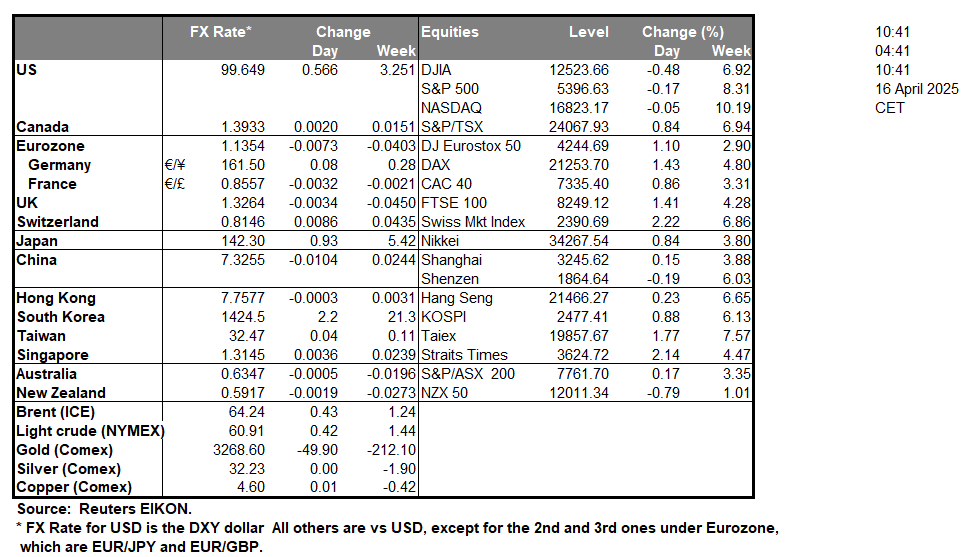

The Bank of Canada’s interest rate decision is set to occur later on today. The majority of market participants are currently anticipating the bank to remain on hold with CAD OIS currently implying a 59.8% probability for such a scenario to materialize. As such we turn our attention to the bank’s accompanying statement in which we would not be surprised to see concern from policymakers in regards to the US’s recent tariff ambitions and their risks to the resiliency of the global economy. Thus, in our view, two scenarios may emerge with the first being that the bank may remain on hold for a prolonged period of time in an attempt to counter a possible resurgence of inflationary pressures, which may be seen as bullish for the Loonie. On the flip side, the bank may showcase a concern for the resiliency of the Canadian economy and thus may imply that they could be prepared to cut rates in an attempt to aid the economy if needed, which may be seen as bearish for the Loonie.In the US Equities markets, we would like to note the recent developments with Nvidia. According to Reuters, NVIDIA (#NVIDIA) announced yesterday that it would take $5.5 billion in charges following the decision by the US Government to limit the company’s exports of its H20 artificial intelligence chip to China in an attempt to curb China’s technological advancements. Thus, the limitation of exports may weigh on Nvidia’s stock price.Over in Asia, China’s GDP rate for Q1 on a year-on-year basis came in better than expected at 5.4% versus 5.2%, implying that the Chinese economy continued to expand in Q1 at a greater rate than what was expected which in turn may aid the CNY.

EUR/USD appears to be moving in an upwards fashion, with the next possible target for the bulls being the 1.1470 (R1) resistance line. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 70, implying a strong bullish market sentiment. For our bullish outlook to continue we would require a clear break above the 1.1470 (R1) resistance line with the next possible target for the bulls being the 1.1680 (R2) resistance level. On the flip side for a sideways bias we would require the pair to remain confined between the 1.1195 (S1) support level and the 1.1470 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.1195 (S1) support level with the next possible target for the bears being the 1.0960 (S2) support line.

