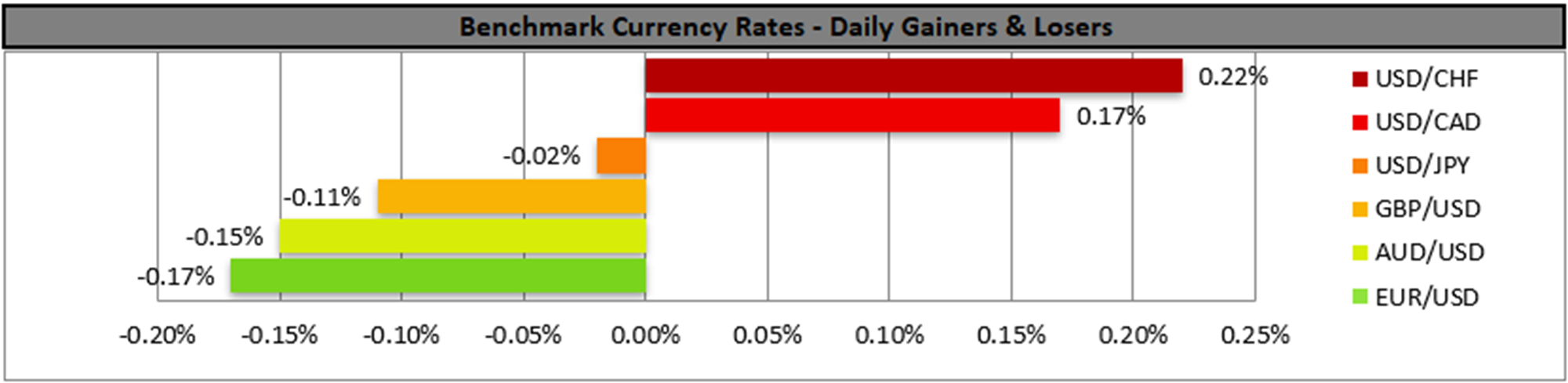

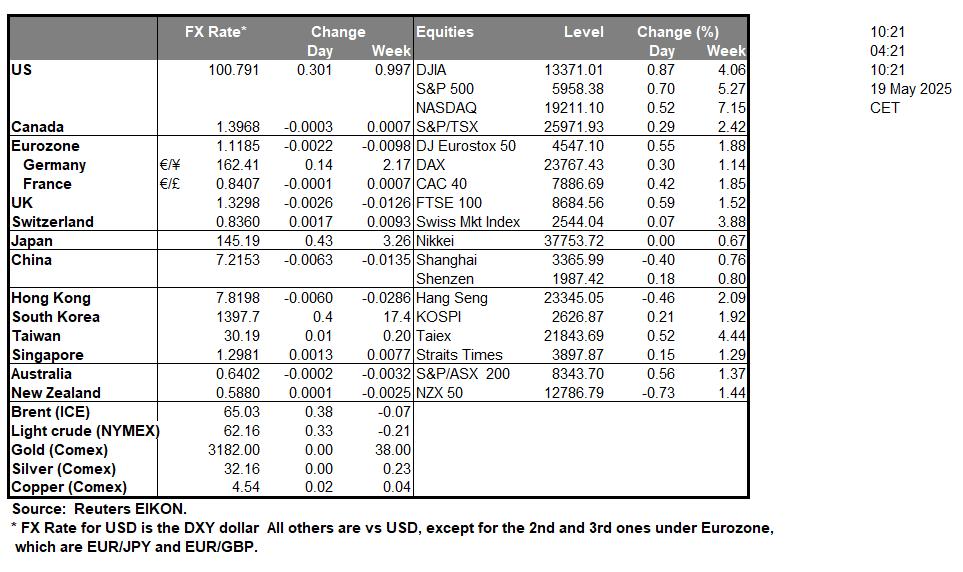

The main headlines over the weekend in the financial press may have been the downgrading of the U.S. government’s credit rating, weighing on the USD. Should we see more credit rating agencies downgrading the US economy, we may see the market’s worries for the US economic outlook being enhanced and thus weakening the USD further. We see the case to be supportive for safe havens and at the same time weigh on riskier assets.

