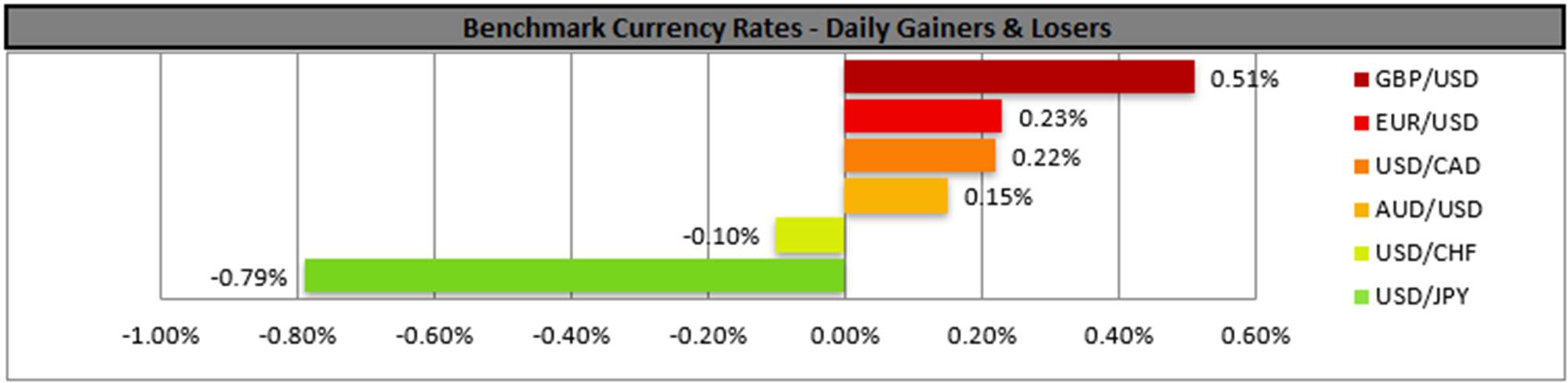

The bearish tendencies of the USD against its counterparts seem to be maintained despite the greenback opening with a positive gap during today’s opening. On a deeper fundamental level, yesterday’s assassination attempt on former President Trump, may enhance uncertainty somewhat, yet we expect that effect to calm down quickly. On the flip side the unsuccessful attempt, could cause a rally around the flag effect for Trump supporters and thus enhance the possibility of him getting elected. Should market expectations enhance for such a scenario we may see riskier assets such as US stock markets getting some support as in parallel, the market’s expectations for the Republicans to return to the White House and deliver tax cuts cut strengthen the optimism of the market. On the monetary front, we note the speeches of Fed Chairman Powell and San Francisco Fed President Daly later today and any comments tilting on the dovish side, could weigh on the USD and at the same time support US Stock markets and gold’s price. In the FX market, we note the renewed strengthening of the JPY and suspect a possible market intervention by Japan. Uncertainty for further action by BoJ may be enhanced today and tomorrow.

