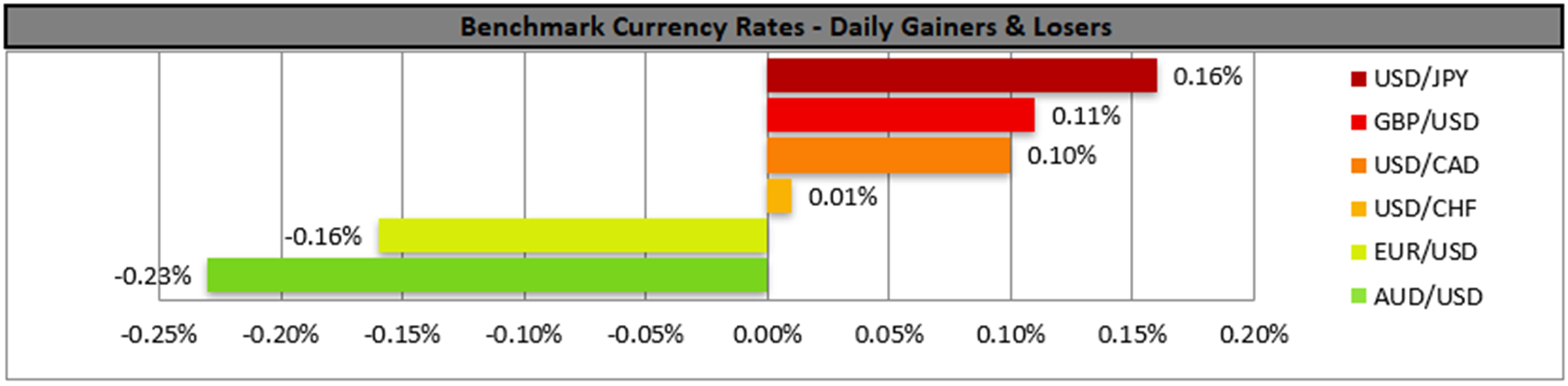

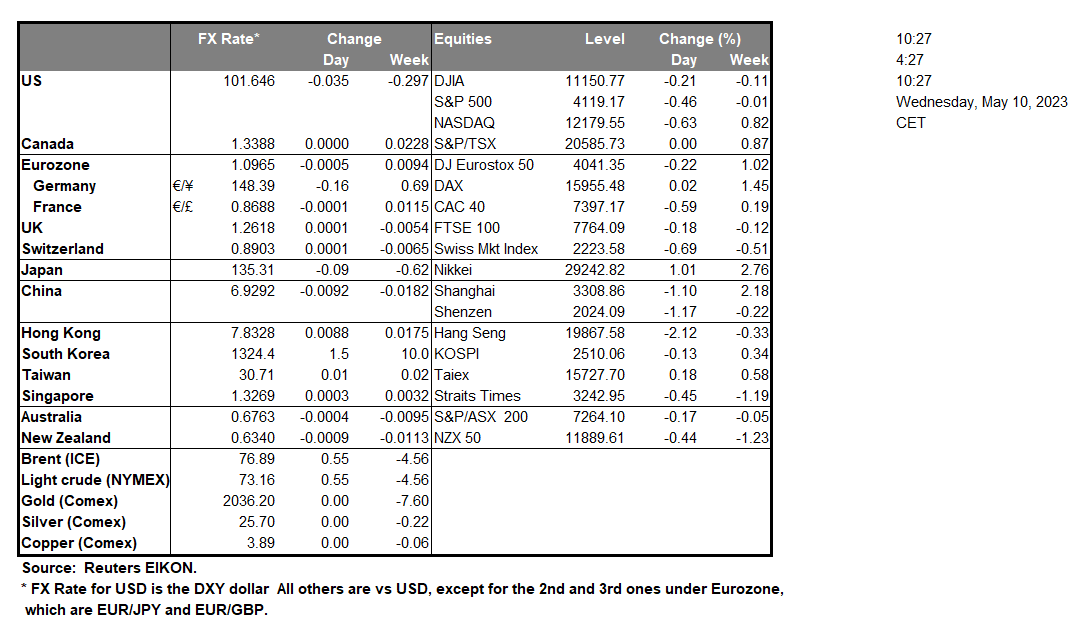

The USD remained little changed, amidst low market volatility, as a wait-and-see position is being maintained ahead of the release of the US CPI rates for April. The headline CPI rate is expected to remain unchanged at a year-on-year level while the respective core rate is expected to tick down in a sign of relatively stubborn inflationary pressures in the US economy. Should the rates slow down more than expected, we may see the market sentiment in US stock markets improving allowing for key indexes to end their day in the greens. On the flip side, should the CPI rates meet their respective forecasts or even accelerate and given the tight US employment market as reported by April’s data, we may see the USD gaining asymmetrically high support as such a release may allow Fed officials to start leaning towards the hawkish side once again. It was characteristic on a monetary level, that NY Fed President Williams warned yesterday that should inflation not come down, rates may have to be increased further. On a fundamental level, market jitters for a possible default of the US Government intensified after US President Biden and US lawmakers failed to reach an agreement about raising the debt ceiling. The two sides are to continue meeting on a daily basis and we expect the issue to drag on, possibly being resolved in the last minute and that may weigh on the market sentiment, especially in the equities markets. Furthermore, we still see the market worries for the US banking sector being present and weighing on the market sentiment while worries for a possible recession in the US economy seem to have eased yet still are simmering under the surface. Fed Board Governor Jefferson tried to play