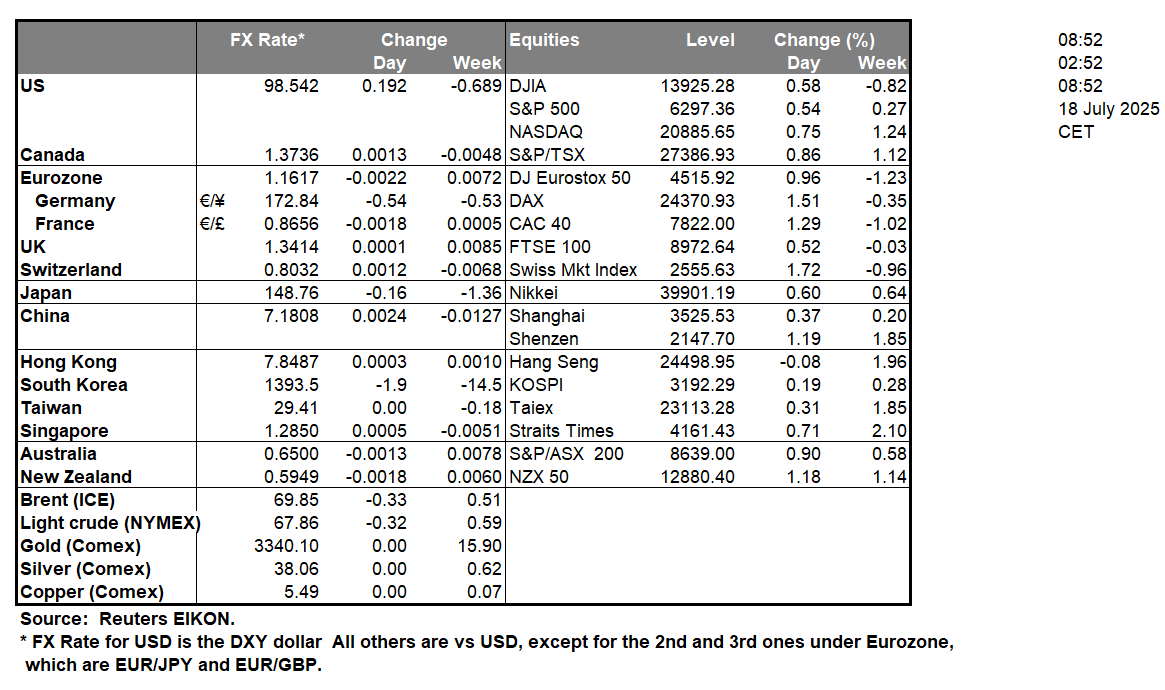

The USD Index continued to rise yesterday in a sign that the greenback gained against its counterparts. Substantially stronger than expected financial data tended to provide support as they implied a boost both on the demand side of the US economy as well as on its production side, while the weekly initial jobless claims figure implied a tighter than expected US labour market. The higher-than-expected retail sales for the past month, tends to dissolve any doubts created by the PPI rates for June and suggests the continuation of the Fed’s tight monetary policy, at least for a couple of months. In the crypto world, the US House of Representatives passed the GENIUS Act, sending it to US President Trump, who is expected to sign it into law, while also approved the Clarity Act, which was sent to the Senate for passing. As for gold, it seems that the precious metal maintains a wait-and-see position which is a bit uneasy and its negative correlation with the USD remains inactive at the current stage, given USD’s strengthening.