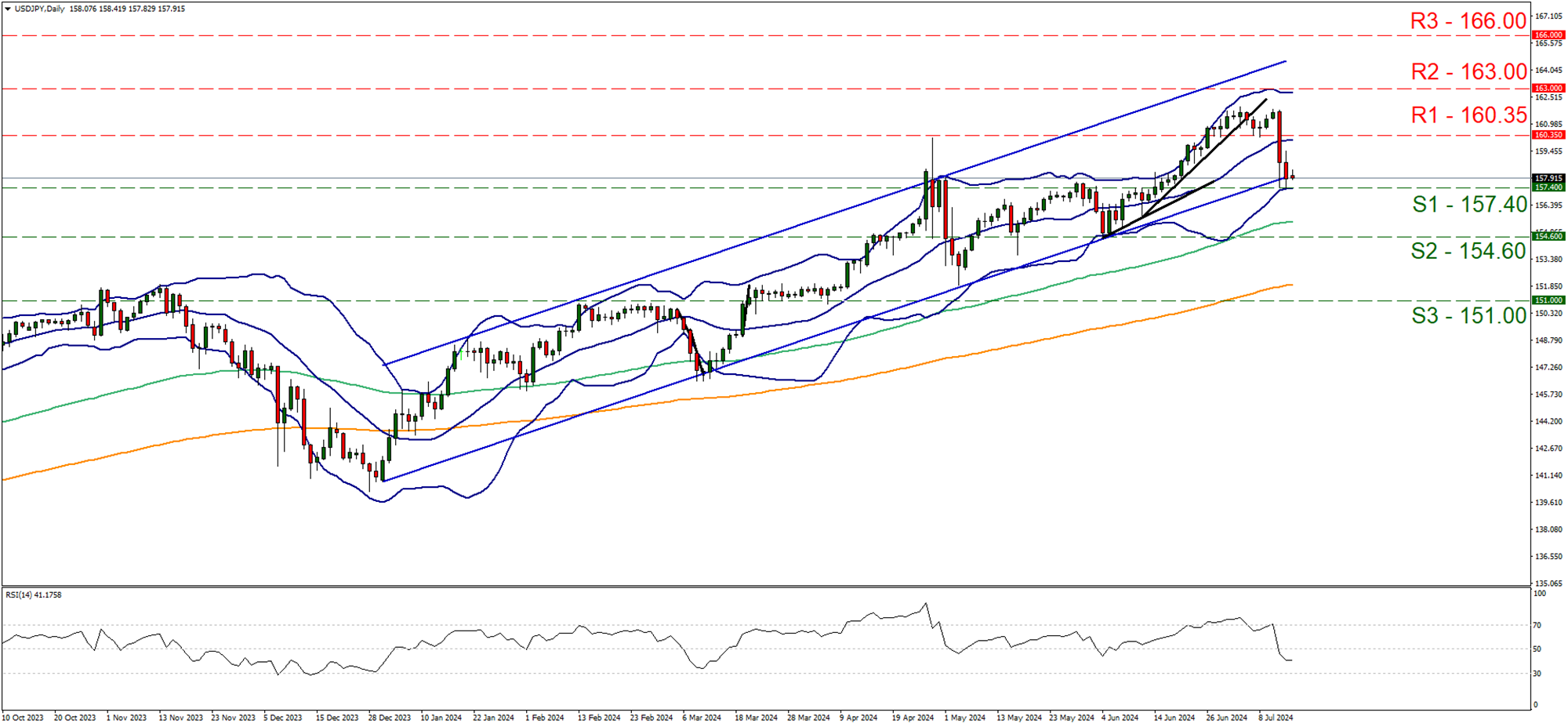

USD/JPY took another swing at the 157.40 (S1) support line yesterday, yet the level held its ground. We still see some bearish tendencies for the pair being present, given also that the RSI indicator below our daily chart is between the readings of 50 and 30. Also note that the price action of the past two days is about to break the lower boundary of the upward channel that was guiding the pair since the start of the year. Yet, the fact that the price action was unable to clearly break the 157.40 (S1) support line tends to imply some stabilization of the pair. For a bearish outlook, we would require the pair to break the 157.40 (S1) support line and take aim aim the 154.60 (S2) level. For a renewal of the bullish outlook the bar is high, as the pair would have to rise and break the 160.35 (R1) resistance line clearly, thus opening the gates for the 163.00 (R2) base.

