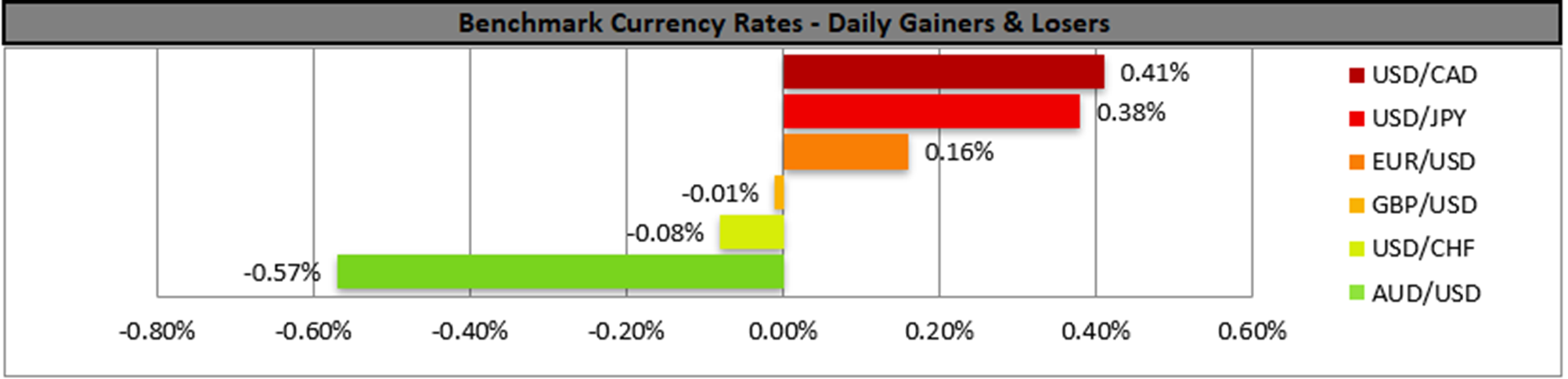

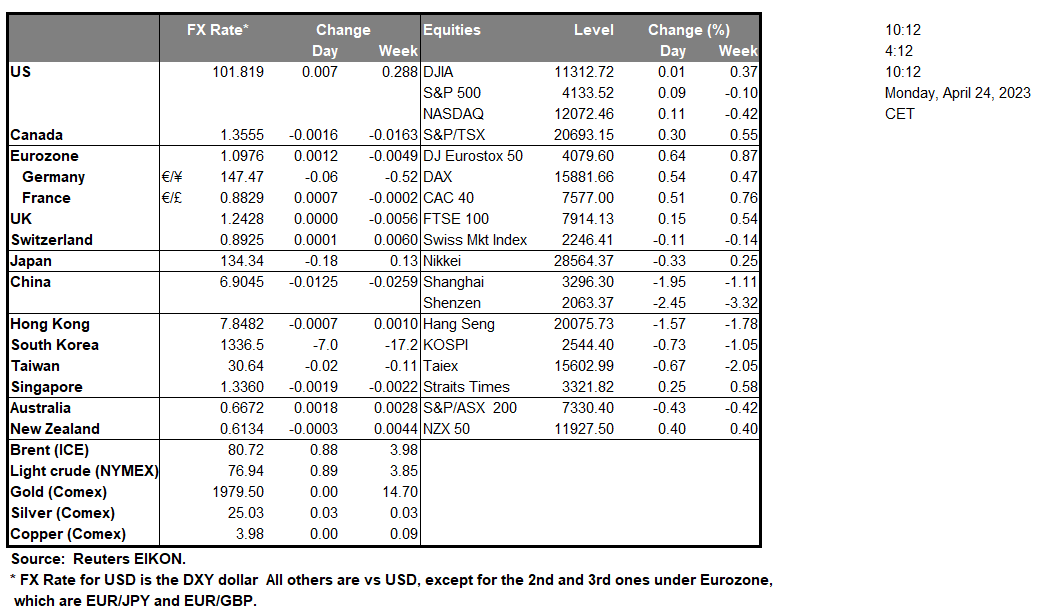

The USD remained rather stable on Friday closing the week relatively unchanged as the market maintains its wait-and-see position and worries about a recession in the US economy remain ever-present. It’s expected to be an easy-going Monday, with fundamentals taking the lead given the low number of high-impact financial releases expected. Also, we note that US stock markets ended the day mixed, yet lower for the week, as investors try to navigate through the conflicting messages from earnings reports released, the worries for a recession and the Fed’s intentions. In the current week, we expect a plethora of earnings reports of high-profile companies to be released, yet we highlight Microsoft (#MSFT) and Alphabet (#GOOG) on Tuesday and Meta (#FB) on Wednesday and Amazon (#AMZN) on Thursday. On the commodities front, we note the continuous drop in oil prices, with a brief interruption on Friday, mainly due to market worries for the demand side of the commodity. Back in the FX market, we note BoJ Governor Ueda’s comment that he would like to see a “quite strong” inflation before altering the bank’s yield curve control policy, which could be perceived as dovish and weigh on JPY.