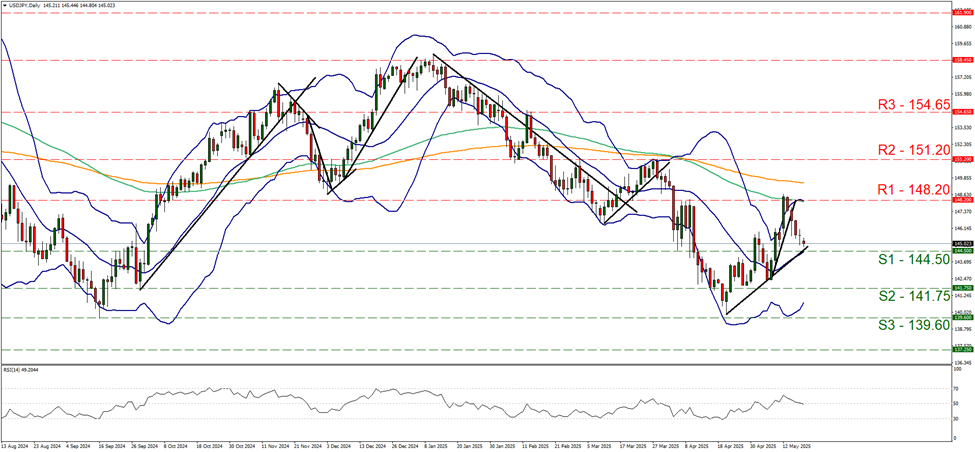

On a technical level, USD/JPY continued to fall for a 5th straight day in today’s Asian session, aiming for the 144.50 (S1) support line. Yet despite the dropping of the pair’s price action the RSI indicator was unable to clearly break below the reading of 50, implying that the market is still uncertain about the pair’s future direction. For the adoption of a bearish outlook we would require the pair to clearly break the upward trendline which is active since the 22nd of April, break the 144.50 (S1) support level, clearly and start actively aiming for the 141.75 (S2) support level. For a bullish outlook, we would require USD/JPY to bounce on the prementioned upward trendline, rally breaking the 148.20 (R1) resistance line and thus pave the way for the 151.20 (R2) resistance level.

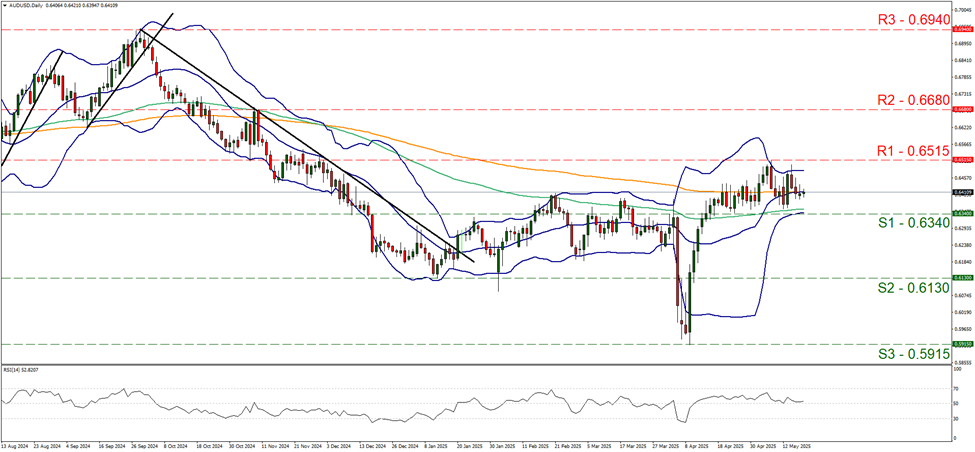

As for RBA’s interest rate decision in tomorrow’s Asian session, the market expects the bank to deliver a rate cut of 25 basis points and currently AUD OIS imply a probability of 98% for such a scenario to materialise. Yet a simple rate cut may not be enough for a weakening of the Aussie, as the market has almost fully priced in such a scenario and expects another two rate cuts until the end of the year. Should the bank also imply in its forward guidance that more rate cuts are in the pipeline, indirectly justifying the market’s expectations we may see the Aussie slipping. On the flip side should the bank fail to signal more rate cuts to come, the rate cut may turn hawkish, contradicting market expectations, thus supporting the AUD.

AUD/USD despite some ups and downs remained well between the boundaries set by the 0.6340 (S1) support level and the 0.6515 (R1) resistance line. We maintain a bias for a sideways motion of the pair between the prementioned levels, which is enhanced by the narrowing of the Bollinger Bands as well as the RSI indicator which tends to remain close to the reading of 50 implying a rather indecisive market. Should the bears take over, we may see the pair breaking the 0.6340 (S1) support line and start aiming for the 0.6130 (S2) support level. Should the bulls take over, we may see the pair breaking the 0.6515 (R1) resistance line and start aiming for the 0.6680 (R2) resistance barrier.

