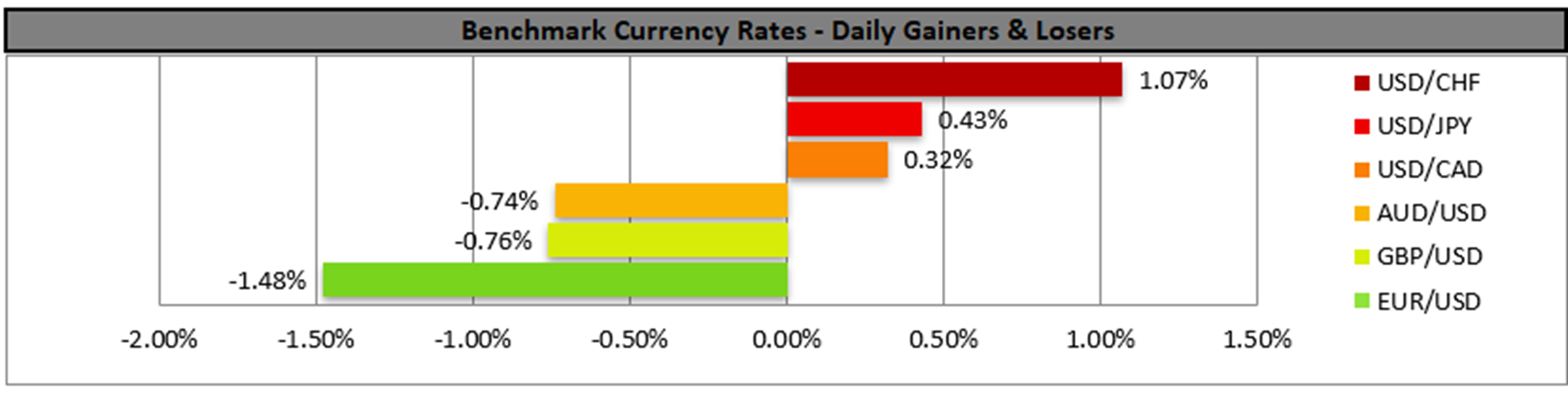

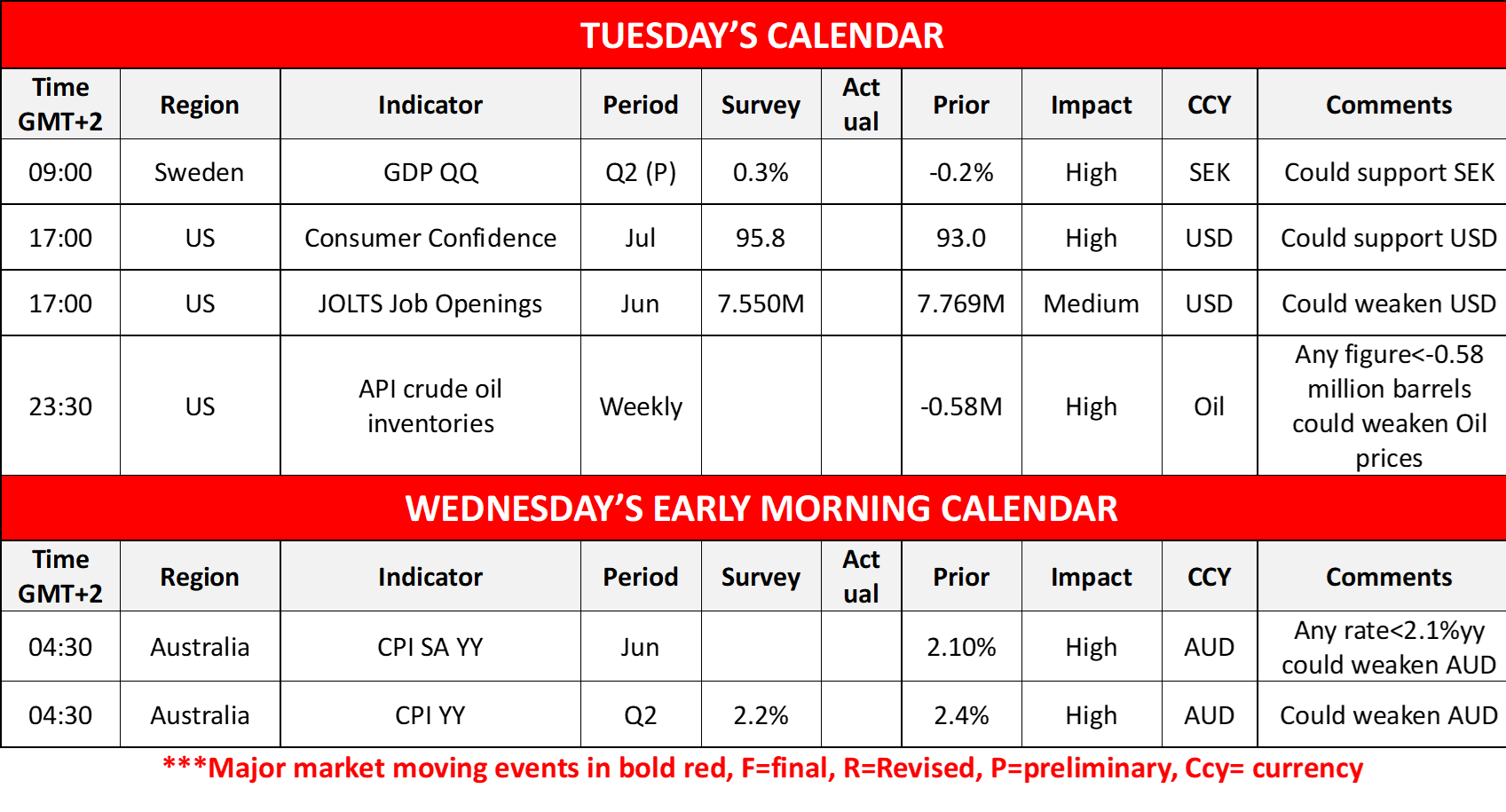

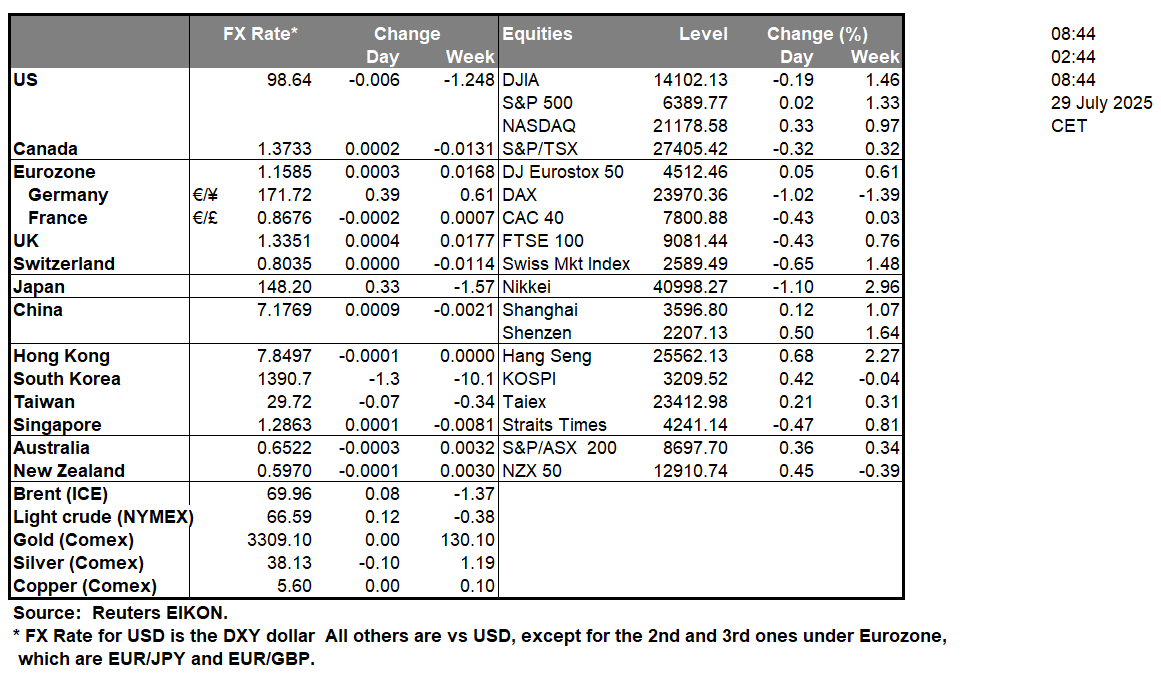

The USD rose yesterday in a sign of support given the announcement of an EU-US trade deal framework. It should be noted that the USD got similar support after the announcement of the US-Japanese trade deal and all is pointing towards market worries easing as trading tensions tend to thaw. US President Trump’s 1st of August deadline is nearing thus we may see the market’s focus on the issue remaining very well alive. Today we note the release of the US consumer confidence for July and its reading is expected to rise which tends to imply more optimistic expectations on behalf of US consumers and if actually so could provide some support for the USD. Yet given the release of the US employment report for July on Friday, we note the release of June’s US JOLTS job openings figure, which is expected to drop and if so could weigh on the USD as it may imply that the US employment market cooled off in the past month.

Across the Atlantic the deal sent the common currency spiraling down as it is considered as skewed in favour of the US. It seems that the market’s perception in Europe, is worried for the consequences of the deal on the EU economic outlook, as a 15% tariff on EU products entering US soil may reduce EU exports to the US. Furthermore, EU’s pledge to buy US energy products of $250 billion per year, may prove to be unrealistic. It’s characteristic that EU equities markets ended the day in the reds. Overall, should market worries intensify we may see the EUR suffering further losses.

