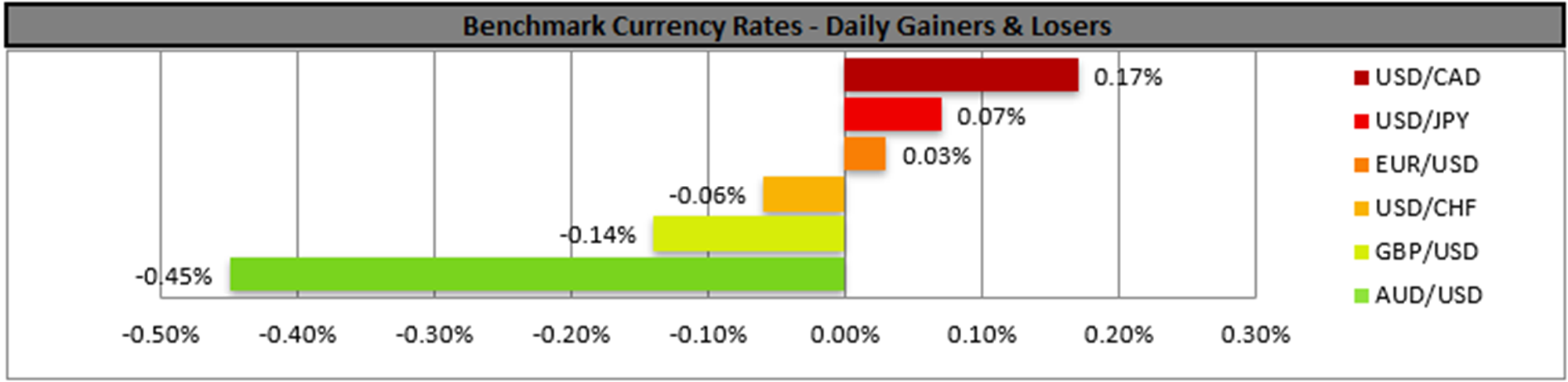

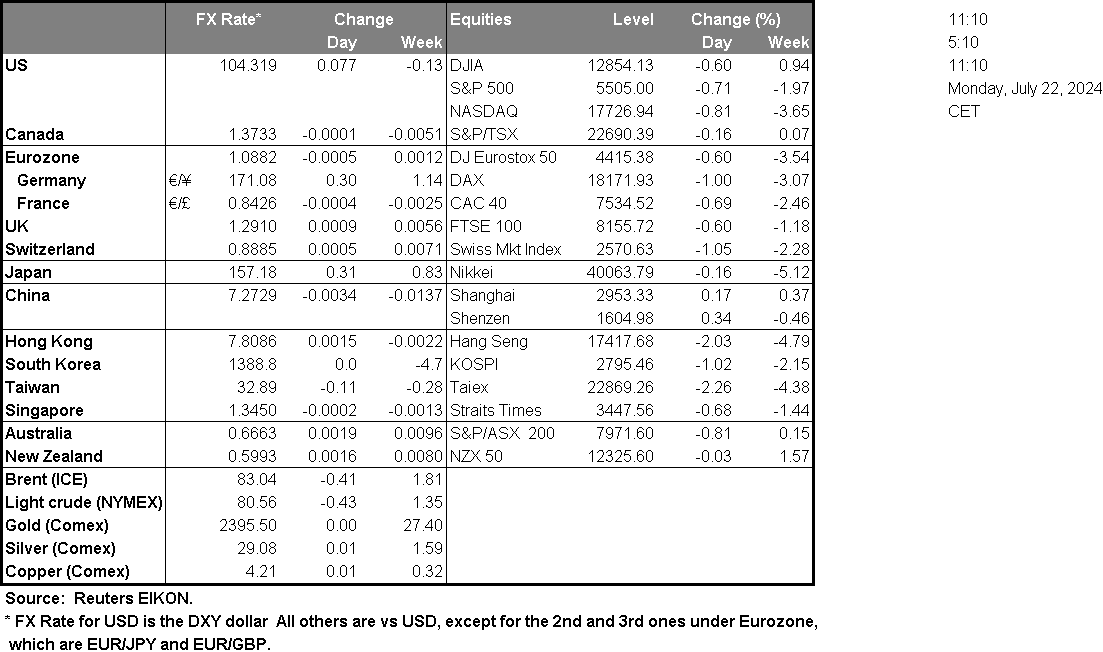

In a rather quiet Monday, we expect fundamentals to lead the way for the markets given the lack of high-impact financial releases. It should be noted that despite opening with a negative gap the USD seems to be regaining the lost ground and maintaining an upward movement against its counterparts. It should be noted that over the weekend, US President Joe Biden abandoned his re-election bid and endorsed Vice President Kamala Harris. Donors for the Democratic party seem to be stepping up yet the past poor readings in the polls for Kamala Harris raise doubts for her chances to win Trump. Another interesting issue is who she will be choosing for Vice President on the ticket. Market-wise, the issue may enhance the market’s optimism and thus provide some support for riskier assets. Also, the chaos caused by Microsoft’s outage on Friday seems to be over, yet the incident highlighted the fragility of the IT system on a global scale. The outage was caused by a flawed update of Crowdstrike, a major software security provider. A small file, which could be a single web page image, practically threw the IT system in disarray, crippling banks, airports, stock markets and other businesses around the world.