その他の注目材料

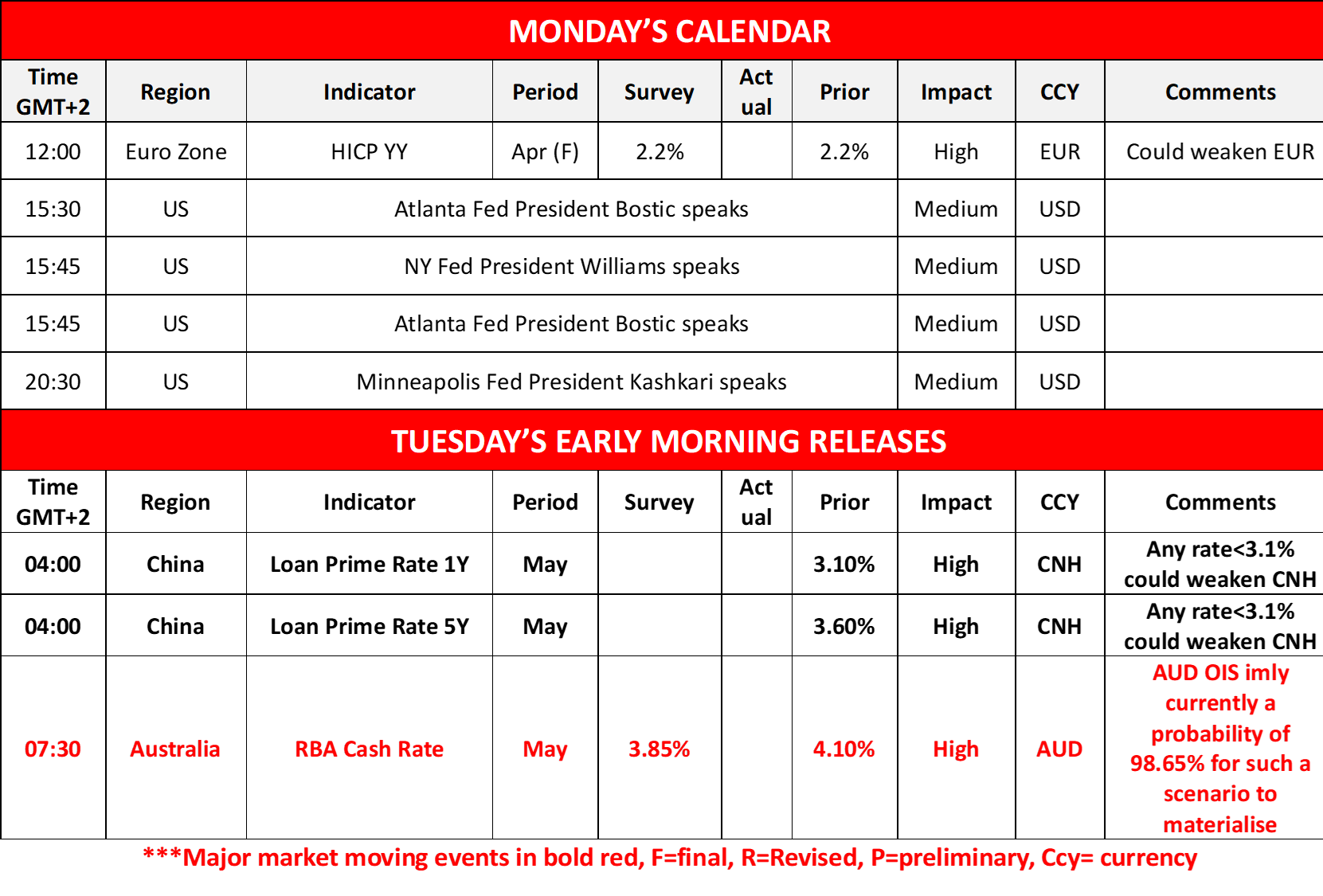

Today we note the release of EuroZone’s final HICP rate for April, while Atlanta Fed President Bostic, NY Fed President Williams and Minneapolis Fed President Kashkari are scheduled to speak. In tomorrow’s Asian session, we note that China’s PBoC is to release its interest rate decision.

今週の指数発表:

On Tuesday we get Canada’s CPI rates for May and Euro Zone’s preliminary consumer confidence indicator for May. On Wednesday we get New Zealand’s trade data for April, Japan’s Tankan indexes for May and trade data for April as well as UK’s CPI rates for the same month. On Thursday we highlight the release of the preliminary PMI figures for May of Japan, France, Germany, the Euro Zone as a whole, the UK and the US, while we also get Germany’s Ifo indicators for May, UK’s CBI indicator for trends in industrial orders also for May, as well as the US weekly initial jobless claims figure. On Friday, we get Japan’s CPI rates for April, Germany’s detailed GDP rates for Q1, UK’s retail sales for April and Nationwide House Prices for May and to finish off the day, Canada’s retail sales for March.

USD/JPY Daily Chart

Support: 144.50 (S1), 141.75 (S2), 139.60 (S3)

Resistance: 148.20 (R1), 151.20 (R2), 154.65 (R3)

AUD/USD デイリーチャート

Support: 0.6340 (S1), 0.6130 (S2), 0.5915 (S3)

Resistance: 0.6515 (R1), 0.6680 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。