本日のその他の注目点

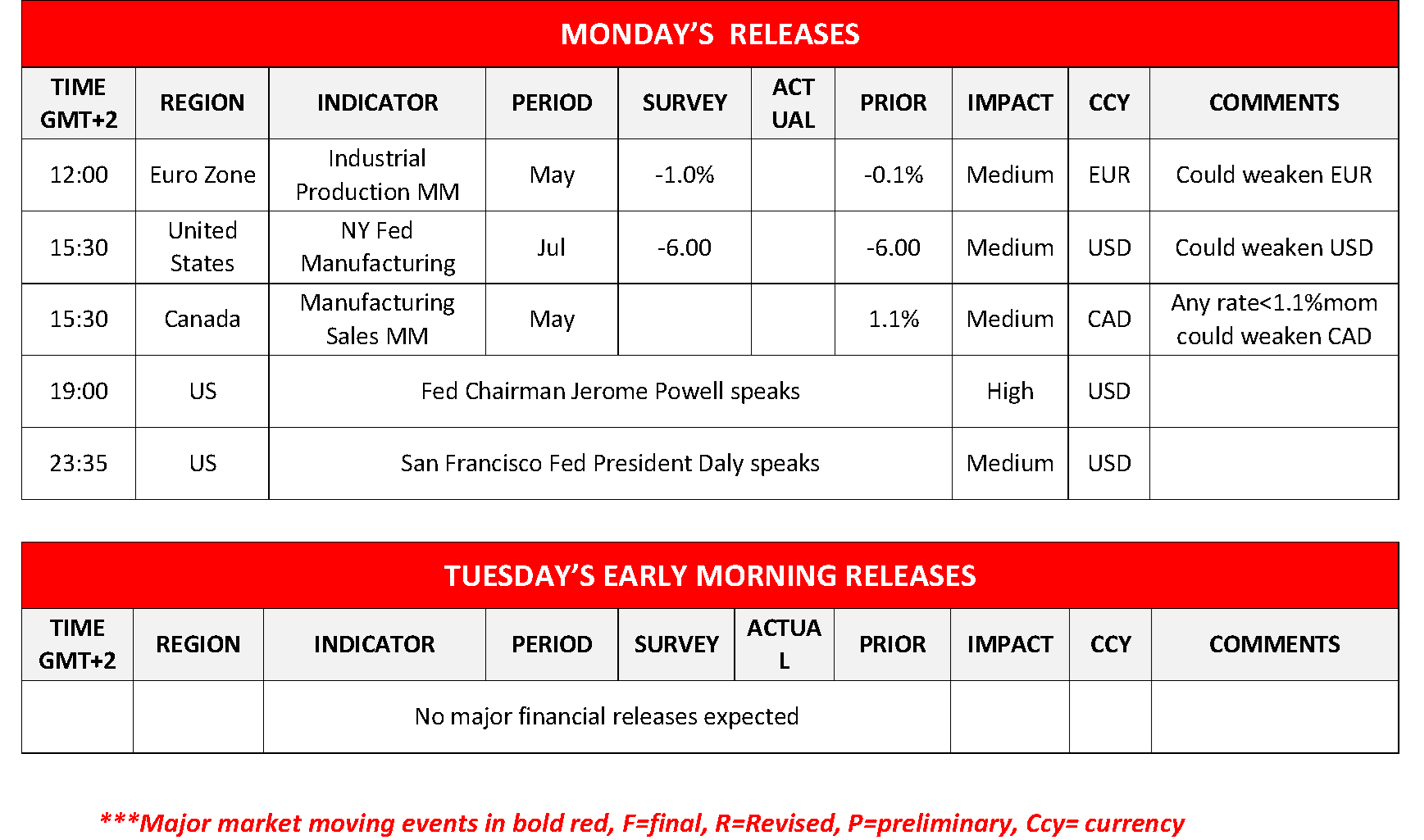

Today in the European session, we note the release of Eurozone’s industrial output for May. In the American session, we get the US NY Fed Manufacturing index for July and Canada’s manufacturing sales for May. Yet Loonie traders may keep an eye out for falling oil prices that may weigh on the CAD.

