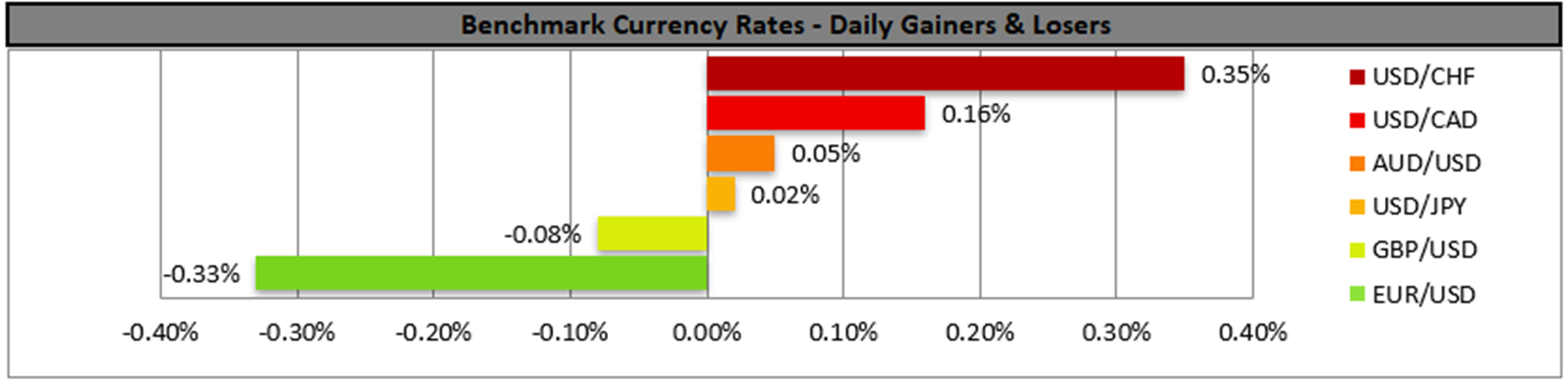

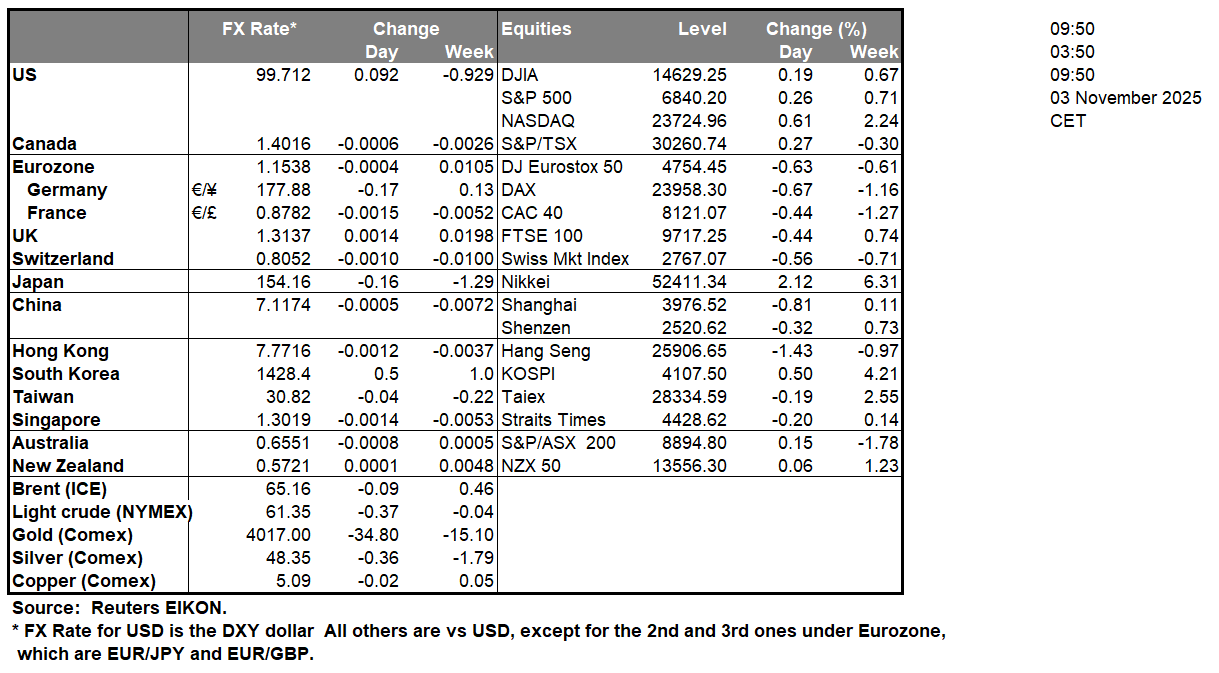

As the week begins, we note that the USD ended last week in the greens, while fundamentals continue to lead the way for the markets. The US Government shutdown continues to keep the markets in the dark as the release of key US financial releases is being delayed. In the FX market the release from Australia of RBA’s interest rate decision is expected to gather some attention in tomorrow’s Asian session. After the acceleration of the Australia’s CPI rates for September and Q3, market expectations for the bank to deliver a rate cut have been erased and the bank is currently widely expected to remain on hold. AUD OIS imply that the bank is also expected to remain on hold until Spring next year and proceed then with a rate cut. Hence, market attention may shift towards the bank’s forward guidance. For the time being, we expect the bank’s forward guidance to imply that any easing of its monetary policy is to be delayed, which could be supportive for the Aussie. On the flip side a possible dovish tone in the bank’s forward guidance may force the market to readjust its expectations, as it would be taken by surprise, and thus weigh considerably on the Aussie.

