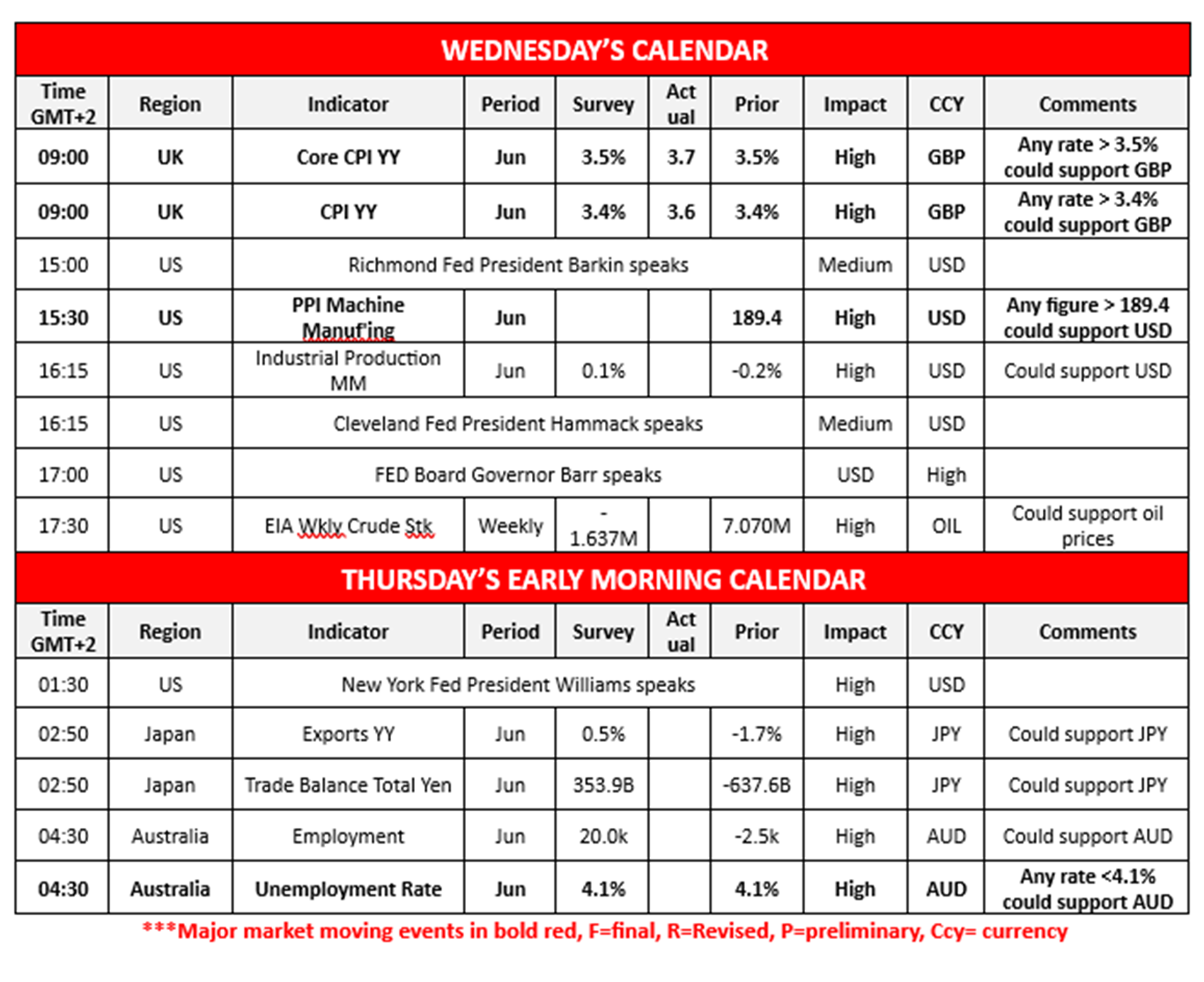

The UK’s CPI rates for June were released earlier on today, during the early European trading session. The inflation print showcased an acceleration of inflationary pressures in the UK economy as the CPI rates across the board on a core and headline level both on month-on-month basis and on a year-on-year basis came in hotter than expected. In turn the data implies an acceleration of inflationary pressures in the UK economy, which could increase pressure on the Bank of England to withhold from cutting interest rates in the near future and could thus aid the sterling.In the US according toa report by Bloomberg, President Trump stated that “Probably at the end of the month, and we’re going to start off with a low tariff and give the pharmaceutical companies a year or so to build, and then we’re going to make it a very high tariff” which could weigh on the stock prices of pharmaceutical companies such as Pfizer amongst others.In Europe, ASML has raised some concerns over the company’s outlook in spite of them beating their earnings expectations per Bloomberg. In particular, we note the statement that “At the same time, we continue to see increasing uncertainty driven by macro-economic and geopolitical developments. Therefore, while we still prepare for growth in 2026, we cannot confirm it at this stage” which could weigh on the European Equities markets and the company’s stock price should the economic outlook deteriorate. Australia’s employment data for June is due out in tomorrow’s Asian trading session and could increase volatility in the Aussie. In particular, should the data showcase a resilient labour market it may aid the AUD.

XAU/USD appears to be moving in a predominantly sideways fashion. We opt for a sideways bias for the commodity’s price and supporting our case is the RSI indicator below our chart, which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand, for a bullish outlook, we would require a clear break above the 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level. Lastly, for a bearish outlook, we would require a clear break below the 3240 (S1) support line, with the next possible target for the bears being the 3115 (S2) support level.

EUR/USD appears to be moving in a sideways fashion after breaking below our support turned to resistance at the 1.1685 (R1) level. We opt for a predominantly sideways outlook for the pair and supporting our case is the MACD indicator below our chart, which may facilitate our view that the pair may move to test our 1.1480 (S1) support level. Moreover, the RSI indicator currently registers a figure near 50, which may also imply that the bullish momentum that was guiding the pair may have diminished. Nonetheless, for our sideways bias to be maintained, we would require the pair to remain between our 1.1480 (S1) support level and our 1.1685 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 1.1480 (S1) support level with the next possible target for the bears being the 1.1275 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 1.1685 (R1) resistance level with the next possible target for the bulls being the 1.1885 (R2) resistance line.

その他の注目材料

Today we get the US’s PPI machine manufacturing figure and industrial production rate both for June as well and ending the day is the EIA weekly crude oil inventories figure. In tomorrow’s Asian session we note Japan’s trade data and Australia’s employment data, both for the month of June. On a monetary level we note the speeches by Richmond Fed President Barkin, Cleveland Fed President Hammack and Fed Board Governor Barr today and in tomorrow’s Asian session the speech by NY Fed President William’s.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

EUR/USD デイリーチャート

- Support: 1.1480 (S1), 1.1275 (S2), 1.1085 (S3)

- Resistance: 1.1685 (R1), 1.1885 (R2), 1.2070 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。