Oil prices seems to have interrupted it’s upward movement with bearish tendencies yesterday and during today’s Asian and early European session since our last report. In today’s report we have a look at the state of the US oil market, the crisis in Lebanon’s southern border and the market expectations for a possible increase of Saudi Arabia’s oil production levels. The report is to be concluded with a technical analysis of WTI’s daily chart.

Tightening of the US oil market resumes

The US oil market seems to be tightening give the related indicators in the past seven days. We make a start with the release of the US Baker Hughes active oil rig count remained unchanged, implying a possible easing of the demand side in the US market. The release had little if any effect on prices, passing unnoticed. On the other hand, on Tuesday we got the API weekly US crude oil inventories figure.

The release showed that oil inventories dropped by -4.339 million barrels a drawdown which was wider than expected being slightly bullish for oil prices upon release. Similar signals were sent to the market on Wednesday as the EIA also reported a wider than expected drawdown of -4.417 million barrels.

Both releases tended to align towards showing a tightening US market, given that production levels were not able to catch up with aggregated oil demand in the US. Should the tightening of the US oil market be maintained or tighten even further it may have a bullish effect on oil prices.

Market expectations for Saudi oil production levels to rise

Yet despite the tightening of the US oil market, oil prices took dived on Wednesday and today’s Asian and European sessions, hence we should be looking for another fundamental issue affecting the markets. News hit the market that Saudi Arabia is preparing to abandon its $100 per barrel price target, in a signal that Saudi oil production levels may rise in the coming months.

The news tended to intensify market expectations for a possible abundance of oil in the supply line of the international market given that Saudi Arabia is the world’s biggest crude exporter. The issue gains on interest as next week OPEC+ is to have its next ministerial meeting and the prospect that the issue may be magnified is enhanced thus weighing even further on oil prices

Israel Hezbollah war chances escalate

Staying in the Middle East we also note the escalation in the military conflict between Israel and Hezbollah with the Israeli Airforce pounding Palestinian position in Southern Lebanon. Intel states that Hezbollah is preparing or has allready declared war on Israel and the situation could evolve into a regional conflict in the area, at which the oil market is particularly sensitive. Should we see also Iran being directly involved in a possible war with Israel we expect some bullish tendencies for oil prices as the international oil supply lines could come under increased threat, considering also the Houthi rebels further in the south.

Libyan supply to return

Furthermore we also note that Libyan supply may return intensified further market expectations for an increase in the supply of the international oil market. As per Reuters, a United Nations statement on Wednesday said delegates from divided Libya’s east and west agreed on the process of appointing a central bank governor, a step which could help resolve the crisis over control of the country’s oil revenue that has disrupted exports thus unchaining oil production in the north African country. The issue is expected to have further bearish effects on oil prices, should it be realised.

Oil Technical Analysis

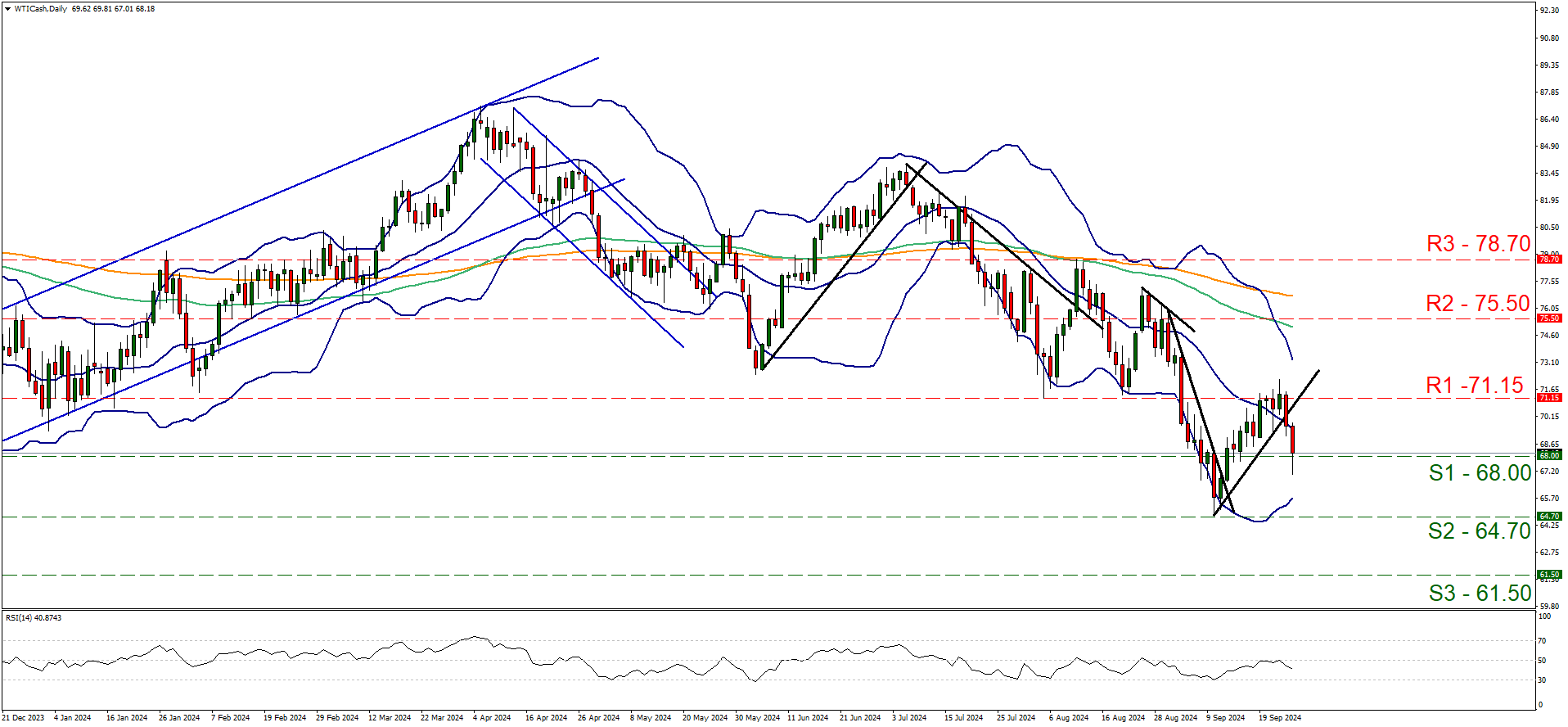

WTICash Daily Chart

- Support: 68.00 (S1), 64.70 (S2), 61.50 (S3)

- Resistance: 71.15 (R1), 75.50 (R2), 78.70 (R3)

Oil’s price action dropped yesterday and during today’s European session, put the 68.00 (S1) support line to the test. We tend to maintain a bearish outlook for the commodity’s price action, given also that the RSI indicator took a downward turn and has started to aim for the reading of 30, implying that the market sentiment has started to turn sour.

Also, there is still some considerable distance to the lower Bollinger band, implying that the bears have ample of room to play. Should the bulls maintain control as expected, we may see WTI prices breaking the 68.00 (S1) support line clearly and take aim of the 64.70 (S2) support level, while even lower we note the 61.50 (S3) support barrier.

On the flip side for a bullish outlook we would require WTI’s price action to reverse direction, regain the losses made yesterday and today break the 71.15 (R1) resistance line clearly and start aiming for the 75.50 (R2) resistance level.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked in this communication.