down the issue as he stated that the US economy is slowing down in an “orderly” manner which also implied optimism for inflation to cool down. Overall, we note the complexity of fundamentals leading the US markets which seem to bear a certain degree of uncertainty currently and stakes are high, which in turn may be forcing market participants in a more cautious stance.

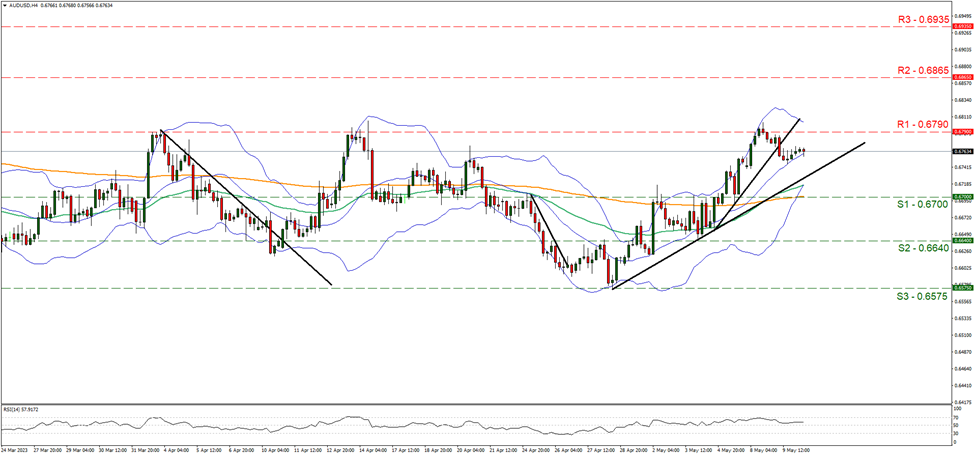

AUD/USD edged lower yesterday after hitting a ceiling on the 0.6790 (R1) resistance line, yet the overall picture of a stabilisation of the pair seems to prevail. In its stabilisation, AUD/USD also broke the upward trendline guiding the pair since the 4 of May, while the RSI indicator neared the reading of 50, implying a rather indecisive market. Hence we switch our bullish outlook in favour of a sideways motion bias initially. Should the bulls regain control over the pair we may see AUD/USD breaking the 1.2660 (R1) resistance line and aim for the 1.2865 (R2) resistance level. Should the bears take over, we may see the pair dropping and testing if not breaking the 1.2465 (S1) support line in search of lower grounds.

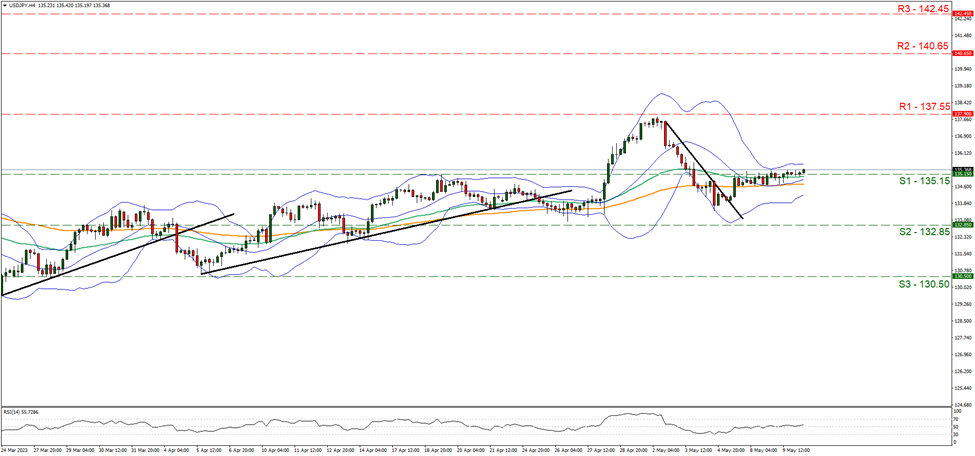

USD/JPY edged slightly higher breaking the 135.15 (S1) resistance line, now turned to support. We still see the slight bullish tendencies of the pair as unconvincing, given that also the RSI indicator remains near the reading of 50 and hence we tend to maintain our bias for the sideways motion to continue. Nevertheless, should the pair find fresh buying orders along its path we may see it aiming if not reaching the 137.55 (R1) resistance line. Should a selling interest be expressed by the market, we may see USD/JPY breaking the 135.15 (S1) support line and aim if not reach the 132.85 (S2) support level.

