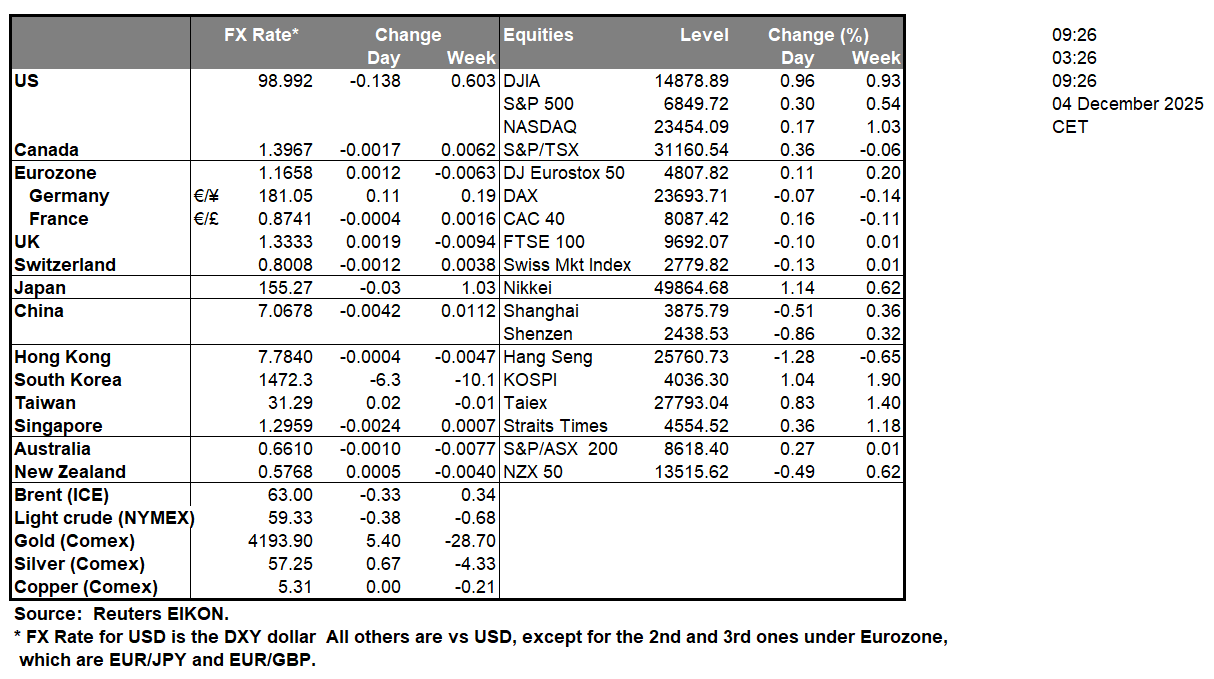

The US ADP employment change figure for November was released during yesterday’s trading session. The figure came in at -32k marking a sharp contract to the prior figure of 47k and the anticipated release of 5k. In turn the data tended to paint a picture of a loosening labour market in the US economy and may have thus increased market optimism for a rate cut by the Fed in their meeting next week. Truth be told, even prior to the release the markets had already been in a position where they anticipate a rate cut by the Fed in the coming week. Nonetheless, the release may have weighed on dollar whilst aiding it’s counterparts. However, the ISM non-manufacturing PMI figure for November managed to beat expectations by economists by coming in at 52.6 versus 52.0 and higher than the prior figure of 52.4 , showcasing a continued expansion of the US non-manufacturing sector, which may have allowed the dollar to strengthen slightly.On a geopolitical level, according to “The Hill” President Trump stated that there will be strikes on land in Venezuela “soon” implying that a further escalation between the two nations may be imminent and could rapidly deteriorate over the next few days. In turn any military escalation between the two could lead to heightened instability in the region and could possibly lead to safe haven inflows into gold and could also possibly provide support for oil prices.In Europe, ECB President Lagarde stated yesterday “We expect inflation to stay around our 2% target in the coming months” which tends to further support our ongoing opinion that the ECB appears to be in no rush to cut rates and could opt for a “holding pattern” with their monetary policy. In turn this could provide support for the common currency.In Canada, the nation’s Ivey PMI figure is set to be released during today’s American session and could influence the CAD.

On a technical level, EUR/USD appears to be moving in an upwards fashion after re-emerging above our 1.1560 (S1) support level. We now opt for a bullish outlook for the pair and supporting our case are all three indicators below our chart which tend to imply a bullish market sentiment. For our bullish outlook to be maintained, we would now require a clear break above our 1.1685 (R1) resistance level, with the next possible target for the bulls being our 1.1815 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. Lastly, or a bearish outlook we would require a clear break below our 1.1560 (S1) support line with the next possible target for the bears being our 1.1405 (S2) support level.