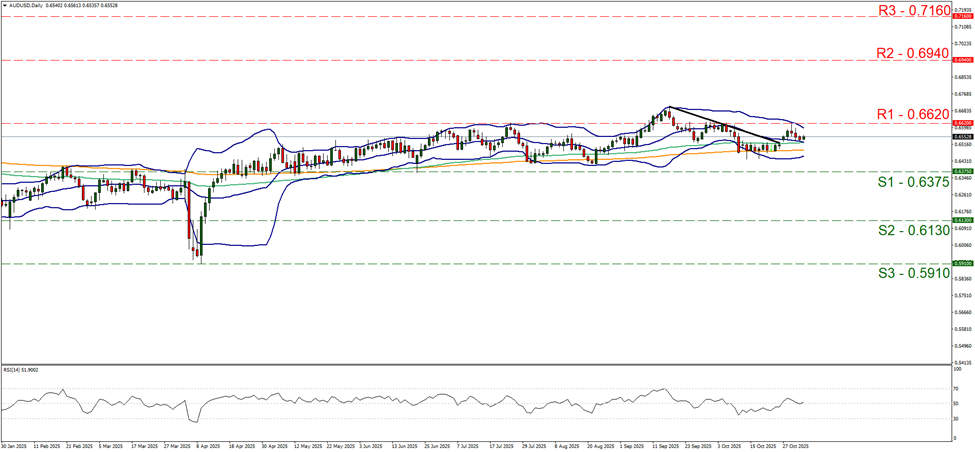

AUD/USD remained relatively stable on Friday and in today’s Asian session, well between the 0.6620 (R1) resistance line and the 0.6375 (S1) support level. We maintain a bias for the pair’s sideways motion within the corridor set by the prementioned levels to be continued. Supporting our opinion are the Bollinger bands are narrow and converging slightly implying lower volatility for the pair and the RSI indicator which remains at the reading of 50 implying a rather indecisive market for the pair’s direction. Yet RBA’s interest rate decision could alter AUD/USD’s direction. Should the bulls take over, we may see the pair breaking the 0.6620 (R1) resistance line and start aiming for the 0.6940 (R2) resistance level. Should the bears be in charge, we may see the pair breaking the 0.6375 (S1) support line and start aiming for the 0.6130 (S2) support base.

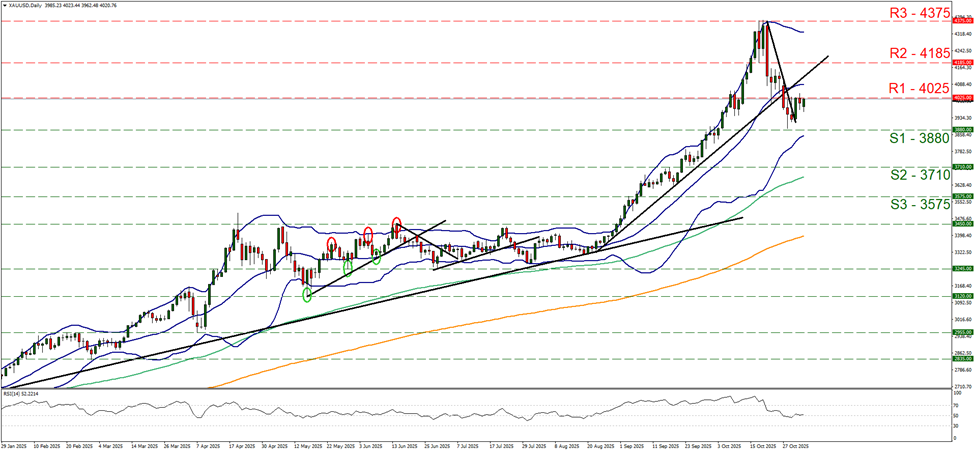

Also on a technical level, we note that gold’s price hit a ceiling on Friday at the 4025 (R1) resistance line, yet the precious metal’s price is took another swing at the R1 in today’s Asian session. For the time being, the RSI indicator remains near the reading of 50, implying an indecisive and probably unprepared market for another intense bullish movement of golds price. For a bullish outlook to emerge, we would require gold’s price to clearly break the R1 with the next possible target for the bulls being the 4185 (R2) resistance barrier. For a bearish outlook to be adopted we would require gold’s price to break the 3880 (S1) support line and thus pave the way for the 3710 (S2) support level.