その他の注目材料

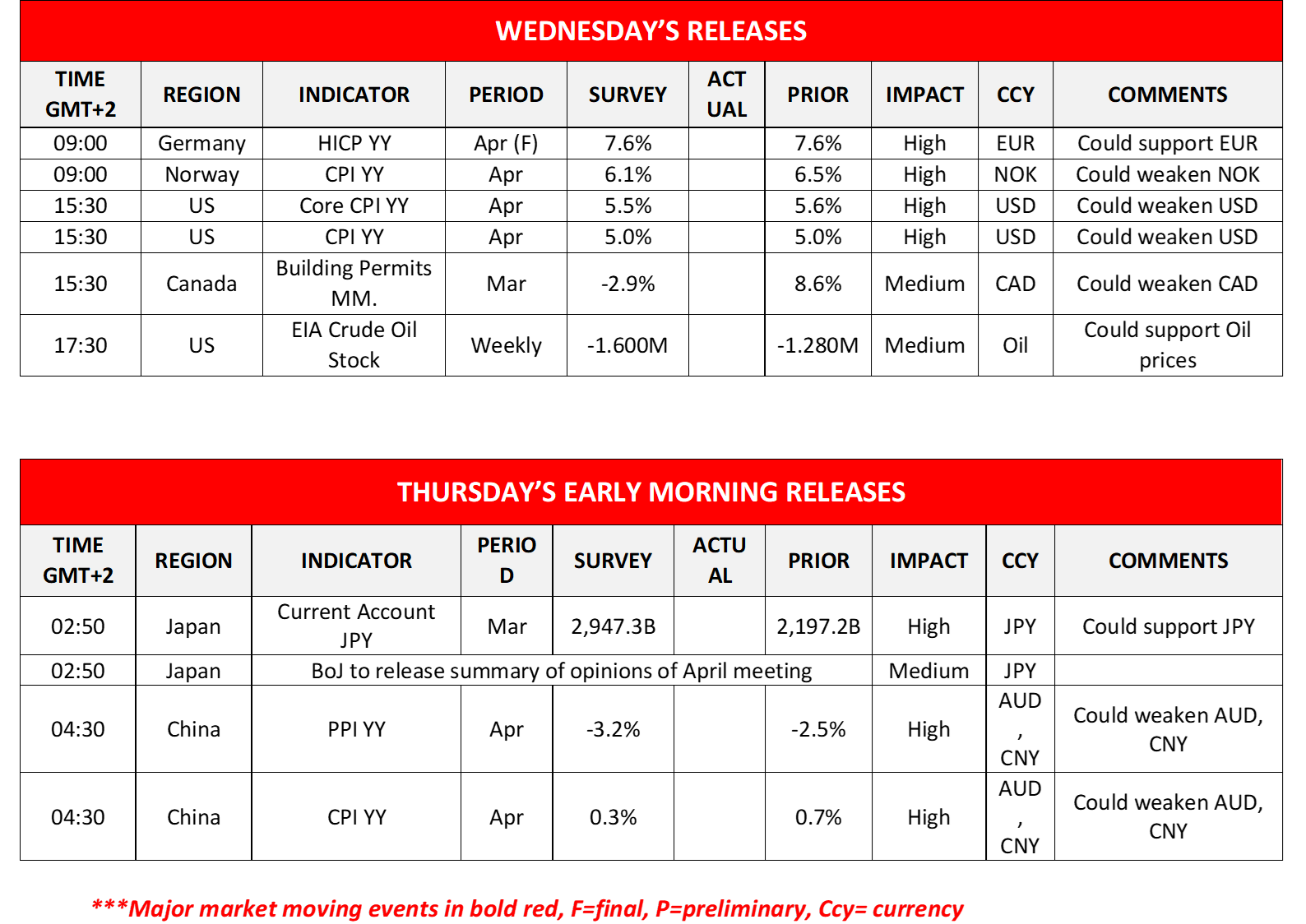

During today’s European session, we note the release of Germany’s and Norway’s inflation metrics for April. In the American session besides the US CPI rates for April we also note the release of Canada’s building permits growth rate for March while oil traders may be more interested in the release of the US EIA weekly crude oil inventories figure. During tomorrow’s Asian session, we note the release of Japan’s current account balance for March and China CPI and PPI rates for April, while on the monetary front, we note the release of BoJ’s summary of opinions of the late April meeting.

USD/JPY 4時間チャート

Support: 135.15 (S1), 132.85 (S2), 130.50 (S3)

Resistance: 137.55 (R1), 140.65 (R2), 142.45 (R3)

AUD/USD 4時間チャート

Support: 0.6700 (S1), 0.6640 (S2), 0.6575 (S3)

Resistance: 0.6790 (R1), 0.6865 (R2), 0.6935 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。