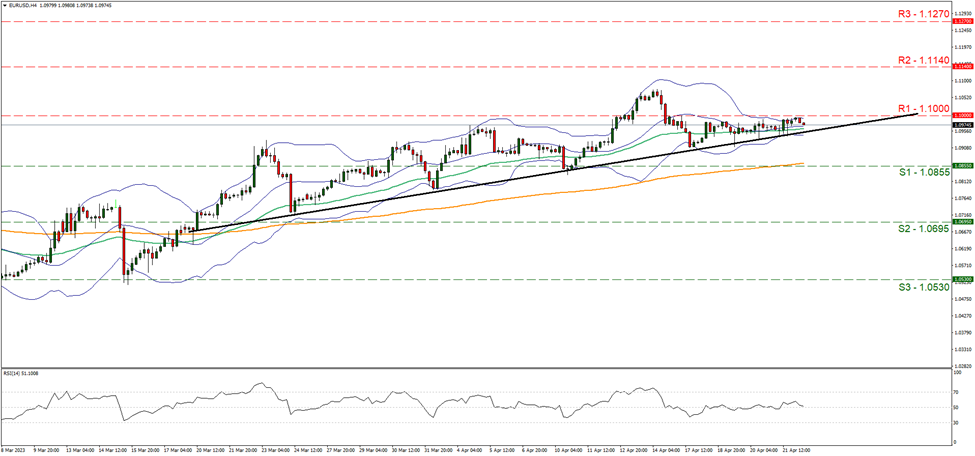

EUR/USD seems to have hit a ceiling at the 1.1000 (R1) resistance line. We tend to maintain our bias for the sideways motion to continue given that the RSI indicator continues to run along the reading of 50, implying a rather indecisive market. On the other hand, we note the upward trendline that has been guiding the pair since the 20 of March, hence some bullish tendencies may be present. Should the bulls actually take charge of the pair’s direction, we may see EUR/USD breaking the 1.1000 (R1) resistance line and aim for the 1.1140 (R2) resistance level. Should the bears take over, we may see the pair reversing course, breaking the prementioned upward trendline, yet for a bearish outlook we would also require the pair to break the 1.0855 (S1) support line, with the next possible target for the bears being the 1.0695 (S2) level.

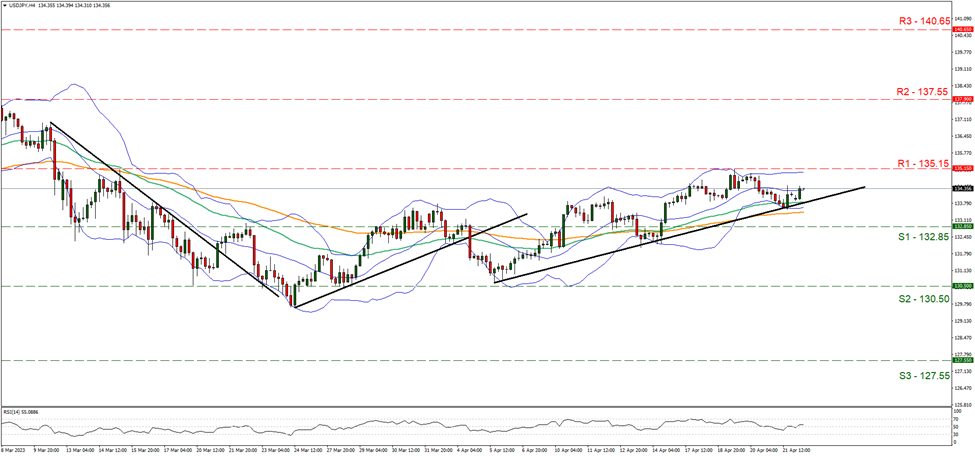

USD/JPY remained comfortably between the 135.15 (R1) resistance line and the 132.85 (S1) support line. The RSI indicator seems to remain close to the reading of 50 implying that the market sentiment may allow for the sideways motion of the pair to continue, yet there is also an upward trendline guiding the pair since the 5 of March. Hence, we tend to maintain our bias for a sideways motion yet would not be surprised to see a buying interest being expressed by the market for the pair. Should the pair find extensive fresh buying orders along its path, we may see USD/JPY breaking the 135.15 (R1) resistance line and taking aim of the 137.55 (R2) resistance level. Should on the other hand, a selling interest be expressed by the market, we may see USD/JPY breaking the prementioned upward trendline, the 132.85 (S1) support line and take aim of the 130.50 (S2) support level.

