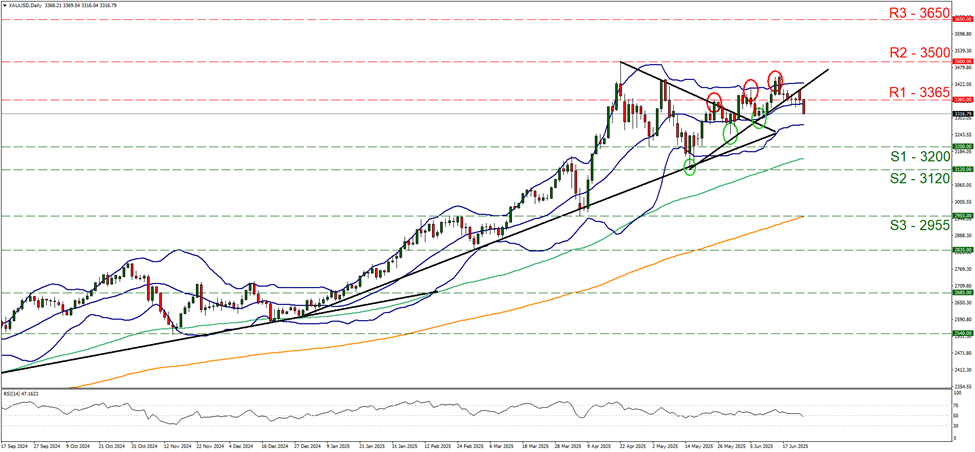

On a safe haven level, we note the drop of gold’s price, clearly breaking the 3365 (R1) support line, now turned to resistance. The RSI indicator edged lower reaching the reading of 50, which implies that the market sentiment seems to remain rather indecisive as to the precious metal’s price direction. Please note that gold’s price seems to have started to form lower peaks and lower troughs in its price action. For the bearish outlook to be maintained we would require gold’s price to start aiming for the 3200 (S1) support line and set as the next possible target for the bears the 3120 (S2) level. Should the bulls take over we may see gold’s price reversing direction by breaking the 3365 (R1) line and start aiming if not reaching the 3500 (R2) level.

その他の注目材料

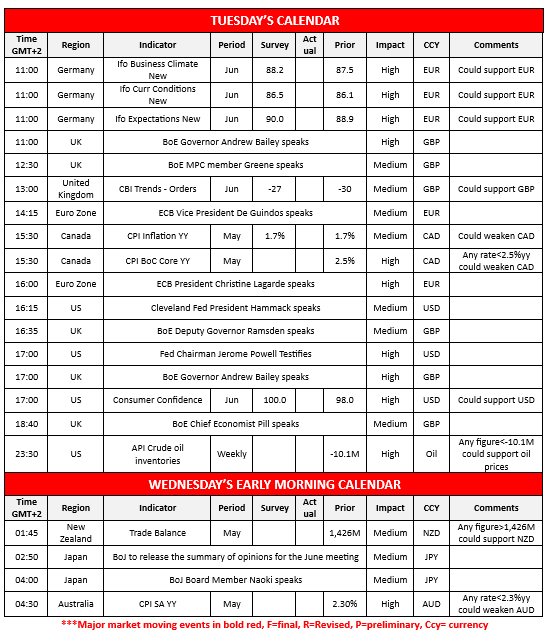

Today we get Germany’s Ifo indicators for June, UK’s CBI for trends in industrial orders for June, we highlight Canada’s CPI rates for May, and the US consumer confidence for June and oil traders may be interested in the API weekly crude oil inventories figure. In tomorrow’s Asian session, we get New Zealand’s trade date for May and we highlight the release of Australia’s CPI rates for May, while BoJ is to release the summary of opinions of the June meeting.

WTI Daily Chart

- Support: 64.00 (S1), 59.85 (S2), 54.80 (S3)

- Resistance: 68.40 (R1), 72.00 (R2), 75.65 (R3)

XAU/USD Daily Chart

- Support: 3200 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。