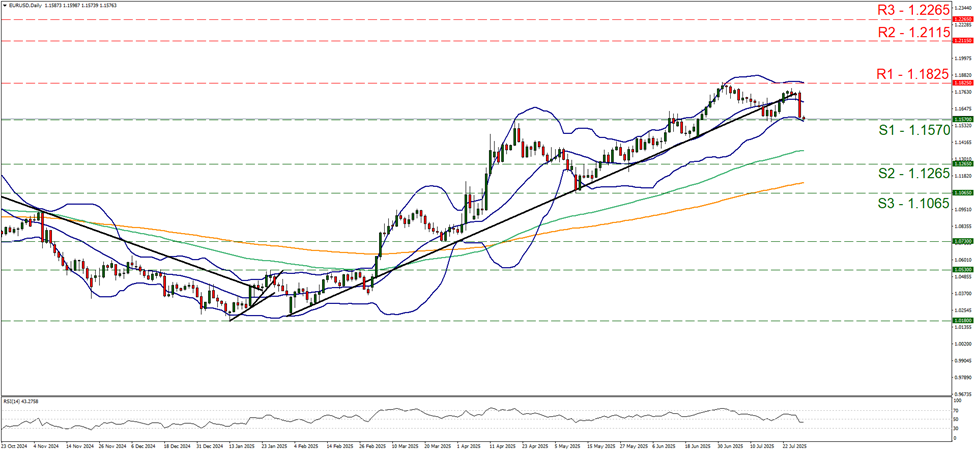

Since yesterday’s report we readjusted the R1, the S1 and the S2, in order to better reflect the boundaries of the pair’s movement over the past month. EUR/USD tumbled yesterday reaching the 1.1570 (S1) support line. We note that the Bollinger bands remain narrow, while the RSI indicator to drop below the reading of 50 implying some bearish tendencies. For the time being we maintain our bias for a sideways motion bias as long as the pair’s price action remains between the S1 and the R1. For the adoption of a bearish outlook we would require a clear break below the 1.1570 (S1) support level with the next possible target for the bears being the 1.1265 (S2) support line. For a bullish outlook to emerge we would require the pair to break the 1.1825 (R1) resistance line and thus pave the way for the 1.2115 (R2) resistance level.

In tomorrow’s Asian session, we highlight the release of Australia’s CPI rates for June and Q2. A possible slowdown of the CPI rates could weigh on the Aussie as it would signal an easing of inflationary pressures in the Australian economy. We should note that currently the CPI rates for June are at 2.1%yy, which is pretty close to RBA’s lower end of its inflation target zone of 2%-3%. Hence, a possible slowdown of the CPI rates could add more pressure on Australia’s central bank to ease further its monetary policy. On fundamental level, the US trade deals may be weighing on the Aussie as market worrier for a possible adverse effect on international trade seem to be maintained.

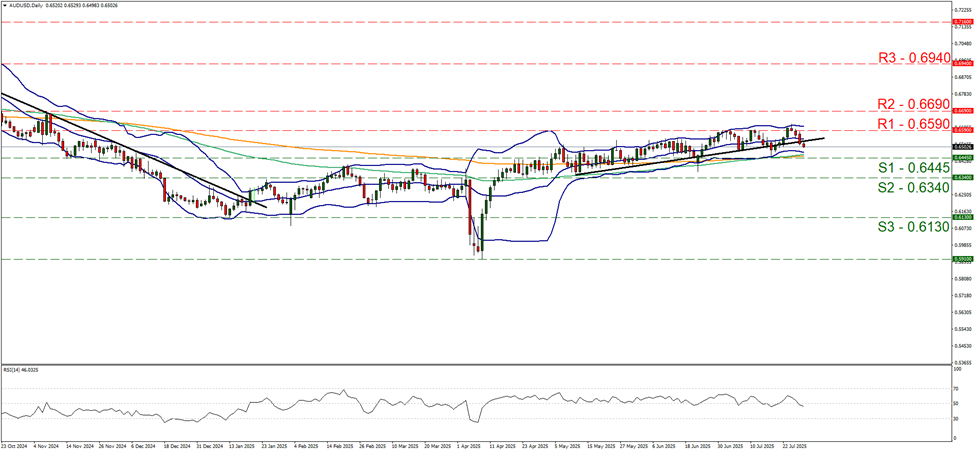

AUD/USD continued to fall after failing to breach clearly the 0.6590 (R1) resistance line. In its downward motion the pair broke yesterday the upward trendline guiding the pair since the 12th of May, hence we switch our bullish outlook in favour of a sideways motion bias initially, It’s characteristic that the RSI indicator has dropped below, yet remains close to the reading of 50. Should the bears take charge of the pair’s direction we may see the pair breaking the 0.6445 (S1) support line and start aiming for the 0.6340 (S2) support level. Should the bulls take over, we may see the pair breaking the 0.6590 (R1) resistance line and start aiming for the 0.6690 (R2) resistance base.

その他の注目材料

Today we get Sweden’s preliminary GDP rate for Q2, while oil traders may be more interested in the release of API’s weekly crude oil inventories figure.

EUR/USD デイリーチャート

- Support: 1.1570 (S1), 1.1265 (S2), 1.1065 (S3)

- Resistance: 1.1825 (R1), 1.2115 (R2), 1.2265 (R3)

AUD/USD デイリーチャート

- Support: 0.6445 (S1), 0.6340 (S2), 0.6130 (S3)

- Resistance: 0.6590 (R1), 0.6690 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。