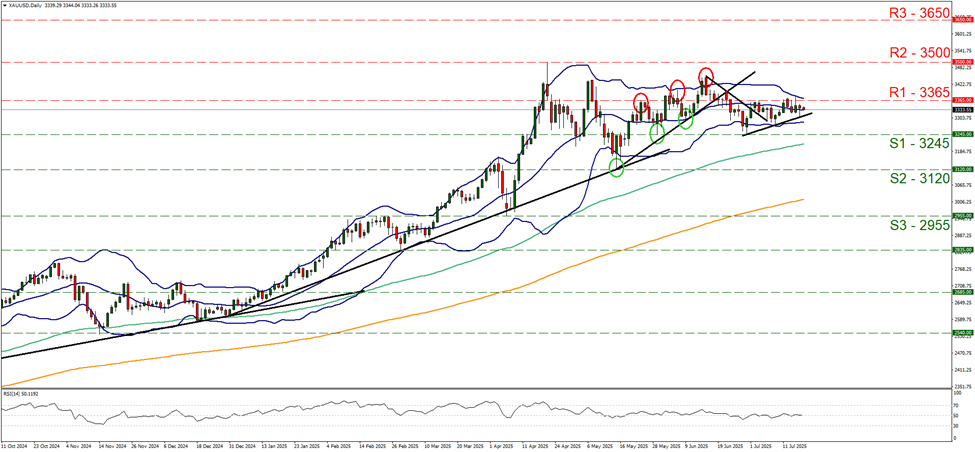

It’s characteristic that on a technical level, XAU/USD continued its sideways motion just below the 3365 (R1) resistance line. Hence yesterday’s sideways motion is being maintained and we note that the RSI indicator continues to run along the reading of 50 and the Bollinger bands are narrowing, both indicators suggesting a possible continuation of the sideways movement. For a bullish outlook, we would require a clear break above the 3365 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) All Time High resistance level. For a bearish outlook, we would require a clear break below the 3245 (S1) support line, with the next possible target for the bears being the 3120 (S2) support level.

In Japan, the election of the House of Councilors on Sunday may prove to be critical for the stability in the Japanese political scene. The ruling coalition of LDP and Komeito, is reported to be facing tough opposition for Japan’s upper House and may lose the majority. In such a scenario, we may see the JPY weakening as the political outlook of Japan becomes uncertain. A possible win of the opposition may add more pressure on the BoJ to keep rates unchanged in contrast to the bank’s efforts to tighten its monetary policy. Hence, should the ruling coalition lose the majority we may see the elections weighing on the Yen. On a macro level, we note the slowdown of Japan’s CPI rates for the past month both at a headline as well as at a core level, which may be contradicting BoJ’s narrative and seems to have dissolved currently the market’s expectations for a rate hike at end of the year. The elections take place in the midst of US President Trump’s trade wars at which the US has targeted Japanese products with higher tariffs. Trump’s tariffs tend to maintain the risks for growth of the Japanese economy on the downside thus any escalation could weigh on JPY.

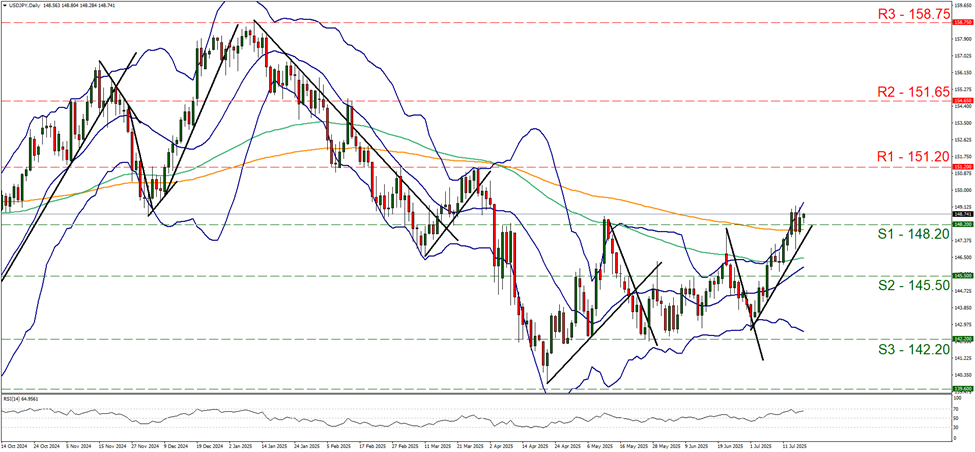

USD/JPY’s upward motion is maintained after breaking 148.20 (S1) resistance line now turned to support. We intend to maintain our bullish outlook as long for the pair as the upward trendline guiding it remains intact and given also that the RSI indicator remains high implying a bullish market sentiment for the pair. Should the bulls remain in charge, we may see the pair aiming if not breaking the 151.20 (R1) resistance line. Should the bears take over, way see USD/JPY, breaking the prementioned upward trendline, in a first signal that the upward motion has been interrupted, break also the 148.20 (S1) support line clearly and continue lower to reach if not breach the 145.50 (S2) support base.