XAU/USD appears to be moving in an sideways fashion after failing to clear our 4240 (R1) resistance level. We opt for a sideways outlook for the precious metal’s price and supporting our case is the break below upwards moving trendline located on our chart. For our sideways bias to be maintained we would require gold’s price to remain confined between our 4142 (S1) support level and our 4240 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 4240 (R1) resistance line with the next possible target for the bulls being our 4315 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4142 (S1) support level with the next possible target for the bears being our 4080 (S2) support base.

その他の注目材料

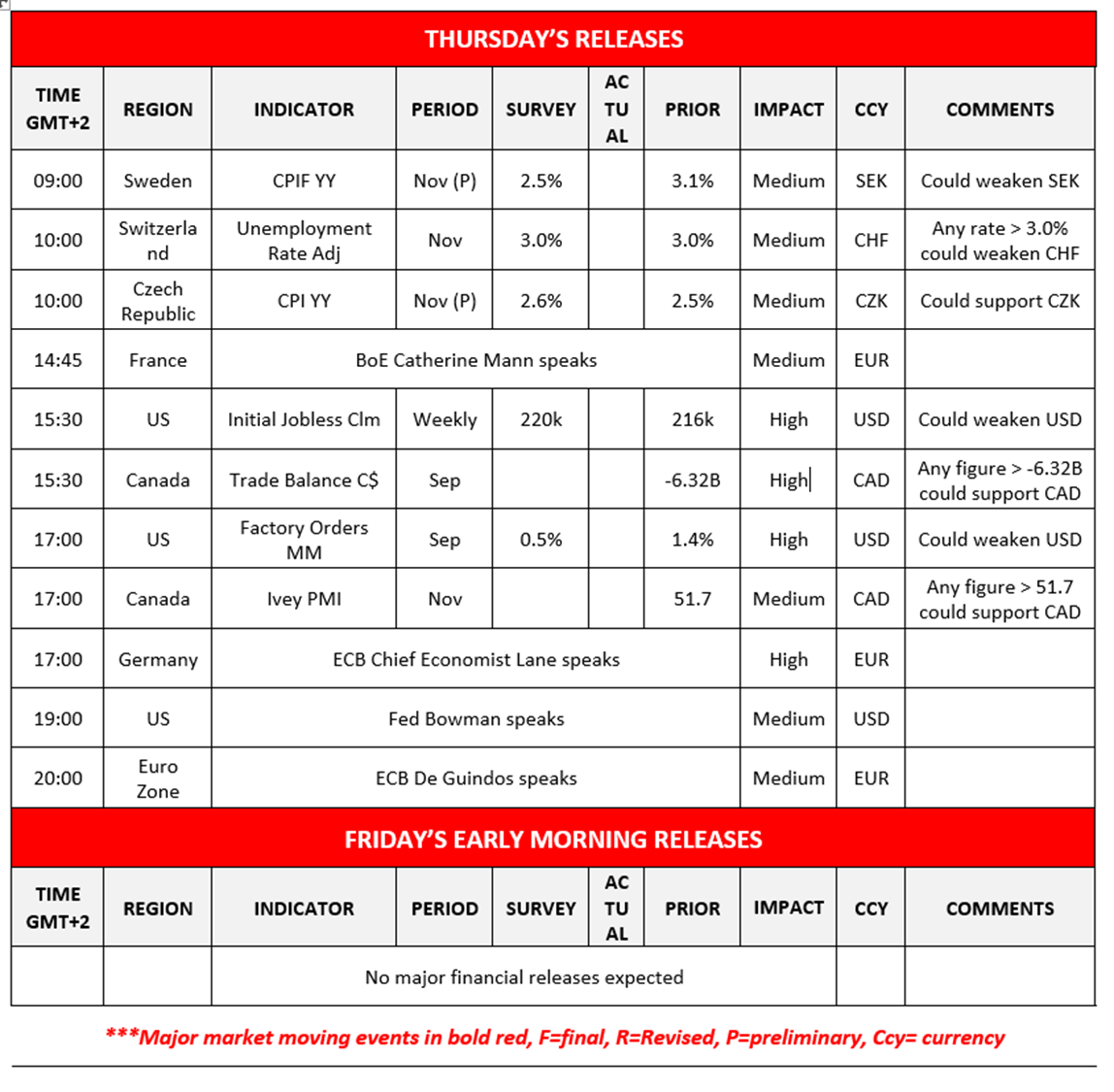

Today we get Sweden’s preliminary CPI rate, Switzerland’s unemployment rate and the Czech Republic’s preliminary CPI rate all for November, followed by the US weekly initial jobless claims figure, Canada’s trade balance figure for September, the US Factory orders rate for September, and Canada’s Ivey PMI figure for November. On a monetary level we note the speeches by ECB Chief Economist Lane, Fed Bowman and ECB De Guindos.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1460 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

XAU/USD H4 Chart

- Support: 4142 (S1), 4080 (S2), 4010 (S3)

- Resistance: 4240 (R1), 4315 (R2), 4380 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。