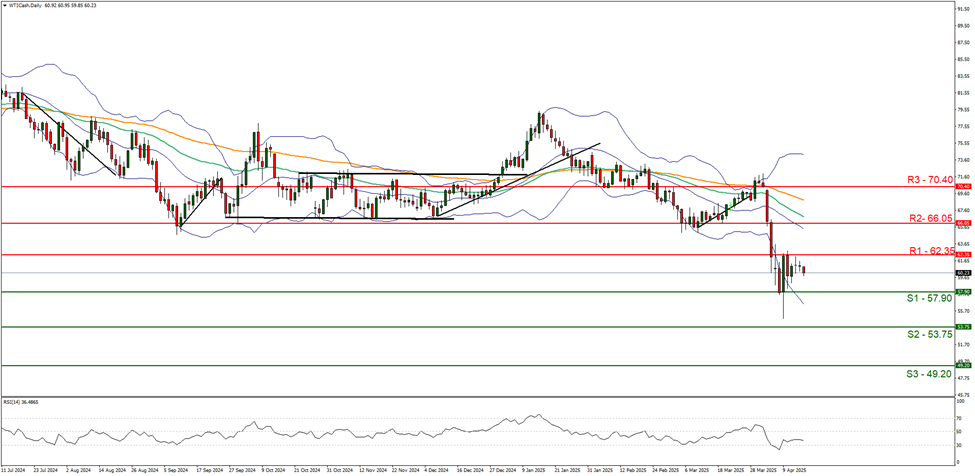

WTICash appears to be moving in a downwards fashion following it’s failure to clear our 62.35 (R1) resistance line. We opt for a bearish outlook for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure below 40 implying a strong bearish market sentiment. For our bearish outlook to continue we would require clear break below the 57.90 (S1) support line with the next possible target for the bears being the 53.75 (S2) support line. On the flip side for a sideways bias we would require the commodity’s price to remain between the 57.90 (S1) support level and the 62.35 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 62.35 (R1) resistance line with the next possible target for the bulls being the 66.05 (R2) resistance level.

その他の注目材料

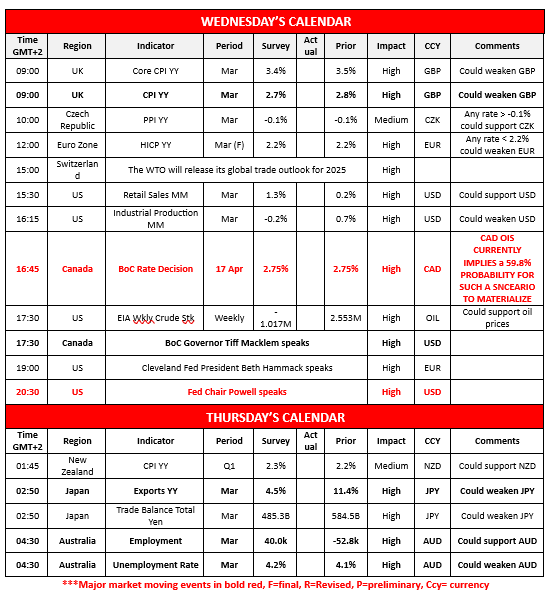

In today’s European session, we note the release of UK’s CPI rates, the Czech Republic’s PPI rate and the Eurozone’s final HICP rate all for the month of March. Later on during the day we get the release of the WTO’s global trade outlook for 2025, the US retail sales and industrial production rates for March, followed by the BoC’s interest rate decision, the weekly EIA crude oil inventories figure, and the speeches by BoC Governor Macklem, Cleveland Fed President Hammack and Fed Chair Powell. In tomorrow’s Asian session we note New Zealand’s CPI rate for Q1, Japan’s trade data and Australia’s employment data both for the month of March

EUR/USD Daily Chart

- Support: 1.1195 (S1), 1.0960 (S2), 1.0735 (S3)

- Resistance: 1.1470 (R1), 1.1680 (R2), 1.1885(R3)

WTICash Daily Chart

- Support: 57.90 (S1), 53.75 (S2), 49.20 (S3)

- Resistance: 62.35 (R1), 66.05 (R2), 70.40 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。