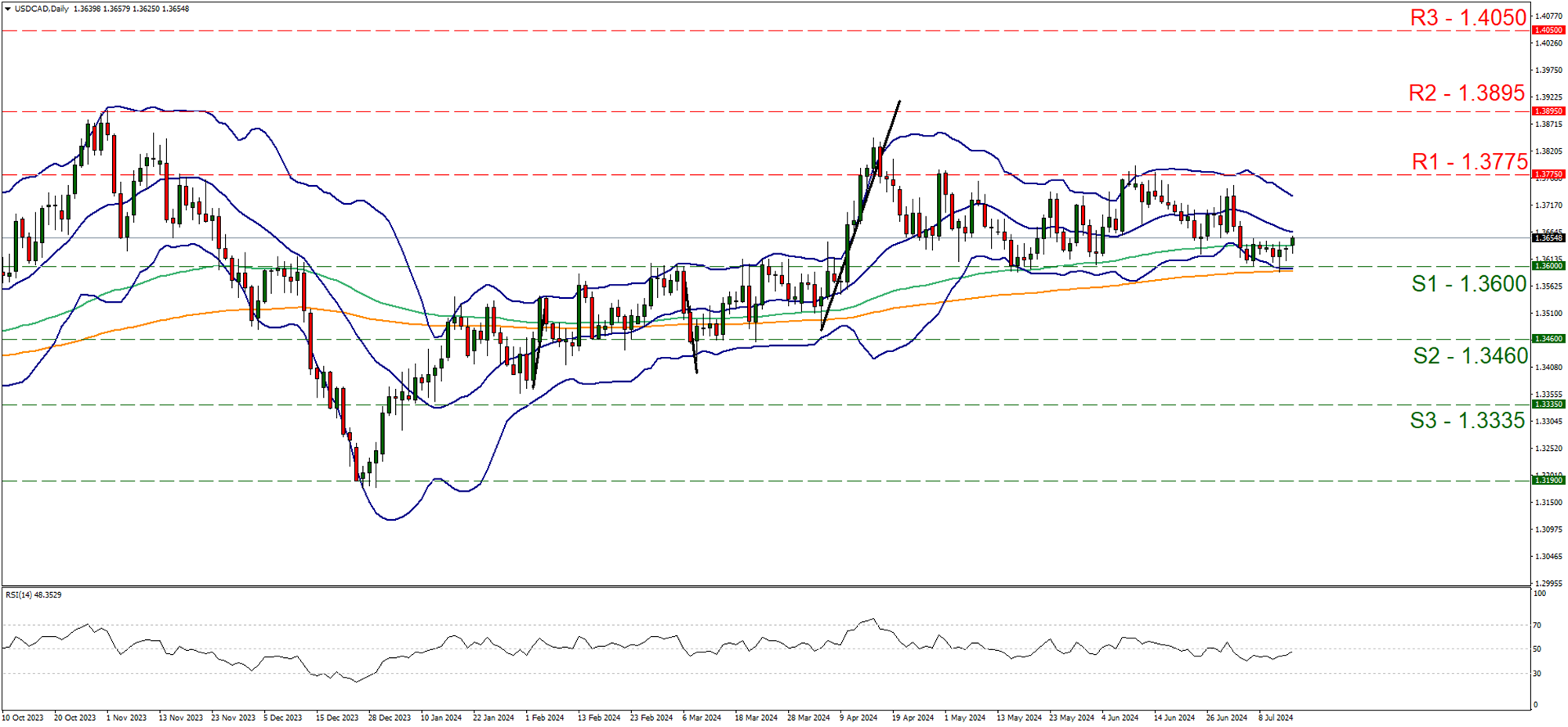

On a technical level, we note that USD/CAD after bouncing on the 1.3600 (S1) support line on Thursday is edging higher. We tend to maintain a bias for a sideways motion between the S1 and R1, given that the main body of the pair’s price action remains confined between the prementioned levels since the 19 of April. The RSI indicator is rising and nearing the reading of 50, implying that bearish tendencies for the pair have faded away, yet the indicator has to rise further to imply bullish tendencies. If the bears regain control over the pair we may see USD/CAD breaking the 1.3600 (S1) line and aiming for the 1.3460 (S2) level. We may see some upward movement yet for a clearcut bullish outlook we would require a breaking of the 1.3775 (R1) line.

今週の指数発表

On Tuesday, we get Germany’s ZEW Economic sentiment and current conditions figures for July, the US retail sales rate and Canada’s CPI rates both for June. On Wednesday, we get New Zealand’s CPI rate for Q2, Japan’s Tankan index figures for July, followed by the UK’s CPI rates, the Eurozone’s final HICP rate and the US industrial production rate all for the month of June. On Thursday, we highlight on the monetary front ECB’s interest rate decision while as for financial releases, we get Japan’s trade balance figure and Australia’s employment data both for the month of June, followed by the UK’s employment data for May, the US weekly initial jobless claims figure and the US Philly Fed business index for July. On Friday we get Japan’s CPI rates for June, UK’s retail sales for June and CBI business optimism figure for Q3, as well as Canada’s retail sales rate for May.

USD/JPY Daily Chart

- Support: 157.40 (S1), 154.60 (S2), 151.00 (S3)

- Resistance: 160.35 (R1), 163.00 (R2), 166.00 (R3)

USD/CAD Daily Chart

- Support: 1.6000 (S1), 1.3460 (S2), 1.3335 (S3)

- Resistance: 1.3775 (R1), 1.3895 (R2), 1.4050 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。