その他の注目材料

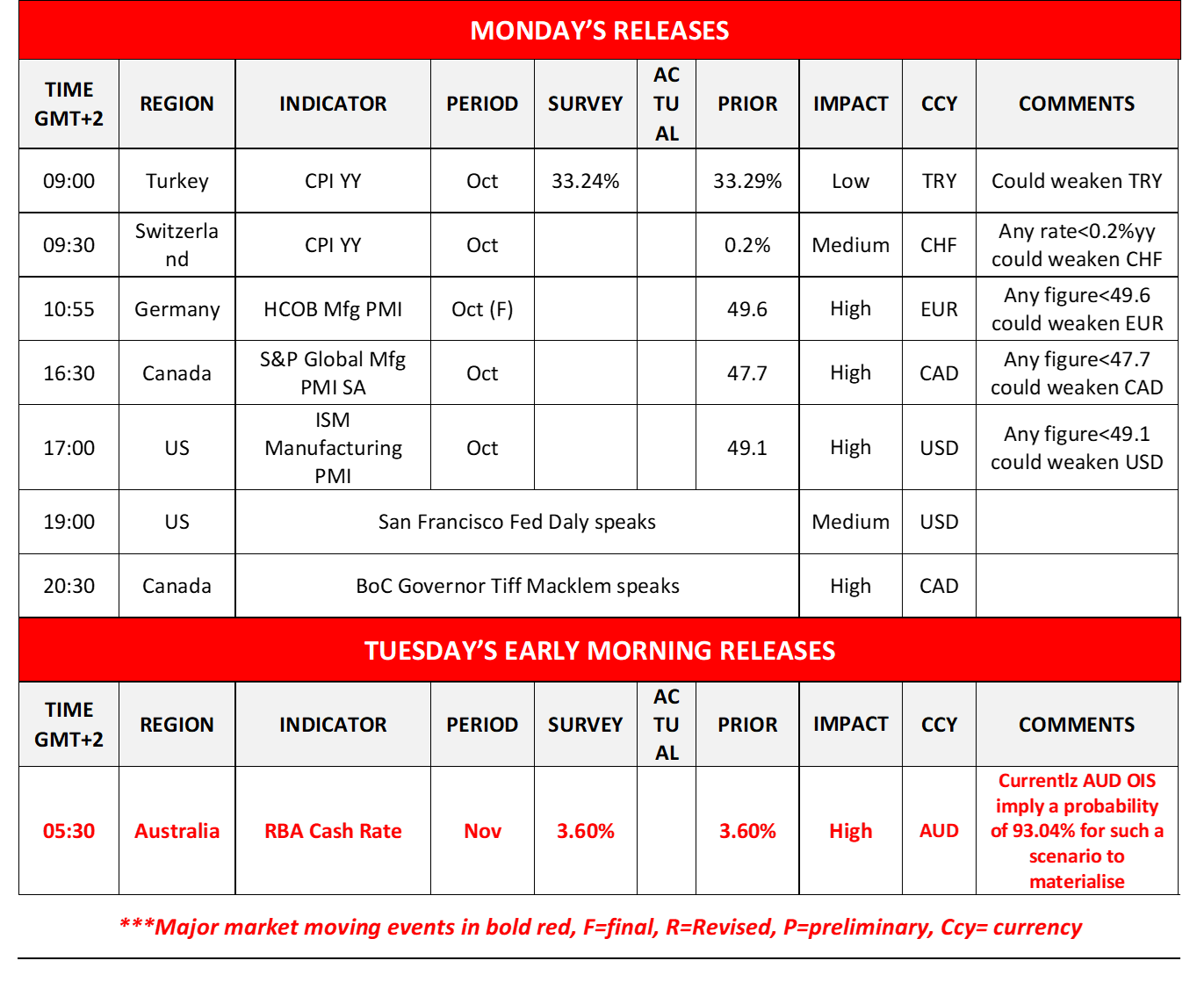

Today we get Turkey’s and Switzerland’s CPI rates, Germany’s and Canada’s Manufacturing PMI figures and the US ISM manufacturing PMI figure all being for October. On a monetary level, we note that San Francisco Fed President Daly and BoC Governor Tiff Macklem are scheduled to speak.

今週の指数発表:

On Tuesday, we get Canada’s trade balance figure, the US Factory orders rate and JOLTs Job openings figure all for September. On Wednesday, we get Australia’s manufacturing figure, Germany’s industrial orders rate for September, the Czech Republic’s preliminary CPI rate for October, the Riksbank’s interest rate decision, France’s services PMI figure, the Zone’s composite final PMI figure, the US ADP employment figure and ISM Non-Manufacturing PMI figure all for October. On Thursday, we get Australia’s trade balance figure, Sweden’s CPI rate for October, Sweden’s CPI rate for October and Unemployment rate for October, the Riksbank’s the BoE’s and the CNB’s interest rate decisions and lastly Canada’s Ivey PMI figure for October. On Friday we note the UK Halifax house prices rate for October, the US Employment data for October as well and lastly the University of Michigan consumer sentiment figure for November.

AUD/USD デイリーチャート

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

XAU/USD Daily Chart

- Support: 3880 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4025 (R1), 4185 (R2), 4375 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。