その他の注目材料

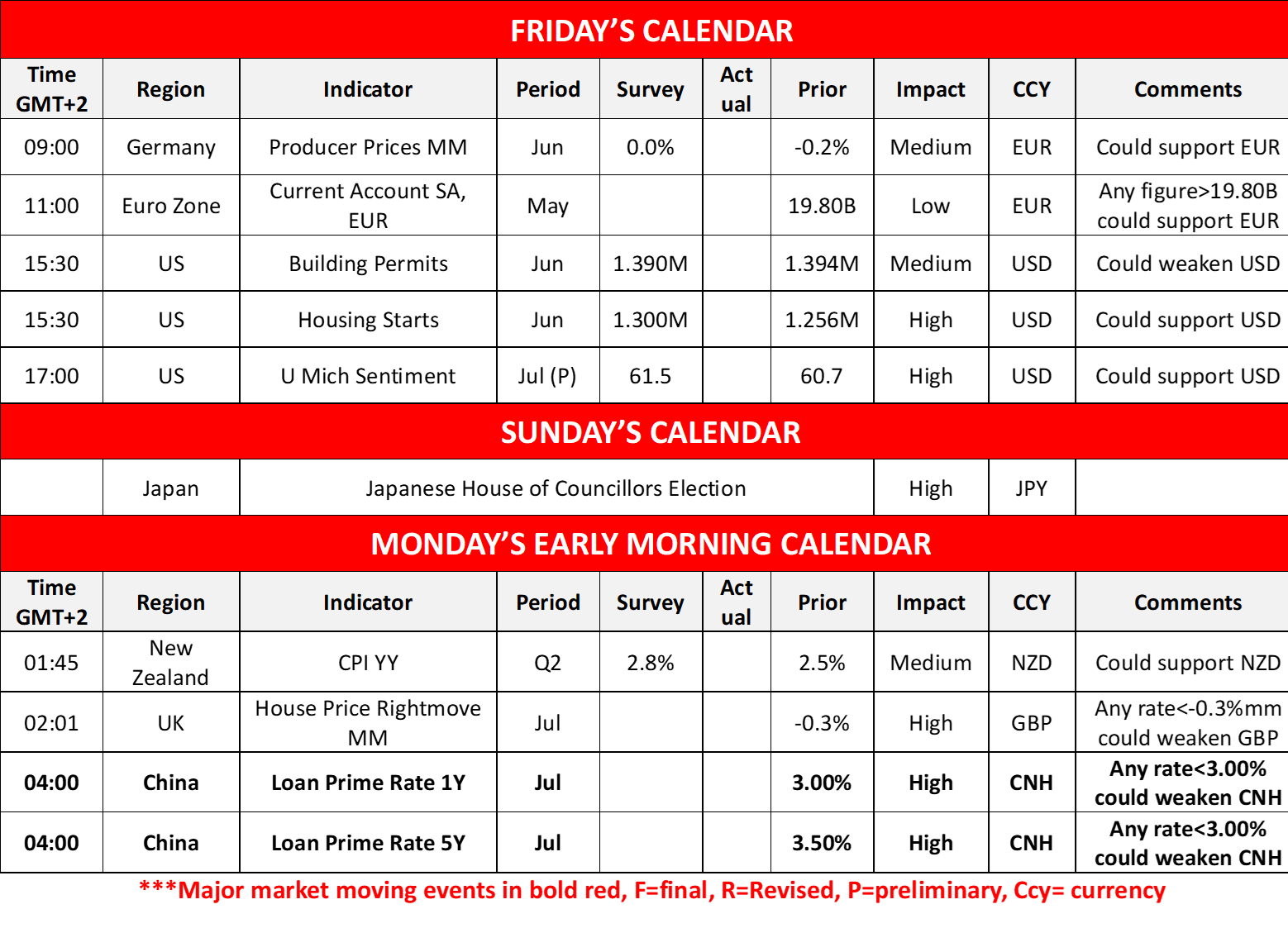

Today we get Germany’s PPI rates for June, Euro Zone’s current account balance for May, the US Building Permits and House Starts for June and the preliminary University of Michigan consumer sentiment for July. On Monday’s Asian session, we get New Zealand’s CPI rates for Q2 and from China PBoC’s interest rate decision.

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

USD/JPY Daily Chart

- Support: 146.20 (S1), 145.50 (S2), 142.20 (S3)

- Resistance: 151.20 (R1), 151.65 (R2), 158.75 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。