Fed Governor Waller took to the stage yesterday to discuss the US’s economic outlook. The Governor who is well known for his dovish stance, stated yesterday that “ the labor market is still weak and near stall speed. Second, that inflation through September continued to show relatively small effects from tariffs and support the hypothesis that tariffs are having a one-off effect raising price levels in the U.S. and are not a persistent source of inflation”. The comments by the Governor showcase his concerns over the US Labour market which has raised alarm bells over the past few months. Furthermore, the Governor went as far as to state that “the data leads me, at this moment, to support a cut in the FOMC’s policy rate at our next meeting on December 9 and 10 as a matter of risk management” hence clearly stating that should things remains as they are currently the Governor will be voting for a rate cut next month. The affirmation of a rate cut vote from the Governor is obviously dovish in nature, yet when considering the divisions within the Fed, the comments made by the Governor may have a temporary impact on the dollar. The RBA’s last meeting minutes were released earlier on today and appear to show a cautionary stance from RBA policymakers. In particular it was stated that “Members determined that they could afford to be patient ” when referring to the restrictiveness of the banks monetary policy. Hence, the implications of the bank remaining on hold for the time being may have provided support for the Aussie.

EUR/USD appears to be moving in a sideways fashion after re-emerging above our 1.1560 (S1) support level. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 1.1685 (R1) resistance line with the next possible targets for the bulls being our 1.1815 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 1.1560 (S1) support line with the next possible target for the bears being our 1.1405 (S2) support level.

US500 appears to be moving in a downwards fashion after the index took aim and is currently resting on our 6635 (S1) support level. We opt for a bearish outlook for the index and supporting our case are all three indicator below our chart which currently point towards a bearish market sentiment. For our bearish outlook to continue, we would require a break below our 6635 (S1) support level with the next possible target for the bears being our 6515 (S2) support line. On the other hand, for a sideways bias we would require the index to remain confined between our 6635 (S1) support level and our 6815 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 6815 (R1) resistance line with the next possible target for the bulls being our 6925 (R2) resistance ceiling.

その他の注目材料

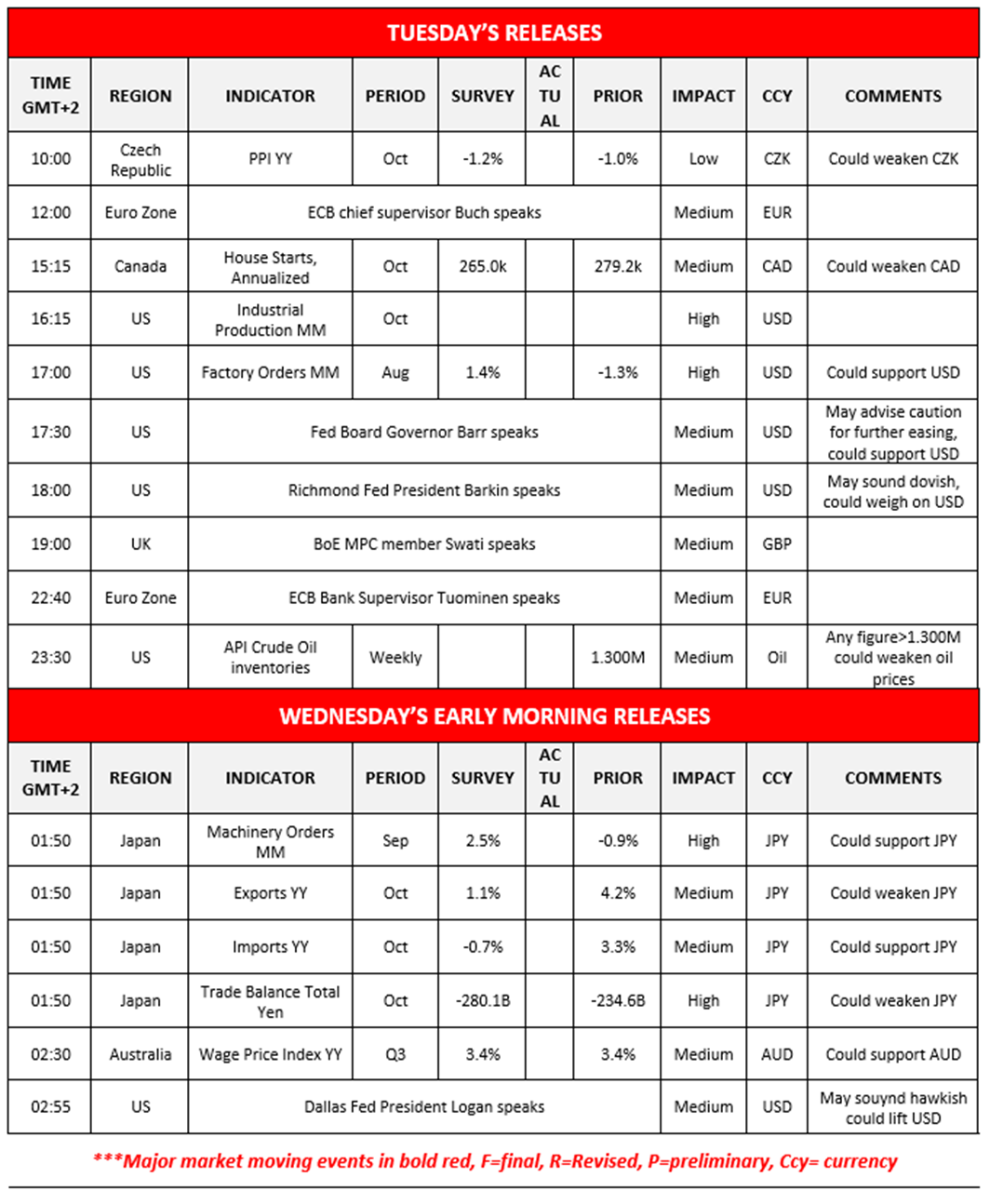

Today we get the Czech Republic’s PPI rates for October, Canada’s House starts for October, the US industrial production for October and the factory orders for August, while later on we get from the US the API weekly crude oil inventories figure. On a monetary level, we note that ECB chief supervisor Buch, Fed Board Governor Barr, Richmond Fed President Barkin, BoE MPC member Swati and ECB Bank Supervisor Tuominen are scheduled to make statements. In tomorrow’s Asian session, we get Japan’s October trade data and September’s machinery orders while from Australia we get Q3’s wage price index and in the US Dallas Fed President Logan speaks.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1405 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

US500 H4 Chart

- Support: 6635 (S1), 6515 (S2), 6415 (S3)

- Resistance: 6815 (R1), 6925 (R2), 7040 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。