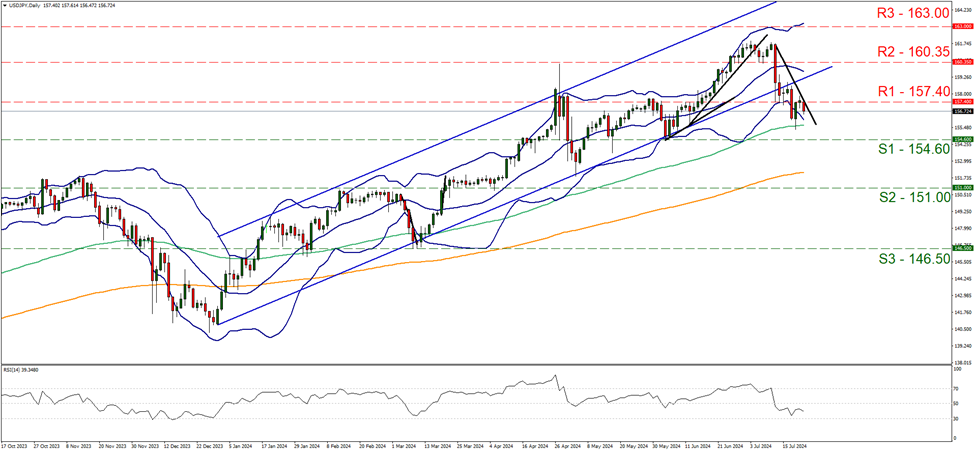

USD/JPY edged higher on Friday testing the 157.40 (R1) resistance line, yet seems to hit a ceiling and corrected lower yesterday. Fridays’ movement practically created a lower peak allowing us to rest a downward trendline on it, showing also the limitations of the downward movement. We intend to maintain a bearish outlook for the pair as long as the downward trendline remains intact. We also note that the RSI indicator remains between the reading of 50 and 30 implying a bearish predisposition on behalf of the market. Should the selling interest be maintained we may see the pair aiming for the 154.60 (S2) resistance level. For a bullish outlook, we would require the pair to break initially the prementioned downward trendline, in a first signal that the downward motion has been interrupted continue to break the 157.40 (R1) resistance line and taking aim of the 160.35 (R2) resistance level.

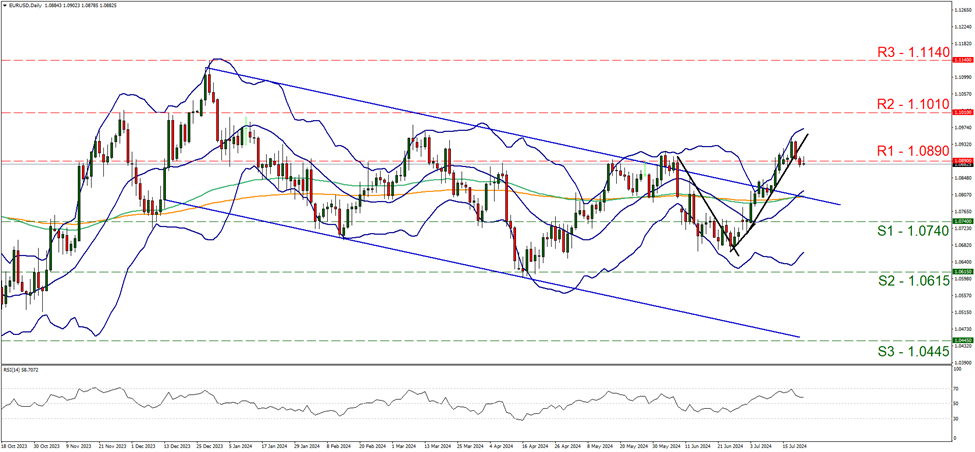

Against the EUR the USD remained relatively unchanged during today’s Asian session, just below the 1.0890 (R1) resistance line. We note that Friday’s movement highlighted the interruption of EUR/USD’s upward movement, noting the possibility of a bearish outlook, yet the RSI indicator remains above the reading of 50, which tends to imply the presence of a bullish residue among market participants. Should the bearish sentiment be maintained we may see the pair placing some distance between its price-action and the 1.0890 (R1) resistance line and start aiming for the 1.0740 (S1) support level. Should the bulls take over, we may see the pair breaking the 1.0890 (R1) resistance line, paving the way for the 1.1010 (R2) resistance level.

本日のその他の注目点

No major financial releases are expected.

今週の指数発表

On Tuesday we get the Eurozone’s preliminary consumer confidence for July and Turkey’s CBT interest rate decision. On Wednesday we get the preliminary PMI figures of Australia, Japan, France, Germany, the Eurozone as a whole, the UK and the US for July and Germany’s GfK Consumer confidence for August and on the monetary front we note the release from Canada BoC’s interest rate decision. On Thursday we get Germany’s Ifo indicators and the UK’s CBI trends for industrial orders, both being for July, UK’s CBI Business Optimism for Q3 and from the US we get June’s durable goods orders, the weekly initial jobless claims figure and we highlight the release of the GDP advance rate for Q2. On Friday, we get from Japan Tokyo’s CPI rates for July, and from the US the consumption rate and Core PCE price index, both being for June as well as the final University of Michigan consumer sentiment for July.

EUR/USD デイリーチャート

- Support: 1.0740 (S1), 1.0615 (S2), 1.0445 (S3)

- Resistance: 1.0890 (R1), 1.1010 (R2), 1.1140 (R3)

USD/JPY Daily Chart

- Support: 154.60 (S1), 151.00 (S2), 146.50 (S3)

- Resistance: 157.40 (R1), 160.35 (R2), 163.00 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。