その他の注目材料

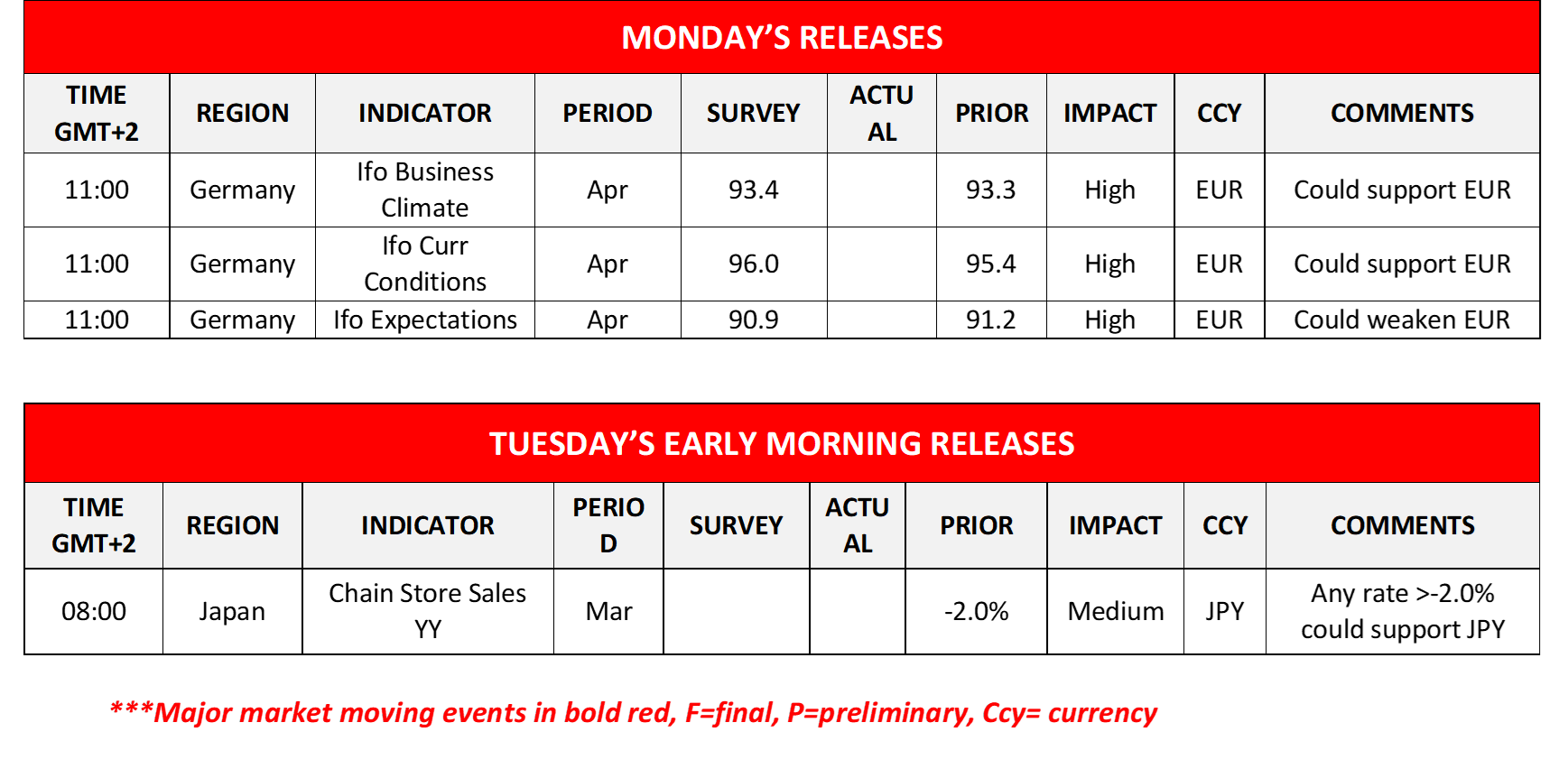

Today we note Germany’s Ifo indicators for April and tomorrow in the Asian session Japan’s Chain store sales for March.

今週の指数発表:

On Tuesday, we note the UK’s CBI figures and later the release of the US Consumer Confidence figures for April. On Wednesday, we note the release of New Zealand’s trade data for March, Australia’s CPI rates for Q1, Germany’s Gfk Consumer sentiment figure for May, UK’s CBI Distributive Trades figure for April and the US durable goods orders for March. On Thursday we get Sweden’s Preliminary GDP for Q1, Canada’s Business Barometer both for April, the preliminary US GDP rate for Q1 and the weekly initial jobless claims while we also note Riksbank’s and CBT’s interest rate decisions. Lastly, in a packed Friday, we get Tokyo’s CPI print for April, Japan’s Preliminary Industrial production rate for March and BoJ’s interest rate decision, France’s, Germany’s and the Eurozone’s GDP Preliminary rates for Q1, UK’s Nationwide house prices rate, France’s and Germany’s Preliminary HICP rates as well as Switzerland’s KOF indicator figure all for the month of April and later the US Consumption Adjusted and Canada’s GDP for February.

EUR/USD 4時間チャート

Support: 1.0855 (S1), 1.0695 (S2), 1.0530 (S3)

Resistance: 1.1000 (R1), 1.1140 (R2), 1.1270 (R3)

USD/JPY 4時間チャート

Support: 132.85 (S1), 130.50 (S2), 127.55 (S3)

Resistance: 135.15 (R1), 137.55 (R2), 140.65 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。